Between the government levy on liabilities, the Standard & Poor’s ratings downgrades, and general sentiment towards housing risk, the banking industry has been under stress since early May 2017. Whilst the Big Four avoided ratings downgrades on their senior debt, the ratings action was a shot across the bow for the entire industry, and major banks' equity prices have fallen over 12% from their recent highs last month.

Relationship between bank shares and hybrid securities

Many commentators are claiming the banks are oversold and this presents a buying opportunity, but we are fixed income professionals so we’ll leave that call for the equity pros. What we did notice is that the hybrid market had been entirely ignoring this price rout and most ‘Additional Tier 1’ (AT1) hybrids continued to march ever higher in price … until last week when a Spanish bank collapsed.

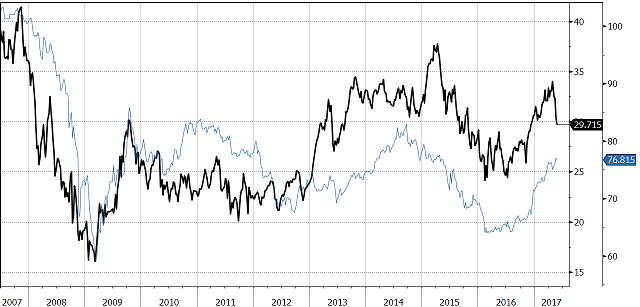

Equities and hybrid securities are indeed different instruments in terms of risk and historical volatility. Hybrids sit above equity in the capital structure (as do all other liabilities) but significant price movements should be correlated, and history confirms that. The first chart below shows the NAB equity and NABHA Tier 1 hybrid price movements over the past 10 years, including the GFC, and clearly indicates a high degree of long term correlation. The chart axes have been normalised so the difference in magnitude of the moves isn’t obvious (hybrids are naturally less volatile than equities), but we can observe the disconnect over the past month, where the equity fell but the hybrid moved higher.

NAB equity (dark line) vs NABHA Tier 1 hybrid (light line).

Source: Bloomberg

NABHA is an ‘old style’ Tier 1 hybrid, and the grandfathering into Basel III for capital qualification drifts off between now and 2022. To a certain extent the same holds true for the Macquarie Bank MBLHB which is essentially the same structure. But the newer AT1 hybrids which are fully Basel III compliant are inherently more risky and as such the correlation to equity markets should be even higher. However, until recently this was not evidenced in the market.

This dichotomy continued until Banco Popular Español collapsed last week, resulting in that bank’s AT1 hybrids being written off entirely and the Tier 2 subordinated debt (T2) converted into equity (which was subsequently bought by Banco Santander for one Euro, ie effectively zero).

Suddenly the Australia hybrid market sat up and took notice, and prices sharply corrected over the space of a few days as the reality sunk in that the equity selloff bears a level of correlation to the hybrid market. The following charts show the reversal in share prices for two of the major banks (CBA and NAB) and a sample AT1 hybrid from each. ANZ and Westpac securities reacted similarly.

CBA equity (dark line) vs CBAPD Additional Tier 1 hybrid (light line).

Source: Bloomberg

NAB equity (dark line) vs NABPC Additional Tier 1 hybrid (light line).

Source: Bloomberg

Where is the value in hybrid securities?

Hybrids are neither good nor bad investments in their own right. It’s a simple matter of risk vs return – are you getting paid appropriately for the inherent risk? In early 2016 when they were trading at credit margins of around 550 basis points (5.5%) on average, the relative value was outstanding. But at current levels 150-200 basis points lower, the trade-off is significantly less compelling, particularly given the weakness in the banking sector in general.

A useful reference point when assessing the relative value of AT1 hybrids are the two ‘bookends’ seen in recent years. Commonwealth Bank of Australia has the distinction of issuing at both the tightest and widest credit margin of the major bank AT1 hybrids in recent years. CBA Perls VII (CBAPD) were issued in October 2014 at a credit margin of just 280 basis points (not good value). Eighteen months later in March 2016 CBA Perls VIII (CBAPE) were issued at a margin of 520 basis points (excellent value). In the middle of that range was the March 2017 CBA Perls IX issue at 390 basis points (fair value).

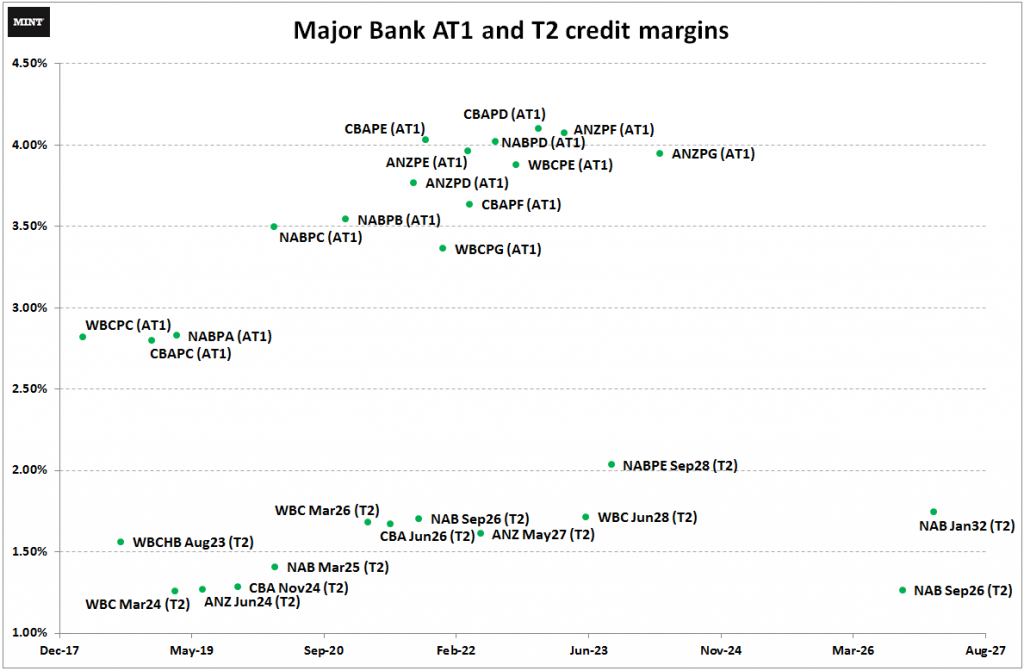

The following chart plots the current credit margin for a variety of major bank AT1 and T2 securities. Note that the AT1 margins are some 60 to 80 basis points higher than just a few weeks ago, following the sell-off.

Major Bank AT1 and T2 current credit margins.

Source: Mint Partners Australia

Where does this leave subordinated debt?

This Spanish real-life test of Basel III highlights something else that is being broadly overlooked in our opinion, which is the relative risk between AT1 and T2 (subordinated) securities. In Australia (currently) there exists on average about 200 basis points (2.0%) of credit spread premium on AT1 over T2, shown in the chart above. As Banco Popular has shown, once a bank is in deep enough strife to trigger AT1 write-offs, it is virtually too late to hope for any recovery value in the subordinated T2 debt.

There is a growing school of thought that this premium is excessive as investors in T2 subordinated debt fare equally poorly in a worst-case scenario. In other words, if investors are going to be exposed to Basel III non-viability risk, they may as well be getting paid for it through AT1 hybrids.

Additional factors to be considered though include lower historical volatility and fixed maturities on the T2 debt (versus a perpetual nature of the hybrids), although that the volatility aspect could easily disappear if markets come to the realisation that the ultimate risk between the two debt types is closer than previously assumed.

Hybrid securities in a diversified portfolio

Hybrids tend to be a much maligned asset class. They are not pure fixed income with price volatility often present. As primarily floating rate instruments, at least in Australia, they also tend to perform poorly in times of severe stress (as opposed to fixed rate bonds which typically benefit from falling yields). While we would never recommend an investor have all their ‘fixed income’ allocation in hybrids, at times they do provide returns that more than compensate for risk, as long as investors understand those risks.

For example, we like NABHA and believe that over the next few years it will trade into the 80’s and even 90’s, and expect it to be called at 100 sometime between now and 2022. However, the short-term risk of a retreat was too high a few weeks ago and we recommended investors pare back positions. At the time we wrote that if this equity sell-off continued - and especially if it manifested into a banking crisis - there was no doubt that the hybrid price would be adversely affected, giving an opportunity to reenter at a better price.

The predominately retail-dominated hybrid market is often inefficient as the delayed price movements in recent weeks have demonstrated, and this provides opportunities. Investors had a ‘free kick’ in being able to sell names such as CBA Perls VIII (CBAPE) at over $108.50 (or circa 320 basis points as a credit margin) in recent weeks while bank shares tanked. The same security is now trading at $105.05 (or circa 400 basis points margin) following the friendly reminder from Banco Popular Español. Not so ‘popular’ now.

Ryan Poth is Head of Portfolio Strategy and Justin McCarthy is Head of Research at Mint Partners Australia. This article is general information and does not consider the circumstances of any individual. The views are the personal views of the authors and individuals should make investment decisions in consultation with their own financial advisers.