The Pension Loans Scheme (PLS) allows senior Australians to obtain a loan from the government to supplement their retirement income. It is available to full and part age pensioners and self-funded retirees who own property in Australia. Age pensioners (or their partners) can top up their pension to receive a total amount of fortnightly pension plus loan amount of up to 150% – or 1.5 times – the maximum fortnightly rate of the age pension. Self-funded retirees who do not receive an age pension can receive the entire 150%. The payments are not taxable and not assessable under the age pension means test.

The PLS is effectively a ‘reverse mortgage’ administered and distributed by Services Australia. The additional payments above any age pension entitlement accrue as a debt secured against real estate the borrower owns, such as the family home or an investment property.

As with a commercial reverse mortgage, participants can stay in their family home and do not have to repay the loan while living there. The government generally recovers the debt when the property securing the loan is sold or from the person’s estate after they have passed away.

The interest rate on the debt is currently 4.5% per annum and safeguards limit the maximum loan that can accrue. People can withdraw from the scheme and repay the loan at any time.

Proposed changes to the PLS

The 2021 Federal Budget includes two main measures aimed at increasing the uptake of the PLS.

1) The most notable change is the introduction of lump-sum payments.

From 1 July 2022 participants in the PLS will be able to access up to two lump-sum advances in any 12-month period, up to a total value of 50% of the maximum annual rate of the age pension. Based on current rates, this is around $12,385 per year for singles and $18,670 for retiree couples.

This will allow a full-rate age pensioner to take their entire annual loan amount as a lump sum. A part-rate pensioner may take an annual loan amount of 50% of the age pension topped up with fortnightly payments. A self-funded retiree has the opportunity to bring forward up to one-third of their annual PLS payments.

The introduction of these advance lump-sum payments will increase the attractiveness of the PLS for senior Australians by giving them the flexibility to pay for large one-off expenditures – such as replacing a car, to make home improvements or renovations, or to pay for aged care services.

2) A second change is the introduction of a No Negative Equity Guarantee for PLS loans from 1 July 2022.

The guarantee, which is common for commercial reverse mortgages, ensures that borrowers will not have to repay more than the market value of their property.

What do these changes mean?

These changes are consistent with the Retirement Income Review which reminded Australians that resources to finance retirement include the age pension, superannuation, their financial assets AND any real estate they own, including their family home. The analysis presented in the final report showed that the PLS is an effective option to substantially improve retirement incomes for both age pensioners and self-funded retirees.

This is the second time recently that the government has expanded the PLS. On 1 July 2019, eligibility was extended to all Australians of age pension age with appropriate real estate. The maximum allowable combined age pension and PLS payment was increased from 100% to 150% of the age pension. From 1 January 2020, the interest rate was reduced from 5.25% per annum to 4.5%, which is up to around 1% lower than for commercial reverse mortgages.

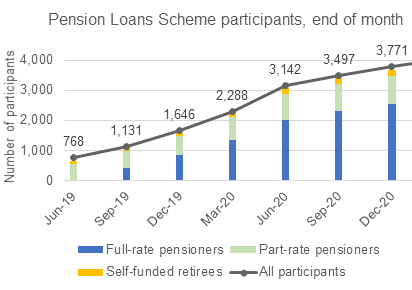

Despite these enhancements, the PLS is not widely used. As of March 2021, there were just over 4,000 participants in the scheme (see Figure 1), which is an extremely low take-up given the 4 million or so Australians of age pension age, including around 2.6 million age pensioners, of which around three quarters are homeowners.

The changes announced in the 2021 Budget to make the scheme more flexible and attractive, if appropriately promoted, have the potential to increase participation.

What would make the PLS more attractive?

Researchers at UNSW have a long-standing interest in exploring how to improve retiree living standards through more effective use of household financial resources, including housing assets. The PLS plays an important role as the family home is typically a retiree’s largest financial asset and most people prefer to ‘age in place’. Schemes that allow people to unlock their housing assets – such as the PLS - should be far more popular than they are.

Previous research findings highlight how to address barriers to the take-up of home equity release products such as the PLS.

First, there is low awareness and understanding of retirement financial products, which are generally complex and have narrow distribution networks. Commercial reverse mortgages and the PLS fall into this category.

Our research on reverse mortgage products shows that interest can be enhanced where the product is described in an easy-to-understand way with a focus on how it can be used to enhance living standards in retirement, rather than the technical aspects of the product design.

Second, the ‘mental account’ for retirement financing typically includes superannuation and any age pension but excludes housing assets. Our preliminary research finds that people are more likely to be interested in reverse mortgage-type products, such as the PLS, when they are specifically reminded of the availability of housing assets to fund retirement.

Third, it is often argued that reverse mortgage-type products should be avoided because they ‘disinherit’ the children. However, our recent research conducted in China, where it could be argued that the generational compact is stronger than in Australia, found that both older homeowners and their adult children supported the take-up of reverse mortgages by the elders but that each group thought the other would disapprove.

Reverse mortgage-type schemes (such as the PLS) should be marketed to both older homeowners and their adult children and families should be encouraged to discuss the opportunity to use housing wealth to fund expenses in retirement.

Finally, interest rate cuts could be considered. The Pension Loans Scheme currently charges an annual interest rate of 4.5% that compounds each fortnight on the outstanding loan balance. This interest rate is lower than that of commercial reverse mortgages available in Australia but is higher than the mortgage rates for owner-occupied mortgages because no repayments are made until the loan is settled, which is typically when the person has passed away.

Katja Hanewald is a Senior Lecturer, Hazel Bateman is a Professor and Katie Sun is an Honours student, all in the School of Risk & Actuarial Studies at UNSW Sydney. All three are also affiliated with THE ARC Centre of Excellence in Population Ageing Research (CEPAR), where Hazel Bateman is a Deputy Director. This article is republished with permission from the UNSW Newsroom.