While smaller companies can offer much greater growth than the broader share market, they have underperformed in the past two years. That is not unexpected given small caps typically underperform in an environment when interest rates are rising and economic growth is slowing.

Indeed, over the past 12 months to 30 October 2023, the S&P/ASX Small Ordinaries Total Return Index has fallen 3.6%, compared with a rise of around 4.0% for the S&P/ASX 200 Total Return Index.

With interest rates still rising and the geopolitical landscape – including the war in Gaza – uncertain, markets are more volatile. There is potential for more downside risk for all shares, but especially for small caps, because they are more exposed to economic cycles and investor sentiment.

However, if investors maintain a longer time horizon, and look through this volatility, investing in small caps can be rewarding. When they turn, small caps generally grow at a faster rate than large cap stocks. But investors may need to be patient to reap returns.

The lure of small caps

The small caps sector is attractive because of the opportunity it offers to invest in high growth businesses early in their business cycle. Stock pickers who choose well can enjoy the benefits of above-average earnings growth early in a company's growth phase, along with possible re-rating benefits, as investors become more aware of the company’s potential over time.

The small cap universe has the added advantage of being more diverse than the large cap universe, so growth opportunities are greater (although so is the risk). The ability of fund managers to generate outperformance depends on whether they can identify opportunities that other investors have not yet recognised. This usually involves unearthing information about a company’s prospects through close scrutiny, regular visits, and rigorous financial analysis.

Successful fund managers need a good eye and an inquiring mind. While large cap stocks are researched intensively, small cap companies are generally less researched. Investing successfully requires greater leg work to understand industries, companies and their management teams and business models. In-person visits are important to understand companies and what drives them. Thorough research provides the opportunity for the small-cap investor to sift through and find undiscovered gems that will deliver strong gains over the long term.

Some sectors will likely perform better than others

Looking ahead to 2024, there are some sectors in the small cap universe that are expected to do better than others and offer good prospects for growth. They include building materials, as well as companies linked to renewable energy, including miners and mining services companies.

In the building materials sector, we expect that strong population growth in Australia will support the prospects of building materials companies like Maas Group (ASX:MGH) and Boral (ASX:BLD). Despite rising interest rates, there is still a huge demand for housing in Australia and a chronic shortage of supply. Both of these companies stand to benefit from housing construction ramping up demand for supplies of construction materials.

The decarbonisation trend will also likely propel miners of critical minerals ahead. The transition from fossil fuels to clean energy technologies, such as renewable energy generation and electric vehicles (EVs), depends on critical minerals such as lithium. While lithium prices have suffered through 2023, we believe that over the longer term, they will rebound and with it, the prices of lithium miners listed on the ASX.

Uranium too may gain in importance, and we expect that some uranium miners such as Paladin (ASX:PDN) and Boss Energy (ASX:BOE) may potentially benefit from any rise in demand for uranium. Boss, for example, is focused on the re-start of the Honeymoon Uranium Project in South Australia. Honeymoon is one of the few uranium projects globally ready to come on-stream in an emerging bull market, with first production targeted for the fourth quarter of this year. Paladin’s Langer Heinrich Mine in Namibia is also on track to be a significant player in decarbonisation, with uranium production targeted for the first quarter of 2024.

In terms of sectors that may lag, technology and healthcare sectors could underperform. Some technology companies are still trading on high multiples and could continue to de-rate if long bond yields continue to rise. Already, the US 10-year yields are sitting at 16-year highs and look set to climb over 5%. This could hurt the tech sector further.

In the healthcare sector, some biotechnology companies that are not yet at the earnings stage could be vulnerable to price falls. More broadly, healthcare has underperformed this year, which is an anomaly as it is normally more defensive. But we have seen vulnerability in some larger companies such as CSL (ASX:CSL) and ResMed (ASX:RMD), which has fed through to the smaller cap healthcare sector as investors de-rate earnings multiples due to the more difficult economic environment.

Small cap winners

We believe the following three small companies could outperform in 2024 and beyond.

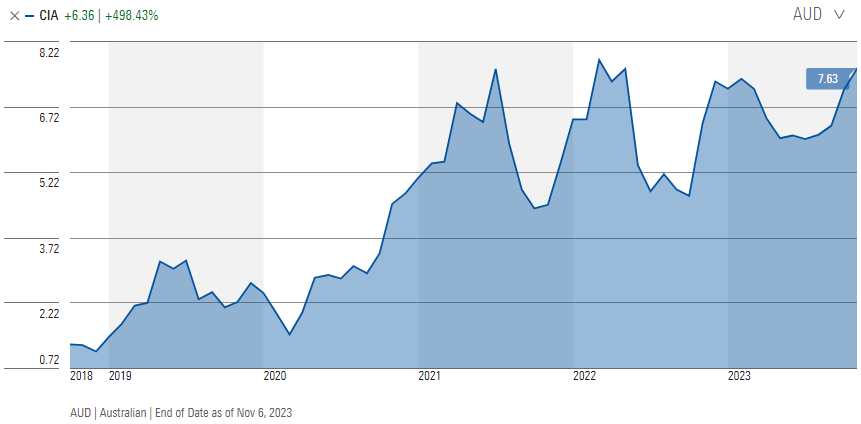

Champion Iron (ASX:CIA)

Champion Iron mines high grade iron ore and is playing an increasingly important role in the 'green steel' market. The company provides high grade ingredients that help reduce carbon emissions in steel production. This is important as producing steel accounts for around 7-8% of global carbon emissions, so Champion has a key role in the decarbonisation process.

The miner also has a long mine life and relative to other global green steel producers, it has a lower cost of production. Yet the company has been put into the same boat as the bigger miners BHP and Rio Tinto when it comes to valuations. However, we believe it should be trading at a material premium. In the short term, we see the iron ore price well supported over US$100/tonne given that inventories of iron ore in China are at a multi-year low and steel demand has remained steady. We are also heading into a period of re-stocking ahead of the Chinese New Year. Longer term, while Chinese demand is likely to ease, steel demand will likely strengthen in other emerging markets led by India. We also anticipate a growing ‘green steel premium’ for producers of high-grade, low impurity iron ore as demand in this segment of the market rapidly expands in the countdown to net zero.

Source: Morningstar

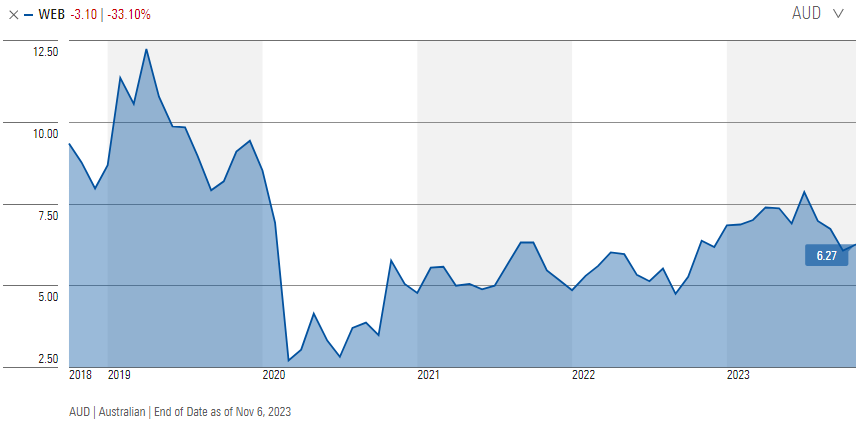

Webjet (ASX:WEB)

Webjet is a global digital travel business operating in both consumer and wholesale markets. While it is better known for its online travel agent portal webjet.com.au, its global marketplace WebBeds, is the second largest wholesaler of hotel beds globally. WebBeds provides a single point of digital connection for a geographically diverse range of hotel operators. Importantly, it is a large market, with $70 billion of Total Transaction Value (TTV) on offer; WebBeds currently holds around 5% market share. The company has emerged well capitalised post the pandemic, having used that time to materially upgrade its platform technology. Webjet is now poised to take market share and is targeting $10 billion in TTV from around $3 billion currently. We expect a re-rating of its shares to reflect that strong expected growth, which is being underestimated by the market.

Source: Morningstar

Smartgroup Corporation (ASX:SIQ)

Smartgroup delivers novated leasing to employees across Australia. Novated leasing demand is rising strongly on the back of greater demand for EVs as the federal government has created incentives for people to buy EVs through such leases. In particular, fringe benefits tax (47%) is not charged on EV purchases below the luxury car tax threshold of $90,000, which means it can be significantly cheaper to buy an EV through a novated lease than outright. We expect this to propel earnings growth for Smartgroup. In the month of July 2023, for example, EV orders represented around half of Smartgroup’s new car orders in its corporate segment, and this could accelerate as EV adoption grows as the Australian economy decarbonises, setting Smartgroup up for outperformance.

Source: Morningstar

Simon Brown is a Portfolio Manager at Tribeca Investment Partners. Tribeca is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. Tribeca may have holdings in the companies mentioned in this article. This information is general in nature and has been prepared without taking account of the objectives, financial situation or needs of individuals.

For more articles and papers from GSFM and partners, click here.

The information contained in this article reflects, as of the date of publication, the current opinion of the author and GSFM Pty Ltd and is subject to change without notice. Sources for the material contained in this article are deemed reliable but cannot be guaranteed. We do not represent that this information is accurate and complete, and it should not be relied upon as such. Any opinions expressed in this material reflect our judgment at this date, are subject to change and should not be relied upon as the basis of your investment decisions. All reasonable care has been taken in producing the information set out in this article however subsequent changes in circumstances may occur at any time and may impact on the accuracy of the information.