One of the more challenging aspects of helping clients solve their investment-related problems is figuring out their true investment objectives. Here is a fictional conversation between a client and an adviser that exemplifies the challenges when working through an investor's objectives:

Q: What would you say are your key investment objectives?

A: We want to generate a return of 5% per annum over 5-year periods.

Q: Ok great, is that before or after inflation?

A: Not sure. Does it make a big difference given inflation is so low? I suppose we do want to preserve the real purchasing power over time, so, after inflation.

Q: And how would you describe your risk tolerance?

A: Fairly high; the investment committee understands that returns only come with taking risk, so we are comfortable.

Q: Would a drawdown (loss of capital) of say 20% in a given year be too high?

A: Yes! That would be unacceptable. Ideally, we would like to see positive returns over 12-month periods. However, we could probably tolerate a 10% loss in a given year.

Q: Understood. Do you have an income target?

A: 4% income per year would be ideal as we expect many of the underlying investors to be approaching retirement.

Q: Are there any other expected liabilities or cash flow requirements?

A: Possibly. Occasionally we have projects that need to be funded in the order of 5-10% of the total asset size.

Identifying multiple objectives

The most notable thing is the sheer number of objectives uncovered over the course of a short conversation. When working with clients, we always discover one or more 'hidden objectives’, and often, the objectives can be contradictory. For example, an aggressive return target of 10% while keeping volatility below 5% is inconsistent. Often a client’s extreme aversion to a real (after-inflation) capital loss would warrant allocating 100% of a portfolio to inflation-linked bonds, yet their return targets remain ambitious and out of reach. This solves one problem but creates others.

The bottom line is that we can likely build a portfolio and strategy to successfully achieve any one of these objectives but find it challenging, if not impossible, to achieve all objectives simultaneously. Investing is like life, as the self-help gurus often preach: you can do ANYTHING but not EVERYTHING.

A VaRy good idea?

Good risk management typically starts with good risk measurement. As management consultant, Peter Drucker, famously said, “You can’t manage what you don’t measure.” There is now a relatively common set of metrics most portfolio and risk managers use to assess the ‘riskiness’ of a portfolio, but they are often based on the flawed assumption of normal distributions and rely on historical data. Statistics such as standard deviation, value-at-risk (VaR), and drawdown are useful but only form one piece of the overall risk measurement mosaic. Other techniques such as stress testing a portfolio or determining how a portfolio would have behaved during a particular market scenario have become the new ‘table stakes’ within risk management.

This then elicits the question: what risk management problem are we trying to solve? We can answer this by more clearly defining ‘risk’ which in the context of a broad investment portfolio is failing to meet the investment objective(s). And since we’ve already established that most investors have more than one objective, we need a way to maximise the chance of delivering on all of these multiple often-contradictory objectives.

To help solve this problem, we have developed a systematic method of maximising our chances of success (or minimising the probability of failure). And despite many people’s worst fears, mathematics is essential in elegantly solving this problem.

Introducing the Weighted Risk Metric

To make an informed decision and address the trade-offs inherent in achieving most investors’ objectives and risks, we invented a proprietary Weighted Risk Metric, which incorporates an overall risk score for each possible strategy.

The Weighted Risk Metric is a mathematical concept that calculates a score for each portfolio on the efficient frontier. The model determines the risks of not achieving the specified ‘aggregate’ goal, or the set of combined objectives. The Weighted Risk Measure can combine different risk measures for combinations of target returns and investment horizons. When the scores for all portfolios are known, we then select the portfolio with the lowest score which has the best chance of successfully delivering on the combined objectives.

The mathematics and model are technical so we won't go into too much detail here, but you can request a research paper here.

Balancing risk and return to solve allocation problems

In a traditional strategic asset allocation (SAA) approach, a portfolio is constructed by optimising the asset universe available within a portfolio based on forecast risk, returns, and correlations. As many balanced portfolios implement a standard SAA approach and use long run or equilibrium capital market expectations, the resulting asset allocations look remarkably similar, as they only attempt to optimise one return or risk objective over a single horizon. In reality, investors do not have an unlimited time horizon and will typically only invest over a specified investment period.

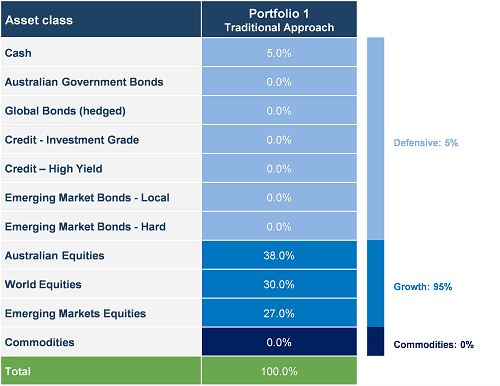

The example below provides the output generated from running a traditional asset allocation analysis. In this instance, we are targeting a total return of 5.9% over an investment horizon of 5 years, or, a 4% return in excess of inflation of around 1.9%. Portfolio 1 has a 95% allocation to ‘growth’ assets and a 5% allocation to ‘defensive’ assets.

Source: Colonial First State Global Asset Management

The ‘growth’ weighting is higher than even a typical 60/40 balanced portfolio, due in part to the current low expected return environment. While this provides a good starting point, it ignores other factors used when making decisions to allocate capital in the real world. For example, in the mock Q&A above, there are many other considerations that are not normally found on the label of an investment product. These include but are not limited to: 1-year shortfall risk (drawdown), inflation protection and an investor’s individual time horizon.

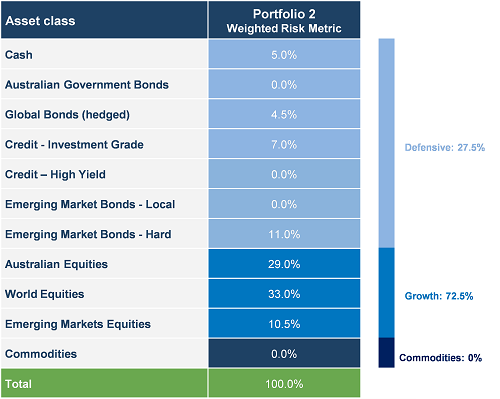

To help solve for the additional factors, a multi-dimensional framework will provide greater insights, which is where the Weighted Risk Metric comes in. Portfolio 2 below has the same objectives as Portfolio 1, however, it incorporates some of the objectives uncovered earlier with weights to capture shortfall risk over any 1-year period and inflation protection over 3-year periods. We have still assigned a weight to achieving a total return target of 5.9% over the full investment horizon of 5 years but are no longer solely solving for this objective.

Adding additional objectives significantly changes the asset allocation, which intuitively makes sense as we are solving for multiple objectives. This is a more conservative portfolio but is also more representative of what the investor is actually expecting in terms of consistent outcomes.

Source: Colonial First State Global Asset Management

This portfolio has a 72.5% allocation to ‘growth’ assets and a 27.5% allocation to ‘defensive’ assets, and the portfolio is more diversified across asset classes than the previous example.

While Portfolios 1 and 2 both are based on the same fundamental view of the economic climate and expectations, they have different risk and return characteristics due to the additional objectives.

I’m a model, you know what I mean

Risk management should be fully embedded in all aspects of an investor’s thinking and process, not just as an afterthought. Indeed, although sophisticated risk monitoring is critical, we should not lose sight of what risk is: failing to meet portfolio objectives. We are the first to acknowledge that the tools we have developed, including the Weight Risk Metric, rely on qualitative inputs and subjective decision making. In this model, we ultimately need to determine how important each objective is and no level of complex maths will help us here.

However, as the British statistician, George E.P. Box said, “All models are wrong, but some are useful.” The Weighted Risk Metric provides a systematic approach to buttress traditional asset allocation methods to capture the subtle nuances within investment objectives. Maybe we can get MORE of what we want after all.

Richard Rauch, CFA is Investment Director for Fixed Income and Multi-Asset Solutions at Colonial First State Global Asset Management, a sponsor of Cuffelinks. This article is for general information only and does not consider the circumstances of any individual.

For more articles and papers from CFSGAM, please click here.