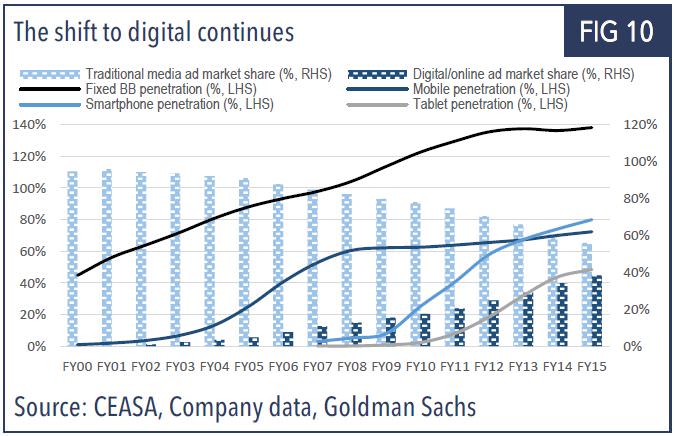

The media landscape is constantly evolving. Advertisers follow eyeballs, spending their money wherever consumers flock. However audiences are bifurcating as digital ingestion grows. Broadband and smartphone penetration continues to rise, permanently changing the distribution model for many media businesses.

Unfortunately, Australian companies are largely exposed to the decaying trends of traditional media. Print, TV and radio are being usurped by global distribution platforms. Google (and its subsidiary YouTube), Facebook (including Instagram), Twitter, Netflix and Spotify are all absorbing local audiences, demanding more ad dollars at the expense of local incumbents.

This technological disruption is weighing on local media companies and as a result they will need to turn to costs and technology to defend their profits.

Newspapers

Newspapers globally have had their businesses disrupted as consumers enjoyed largely free news distributed online. Readership declines saw advertising and classified dollars disappear, forcing restructures and cost-cuts. Printing press closures, out-sourced sub-editing and paywall introductions have acted to arrest some of the decline in profits. For the most successful mastheads (Financial Times, New York Times and Wall Street Journal), circulation revenue (the newspaper or digital subscription cost) now far outweighs advertising revenue and profits are starting to rise. While this industry is deep into a digital conversion, other mediums have only just begun.

Free-To-Air (FTA) television

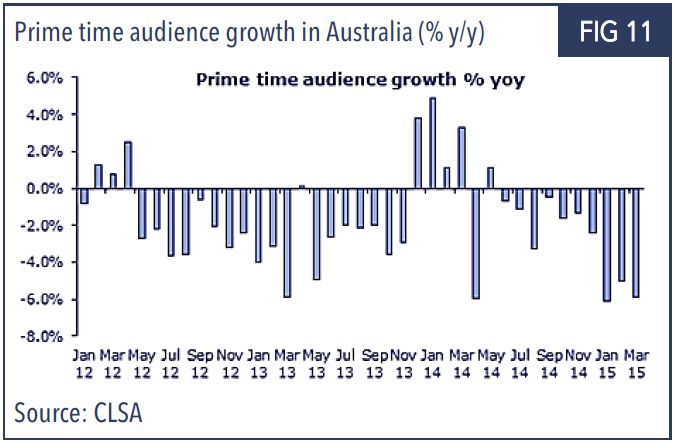

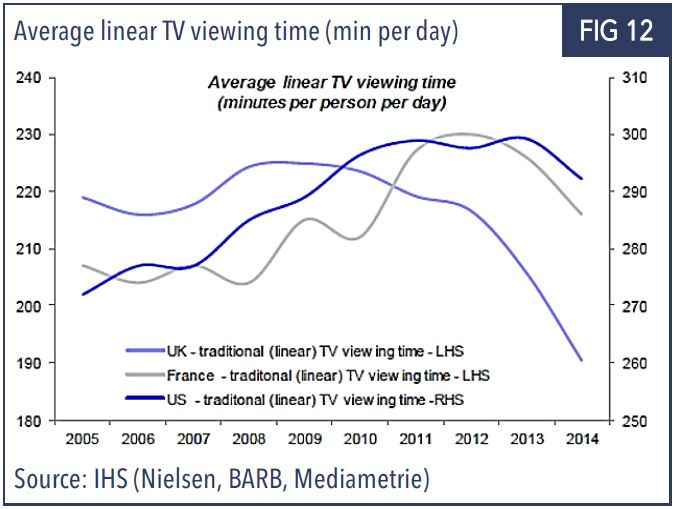

FTA TV has long been a staple of any advertising budget, enjoying roughly 30% of total ad spend. However the launch of Over-The-Top (OTT) services such as Netflix, Apple TV, YouTube, Amazon Instant Video and many more have created vast alternatives to linear television. This has led to loss of audiences across all major networks.

Unsurprisingly these trends are occurring globally. Advertisers will continue to pull money from the category while audience levels decline.

Nine Entertainment and Seven West Media have both launched their own OTT services, Stan and Presto, in joint ventures with Fairfax and Foxtel respectively. Considering the importance of scale in this business, it was disappointing to see two separate domestic services launched. Netflix has amassed over 60 million subscribers globally, and is planning to invest $6 billion in content next year alone. Original content titles are up to 13 and they have a target of 75-80 within five years. This enables Netflix to take programming risks that the networks cannot. Whether the domestic providers will be successful is yet to be seen, either way they will have to rebase the cost structures in the networks.

Programming expenses account for the vast majority of spend of the FTA networks. This can broadly be broken down into News, General Entertainment and Sport.

News continues to perform well as consumers demand a relevant nightly news service. While the networks are well placed to deliver this, savings must be found in this challenged environment. Seven West Media has recently merged the newsrooms of The West Australian and Seven Perth. This integrated newsroom is a first for Australia despite being commonplace in Europe. While an eloquent solution exists in WA, ownership structures largely prevent similar outcomes on the East Coast. Where cross-media integration is difficult to achieve, technology is being used to reduce costs. Journalists are now equipped with handheld devices enabling video content to be shot and sent back for editing without the need for production crews.

General Entertainment is the segment most under-threat from OTT providers. Consumers prefer on-demand ‘binging’ of TV series, an offer unable to be delivered via linear TV. The US TV studios have long been a cornerstone of Australian programming, however their appeal has been lost. We estimate Nine Entertainment pays $150-170 million annually to Warner Bros for largely unsaleable inventory. This deal expires in 2016 and should deliver savings for the company, freeing up resources for reinvestment in local programming. As with networks globally, Australian companies are producing more content in-house. This ultimately needs to appeal to viewers, but does enable better cost control through production.

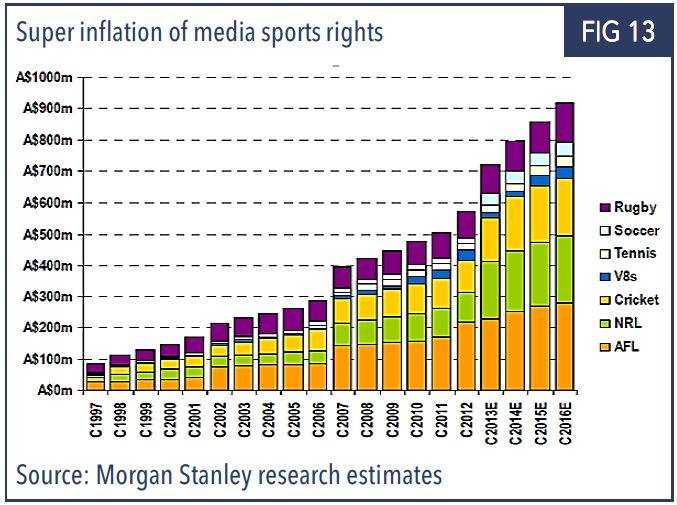

Sports are seen as a ‘must-have’ for TV networks. In a world where eyeballs are straying across mediums, live sport is still able to deliver the mass audiences that advertisers demand. The problem for the TV networks is the rampant inflation in the cost of sports rights at a time when revenue is declining. Added to this the challenge of new competitors, as digital rights attract the likes of Google and Netflix.

Radio

While radio to date has largely been immune from audience declines, the rapid uptake of streaming services from Spotify, Apple and Google signals alarm. Local radio companies have embraced technology, investing heavily in their streaming and digital businesses, providing listeners with easy mobile and desktop options. Aware of the threats posed by global streaming services, local radio companies appear to have time to refine their business models. However, the user experience of ad-free, targeted playlist, social engagement and global on-demand inventory certainly appeals to listeners. Time will tell if Australian consumers switch off the radio.

Digital businesses

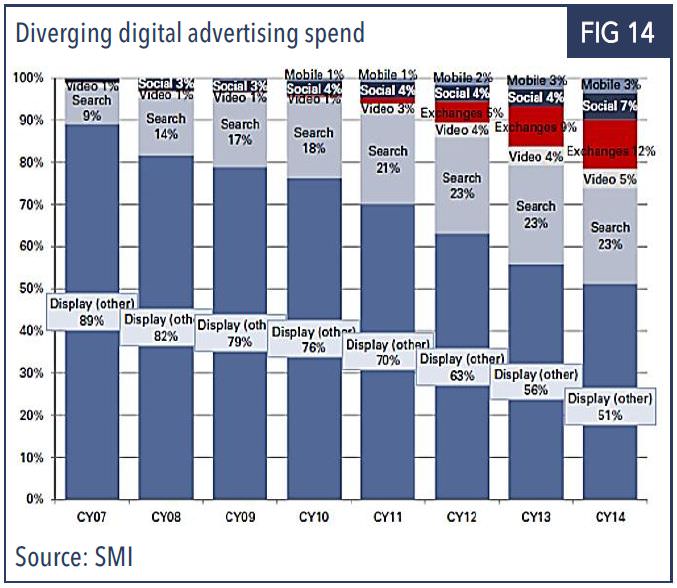

Online media companies have carried this advertising tailwind for a number of years, however divergent trends exist even amongst online spend.

Digital display advertising, the first generation of online advertising, continues to see deflation as endless inventory is auctioned off through ‘ad exchanges’. Social Media and Mobile currently command just 10% of online ad spend, however this number is growing fast. A ‘mobile first’ strategy by large global media companies is a priority on mobile platforms as audiences spend more time on the go. Google reported at its recent June result that mobile YouTube usage grew 60% in the quarter. Advertisers will inevitably follow this proliferation of mobile usage. Further benefitting Social Media advertising is the inherent data capabilities of the medium. Advanced targeting, audience creation, SKU (product code) matching and carousel ads allow advertisers far superior methods through which they can monitor return on investment than the purchase of traditional ‘spots and dots’ from TV networks.

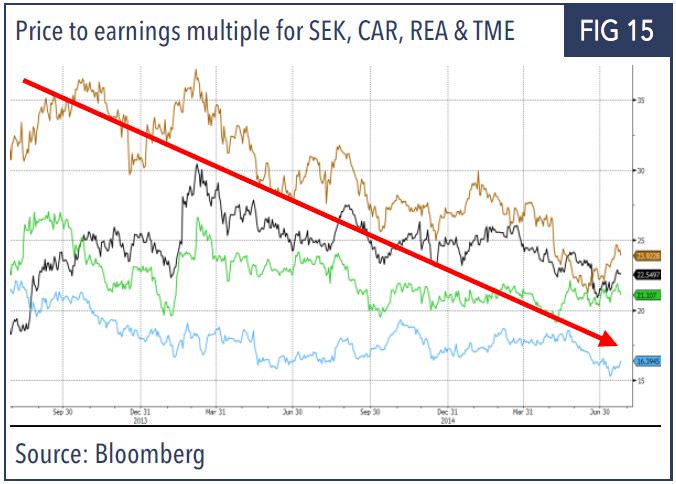

This wave of mobile penetration and diverging digital spend is impacting the highly successful online classifieds businesses. Seek, CarSales, Trade Me and REA have all benefitted from advertisers transitioning their online advertising spend. However, in anticipation of this trend maturing, these companies are investing now, for future revenue opportunities outside their core classifieds model.

CarSales has purchased a finance broker; REA has purchased an online rental application business; and Seek is investing beyond pure job notices. While significant opportunities exist to leverage their dominant consumer positions, investors have thus far been unwilling to pay for these growth options with the companies de-rating over the last two years.

Justin Braitling is a portfolio manager at Watermark Funds Management. This article is for educational purposes only and does not consider the circumstances of any investor.