It is difficult to design a survey without some preconceived idea of what the answers might be, and it’s a welcome surprise when prior assumptions are challenged. It was certainly the case here.

I feel honoured that so many of you shared your personal views on death, retirement and spending.

Our Survey received almost 1,200 responses which is probably the largest sample on this subject since the two papers on retirement income were issued by Treasury. The Survey results have been sent to the Government and hopefully it is valuable input to policy decisions.

We also received well over 1,000 comments which is obviously too much to include in an article.

The comments are attached here in full and largely unedited (warning, we have removed a few unsavoury words and personal identifiers but some may have slipped through).

I encourage you to scan the comments. They are as important as the overall results and many were passionate, considered and heartfelt. Millions of Australians live on their super and policy determines the quality of their lives.

For background, two previous articles are here and here and the Survey is now closed.

Here are some highlights:

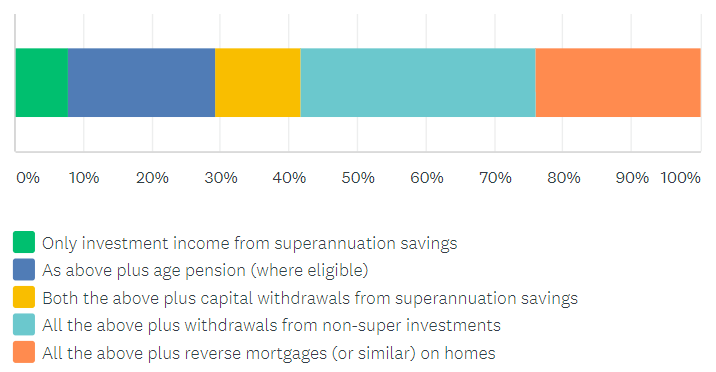

Q1 The definition of retirement income should be:

This was the first surprise. The question allowed readers to cumulatively add to the previous category. Based on past comments received in Firstlinks, I expected far more people to say that retirement income should comprise only pensions (where eligible) and superannuation (both income and capital). These items are widely accepted as sources of retirement funding but the sum of the three was only about 42%.

A further 34% of people accept that retirement income includes withdrawals from non-super assets, and again surprisingly, a solid 24% more accepted the need for reverse mortgages (or similar) on homes.

My interpretation of these results is the Government has more support for its definition of retirement income than I expected. Most people accept it should include drawing widely on assets held during retirement, not only super. This should give the Government more confidence pushing ahead with its broad definition.

It also shows support for equity-release schemes (although a later question suggests not for own use). The Government should improve the Pension Loan Scheme, especially the punitive interest rate of 4.5%.

Here are some sample comments:

"I do not accept the right of Government to apply conditions to how I spend my own 'all taxes paid' wealth. I grudgingly accept the Government may have some moral right to applying conditions to how I spend a Government Pension or wealth earned under Super tax concessional rules."

"With the taxpayer-subsidised boom in assets values of property, it is absurd not to include that stored value in any consideration of lifestyle sustainability."

"To regard as income the withdrawal of your own life savings from the cookie jar, the bank or under the bed just defies logic."

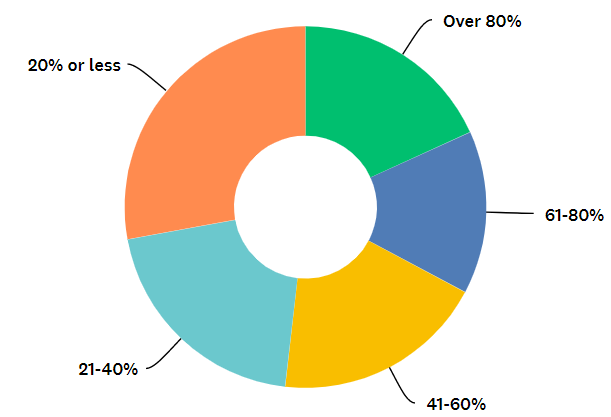

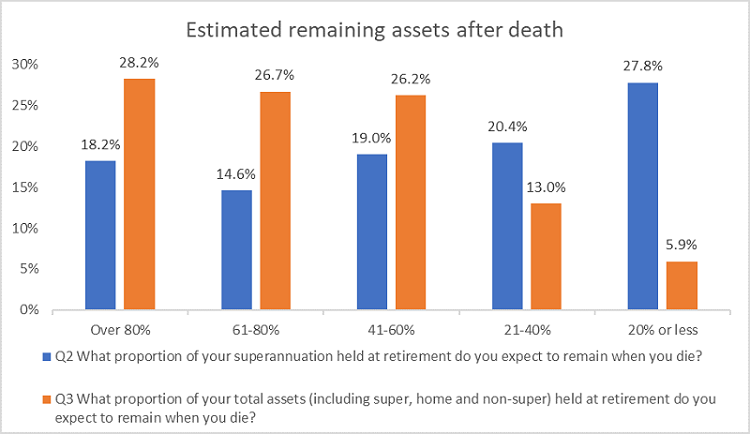

Q2 What proportion of your superannuation held at retirement do you expect to remain when you die?

Another surprise, I did not expect such an even distribution. Only 18% of respondents expect over 80% of their super to be left over on death and 28% expect to have 20% or less. That shows significant expectation to spend the majority of super in retirement, with nearly half at 40% or less.

Q3 What proportion of your total assets (including super, home and non-super) held at retirement do you expect to remain when you die?

The table below contrasts the results for super remaining before death (blue bars) versus all assets remaining (orange bars). This tests the claim that "... retirees die with around 90% of the assets they had at retirement." (Retirement Income Review). It shows most people (28.2%+26.7%=54.9%) expect over 60% of their assets at retirement to remain at death. Less than 20% expect to have only 40% of assets remaining compared with nearly half of super alone.

It's logical and expected that people generally accept super is for spending in retirement but less of their total assets will be consumed.

"I have an ethical preference to minimise consumption, and leave as much as possible to charity. While there is still so much poverty in the world, it seems not right that the well-off among the world live to maximise their own consumption."

"I expect at least that my home, unmortgaged and my super, will remain to support my wife and kids. It is not reasonable to expect to use up everything before one dies. The money all goes around anyway."

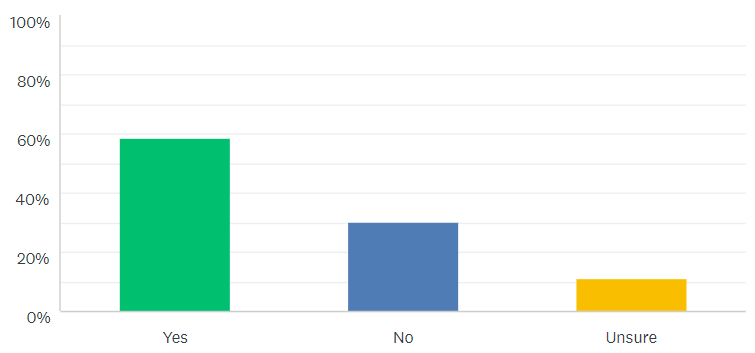

Q4 Would you spend more in retirement if you knew you would never run out of money?

Our previous article quoted research that people would spend more if they knew their money would never run out, and it is one reason the Government is encouraging the development of retirement income products. Again, these results will encourage the Government. About 59% would spend more which confirms their view that some people are living frugally as they are unsure how long their savings will last.

Some respondents thought this was a silly question, assuming that of course people would spend more if they knew they would never run out of money. But that is assuming a certain type of behaviour. Plenty of retirees have enough income to live on and do not want to spend more, while many will leave money to their kids. The question is not intended to test whether people would rush out to buy a Ferrari and take a first-class world cruise if they knew they would not run out of money.

"I spend what I need to spend and that should be sufficient for the government, leave me alone let me die in peace when it is my time and what is left can be used by my offspring."

"I’m too old to get much pleasure from big spending. I am fortunate in being able to spend what I want; but I am not extravagant, and expect to die with more assets than I have now.(I am 85 yo)."

"I doubt if I will run out of money. I could spend more but want to leave something for my children. I believe my children will have less than I have. They may not all own a house."

"Have saved all my life and wouldn't be able to change if it's within my power."

"My income is more than enough to cover my expenses."

"We come from humble beginnings, so v expensive cars, boats are not us - so there is no means to actually spend more if wise investments keep accumulating. Its then up to the next generation(s) to be wise or spend or have a balance."That's a no-brainer!! Seriously I probably would not. I have lived a comfortable but value focussed life & that will not change. I buy what I want, travel where I want & what is left each year I give to the kids!"

"I am happy with my life, why spend more than I need to. Spending more does not buy more happiness."

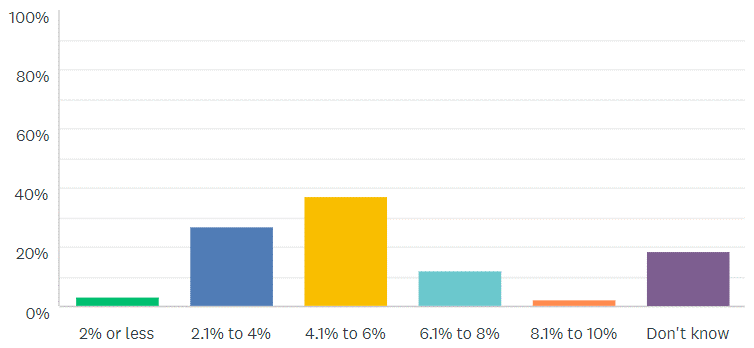

Q5 If someone is 60 years old with a life expectancy of 90, what is a safe annual withdrawal rate to never run out of retirement savings?

Safe withdrawal rates are hotly debated in the industry and academia, but the most popular in this survey was in the range of 4.1% and 6%. Of course, there are many assumptions in this question and we left it very broad. The sum of responses over 4.1% was 51% so there is a fair amount of optimism that growth assets will continue to deliver, because money would run out over 30 years if invested in term deposits at 1%.

"The government has only itself to blame. In today's zero-interest-rate environment, where you can't safely earn enough to keep pace with inflation, you can hardly blame pensioners for being overly cautious about spending and drawing down their assets."

"Don't care, the strategy of focusing on income in a combination of age pension and dividends plus franking to provide all my required spending without capital withdrawal is a far better option."

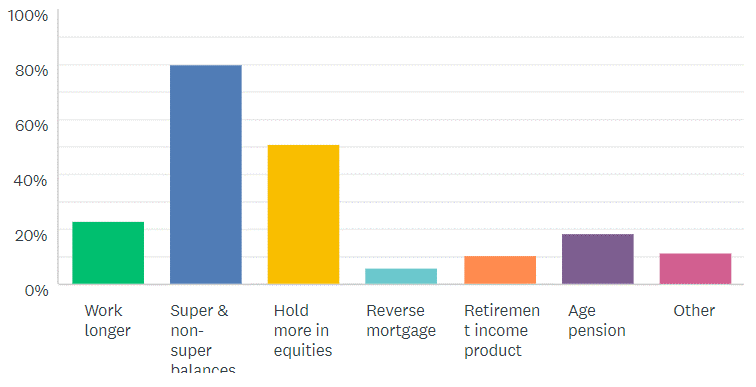

Q6 How will you generate money to live on after age 65? (multiple answers allowed)

The most obvious and popular answer which scored 80% is drawing down on super and non-super, and reflecting the wealthier people who read Firstlinks, only 19% expect to go on the age pension. Our audience also expects little use of reverse mortgages for themselves (although in question 1, they supported others using reverse mortgages). Half of respondents indicate a switch from term deposits (and similar) to equities to generate income.

"I'd work if a suitable job could be found."

"Already retired - having to move up the risk curve significantly to retain income. Almost no TD's now."

"I'm ex fund manager, ex VC/PE so we tend to get higher returns, the key being not to be a slave time wise to finding or helping such investments."

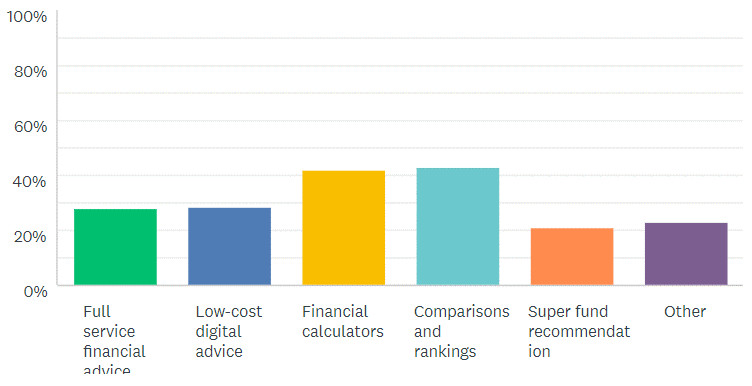

Q7 Which of the following might you use in selecting your retirement strategy, if they offered good functionality? (multiple answers allowed)

Many different products are likely to be used as people plan their retirement strategies, although less than 30% of responses nominated full-service advice if the cost was about 1% of the asset value (which is a typical level). Cheaper digital advice gained similar support. The most appealing choices were online calculators and comparison tools at over 40% each, and a decent 21% would consider a product recommendation from their super fund.

"Have learnt to invest through self education."

"My own bloody spread sheet!!"

"Full service advice at a fixed fee rather than a percentage. Like going to a lawyer or accountant. You pay for what you need when you need it. The best step that could be made in the interest of consumers is to stop the annual fee on a percentage of funds service or at least develop the alternative mentioned above."

"I like to invest directly in equity (with diversification) and do so through an online broker. Since my goal is to leave as much of my wealth as possible to charity, I have an investment horizon that extends beyond my own life time."

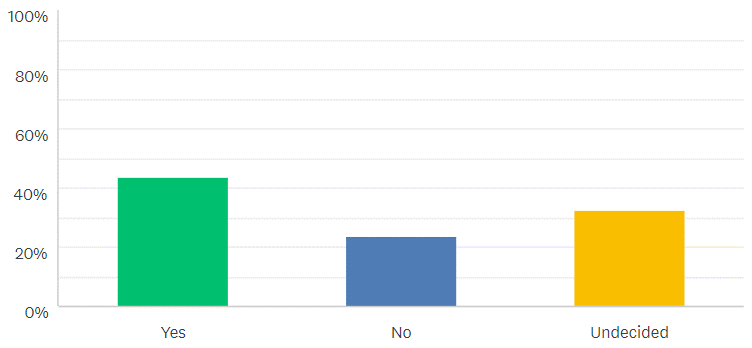

Q8 Do you plan to leave an amount available to buy a place in an aged-care facility?

This response was also higher than I expected, indicating that a reason many people live less lavishly than their resources seem to allow is the uncertainty of the final cost of an aged care place. A strong 44% of respondents plan to leave an amount aside and only 24% will not, although the undecided is a high 33%. Many of the comments on this question were highly personal.

"I hope for the fate like my mother. Wake up in the morning take five paces and drop dead."

"An important question. Recent experience with relatives indicates a lump sum of $500 K to $1Mill to secure a good to high standard of care. This is a very substantial amount for most."

Q9 Any other comments on retirement income, intergenerational inequity, superannuation policies, etc?

With over 400 comments on this question alone, it is impossible to do them justice here. See the attached paper for a full list, lots of great ideas.

Thanks to everyone who participated.

Graham Hand is Managing Editor of Firstlinks. The Reader Survey was open from 5 August to 12 August 2021.