Imagine owning an investment portfolio that could perform in any economic environment. In the deflationary bust of 2008. In the high inflation of the 1970s. In hyperinflation, a la Venezuela. And in the low inflation period of 2009-2021.

It’d be nice, wouldn’t it? Having the reassurance that no matter what is thrown its way, your portfolio would be resilient enough to let you sleep easy at night.

Is it possible to build such a portfolio? There have been various attempts at it, and we’re going to go through three examples of so-called All Weather portfolios today.

Ray Dalio’s portfolio

Hedge fund titan, Ray Dalio, has been pioneer in the field. He’s famous for founding Bridgewater Associates in 1975 and turning it into the US$124 billion giant that it is today.

Dalio is also known as a student of economic cycles. And it was his study of these cycles that led him and his colleagues to try to create a portfolio that could withstand any economic surprise that came its way. They set up the All Weather Fund in 1996, initially to just house Dalio’s trust assets, but eventually to take external money.

As Bridgewater tells the story:

“Market participants might be surprised by inflation shifts or a growth bust and All Weather would chug along, providing attractive, relatively stable returns. The strategy was and is passive; in other words, this was the best portfolio Ray and his close associates could build without any requirement to predict future conditions.”

Dalio knew from his reading of history that no single asset could provide safety at all times; it was only a portfolio of assets that could achieve steady returns under most, if not all, economic conditions.

Dalio’s framework in more detail

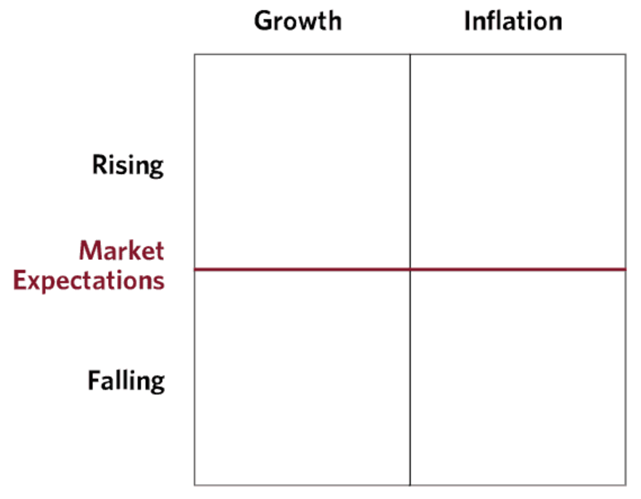

Dalio and Bridgewater broke down economic conditions into four categories:

- Rising prices (inflation)

- Falling prices (deflation)

- Rising growth (bull markets)

- Falling growth (bear markets)

They put this into the following matrix:

Source: Bridgewater

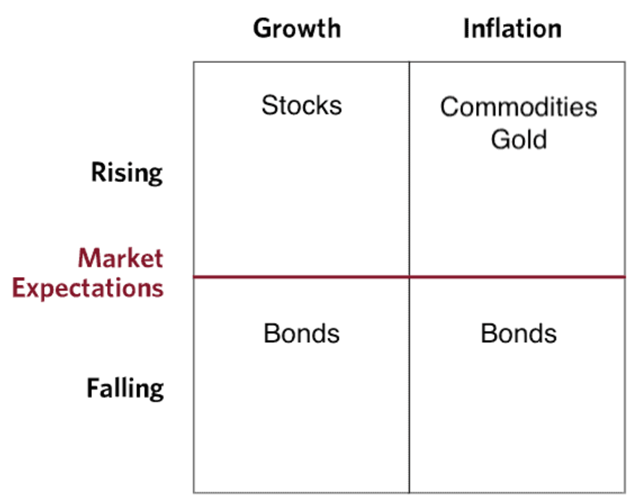

The question then is which assets are best suited to the different economic environments. Dalio concluded that gold and commodities tend to do well during periods of rising prices, while bonds perform best during periods of falling prices. In times of rising growth, stocks do well, while in declining growth periods, bonds are usually the best asset to hold.

Source: Bridgewater

The key is that these different economic environments don’t all occur with the same frequency. For instance, periods of high economic growth happen more often those of high inflation. In his portfolio, Dalio weighted the different assets accordingly.

Dalio’s All Weather Portfolio

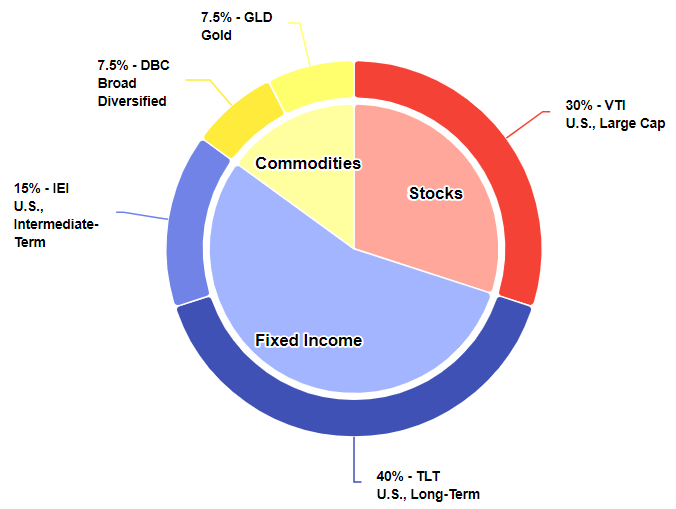

Dalio has been circumspect about his portfolio’s exact contents for much of its history (even to his own clients). However, he later revealed how an individual investor could set up an All Weather Portfolio via ETFs:

Source: www.lazyportfolioetf.com

The portfolio has a heavy weighting to bonds, with 40% in long-term bonds, and 15% in intermediate bonds. Stocks are 30% of the portfolio, while commodities including gold make up the remaining 15%.

For Australian investors, you could switch the US stock and bond holdings to international ones, or a mix of Australian and international, depending on your needs.

How has the All-Weather Portfolio performed?

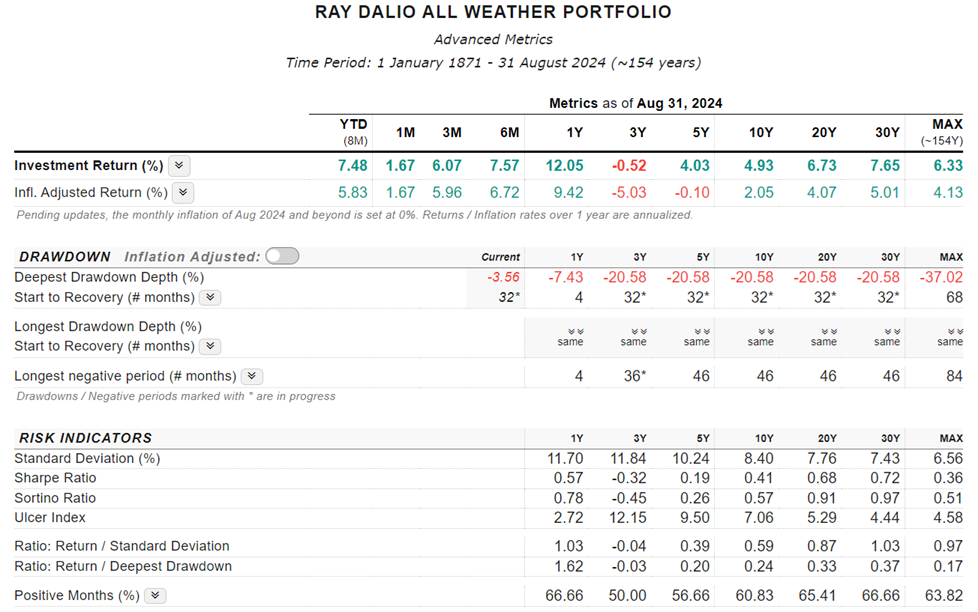

Dalio’s portfolio has performed reasonably well over time. It’s returned 6.7%, 7.7%, and 6.3% per annum (p.a.) over periods of 20, 30, and 154 years respectively.

It’s done that taking much less risk than most other portfolios. For example, $US1 has turned into US$10 over the past 50 years, and during that time, the maximum decline for the portfolio has been 21% (in 2022). And during the GFC, the portfolio only went down 12% from peak to trough.

Since 1871, positive returns have happened 96.1% of the time over three-year periods, and 98.6% of the time over five-year periods.

Source: www.lazyportfolioetf.com

All up, the portfolio has achieved its objective of providing steady returns through economic cycles.

Harry’s Browne’s Permanent Portfolio

The less well-known Harry Browne can also be considered a pioneer of the All Weather portfolio. Browne was a financial adviser and writer who wrote a book in 1970 predicting that high inflation was on the way and that investors should load up on commodities, especially silver and gold. As you can imagine, he made a personal fortune from getting this right.

However by the early 1980s, he knew the tide had turned and he became a passive investing advocate in the mold of John Bogle. That got him thinking about an investment portfolio that could perform under all circumstances.

He wrote a series of articles which culminated in the 1999 book called Fail-Safe Investing. He set out to build a bulletproof portfolio that would meet three requirements:

- Safety

- Stability

- Simplicity

Browne wanted to make sure that his portfolio could cover itself against all possible futures. He put those possible futures into four categories:

1. Prosperity. A period during which living standards are rising, the economy is growing, business is thriving, interest rates usually are falling, and unemployment is declining.

2. Inflation. A period when consumer prices generally are rising. They might be rising moderately, rapidly, or at a runaway rate.

3. Tight money or recession. A period during which the growth of the supply of money in circulation slows down. This leaves people with less cash than they expected to have, and usually leads to a recession – a period of poor economic conditions.

4. Deflation. The opposite of inflation. Consumer prices decline and the purchasing power value of money grows.

Browne theorised that if you were protected in these four situations, you’d be protected in all situations.

Note that if you’re thinking that Browne’s economic scenarios are similar to Dalio’s, you’re right.

Browne thought four investments could cover the different economic environments:

- Stocks to take advantage of prosperity. They tend to do poorly during periods of inflation, deflation, and tight money, but over time those periods don’t undo the gains that stocks achieve during periods of prosperity.

- Bonds also take advantage of prosperity. Also, they profit when interest rates collapse during deflation. Bonds poor less well during times of inflation and tight money.

- Gold is a great asset during inflation. Though it generally does poorly during times of prosperity, tight money, and deflation.

- Cash is most profitable during a period of tight money. Cash is essentially neutral during a time of prosperity, and it’s a big loser during times of inflation.

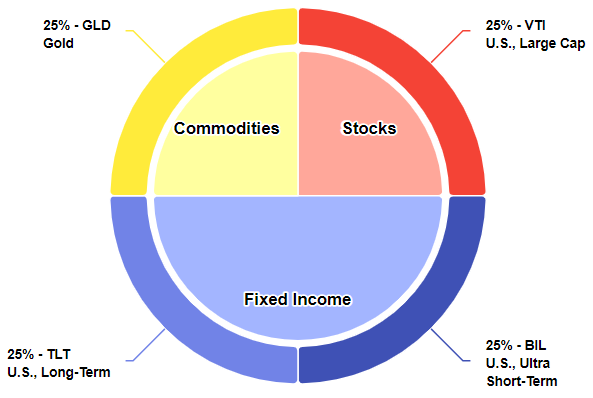

This formed the basis of Browne’s Permanent Portfolio:

Source: www.lazyportfolioetf.com

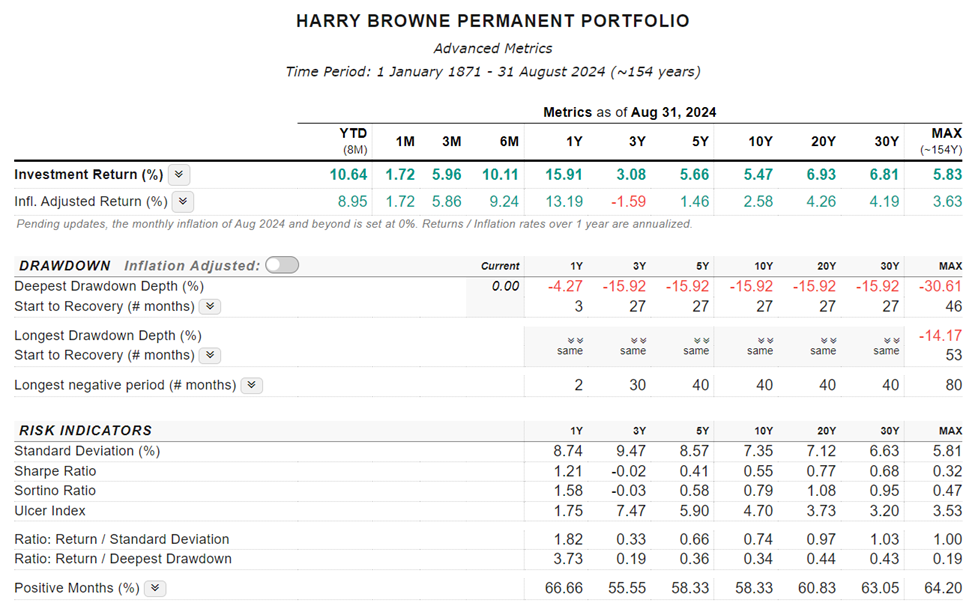

The performance of Browne’s Permanent Portfolio

The portfolio has provided the steady, low risk returns that Browne set out to achieve. It’s returned 6.9%, 6.8%, and 5.8% p.a. over periods of 20, 30, and 154 years respectively. It’s done that with remarkably low volatility. The largest peak to trough drawdown over the past 50 years has been 16% (in 2022). In 2008, the portfolio declined only 12% from the peak. And over every five year period since 1871, the portfolio has made money.

Source: www.lazyportfolioetf.com

The pushback to Browne’s portfolio is from the large holdings in both gold and bonds. Many wouldn’t be comfortable with this. However, Browne’s theory of how these assets could help a portfolio withstand certain economic conditions has proven relatively sound over time.

Note also the similarities between Browne and Dalio's portfolios.

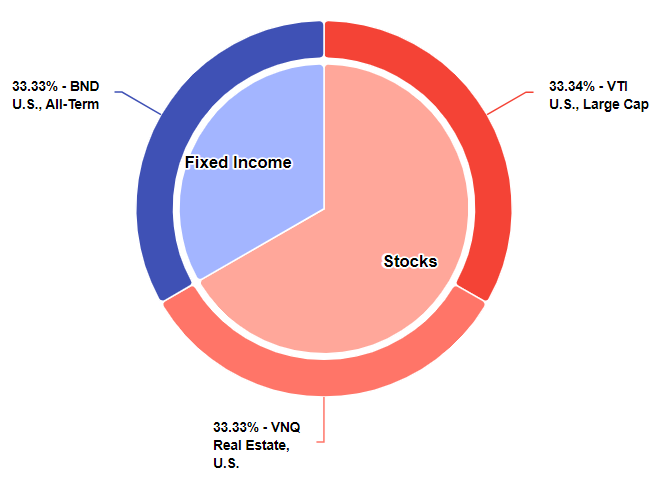

The Talmud Portfolio

Dalio and Browne’s strategies may be considered modern-day upgrades on a more ancient tradition of All Weather portfolios. The Talmud, a collection of Jewish texts from around 2,000 years ago, said:

“Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve.”

US-based investment commentators suggest a Talmud strategy today might look something like this:

Source: www.lazyportfolioetf.com

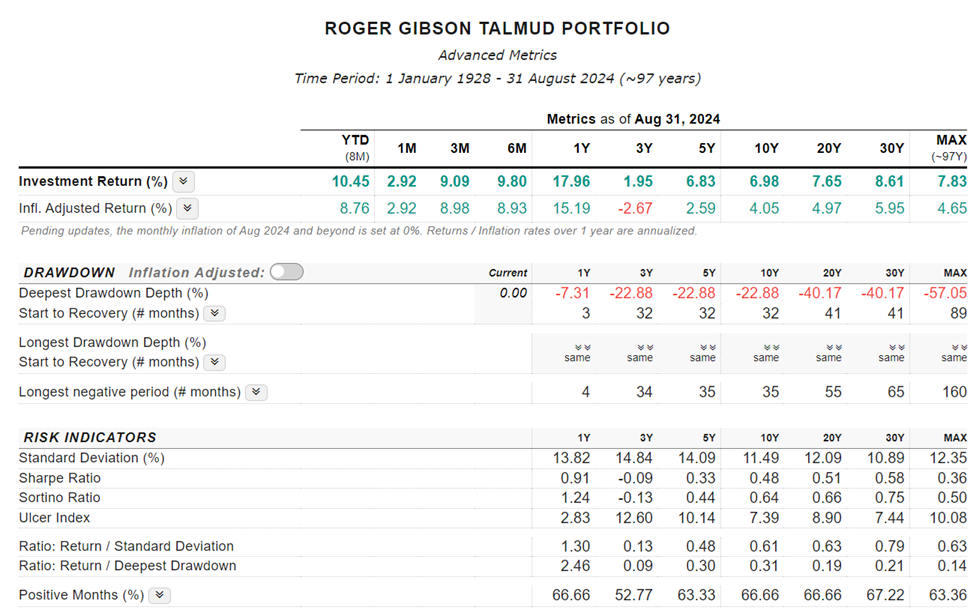

The Talmud portfolio has generally performed better than Dalio or Browne’s versions. It’s returned 7.7%, 8.6%, and 7.8% p.a. over periods of 20, 30, and 154 years respectively.

However, it’s achieved those returns by taking more risk. Drawdowns for the portfolio have been sharper. From peak to trough in 2022, it lost 23%. In 2009, it declined 40%.

Source: www.lazyportfolioetf.com

If having a portfolio that can prove resilient under all economic conditions is the goal, then this version of the Talmud doesn’t pass the test.

Like much of finance, things can evolve and get better with time – from the Talmud, to Browne, to Dalio, you can see the progression towards more modern, sophisticated All Weather portfolios.

The pros and cons of All Weather portfolios

All Weather portfolios such as those mentioned are simple and easy to operate. They won’t make you rich, but you won’t lose your shirt either. Therefore, it suits the risk averse. It’s also for the wealthy, who may want to focus more on wealth preservation.

The downside of the strategy is that the lower risk comes at the expense of returns. Those after high growth aren’t going to find that with these portfolios.

It may also be difficult to hold portions of the portfolios over long periods. For instance, holding a lot of bonds over the past four years would have tested even seasoned investors.

How the All Weather Portfolios compare to 60/40

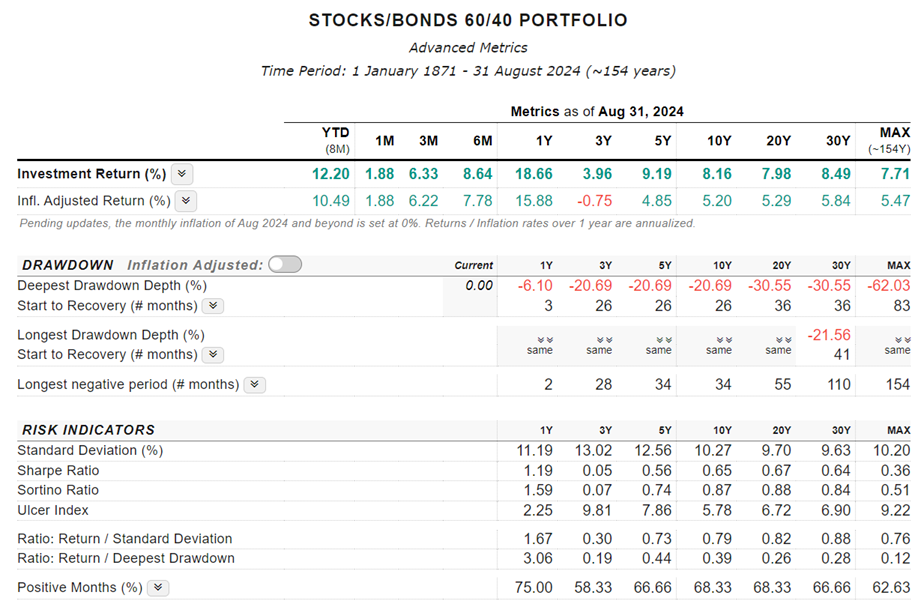

An obvious question is how the All Weather portfolios of Dalio and Browne compare to the more standard stock/bond allocations such as the 60/40. Generally, the 60/40 has delivered better returns, though with more risk attached.

Over the past 30 years, a 60/40 portfolio has returned 8.5% p.a. in US dollar terms, compared to Dalio’s All Weather strategy of 7.7% p.a, and Browne’s Permanent Portfolio of 6.8% p.a.

However, the 60/40 has had much larger drawdowns during that period. In 2022, Browne’s portfolio did best, losing only 16% from peak to trough compared to the 60/40 and Dalio both declining 21%.

In 2009, the story was different. Dalio lost 12%, Browne 13% and the 60/40 went down 31%.

Drawdowns from other periods such as 2000-2002 and the 1970s were also much larger for 60/40 compared to the other portfolios.

That’s reflected in risk measurements for 60/40 such as standard deviation in the table below.

Source: lazyportfolioetf.com

Risk and return are interrelated

Last week, I went through how to build an investment portfolio from scratch. I’ll repeat what I said in that article: there’s no thing as a perfect portfolio. Each portfolio has trade-offs. All you can do is to allocate assets in a way that gives you a decent chance to achieve your goals.

And there’s really one golden rule in asset allocation: risk and return are interrelated. If you want higher returns, you’re generally going to have to take more risk. And vice versa.

James Gruber is the Editor of Firstlinks.