The month of June 2019 capped off a rare half-year when all of the main types of investment posted higher returns than their long-term annual averages for a full year. Everything went up except residential property.

A game of two halves

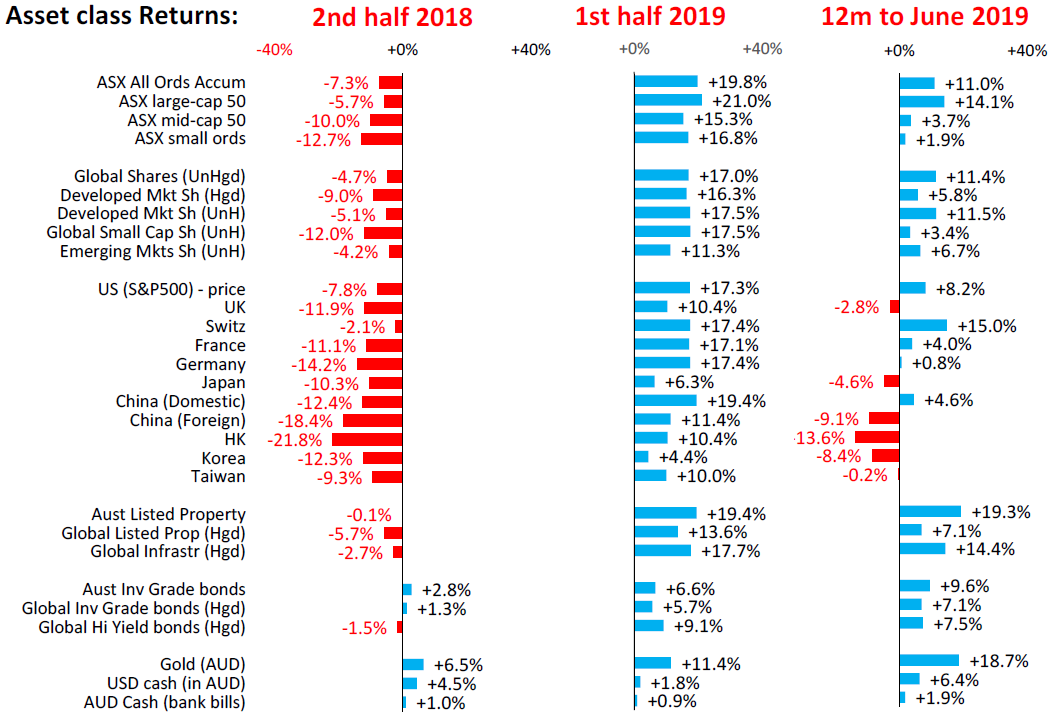

Although the overall returns for the 12 months turned out to be good, it was a ‘game of two halves’, with a sea of red ink in the first half and strong rebounds in the second half.

In fact, if an investor had been living on the moon or under a rock for a year, they would have returned delighted at the end of June. If they looked at their portfolio balances for the first time in a year, they would have said something like, "What a great year – everything must have been good in the world. I’ll have another one of those, thanks!"

All they would see are the returns for the full 12 months, shown below in the right-hand set of bars. The broad Australian share market returned 11%, as did unhedged international shares. Bonds also returned better than their long-term averages: 9% for Australian bonds, and 7% for global bonds. Returns from the Australian listed property market were nearly double their long-term average. And all with inflation at just 1.3% for the year.

We had turned defensive from April 2018 by reducing allocations to Australian and global shares to prepare for a fall. We also reduced our currency hedging on global shares to benefit from the falling AUD, increased bond allocations and added gold and US dollar cash. These changes helped cushion investors from most of the December pain. Then in 2019 after the sell-off, we increased our allocations to shares and shifted portfolio settings back toward a moderately-bullish stance.

Why such a difference?

In the first half (July to December 2018) share prices fell sharply in a global slowdown scare, driven by fears of Trump’s trade wars slowing global growth rates, China’s reluctance to stimulate its slowing economy, two more rate hikes from the US Fed, and fears the Fed would continue to raise rates despite early signs of a slowing US economy. Australian shares followed the global rout, although by not as much as the sharp -20% fall in the US market from late September to late December. It was the worst December for US shares since 1931. In the midst of this global panic, I fielded numerous calls and emails from worried investors asking if this was ‘the next GFC’ or even worse.

The first half of 2019 turned out to be a complete turnaround. The Fed stopped raising US interest rates and even started talking about possible rate cuts, the Bank of Japan and European Central Bank also talked up the prospect of providing more support, and China ramped up its stimulus efforts with spending increases, tax cuts and subsidies. In Australia, the RBA shifted its stance toward lower rates. Bank shares benefited from being let off lightly by the Hayne Royal Commission and the re-election of the Morrison government.

Some highlights among Australian stocks

Australian shares have beaten most other countries this year, driven largely by three broad themes:

- Collapsing local and global bond yields

- Hopes of a housing turnaround following the re-election of the Morrison government, the easing of APRA lending restrictions, and rate cuts from the RBA, and

- One-off commodity price rises.

The collapse in bond yields helped utilities (mainly APA +36% this year, and Ausnet +26%), infrastructure (Transurban +30%, Atlas Arteria +27%), listed property trusts (mainly Mirvac +46%, Goodman +45%, Dexus +29%, Stockland +25%, but the retail trusts were very weak), and also Telstra (+36%).

Hopes of a rebound in housing has helped the banks, especially after the election. Shares in the Big Five are up 13-15% each.

Miners have done well despite the general global slide in most commodities prices with the global slowdown. Iron ore miners have benefited from rising iron ore prices caused by mine closures in Brazil (Fortescue +119%, BHP + 25%, RIO + 32%), and rising gold prices lifted the gold miners (led by Newcrest +47%). The mini-recovery in oil prices this year thanks largely to the escalating Trump/Iran conflict has also benefitted oil/gas stocks (Santos +29%, Woodside +16%).

Most global share markets have also been strong this year. The US tech giants have led the rebound: Apple +25%, Amazon +26%, Facebook +47%, Microsoft +32%, Netflix +37%, and even Uber has climbed back above its IPO price after a poor start. Only Alphabet (Google) has been flat this year (+4%).

Every other global sector, and every major country (apart from Japan +6%), has also returned more than 10% this year, which is more than their usual annual averages.

Bond prices and returns in Australia and around the world have benefited from the continued broad decline in bond yields across the board.

But there is a major disconnect here

The global collapse in bond yields reflects increasingly grave fears of slower growth and even possible recessions in Australia, US, Europe, Japan and many other countries, but share prices everywhere have been surging in anticipation of more sugar hits in the form of lower interest rates and more stimulus to try to arrest these slowdowns. These two are incompatible of course and cannot last for years.

We will no doubt have another ‘global reflation’ scare or two (like February and October 2018), and share prices are sure to correct once again as they are starting to run ahead of weakening profit growth rates.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is for general information purposes only and does not consider the circumstances of any individual.