The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Happy Easter to all.

After the recent market meltdown, the ASX still doesn’t look especially cheap. At a 17x forward price-to-earnings ratio, the ASX 200 remains a bit above its long-term average.

Any stock with a hint of growth still seems priced for perfection. Take high-fliers like Pro Medicus and Technology One, which have both pulled back, yet still trade on eye-watering trailing P/E multiples of 223x and 77x respectively. Or Cochlear, a great company no doubt, but I’m sure it’s that great at 46x P/E. Nor CBA, priced like a tech stock, with a P/E of 27x and price-to-book (P/B) ratio of 3.5x.

I thought it would be useful to dig deeper to try to find where there might be value on the ASX. I ran nine screens through Morningstar’s database, and here are the results:

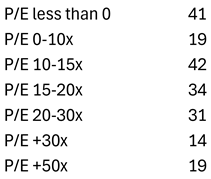

1. ASX 200 stocks split by P/E ratios for FY25

Source: Morningstar

This chart gives an overview of valuations on the ASX 200. Interestingly, 41 of the companies, or more than 20%, don’t make money. Also, there are as many stocks sporting P/Es of more than 50x as there are companies with P/Es under 10x. And there are a lot of companies in the 10-15x range, which surprised me.

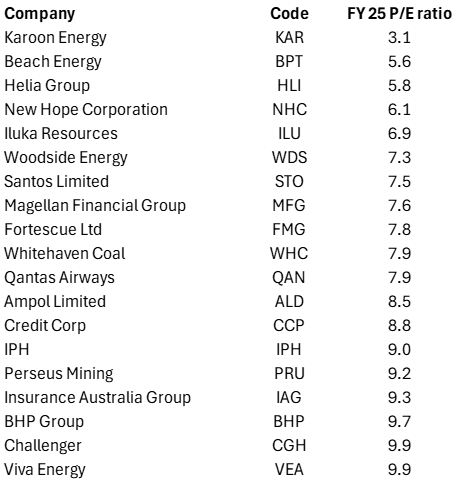

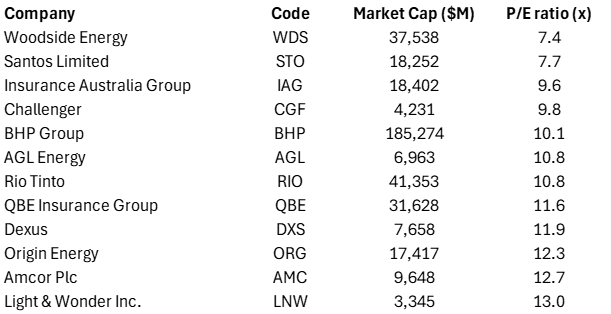

2. ASX 200 stocks with an FY25 P/E ratio of less than 10x

Source: Morningstar

Here are the stocks on a P/E of less than 10x. It’s no surprise to find energy stocks on this list, and Woodside, Santos, Beach, and Karoon look cheap not just on a P/E basis but on every other valuation metric too.

This list also throws up some quality companies. Challenger, IAG, and Ampol are the ones that stick out to me. All are potential ideas for investors looking for value stocks.

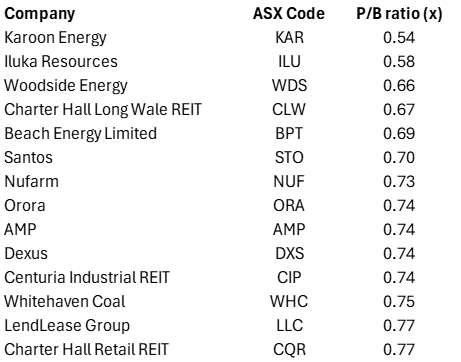

3. ASX 200 companies with a FY25 P/B ratio less than 0.8x

Source: Morningstar

Another way to measure value is via the P/B ratio. Here we screened for those companies on a P/B ratio of less than 0.8x. Again, energy names dominate.

However, the other prominent sector is REITs, which isn’t surprising given they’ve had a tough few years. Charter Hall Retail REIT is still at a decent discount to book value despite having consistently high tenant occupancy at its convenience format sites.

Centuria Industrial REIT looks potential value at this juncture. The shine on industrial property has come off over the past 12 months as vacancy rates rise. However, the long-term trend of rising ecommerce remains intact. And the value of industrial sites in outer metropolitan areas should continue to increase.

Dexus is the other one to possibly look at, especially if you think that rates are coming down and the worst for office property is over.

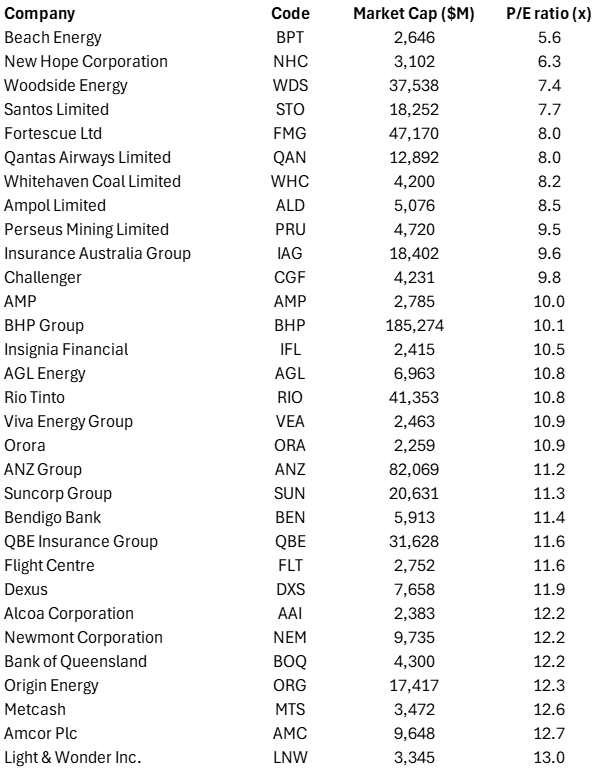

4. ASX 200 companies with a market cap >$2 billion and an FY25 P/E ratio <13x

Source: Morningstar

The previous lists might be coined deep value lists. The next one above provides less stringent valuation criteria to see which stocks pop up. And it does come up with some intriguing prospects. Light & Wonder, the ‘mini Aristocrat’ certainly fits in that category. As do companies such as Amcor, QBE, AGL, Origin, and Newmont.

I think that if you narrowed this list of 31 stocks down to a dozen and held onto them for a decade, the results may be satisfactory. Which dozen though? Here are my choices:

5. ‘Dirty dozen’ ASX 200 companies with a market cap >$2bn and an FY25 P/E ratio <13x

Source: Morningstar

This list seems solid: a mix of potential growth with Light & Wonder, Amcor, IAG, Challenger and QBE, defensive stocks with Origin and AGL, and exposure to beaten down commodity, energy, and real estate names.

Yes, it doesn’t have any tech, healthcare, or banks stocks, though that’s probably the point – these stocks were the biggest beneficiaries of the recent bull run and are still priced as such.

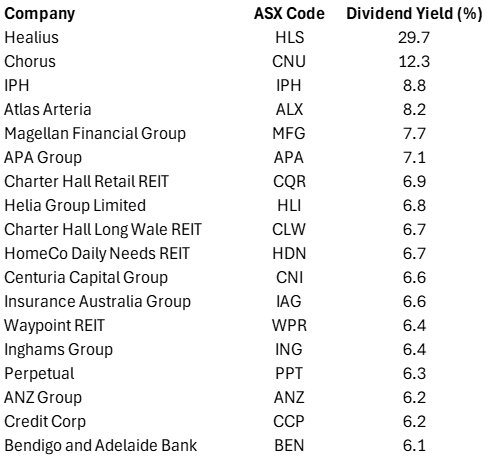

6. ASX 200 stocks ex basic materials and energy, with net dividends yields >6%

Source: Morningstar

This list is for those after income. I think NZ-based Chorus should be in most dividend-focused portfolios. Not far behind is APA, the energy pipeline provider.

As you’d expect, there are lots of REITs in this list. It’s best to be choosy with these, and the starting point should be around the quality of the assets, occupancy rates through time, and the financing of the assets.

Banks are also prominent here, though I’m not so convinced on the prospects for ANZ (management) or the regional banks (lack of scale).

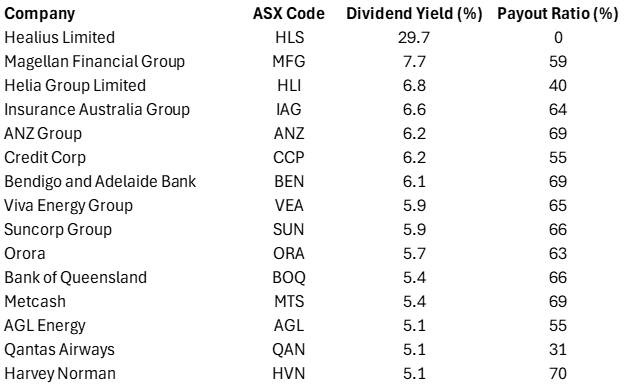

7. ASX 200 ex-basic materials and energy with div yields >5% & payout ratios <70%

Source: Morningstar

The above chart screens for those with sustainable dividend yields. If a company has a high dividend yield and is paying out close to 100% of their earnings, then the yield may not be sustainable.

Here, we’ve taken those ASX 200 companies with net dividends yields of more than 5% and dividend payout ratios of less than 70%. AGL, Metcash, Suncorp and Viva Energy are some of the names on this list that may be worthy of further study.

8. ASX 200 companies with ROEs >20%

Source: Morningstar

It’s time to peruse so-called quality stocks. Here, we have those companies with returns on equity above 20%. In my view, return on equity and return on invested capital are the two best metrics to determine the quality of a business.

The above list shouldn’t come as much of a surprise – these companies frequently make the news because investors love them.

The gaming stocks of Lottery Corp and Light & Wonder have surprisingly high ROEs. Larger companies such as Brambles, Coles, Woolworths, Medibank, and Aristocrat, still manage high returns, thanks to them largely operating in oligopolies, which limits competition.

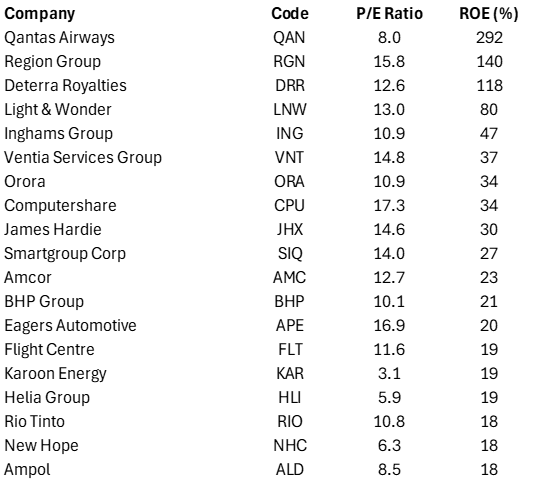

9. ASX 200 stocks with P/E ratio <18x and ROE >18%

Source: Morningstar

This screen looks for quality companies at a reasonable price, or GARP as it’s sometimes known.

Deterra Royalties looks a reasonable prospect, though note that it has one of the world’s best iron ore royalties in WA, but it wants to expand beyond the one royalty via acquisition. It’s a dumb move that is likely to cost investors.

For me, Amcor warrants further investigation. Names that I follow less, such as Eagers Automotive, Computershare, and Smartgroup, may also be worth researching.

Do your own research

Screens are a useful starting point but they are no substitute for further research. After all, they don’t show things such as whether earnings are currently elevated or depressed, whether one-offs have boosted profits, whether commodity prices have helped or hindered, whether companies have benefited or suffered from cyclical or structural trends, and so on.

As an aside, I used Morningstar’s database for the screens though I filtered down the lists via Chat GPT, which proved especially helpful in reducing the need to do complex excel calculations.

****

In my article this week, I explore four strategies for investors to take advantage of the current crisis. They include rebalancing or overbalancing portfolios, buying $1 for 80 cents or less, and wading into the most bombed out sectors.

James Gruber

Also in this week's edition...

The ASX is investigating the introduction of dual class share structures for listed companies. The idea is getting pushback, including from fund managers, but Dimitri Burshtein and Peter Swan suggest that the ASX should ignore those with vested interests and bring Australia into line with developed market peers.

Pascale Helyar-Moray has contributed to new research into the state of women’s wealth in Australia. The research shows the average Australian woman has $428,000 in net wealth, 40% less than the average man. Pascale outlines what the gender wealth gap looks like across different life stages.

John Templeton once said that the four most dangerous words in investing are, “this time, it’s different.” Joe Wiggins has a different take, arguing that the most reliable indicator that sections of financial markets are exhibiting extremes in sentiment or valuation is when investors start to use the words ‘always’ and ‘never’. He has plenty of fodder after recent investor exuberance for US stocks.

In our increasingly digital world, semiconductors are essential to almost all the innovations that are improving our lives. Eric Marais of Orbis has a great overview of what’s driving demand for chips, how the semiconductor industry is evolving, and his firm’s favoured stocks to play the theme.

There’s one asset that has thrived under Trump’s tariffs: gold. Marissa Salim thinks the recent gold highs are unlike previous peaks as fundamentals for the yellow metal look favourable on many fronts.

If you’re considering selling bank hybrids, Schroders’ Helen Mason thinks may now be an opportune time. In an interview with Firstlinks, she outlines her case for this as well as why she likes tier two and Triple-B debt securities following the recent market volatility.

Two extra stories from Morningstar this holiday weekend. Matthew Dolgin explains why Netflix looks expensive despite its ambitious new growth targets, while Joseph Taylor explores Perpetual’s recent moat downgrade.

Lastly, in this week’s whitepaper, VanEck provides a comprehensive review of markets during the March quarter, and what may lie ahead.

****

Weekend market update

In the US on Friday, stocks floated through a forgettable session to settle slightly higher on the S&P 500, wrapping up the holiday-shortened week with a 1.5% loss. Treasurys largely reversed Wednesdays rally with 2- and 30-year yields 3.81% and 4.8%, respectively, up four and six basis points on the day, while WTI crude maintained recent momentum with a push towards US$64 a barrel and gold pulled back only slightly at US$3,315 per ounce. Bitcoin rose towards US$85,000 while the VIX ebbed to just below 30.

From AAP:

The Australian share market has made its first weekly gain since March, clawing back most of the losses forged from US trade war escalations.

The S&P/ASX200 gained 0.78% to 7819.1, while the broader All Ordinaries rose 0.76% to 8021.9.

The top 200 index is about 130 points, or 1.6%, below its level when US President Donald Trump's "Liberation Day" tariffs sent markets into a tailspin.

The local bourse has clawed back 2.1% for the week after sliding more than 9% during the fortnight after the tariff announcements.

Ten of 11 local sectors finished higher on Thursday, led by a 3.8% recovery in energy stocks after a 2.7% slide on Wednesday.

Materials helped lift the bourse higher, rising 1.5% as Rio Tinto rebounded 2.9% after disappointing production caused a similar drop the day before. The sector was up 3.1% for the week.

Financials lifted 0.5% on Thursday to net a 3.3% gain for the week, as CBA posted its fifth straight week of gains. The sector is on the verge recovering from correction territory but is still down 10% from mid-February highs.

Consumer staple stocks performed well, up 1.1 per cent.

Curated by James Gruber, Joseph Taylor, and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website