The pandemic is far from over, as the current lockdowns across the country attest. However, the recession that it caused, for now, is behind us. When it first unfolded, economists hypothesised how this recession may differ from others. The results are in, and for Australia at least, the pandemic-led recession was characterised by the magnitude of the downturn and the speed of the recovery. The initial downturn was sharp due to the introduction of wide-ranging restrictions (including movement of people) and the recovery was fast because governments moved swiftly to implement record levels of stimulus and the economy was not burdened by the hangover of a financial crisis.

Government stimulus has joined low interest rates and easing restrictions to fuel a rapid recovery in Australia and around the world. The global economy’s pace of expansion is accelerating. According to the latest World Bank forecasts (June 2021 Global Economic Prospects), the global economy is set for the fastest recovery from recession in over 80 years. Australia’s economic performance has also been impressive. Since mid-2020 the economy has had three of the strongest consecutive quarters of economic growth on record and a sharply falling unemployment rate, which is now at one of its lowest levels since 2008.

What does this mean for real estate?

There are both short and long-term consequences for real estate. However, the themes depend on the individual property sectors.

Industrial and logistics

Globally, capital demand for quality industrial property has driven the strongest period of growth the industrial and logistics sector has experienced in recent years, with leasing and transaction volumes at record levels.

Industrial & logistics sector real estate demand accelerated dramatically during the pandemic. Lockdowns drove Australians online for their daily requirements and substituted consumption which would have been spent on other activities, like travel. As a result, several years of online retailing growth was condensed within one year.

The sector is still adapting to this demand, with both leasing volumes and investment pricing reaching record levels. Additionally, certain businesses and tenants have begun to switch from ‘just-in-time’ to ‘just-in-case’ inventory strategies for improved resiliency. Some estimates expect typical inventories will increase 5-10% over the next two to three years. This provides positive flow-on effects to leasing demand as a result of increased space requirements.

Retail

Demand for convenience retail assets with long-Weighted Average Lease Expiries (WALE) has continued to be strong, especially if the asset is underpinned by a blue-chip tenant covenant and the essential nature of the use.

As the growth across the industrial sector has highlighted, this recession did not impact consumer demand for goods. The recent Australian Bureau of Statistics retail trade results remained ahead of expectations and retail sales have remained well above pre-pandemic levels both in aggregate and across nearly all categories. This demand has had varying impacts on retail real estate.

The grocery anchored (i.e. Coles, Woolworths and Aldi) and convenience retail sector has performed well over the year and is expected to continue to do so. However, the larger discretionary retail centres have been challenged by mandated social distancing and travel restrictions for both tourists and international students. While the larger centres will continue to evolve and remain relevant, other centres may not fare so well.

In contrast, household consumption over the past year has surged, particularly benefiting real estate leased to hardware stores and other large format retail tenants.

Office

Investment sentiment is improving and has been evidenced by several office properties trading at firm capitalisation (cap) rates (elevated prices), particularly for long WALE assets with secure income streams.

The movements in office vacancies have broadly reflected the economy’s trajectory. The world has watched Australia’s office re-entry closely as our comparatively lower COVID-19 numbers enabled the earlier re-opening of cities, although there is a setback in the current lockdowns. Mobility statistics suggest that office occupancies trace the easing of mandated restrictions, and although this may change over time, there is limited immediate evidence of reduced office demand from remote working strategies.

In many ways the past year was a forced experiment which increased the acceptance of remote working flexibility while simultaneously raising awareness around the purpose of an office. It highlighted the contributions an office has on knowledge, information flow, innovation, productivity, risk management and collaboration.

Quality offices provide environments which contribute to lower absenteeism, lower staff turnover, and better organisational performance.

This sentiment has been shared by a growing chorus of business leaders who have emphasised the importance of informal interactions, access to leaders, business hubs and the storage and transmission mechanisms of social capital.

The cost-benefit of offices will continue to be weighed up by corporates: office costs can be approximately 10% of salary costs yet the boost to productivity with the collaboration and culture-building benefit an office brings can be significantly greater. As such, we believe the office market is likely to see more polarised demand between lower and higher quality office properties.

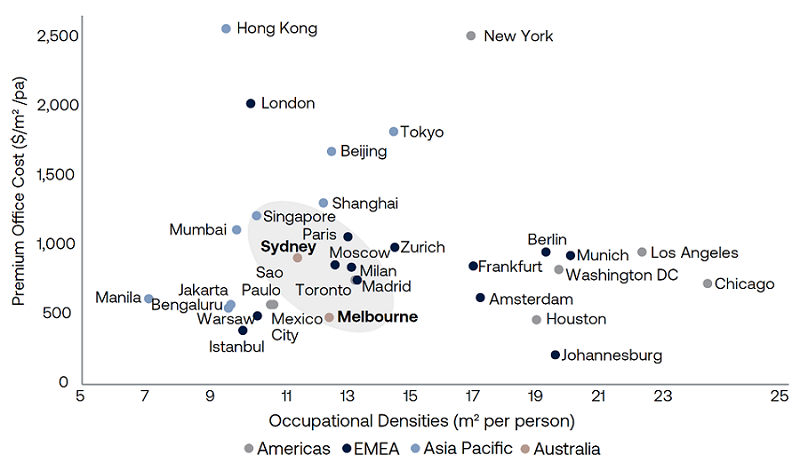

Most businesses and employees believe there will be increased flexibility in the post-pandemic era. However, increased flexibility does not necessarily translate into materially lower office demand. The balance of required space will ultimately be influenced by the flexibility offered to staff and the de-densification. Over many years, businesses have placed more employees into smaller spaces but the pandemic is expected to halt or even reverse this trend.

According to a recently-released JLL Benchmarking Cities and Real Estate Report, pressures to de-densify will likely occur as office design evolves to support productivity, wellbeing and experience alike, and as organisations allocate more square meterage to collaboration and amenities in order to attract and retain high-quality talent.

Office occupational densities vs. occupational costs

Source: JLL Research, Charter Hall Research

We expect the economic recovery to continue, despite some inevitable short-term volatility as the pandemic recedes. The current lockdowns highlight the difficulty in making short-term economic predictions. However, it is the medium to long-term outlook that Charter Hall focuses on for investors and we continue to hold the view that the outlook for the Australian real estate sectors where we invest remains strong.

Steve Bennett is CEO of Charter Hall's Direct Property business. Charter Hall is a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.