New research reveals the uncertain outlook Australians have for their future retirement: 60% admit they won’t have the superannuation and cash to self-fund their retirement, nearly a third (31%) expect to carry debts into their retirement, and three quarters (73%) expect to receive the pension at some point.

The findings were derived from a survey of an independent panel of 1,018 Australians, commissioned by finance platform Money.com.au. The pool of survey respondents matches the age and geographical spread of the Australian population. More than half (573) were aged 35-60, and these respondents were asked the following questions.

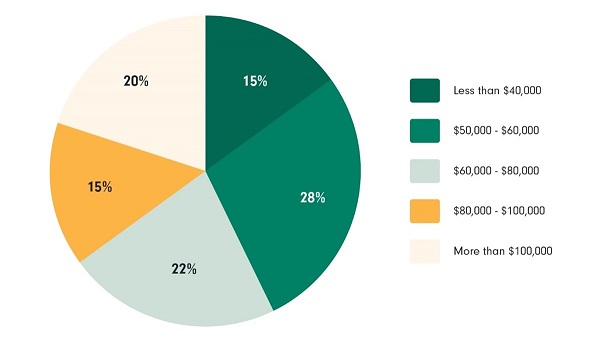

1. What level of annual income do Australians want in their retirement?

Respondents were asked what income they want in their retirement:

- More than half (57%) of respondents want more than $60,000

- 35% want more than $80,000

- While a fifth (20%) want more than $100,000

These income expectations are well above The Association of Superannuation Funds of Australia’s (ASFA) Retirement Standard, which estimated for the June 2022 quarter that singles living a comfortable retirement will spend $47,383 per year, while retired couples will spend $66,725 per year.

While the Retirement Standard increased these figures by around 2% in the June quarter, the income levels that more than half of retirees expect to live on are still at least 27% higher. The Retirement Standard also assumes people don’t carry debts into their retirement.

Respondents have lived through several months of fast-rising inflation and interest rates, which is forcing them to factor price and loan repayment increases into their retirement preparedness and income expectations. People also have new desires – such as travel – after two years of COVID restrictions. A proportion of my own clients are purchasing campervans, cars and spending on travel.

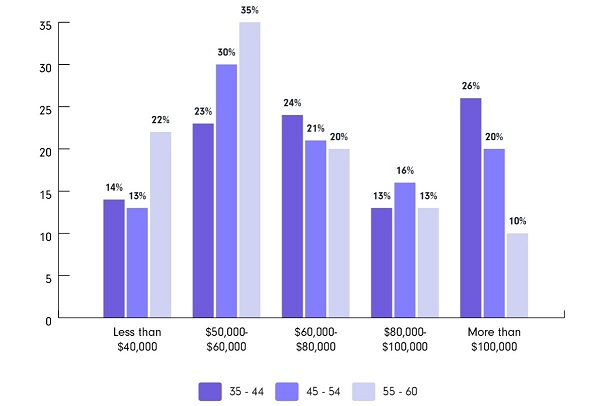

Looking at the results across age groups, respondents that are further from reaching retirement age indicated they want a higher annual income than older respondents. Two-thirds (64%) of 35-44-year-olds and 57% of 45-54-year-olds want more than $60,000 in their retirement compared with just 43% of 55-60-year-olds. More than a quarter (26%) of 35-44-year-olds want more than $100,000 annually compared with 20% of 45-54-year-olds and 10% of 55-60-year-olds.

When analysing responses across the States, Queensland and NSW respondents want a larger income in their retirement. 40% of Queenslanders and NSW residents indicated they want more than $80,000 in annual income compared with 27% of South Australians and 23% of West Australians. While 28% of Queenslanders and 26% of NSW residents also indicated they want more than $100,000 compared with just 15% of South Australians, 14% of West Australians, and 13% of Victorians.

|

Response

|

NSW (%)

|

VIC (%)

|

QLD (%)

|

SA (%)

|

WA (%)

|

ACT (%)

|

|

Less than $40,000

|

11

|

15

|

16

|

12

|

23

|

13

|

|

$50,000 - $60,000

|

25

|

23

|

28

|

42

|

43

|

13

|

|

$60,000 - $80,000

|

24

|

28

|

16

|

19

|

11

|

40

|

|

$80,000 - $100,000

|

14

|

21

|

12

|

12

|

9

|

7

|

|

More than $100,000

|

26

|

13

|

28

|

15

|

14

|

27

|

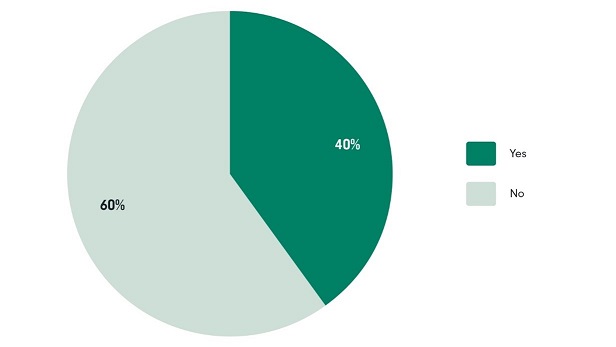

2. Will Australians have enough super and cash flow to receive the income they want in their retirement?

There was a wide gap between people’s income expectations and their preparedness for retirement, and 60% of respondents admitted they won’t have adequate super, savings and cash flow from investments to receive their expected incomes.

Similar proportions of respondents across the different age groups admit they will not have adequate assets and cash to meet their retirement income expectations:

|

Response

|

Age 35-44 (%)

|

Age 45-54 (%)

|

Age 55-60 (%)

|

|

Yes

|

37

|

40

|

42

|

|

No

|

63

|

60

|

58

|

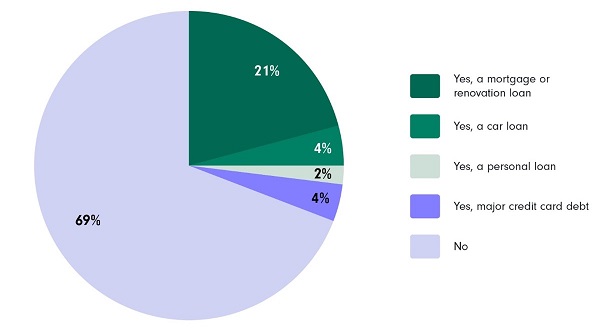

3. Do Australians expect to have any debts when they retire?

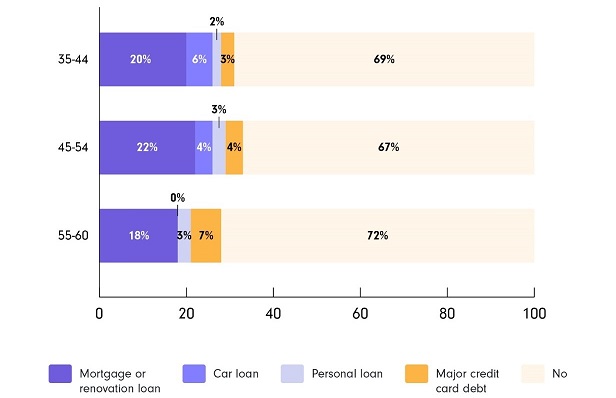

A worrying 31% of respondents expect to carry debts into their retirement. Specifically, a fifth (21%) expect to retire without having paid off their mortgage or renovation loan, while a small proportion of respondents (an equal 4%) said they will still have major credit card debt or a car loan, while 2% expect to be paying off a personal loan.

Across the States, more NSW and Victorian respondents expect to bring debt into their retirement:

- One third (36%) of NSW residents think they will have debt

- Followed by 34% of Victorians

- 29% of West Australians

- 26% of Queenslanders

- And 25% of South Australians

A quarter (24%) of NSW residents and 23% of Victorians expect to have a mortgage or renovation loan when they retire compared with 18% of Queenslanders, 17% of South Australians, and 14% of West Australians.

By age group, a higher proportion of younger respondents expect to have debt when they retire, suggesting they may have larger loans to pay off: 32% of 35–54-year-olds compared with 27% of 55–60-year-olds.

A higher proportion of younger respondents also expect to carry a mortgage or renovation loan into their retirement: 21% of 35–54-year-olds compared with 18% of 55–60-year-olds.

The unfortunate reality is that to meet their expected retirement incomes, a large segment of the population will need to work longer or make significant sacrifices. Those who are already retired are also facing challenges, as they are unable to build their super, while contending with constantly rising costs, from health insurance premiums to interest rates and energy prices.

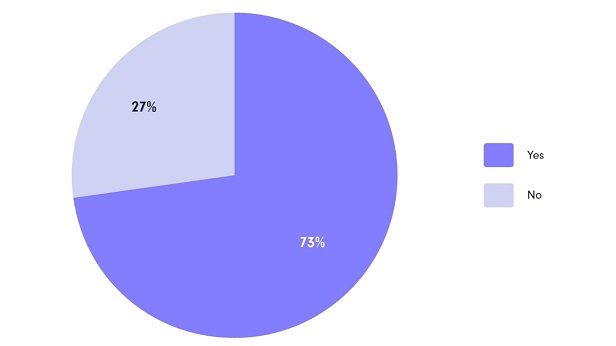

4. What proportion of Australians will need to receive a pension during their retirement?

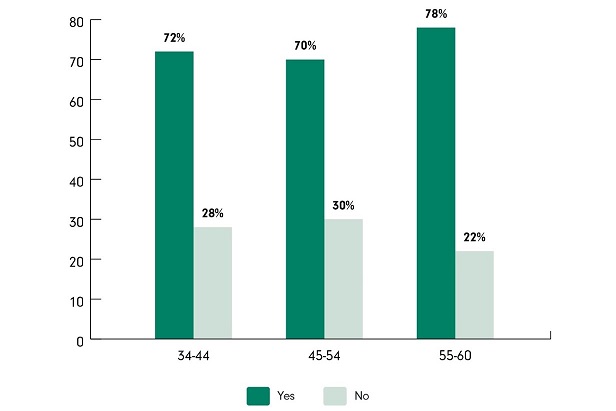

The survey found that three-quarters (73%) of respondents will need to receive a pension at some point to support their retirement. A larger proportion (78%) of over-55s believe they will need a pension, compared with 71% of under-55s.

The maximum pension singles can receive is $1026 per fortnight, while the maximum for couples is $1547 fortnightly. Those who retire with assets, savings or an income stream will receive a lower pension, or no pension at all.

The pension also isn’t keeping up with the inflation rate, nor is it a realistic amount for those who have debt, pay rent or have costly health expenses. There is also a risk that those who are factoring a pension into their retirement plan might not be entitled to it. For instance, couples will be evaluated together, not individually: if your partner has a high income or assets in their retirement, this could render the couple ineligible in the early stages of their retirement.

Without this guarantee, I urge individuals to implement a financial plan as soon as possible to manage debts, savings and super. Some individuals may plan to sell their property once they exhaust their funds, with the view to downsizing or renting and using the cash to live out the rest of their retirement.

There was also little difference in expectations among age groups:

- 78% of over-55s admitted they would need a pension to support them in their retirement

- Compared with 71% of under-55s

Interestingly, the high proportion of younger respondents predicting the need for such a support measure suggest the ability for the population to save for their future has been significantly impacted by rising costs of living.

Helen Baker is a licenced financial adviser and Money.com.au spokesperson. This article is intended to provide general information only, and not financial advice. Before acting on any information in this article, you should consider your individual and business circumstances, and seek independent and professional legal, financial, taxation or other advice to help you determine whether these actions are appropriate for your needs.

The full survey results, including age and State breakdowns, can be found here: money.com.au/research/savings-and-assets.