US Senate Majority Leader Mitch McConnell (the Turtle to fans of The Daily Show) has been largely responsible for one of the least productive periods of recent US law enactment. Stagnancy in the Senate was the weapon used against President Obama. McConnell has also stated that some of President-elect Trump’s proposals, including a trillion dollars in new infrastructure spending, are not priorities for Senate Republicans. Regardless, the market currently only has infrastructure spending in its sights.

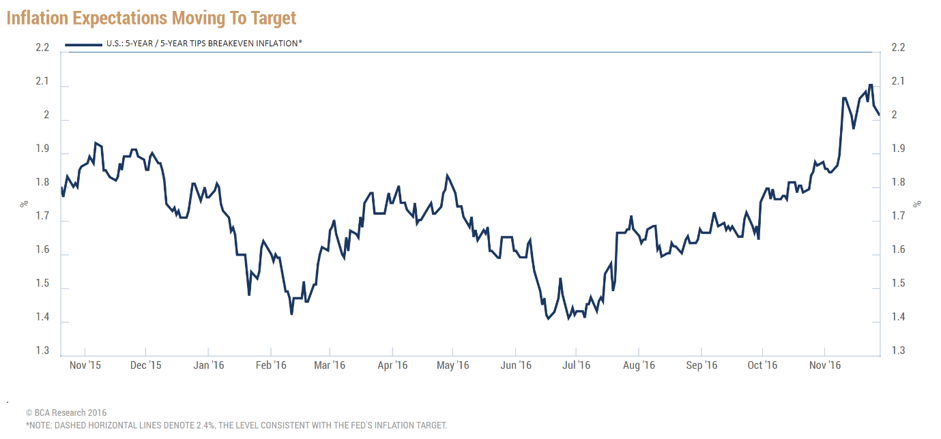

Rates rising on inflation expectations

US stocks experienced an historically high intra-day move on the night of the US election. US futures at one point were almost ‘limit down’ (a market rule of a maximum of -5%). However, it took just 49 minutes of morning trading for stocks to move positive before finishing over 1% higher for the day. What happened? The perceived wisdom prior to the election was that stocks would fall heavily if Trump was elected, but in hindsight maybe traders had their ‘Brexit’ hedge on this time. They weren’t going to get caught short again.

So stocks are now higher and bonds are selling off as the market now believes Trump’s investment plan can create growth. But a closer inspection of bond yields reveals that it’s not so much growth the market is expecting but inflation (and a slightly higher default risk as Trump has had six companies go bankrupt); 30-year bond yields are spiking, delivering the largest percentage rise in yields ever.

With all this market volatility it’s easy to get caught up in the emotion of the moment. The smart investors, however, are looking at the fundamentals, which are the ultimate driver over the medium to long term.

Inflation and share prices

If the market is right and inflation is due to rise, how should this affect stock prices? Intuitively one might think stocks should be protected from inflation’s taxing effects because companies own real productive assets, but Warren Buffett delivered an important lesson on this topic almost 40 years ago.

In 1977, Fortune magazine published an article by Buffett titled ‘How inflation swindles the equity investor’. In summary, the article highlights the following points:

- conventional wisdom that stocks would retain their real value despite inflation didn’t eventuate

- stocks, actually, are similar to bonds in economic substance in that they pay what turns out to be a ‘sticky’ coupon

- share returns on capital have averaged 13% over 10-year periods since the end of WW2, regardless of the inflation rate

- this 13% return on equity has historically translated into about a 10% annual return for investors as stocks tend to trade at 1.7x equity value

- while the yearly high and low over this period was 14.1% and 9.5%, average returns showed no signs of moving higher than average in inflationary years

- stocks are still riskier than bonds as the ‘13%’ return moves around a little year to year

- stocks are also riskier as they are ‘perpetual’ instruments – meaning there is no future maturity date where your capital is repaid to allow a renegotiation of your return

- the only way to earn better returns over time is via five earnings levers: (1) turnover, the ratio of sales to total assets employed (2) cheaper leverage, (3) more leverage, (4) lower taxes and (5) wider margins

- there is no fundamental reason for return on capital to rise in response to higher inflation.

I’d urge you to read this article for its invaluable lessons in clear and understandable terms. It will also put you one up on many professional investment managers who are still to learn Buffett’s inflation and stocks message. While stocks remain preferable to bonds in a higher-inflation environment, they are still negatively impacted. Higher inflation hurts all investment returns, it’s just a matter of to what degree.

Stephen Ross is a Portfolio Manager at OwnersAdvisory by Macquarie, a do-it-yourself investment platform. Owners Advisory is a division of Macquarie Equities Limited. Important disclosure information about any research contained in this document is available at www.macquarie.com/disclosures. Owners Advisory is a sponsor of Cuffelinks.