Managing a diversified equity portfolio is sometimes similar to being a farmer in that at any stage you are likely to be ‘harvesting’ or selling good stocks that are now over-valued and ‘planting’ or buying companies that appear undervalued.

When you look at the collection of stocks in any portfolio, it is both unlikely and probably undesirable to face a situation where all the stocks are dramatically ahead of the index and also ahead of our valuations. This turn of events would probably indicate a lack of selling discipline by the fund manager. Furthermore if this was the case, the following month or quarter could show those very same stocks all down simultaneously as well.

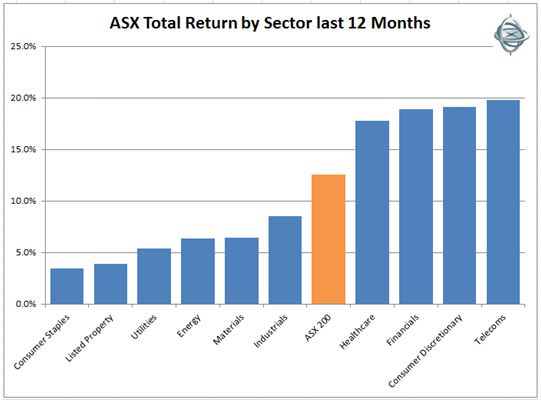

Over the last 12 months the ASX 200 has given investors a total return (price appreciation plus dividends) of +12.5%. As you can see from the chart there has been a significant dispersion of returns amongst the 11 sectors that make up the ASX.

In this piece we present an overview of the sectors in the market, as well as looking at those securities that have performed well over the last 12 months and those that have lagged.

What's working?

Telecoms have been the best performing sector over the past year with heavyweight Telstra (+17%) finally increasing dividends and capturing mobile market share. This performance from Telstra was eclipsed by the second tier players such as TPG (+105%) and iiNet (55%) which have benefited from strong customer growth.

Consumer Discretionary has benefited from investors looking to capitalise on a recovery in Australian consumer spending. However, unlike telecoms there has been a wide dispersion in returns amongst this sector. Previous market darlings like The Reject Shop (-43%), Wotif.com (-43%) and Myer (-20%) have struggled over the year. Alternatively investors have bid up RealEstate.com (+77%) and Harvey Norman (+19%) to take advantage of a housing market recovery.

Financials continued their run of providing solid returns to investors mainly due to falling bad debts boosting bank profits. Bank returns were understandably tightly clustered as they are influenced by similar dynamics with ANZ (+20%) the leader and Westpac (+18%) bringing up the quite respectable rear. Sizzle in the Financials sector was provided by companies like Henderson (+97%) and Macquarie (+63%) whose profits are directly linked to bullish equity markets.

What's lagging

Consumer Staples was the worst performing sector in the market as reasonable performances from Woolworths (+10%) and Wesfarmers (+7%) were dragged down by a collection of other companies like Treasury Wines (-34%), Metcash (-30%), Graincorp (-25%) and Coca-Cola (-19%) which fell due to a range of stock-specific issues.

After being the glamour sector in 2012, Listed Property has turned in a rather pedestrian performance, essentially tracking the sector's distribution yield. If an investor’s focus is on owning trusts whose earnings come from collecting recurring rents such as IOF (+11%) and SCA Property (+6%) rather than development profits, they should be happy with this. Some portfolio returns were assisted by the takeover of Commonwealth Office (+18%).

As a sector, Utilities returned 5% over the last year. Regulated utilities like electricity and gas distributors SP Ausnet (+15%), Envestra (+15%) and Spark (+9%) were generally higher due to tariff increases. Electricity retailers like AGL (flat) struggled during the year due to elevated levels of competition for customers and discounting eroding margins.

What's missing?

Typically any piece discussing the ASX mentions the rock diggers, as this is a large part of the index and for Australian equity fund managers, correctly picking the resources over or underweight is a key determinant of relative performance. Whilst as a sector over the last year, Materials trailed the index returning 6%, the main miners, BHP (+12%) and Rio Tinto (+13%), have mostly matched the index.

Hugh Dive is Head of Listed Securities at Philo Capital Advisers.