Copper has been used by humans over for well over 10,000 years. More than ever, this ancient metal is a key driver behind humanity’s technological progress, from AI to net zero.

However, demand for this often-underappreciated metal is outstripping supply, driving up prices and potentially hampering the pace of development. Copper is at the heart of electricity, and high conductivity and light weight make it an indispensable material in electric wiring and grids, accounting for approximately 90% of global copper usage.

AI and renewable energy have physical requirements and need infrastructure such as data centers to house and process the vast amount of data and wind turbines and electric vehicle (EV) batteries to meet sustainability targets. Electricity and copper are critical inputs into both these stories and will drive incremental structural demand in the coming years.

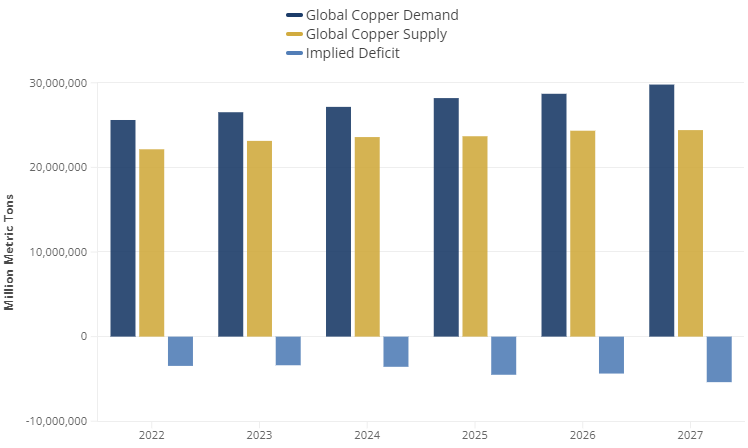

Figure 1: Heading for a significant copper shortage (Figures do not yet include AI effects)

Source: BloombergNEF

Data centers are a crucial component of the rapid diffusion of AI technologies and the power markets will see demand rocket as more data centers are built to support AI. A traditional rack in a data center typically needs between 10-15kW of power. Compare this to the 40-60kW of power needed for AI-ready racks with energy intensive GPUs (Graphics Processing Units) – this represents between 4-6x more power and cooling usage.

For a sense of scale – in 2022, just in the US, data centers consumed 17GW of energy. It is estimated that by the end of the decade, data centers power needs will double to 35GW. When viewing this growth, keep in mind:

- data center buildout estimates from AI penetration are early stage and likely underestimates ultimate demand. Blackstone’s COO John Gray on a recent earnings call said he expects that tech companies will invest $1 trillion over the next five years in AI and this is mostly directed towards data centers.

- this incremental power demand will likely draw from clean energy technologies as much as traditional power sources. Even clean energy is a massive copper user.

What does this mean for copper demand?

While the physical market implications are still at an early stage for the global copper markets, the outlook provides strong secular tailwinds to demand. It is estimated that it takes close to 65,000 tonnes of copper per every GW of applied power. AI and data center usage for copper lies within two major areas:

- actual components into data center such as power distribution, grounding and interconnections and

- the generation of incremental electricity to power and cool the data center.

The actual copper usage will not be static as fibre is a more efficient form of connections, but more processing intensity will demand more copper usage.

If we assume that between 3-5GW of data center applied power are built every year in the US (and the AI race is hardly US only) – the potential incremental copper demand just from the US data center buildout could range between 0.5-1.5% of global copper demand. Although this might seem insignificant, even a 1% shortage could plunge the market into a significant deficit.

Renewable energies fuel copper use

Looking beyond copper applications in data centers, the need for more power will also drive incremental generation from clean energy, potentially in the form of distributed grids (think solar panels and wind turbines). Consider that it takes between 4-5 tonnes of copper to build an onshore wind turbine or solar panel to generate 1-3MW of power.

Add to that the increased roll-out of electric vehicle (EVs) batteries and the push for sustainability has an unintended consequence of eating up a finite resource. A traditional internal combustion engine vehicle uses a fraction of the copper contained in an EV – 48 pounds for a combustion engine vs 183 pounds for an electric vehicle battery. A hybrid car contains 88 pounds of copper.

As the world endeavours to achieve net-zero emissions over the next three decades, copper demand is anticipated to grow five to six-fold. However, this surge might be challenging to meet given current supply constraints.

Constraints in copper mining

Copper supply has been further strained by operational and political instability in regions where it is mined, including Congo, Kazakhstan, Mongolia, and Latin America. Over the past year, an estimated 3-5% of global supply has been disrupted due to these factors.

Moreover, copper's supply response is notoriously slow. A typical copper mine takes about 10-15 years to explore, develop and bring online. There are no quick fixes like shale wells in the oil industry, which can be operational in mere days.

As a result of these factors, the copper market is barrelling towards a significant deficit and a price surge over the next few decades that investors should not discount when looking at the potential for AI and renewable energy.

Albert Chu is a portfolio manager at Man GLG, a fund manager partner of GSFM, a Firstlinks sponsor. The information included in this article is provided for informational purposes only.

For more articles and papers from GSFM and partners, click here.