Sir Arthur Lewis (1915-1991) was an economist from Saint Lucia in the Caribbean who was awarded the Nobel Prize in Economics in 1979 for his theories on development. His ‘dual sector model’ suggested that economies can modernise without triggering inflation because the growing industrial sector can rely on a large supply of farm workers to work for low, but not subsistence, wages. This allows industry to earn, then reinvest, excessive profits. But one day the stream of peasants dries up. When a developing economy reaches this ‘Lewis turning point’, wages growth exceeds productivity, industrial profits decline, investment drops and inflation stirs.

Major changes approaching for China

A big challenge for China is that the country is approaching a Lewis turning point at the same time it faces a ‘demographic time bomb’, a term that describes the rapid ageing of its 1.4 billion population. Another test is that China is confronting the ‘middle-income trap’. This is a term for when a country’s initial and successful drive to industrialise becomes bogged at middle-income levels unless the country can develop the skilled workforces, sophisticated manufacturing, financial sectors, institutions, governance standards and rule of law that advanced countries possess.

On top of these challenges, another has emerged for Beijing, along with an opportunity. China’s growing political and economic clout has created a hostile global environment but a relatively weaker US.

China’s policymakers have long seen the first two challenges coming. Along with some institutional reform, their answer was to make domestic demand a bigger driver of economic growth. But the pivotal market reforms of the past 15 years to rebalance the economy away from exports and investment appears too inadequate a solution for Chinese leaders in a harsher world but one where it senses the US is vulnerable.

Beijing’s response to help double the economy’s size from 2020 to 2035 and to ensure its global influence? A 'dual circulation' strategy, which marries the ‘external circulation’ of global demand with the ‘internal circulation’ of domestic demand.

The split-economy strategy emerged from a Politburo meeting in May 2020 and appears deliberately ambiguous. Official pronouncements since indicate the plan aims to reduce China’s reliance on other countries for national-security reasons while boosting the country’s ‘soft’ global power to approach (thus nullify) that of the US. While the previous rebalancing aimed to lessen China’s dependence on exports, the dual-circulation strategy seeks to limit China’s reliance on imports and the US-dominated global financial and trading system.

The strategy’s essence is prioritising domestic production, innovation and self-sufficiency. It is a call to turn China into a sophisticated manufacturing hub, form China-centric global production networks that multinationals come to rely on, develop a yuan-based international financial network, and possibly turn China into a military-technological complex. The means to these goals include subsidies, export controls, data restrictions and dangling China’s consumer market as an enticement to attract foreign capital and technology.

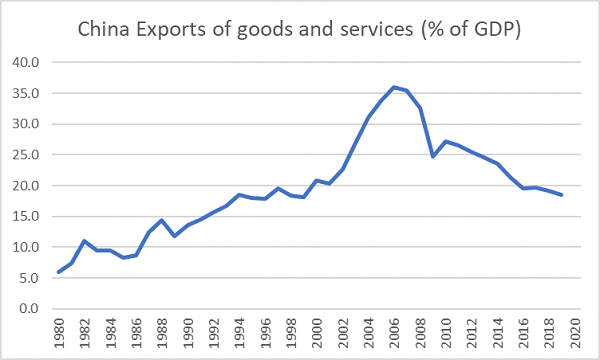

Source: World Bank Open Data

A challenge for other countries including Australia

Just as important is what Beijing’s dual-circulation strategy does not do. The policy lacks any unleashing of market forces. It is not a retreat into North Korean-style autarky. The strategy heralds no easing of the Communist Party’s political control. Nor is it a plan to break the international order.

The dual-circulation strategy, in many ways, might seem a partial shift. But it is poised to drive China’s economy, boost its regional hegemony, make China a leader in industrial, technological and financial spheres, and advance China’s global influence. The strategy is likely to challenge some of the countries and industries dependent on China as an export destination and offer a fresh competitor to industrial powerhouses such as Germany that export capital goods. It foretells of renewed pushes to internationalise China’s financial system and promote the use of the yuan to rival the US-dollar-based global financial network.

The plan signals more significant trade agreements rather than any drive to liberalise world trade. It flags further Chinese efforts to dominate global bodies so it can influence the rules-based global order and set global technology standards. It likely means an intensification of the clash with the US to dominate the technologies of tomorrow. China’s dual-circulation strategy signals that an era approaches when international linkages are more an overt means to enhance global power rather than a cooperative way to boost economic efficiency.

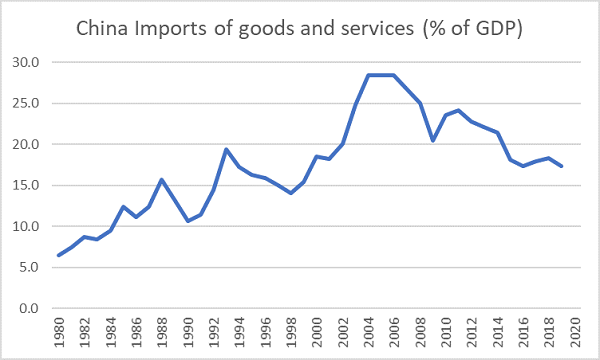

Source: World Bank Open Data

To be sure, China’s new strategy might not be that noticeable over time and Beijing’s reluctance to provide details means it could morph into anything. It’s too early to emphatically rebut those who dismiss it as just the old rebalancing strategy. Same goes for responding to those who say it’s just an extension of the Made in China 2025 drive for technological leadership and the Belt and Road Initiative. There are major developments that don’t sit easily within the strategy. Beijing’s aggression in the South China Sea, crackdown on Hong Kong, intimidation of Taiwan and ‘wolf warrior’ diplomacy risk a backlash that would nullify any advancements in soft power. The dual-circulation strategy might come with a larger-than-expected cost to efficiency. The strategy relies on a certain level of foreign participation and human-rights abuses might deter some western companies.

The next step in China's global power move

But if developments ‘follow the money’ as they often do, China’s supersized economy will be enough of a magnet to tie much of the world to China. There’s every chance Beijing will engineer a partial decoupling from the US-led world on its own terms. Such a separation would form the next phase of China’s modernisation, the next leap in its global power, perhaps even the next ‘China shock’, where China’s industrialisation so far formed the first shock.

Michael Collins is an Investment Specialist at Magellan Asset Management, a sponsor of Firstlinks. This article is for general information purposes only, not investment advice. For the full version of this article and to view sources, go to: https://www.magellangroup.com.au/insights/.

For more articles and papers from Magellan, please click here.