Extensive research has been conducted into retiree concerns, with three key concerns consistently coming out on top:

- running out of money

- facing unexpected health and aged care costs

- not being able to maintain a comfortable standard of living in retirement.

In other words, not knowing what’s waiting for us in the future – or uncertainty.

Uncertainty is impacting quality of life in retirement

The investment strategies and products that have served so well in accruing assets via super don’t necessarily provide the kind of financial certainty Australians want (and need) in retirement.

It doesn’t help that super has long been framed as a ‘nest egg’ to fund our retirement – a label that is hard to shake off in the retirement phase. After being told all our working lives to grow our savings for retirement, studies show that many retirees are reluctant to draw it down, opting instead to spend less and preserve as much of it as possible in the face of an uncertain retirement timeframe.

The upheavals of recent years have also played a significant role in the diminishing drawdown of savings that we are seeing. Uncertainty about market volatility, about inflation and the cost of living, uncertainty about unplanned future expenses – all of these influence a person’s financial confidence going into retirement.

Ultimately, this has a tangible impact on the quality of life in retirement; not only is uncertainty depriving many older Australians of a lifestyle they can actually afford, but the considerable financial concerns carried into post-work life impacts their physical, mental and emotional wellbeing.

The current approach to retirement income

Today, more than ever, retirees want the confidence to spend and enjoy the continuity of their lifestyle. For this, they need certainty and flexibility from their investment strategies, as well as solutions to the unpredictable financial outcomes they’ll likely face in retirement.

At one end of the spectrum, account-based pensions provide flexibility but can leave retirees shouldering significant investment and longevity risk and fail to fully address the financial fears held by retirees.

At the other end, traditional lifetime annuities involve trade-offs between income certainty and flexibility and are often limited in terms of how one can invest, withdraw or use their money.

The Age Pension, upon which many Australians rely once their retirement savings are exhausted, barely provides enough income to sustain a subsistence level of retirement.

As life expectancies increase and living costs rise, the strategies and products currently available are becoming less effective in addressing the need for certainty. With the retirements of 4.2 million plus Australians1 at stake, new and innovative income solutions are urgently needed to complement existing products and strategies. Next-generation income solutions that provide certainty.

Rethinking income sources in retirement

A 2022 Actuaries Institute report2 noted that combining traditional products with innovative solutions could lead to a remarkable 30% increase in retirement income.

Further, the report noted that methods, such as using investment-linked lifetime income streams, have been shown to lift retirement income without increasing longevity risk: a win-win outcome that would see Australian retirees benefit from larger payments and a better quality of life without increasing the likelihood of outliving their savings2.

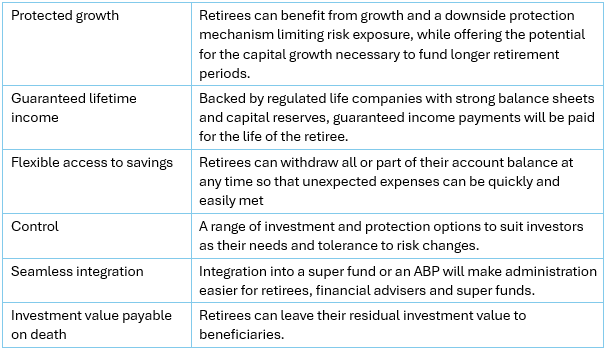

The next generation of retirement products must improve on earlier efforts, with outcome-oriented solutions designed around core features, including:

Recently, we have seen an emergence of innovative retirement solutions designed to pay a guaranteed income for life with more flexibility in their design. These next-generation lifetime income solutions have been designed to provide income certainty, flexibility, and the ability to access capital whenever needed.

Australians should be able to live their lives with certainty and not have to worry about tomorrow’s ‘what ifs’, market volatility or whether they’ll have enough money for the future.

Justine Marquet is Head of Technical Services at Allianz Retire+, a sponsor of Firstlinks. This article is for general information only and does not take into account your objectives, financial situation or needs. For personal financial advice please speak to your financial adviser.

Allianz Guaranteed Income for Life (AGILE) is a next-generation retirement income solution that delivers certainty in the form of a guaranteed income for life. To learn more, visit www.allianzretireplus.com.au/about-us/certainty.

1 Australian Institute of Health and Welfare, ‘Older Australians’, 20 November 2023.

2 Actuaries Institute, ‘Actuaries develop a framework for maximising retirement income’, 26 April 2022.