The most interesting high-level observation on markets at the moment is the fact that they are selling at an all-time high despite the elevation of geopolitical tension, complete confusion on the forward path of the economy, and the increasing technical skew in market indices that is no doubt a function of the never-ending march of passive investing.

Geopolitically, we have the real threat of war in Taiwan, the ongoing war in the Middle East, and the tragic war in the Ukraine.

On the economy, PM Capital’s view has not changed. We always thought that the economy would sustain itself through 2024 and that there was now a higher floor in inflation, meaning that although rates have gone up enough to dampen an already slowing economy, with higher embedded inflation and an economy that was in reasonable shape, it was unlikely that rates would need to fall too much or too soon. Central bankers could afford to be patient and historically, 4% interest rates are not that high especially given higher embedded inflation.

I would also reiterate the danger of making decisions based on macro-economic forecasts. In the last 12 months, market sentiment was convinced of the imminent recession, then became convinced of a soft landing, then started talking about no landing and now economic indicators are suggesting an upturn. Who knows?

The other feature of today’s markets is the unhealthy concentration of daily trading and the impact on market performance of what was the top ten stocks in the United States, then becoming the Magnificent Seven and the way it is going, likely to end up in the one and only – Nvidia.

It is interesting to note how the industry is always rabbiting on about concentration of risk yet here we are today with the greatest concentration of risk in the fewest stocks that we have ever seen. That creates the perfect opportunity for investors to diversify from that risk and take advantage of where the valuation opportunities are.

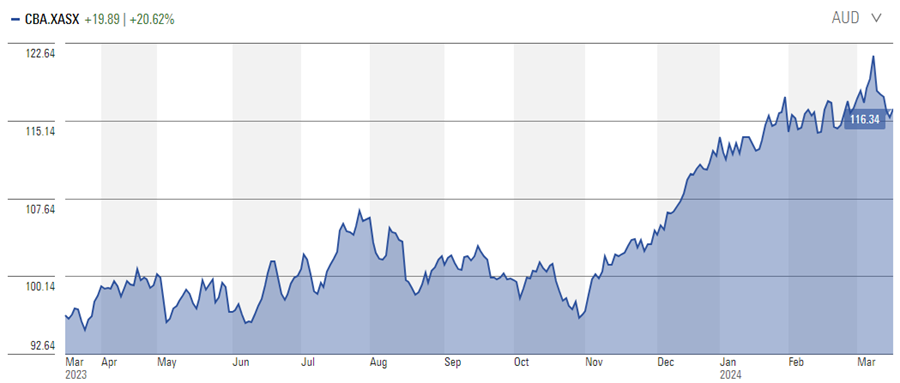

1 CBA = 3 of Europe’s top banks

That brings me to my favourite topic – Valuation.

Back in October we highlighted that “when I look at our portfolio, valuations still appear to be in our favour. …the overall Price-Earnings ratio of the portfolio is in absolute terms, probably as low a number as I can recall”. So, the uplift in the market from the September lows has not really surprised me.

What does surprise me is that valuations in some of our investment themes are more like what you see at the bottom of a market, not the top. Single digit PE ratios and double-digit dividend yields.

The most extreme example is our European Banks, selling on a 6x PE and a 10% dividend yield*. Here is an interesting anecdote.

CBA, the largest bank in Australia, has a market value of circa $200 billion and receives $1 of every $10 that flows into the Australian Stock Exchange from passive funds^. For $200 billion, you can buy some of the largest retail banks in Europe, like Lloyds in the UK, Caixia Bank in Spain, plus Intesa in Italy. The population of Australia is nearly 26 million. The combined population of the UK, Spain, and Italy is over 170 million. We are short CBA and long Lloyds, Caxia and Intesa.

Source: Morningstar

The point is that there are extreme valuation differentials in markets today and being passive (through index investing) is not the way to take advantage of them.

A further valuation anomaly

Another valuation extreme is the US dollar.

Having visited the United States twice in the last three months, it was quite stark how significantly prices have increased post-Covid and, in Australian-dollar terms, made you feel like a pauper.

Nominal prices are pretty much the same as Australia but after adding the 10% state tax, the 4% charge they now automatically put on your bill for the kitchen staff, then the 25% tip the waiter is expecting and converting into Australian dollars, the price is twice what you pay in Australia. So, an average pizza and beer at an average sports bar, is approximately A$80.

Source: Trading Economics

In another anecdote on the impact of Covid and why inflation is embedded in the system, I walked into a convenience store to get a bottle of water. I went to the counter to tap with my card and, before I tapped for the final amount, the machine asked if I would like to tip 20, 25 or 30%. No thanks…

Paul Moore is the founder and Chief Investment Officer of PM Capital. The information herein may change without notice, does not constitute advice or a recommendation, and does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Consider the PDS and Target Market Determination available at www.pmcapital.com.au and seek financial advice prior to making an investment decision. Past performance is not a reliable guide to future performance. The return of capital, or rate of return, is not guaranteed.

*As at 29 February 2024.

^Market capitalisation of ASX:CBA as at 19 March 2024 is $195 billion, source: ASX