The enterprise technology industry is currently undergoing its most significant transition in two decades. Cloud computing has emerged as a compelling alternative to the traditional deployment of IT resources on premise, giving rise to new, multi-billion dollar cloud businesses, and disrupting incumbent IT vendors.

Major cloud applications

“It's not water vapor. It's a computer attached to a network.” Larry Ellison, Oracle CEO, 2009

For most people, interaction with cloud computing is done through the consumer cloud services that they access on a regular basis. Streaming cloud services like Spotify and Netflix have revolutionised consumers’ consumption of media, delivering a catalogue of music and video via the internet for a monthly subscription fee. Apple’s iCloud centralises the storage of photos, documents, contacts and other information on Apple’s servers, accessible from multiple connected devices. Similarly, Dropbox has transformed file storage by allowing users to store files on its servers rather than locally on their PCs or other devices.

Cloud computing is also having a dramatic impact on the way enterprises use technology. Traditionally, enterprises have purchased hardware and software licenses upfront, installing and managing equipment in on-premise data centres. However, cloud vendors have increasingly enabled IT resources to be hosted in third-party data centres, and delivered over the internet for a subscription fee. This model of IT is often referred to as ‘public’ cloud delivery, because enterprises typically share IT resources with many other enterprises, hosted in hyper-scale cloud data centres.

Sales automation software company Salesforce.com was among the first and most successful enterprise cloud computing companies, having grown rapidly since its creation in 1999. It was followed by Amazon, which launched Amazon Web Services (AWS) in 2006. AWS provides cloud computing and storage services, and is one of the largest and most dominant cloud vendors today, with $4.6 billion of cloud revenue in 2014. In aggregate, market research firm Gartner estimates that the public cloud computing market was worth over $150 billion in 2014, and expects it to double by 2019.

Benefits and adoption

Cloud computing confers a number of benefits:

- It enables enterprises to benefit from the economies of scale achieved by their cloud vendors, often reducing the total cost of ownership of enterprise technology, and improving the quality of their IT.

- Subscriptions for cloud services are typically billed on an ongoing basis, reducing significant upfront costs.

- While on-premise hardware and software resources can be difficult and time-consuming to provision, enterprises are now able to provision cloud hardware and software with the click of a button.

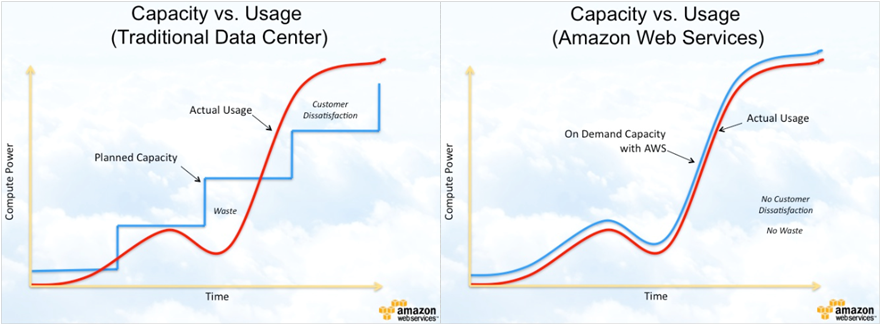

- As shown below, the cloud allows enterprises to adjust their cloud hardware and software capacity according to their needs, increasing the efficiency of their technology expenditure. This flexibility enables smaller firms to scale up and down quickly as required. For example, a promotional web article or video might prompt a spike in traffic to their website.

Source: Amazon

Cloud computing has so far been most readily adopted by smaller enterprises, which are likely to derive the most significant benefit from the scale and resource utilisation achieved by cloud vendors. In 2013, approximately 50% of Salesforce.com’s revenue was sourced from small and medium-sized businesses with fewer than 1,000 employees. Likewise, WorkDay, which sells payroll software in the cloud, has been focusing on mid-market customers in the United States. AWS has been extremely successful in attracting and supporting the growth of (former) start-ups, including Uber, Airbnb, Netflix, Spotify, Yelp, and Shazam.

Among large enterprises, cloud adoption has focused on discrete business processes and development and testing workloads. Large enterprises have typically few incentives to migrate mature, mission-critical processes to the cloud. This is the case for commonly-used custom airline reservation systems running on IBM mainframes, integrated Oracle financials applications, or SAP supply chain management products used by multinational companies. Large-scale migrations may be multi-billion dollar undertakings, and can involve material transition risk. Large enterprises can also be affected by regulatory considerations, data sovereignty or security concerns.

Example: implications for Microsoft

New cloud entrants threaten to disrupt the businesses of incumbent IT vendors. After achieving consumer success with its Gmail service, Google released ‘Apps for Work’, which delivers email, word processing, and spreadsheet functionality via the internet, in competition with Microsoft’s lucrative Office business. Concurrently, Amazon offered its customers the ability to initiate and migrate server workloads to the public cloud, and improved the ease with which they could implement alternatives to Microsoft’s software.

Microsoft has aggressively responded to these challenges, releasing the cloud-delivered Office 365 productivity suite and its Azure cloud platform. Cloud customer benefits include: mobile access to Microsoft software products, latest updates, and enhanced functionality, all with lower implementation and management costs. It is not surprising that Microsoft’s commercial cloud business grew by 88% in the fourth quarter of 2014, after posting seven consecutive quarters of triple-digit growth. It now has an annualised revenue run-rate in excess of $8 billion, making it the largest enterprise cloud vendor globally.

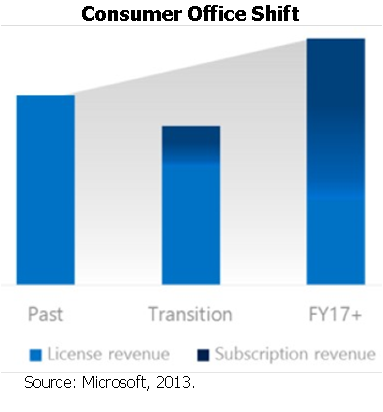

However, the shift from the sale of on-premise licenses to cloud subscriptions has materially affected Microsoft’s revenue and earnings in the short term. While it has traditionally recognised one-time on-premise sales upfront, cloud contracts are typically characterised by smaller, ongoing payments. It will take time for cumulative subscription revenue to exceed the value of cannibalised on-premise sales. Meanwhile, the cost of delivering cloud software is structurally higher than on-premise. Microsoft’s cloud earnings margins should, however, expand as its cloud business grows and it improves the utilisation of its data centres.

It is Magellan’s view that in the longer-term, Microsoft is likely to benefit significantly from growth in its cloud business. Cloud delivery increases the addressable market for Microsoft’s products by allowing enterprises to access, deploy, and manage its software products more easily and cost effectively. Microsoft considers that the lifetime value of transactional Office customers increases 1.2-1.8x when they migrate to the use of Office 365. Cloud delivery may also allow Microsoft to launch new, innovative products that were previously not feasible on-premise, such as machine-learning software leveraging Microsoft’s hyper-scale data centre network. Cloud delivery of Office could also reduce piracy over time.

While the upfront price of Microsoft’s cloud products is lower than its on-premise products, the cumulative total price of its cloud products over time is likely higher. This dynamic is particularly apparent with respect to consumer Office 365. Office 365 has a subscription price of $100 per annum, a large discount to the circa $180 upfront price on-premise. However, customers have historically only upgraded their on-premise Office licenses every five to seven years, implying an equivalent price of $26-36 per annum on-premise. As shown below, the short-term headwind of lower upfront revenue is dwarfed by an indicative longer-term benefit from the shift to cloud subscriptions.

Shift to the cloud affects many businesses

The shift to the cloud has had a significant impact on the enterprise IT industry, and presents challenges and opportunities for incumbent vendors. As they transition, many inherently stable software companies may experience short-term earnings and stock price volatility well in excess of any change in their underlying value. Such volatility may potentially present attractive investment opportunities for long-term investors.

Michael Poulsen is an Investment Analyst covering the Information Technology sector at Magellan Asset Management Limited. This material has been prepared by Magellan Asset Management Limited for general information purposes only and must not be construed as investment advice. It does not take into account your investment objectives, financial situation or particular needs.