During the last 18 months, the Australian private equity (PE) market has continued to demonstrate strong momentum, with annual transaction volumes above pre-pandemic levels. While exits had slowed down in 2020, they rebounded strongly in 2021 in the context of a favorable valuation environment, availability of cheap leverage and significant dry powder. There continues to be strong investor interest in Australia, given the overall resiliency and low volatility of PE investments. And also due to the relative under-penetration of the PE market compared to other developed markets globally.

2021 was a record year for Private Equity investments around the world both in terms of capital invested (close to $1.6 trillion) as well as per deal count c.35,000 transactions. The North American market represented approximately 65% of the buyout activity, one of the largest proportions in the time series of the last decade.

For relative context, capital invested was 50% higher than the prior record pre-pandemic year in 2018. That made the dry powder to yearly capital invested ratio to drop to its lowest level in more than 15 years, to 2.8 years (i.e., assuming the deal making pace of 2021, it would take 2.8 years to invest all the uninvested capital).

It's been interesting to see that as of 2Q22, deal making activity globally is still strong, although slightly behind 2021, marking $638 billion and c.15,000 investments by private equity. Those figures are still on track to beat 2018 stats, as referenced in the chart below.

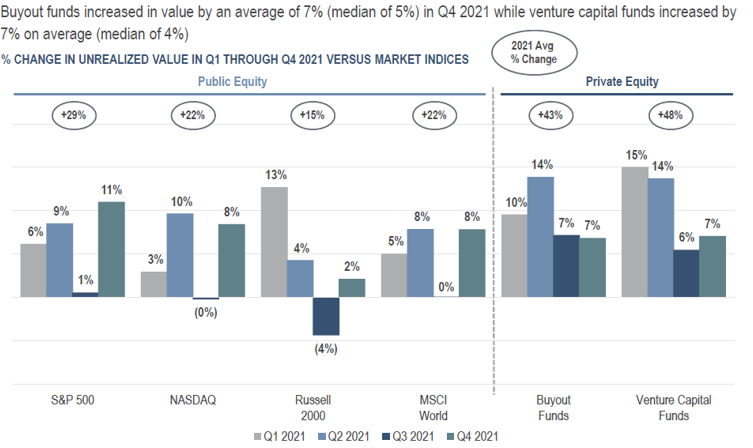

Performance of private equity portfolios in 2021 was strong. Neuberger Berman’s large portfolios of buyout funds increased in value during the year by 43%. In comparison, the S&P500 was up 29%, the NASDAQ 22% and the MSCI world also 22%. Russell 2000 lagged other stock indexes and went up by 15% in the year.

Summary Findings: Quarterly Performance in 2021

Source: GP materials, capital account statements, preliminary GP guidance, Capital IQ.

In the first half of 2022, despite the volatility in capital markets that drove global stock exchanges down, with the S&P500 and MSCI world down 4% in 1Q22 and an additional negative 16% in 2Q22, performance in private equity buyout based on a wide range of buyout portfolios, weathered the storm well, with just a drop of 2% in the first half of the year (vs. the negative 20% of S&P and MSCI). This is a good recent example of some characteristics of the private equity asset class - lower volatility than public markets in turbulent times and attractive performance over time.

Private markets are ‘democratising’?

This term has gained momentum in recent years and refers to the accessibility of private market products that traditionally were only accessible to institutional investors.

Historically, across the globe, the main hurdles were both regulatory requirements (for instance, the requirement to qualify for a wholesale investor status in Australia) and investment minimums (usually the minimum investing amount is in the millions of dollars).

Today, both regulators and fund managers globally are helping individual investors to overcome those hurdles through the launch of suitable products with retail-friendly regulation. It also means making private market products more accessible or advantageous for investors in a particular jurisdiction. For instance, in Australia, Neuberger Berman expects to broaden the offering in the Australian market by launching a local Investment Trust providing access to private equity, mainly through direct investments and secondaries. Investors will have the ability to subscribe and redeem on a monthly basis and with a low investment minimum.

PE market trends

Neuberger Berman is currently seeing additional selectivity in the buyout market. New buyouts are still happening, but investment firms are carefully selecting the sectors and companies that they want to have exposure to, and valuations are being contested. The pace of deployment has slowed down in the short term compared with 2021 but remains strong in historical terms. Nevertheless, this is the type of environment that may create opportunities for well-positioned investors.

In terms of sectors, continuing with the trend accelerated by the lockdowns, Neuberger Berman continues to see significant interest in resilient, cash generative, asset-light businesses and with recurrent or high-level visibility of revenues. This includes software, technology, and healthcare, but also sectors disrupted by new technologies such as financial services.

One interesting comparison between current investment opportunities and those from a decade ago or more, is the revenue growth and EBITDA margins of these asset-light businesses. For instance, prior to the GFC, a large number of industrial companies were bought, and the plan was for them to grow about single digit on an annual basis. And for that it required significant investments in fixed assets, additional investment in working capital and potentially increasing their footprint, with a potential gain of modest improvement in EBITDA margins.

Today, many businesses acquired by private equity require limited investment to grow, perhaps more sales teams (think about an accounting software), but don’t have to invest in fixed assets or working capital, so they have significant more free cash flow available than an industrial or traditional company selling goods. Also, their revenues don’t involve any logistic service, as it can be delivered online, so there is no need to worry about energy or oil prices. And usually, they grow faster organically as they can upsell by selling additional add-on services, without any additional cost.

Out of this comparison, it stands out that the quality of the businesses targeted today by the private equity industry is of a higher standard than just a decade ago. And not surprisingly, returns have been attractive across funds.

Pain points for investors entering private markets

The main pain point is the limited access to the funds and vehicles of this asset class given the regulatory hurdles (imposing for instance eligibility requirements like ‘Qualified Purchaser’ status in the US or ‘Professional Investor’ status in the EU or ‘Wholesale Investor’ status in Australia) and the minimum commitments.

Then, the next pain points are the illiquidity of these products (usually capital is locked for 10 years, although there are distributions over time), the time difference between making the commitment and having all the capital committed actually invested (usually private funds don’t take the money from investors upfront but rather ‘calls capital’ and usually those calls happen during the 3-5 years that it takes them to put the capital to work).

And lastly, the reporting cycle (once every quarter) and method (through a secure platform).

In response to these pain points, a few large managers like Neuberger Berman are offering fully funded vehicles, either with or without liquidity, shorter investment periods and monthly reporting or monthly updates.

José Luis González Pastor is a Managing Director of Neuberger Berman in the Private Equity team and a senior member of the Firm's Private Investment Portfolios group.

Neuberger Berman is a sponsor of Firstlinks. This information discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is not intended to be an offer or the solicitation of an offer. For more detailed references, disclaimer and appendix, the full article can be viewed here.

For more articles and papers from Neuberger Berman, click here.