Gold investors enjoyed another solid year of gains in 2020, as a multitude of investment tailwinds saw the precious metal increase by 25% and 14% in USD and AUD terms. It again outperformed most mainstream asset classes and acted to mitigate overall portfolio losses during Q1 when equity markets were particularly vulnerable.

The gold price also hit new all-time highs in nominal terms last year, trading above US$2,050 and A$2,800 per troy ounce (oz) in August, before undergoing a textbook correction by the end of November.

The precious metal finished 2020 on a positive note, rising by almost 7% in December (USD terms) to end the year trading at US$1,891 and A$2,455 per oz.

Gold ETF inflows smashed records last year

From a demand perspective, the highlight of 2020 was the inflows seen into gold ETFs globally. Total holdings increased by more than 30%, and ended 2020 at 3,751 tonnes, with these holdings worth more than US$228 billion.

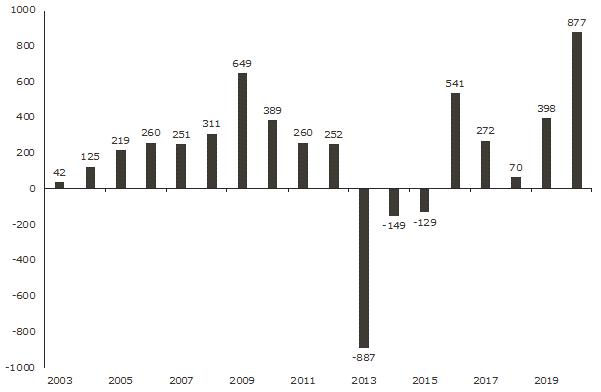

Across the entire year, more than 875 tonnes of gold were purchased through these vehicles, a level of demand that comprehensively broke previous records. This can be seen in the chart below, which plots annual demand across every calendar year from 2003 onward.

Chart: Net inflows (tonnes) into gold ETFs by calendar year

Source: World Gold Council

From a dollar perspective, flows into gold ETFs in 2020 were even more impressive, with almost US$48 billion invested last year. That is approximately two and a half times the amount invested in 2009 and 2016, which were both historically strong years for investment demand.

Australian investors were very much at the forefront of the increase in demand for gold ETFs last year, with total holdings in ASX-listed gold ETFs rising by more than 65%. That is more than double the rate of growth seen globally, and includes inflows into Perth Mint Gold (ASX:PMGOLD), which saw its market value almost double from $292 million to $580 million in 2020.

Overall gold demand soft in 2020

Despite the huge flows into gold ETFs, overall demand for the precious metal was relatively modest, with key consumer markets like India and China seeing sharp reductions in purchasing. This was due to the record high prices, as well as the impact of COVID-19, with disposable incomes severely impacted.

By Q3 2020, jewellery demand was 30% lower than levels seen in 2019, whilst end-of-year data for 2020 (not available at the time of publication) may indicate that total demand levels dropped by up to 50% last year.

Central bank demand also fell, with best estimates suggesting net purchases fell by as much as 50% last year. It must be noted though that this demand is in comparison to the five-decade highs seen in 2018 and 2019.

Outlook for gold in 2021

After a record run in 2020, there are some potential headwinds for gold. The first of these is the fate of the USD. Since late March 2020, the US dollar has fallen by more than 12% (DXY index), with speculative positioning relatively stretched by the end of 2020.

If the USD losing streak comes to an end soon, the gold price may pull back in the short-term, though for Australian investors it would likely be less of an issue as the AUD would also be under pressure in these circumstances.

Strength in equity markets, coupled with rising optimism regarding the incoming Biden administration, are also headwinds for precious metals in the short-term, with gold’s weakness over the past fortnight coinciding with Democrat victories in the Georgia Senate election runoff.

History would suggest the market will end up seeing these political developments as gold bullish, with the precious metal historically performing best (with average annual returns +20% in USD terms) when Congress is controlled by the Democratic party, as it will be going forward.

Other tailwinds that are relevant to the outlook for gold include:

- Rising inflation expectations

The US five-year forward inflation expectation rate ended 2020 at 2.03%. That is higher than the end of 2019, and an increase of more than 1.10% since inflation expectations plunged during March 2020.

- Record low yields

By the end of 2020 only 15% of all global bond markets had a yield above 2%, with most government bonds now yielding less than inflation rates.

- Outlook for monetary policy

Central Banks have been clear that more monetary stimulus will be forthcoming in 2021 and beyond, with cash rates unlikely to move higher for years to come.

Gold stands to benefit from this backdrop of already low to negative real yields and potentially higher inflation, especially given it has historically increased by approximately 20% per annum in AUD terms in years where real cash rates were 2% or lower, where they are today.

The fallout from COVID-19 remains an X-factor for gold, and indeed for financial markets as a whole. Whilst everyone hopes that we have seen the worst, and that 2021 marks the beginning of a ‘post COVID’ world, there are no guarantees.

Mutations are beginning to develop, whilst meaningful parts of the global economy remain locked down. Even the best-case scenario, which would see a successful rollout of vaccines around the world, represents an enormous logistical and political challenge, with global economic output unlikely to catch up to its pre COVID-19 trajectory for years.

Markets are pricing in a best-case scenario right now. If the situation deteriorates, expect risk assets to suffer, policy makers to deploy even more stimulus, and safe haven assets like gold to catch a bid.

Combined, these potential tailwinds indicate that gold prices are likely to remain biased to the upside for some time to come. Most importantly, from a portfolio management perspective, the precious metal offers unique diversification benefits to investors, which should see investment flows supported in 2021 and beyond.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.