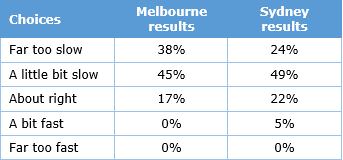

In March 2019, the Thinking Ahead Institute conducted its first public seminars in Sydney and Melbourne. We polled the audience of investment professionals on the current pace of action in the industry on inclusion and diversity. Delegates voted on five options and the overwhelming response in both cities shows us there is a lot of scope to improve.

Improved diversity is the new corporate zeitgeist. We need more women, we need more ethnic minorities, we need more, well ... just anyone that doesn’t look like ‘us’. And sorry, did I forget to mention we need it fast?

The investment industry is struggling to catch up. Why? Because for too long both structural and unconscious bias have limited opportunities for non-white, non-male, non-private school educated individuals. The workforce is so visibly homogenous that it has almost become embarrassing.

There have been signs of progress. The light shone on gender pay gaps, the recently proposed crackdown in the UK on ethnic pay gaps, and the increasing challenge against companies who have exercised discriminatory policies have dragged many companies into the limelight.

Wanted: quick fixes please! But wait … why exactly are we doing this diversity thing anyway?

As with most things in life, anything worth doing is hard and quick fixes are elusive. While many organisations have accepted the virtue of more diverse teams, it’s worth spending a little more time exploring why. Is this about compliance or commercials? Is this about performance or is this about culture? And by the way, will more women help my team make better decisions?

Digging deeper: the business case for diversity

The benefits of diversity have already long been noted. In a speech to Stanford Business School in 1998, Lewis Platt, then-CEO of Hewlett Packard noted:

“I see three main points to make the business case for diversity:

- A talent shortage that requires us to seek out and use the full capabilities of all our employees

- The need to be like our customers, including the need to understand and communicate with them in terms that reflects their concerns

- Diverse teams produce better results.

This last point is not as easy to sell as the first two - especially to engineers who want the data. What I need is the data, evidence that diverse groups do better.”

Therein lies the problem. While it is generally accepted that diversity has many benefits, the arguments quickly meld into answering the question “does having more diverse teams improve business performance?” The often-cited McKinsey publication, Diversity Matters, found that companies in the top quartile of gender and ethnic diversity were 15% and 35% respectively more likely to have experienced financial returns above their national industry median. They found the reverse for companies in the bottom quartile. But, as the study notes, correlation is not causation; greater gender and ethnic diversity in corporate leadership does not automatically translate into more profit.

Building collective intelligence: is it diversity or is it cognitive diversity?

So how do you improve the collective intelligence within teams? Improved cognitive diversity goes a long way. Business school professors, Alison Reynolds and David Lewis, define cognitive diversity as “differences in perspective or information processing styles.” In their research published in Harvard Business Review, they noted a “significant correlation between high cognitive diversity and high [team] performance” when executing new, uncertain and complex tasks.

Brilliant. We have a link between cognitive diversity and performance. Unfortunately, the bad news is, unlike demographics, cognitive diversity does not come with a shiny label. It is hard to detect at face value. The worse news, from Reynolds and Lewis, is that:

“ ... having run the execution exercise around the world more than 100 times over the last 12 years, we have found no correlation between this type of [surface-level] diversity and performance”.

And to add insult to injury, Wharton management professor, Katherine Klein, notes that “board gender diversity either has a very weak relationship with board performance or no relationship at all”.

Some readers will be torn between wanting to have more diversity in the workplace and some hard-line academics who say that merely putting a bunch of women on your board won’t necessarily improve performance (which of course needs to be balanced with the heavily caveated studies which say that they will).

There is, however, some further evidence. Anita Woolley, Associate Professor at Carnegie Mellon University, has devoted much of her research to systematically examining the collective intelligence of teams. In the search for a collective intelligence factor (the c-factor), Woolley and her co-authors argue that there are three factors which correlate significantly to a team’s collective intelligence:

- the average social sensitivity of group members

- the equality in distribution of conversational turn-taking, and

- the proportion of females in the group.

But the latter two factors did not remain statistically significant after controlling for social sensitivity. In Klein’s work she postulates that the weak relationship between surface-level diversity and team performance could be due to the fact that the women named to corporate boards may not in fact “differ very much in their values, experiences, and knowledge from men”. Even if these women were different from men, “they may not speak up in board conversations and they may lack the influence to change the board’s decisions”. Her research points to the idea that outliers to a group often self-censor and even when these individuals speak up, majority group members may discount their views, not taking “full advantage of their own cognitive variety”.

Diversity: the not-so-hard facts

We need to tread carefully here. This is not a hard science. Greater surface-level diversity is not the magic bullet for solving your team’s decision-making issues. But, on the other hand, there are quite a few reasons why greater diversity is of benefit to your organisation.

Improved diversity of people from different socio-economic, educational and cultural backgrounds is a useful path to improved cognitive diversity, especially if all of your team currently comes from a limited range of backgrounds. We also know that good diversity policies (a) ensure that there are clear signals to your employees that there are no glass ceilings and everyone has fair access to opportunities, (b) allow organisations to access the best and widest pool of talent available, (c) ensure that your organisation is reflective of a global client base and a changing global landscape and (d) align with UN’s sustainable development goals.

So where does this leave us?

To truly leverage the benefits of diversity requires organisations to put in effort – diversity requires integration for it to work well. James Surowiecki in his 2004 book, The Wisdom of Crowds, argues that groups can make better decisions than individuals but only if three conditions apply: diversity, independence and an effective means of aggregating views. His last point on aggregation is critical. There’s no point in having a diverse team if nobody listens to what anybody else is saying. And there’s no point having a diverse team if people feel excluded and believe they don’t have a voice.

Organisations need a sustained, systematic and long-term commitment to diversity and inclusion. While the theory around diversity is important, it’s the practice that really matters.

We explore this point further in our paper, How to choose? A primer on decision-making in institutional investing.

Marisa Hall, MSc, FIA, is a Director in the Thinking Ahead Group, an independent research team at Willis Towers Watson and executive to the Thinking Ahead Institute.