The pandemic has had profound implications for the way we use real estate. As we transition into a post-pandemic environment, tenant preferences and behaviours are now providing more certainty to the outlook of our major real estate sectors.

Evolution of office space between two extremes

The office sector is emerging from one of the largest experiments workplaces have undergone, manifesting from mandated social distancing requirements which forced people to transition from working in offices to homes. This underpinned a proliferation and advancement of communicative technologies while broadening the perceptions around working remotely. The speed at which this transition occurred attracted significant levels of commentary and polarised opinions. Overarching views ranged between two extremes: ‘the office is dead’ versus ‘the pandemic was temporary and will have no impact on the sector’.

With the benefit of time and evidence from market activity, we can comfortably dispel both these extreme perspectives. The office is not dead but is certainly undergoing changes as tenants adapt to working in a COVID normalised world. The counterbalancing elements from those two extreme perspectives will influence the outlook of the sector, generating diverged performances across various assets.

Looking through the lens of tenant leasing enquiries and actual leases being signed, it’s evident that the market rebound has accelerated quicker than originally anticipated. The recovery in tenant demand advanced despite the COVID related lockdowns across the major markets in the second half of 2021. Occupied office space (as measured by leased spaced) across national office markets increased by 185,700 sqm over the December quarter - the strongest result since September 2018.

Moreover, sentiment surveys also reflected the growing appetite for office space from tenants. Demand drivers such as new set-up and expansion as the economic recovery gathers momentum have increased by 119% since May 2021 across the region (Source: CBRE Asia Pacific Leasing Market Sentiment December 2021).

A focus on quality space

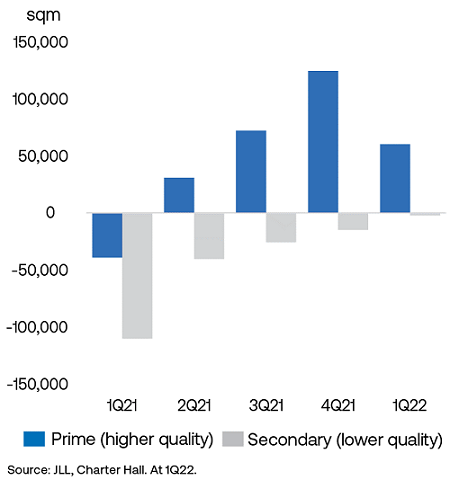

However, headline figures masked one important trend. We are witnessing a significant divergence based on building quality. Prime sector occupied stock posted the highest quarterly growth in tenant demand since December 2007, up 228,000 sqm, with strong results across both CBD (124,600 sqm) and metropolitan (103,800 sqm) markets. Over 2021, Prime (higher quality) occupied space increased by 497,000 sqm, the largest annual increase since 2016. Over the same period, Secondary (lower quality) occupied space reduced by 73,700 sqm, highlighting the markets focus on a flight to quality (see chart).

Changes in Office CBD occupied space, by asset quality

Leasing volumes have evidenced the strong demand for high quality office buildings through the COVID recovery.

Workplaces are now more than ever a statement of purpose. The quality of an office will be a pivotal part of attracting workers and promoting collaboration, learning, innovation and productivity. Quality offices will host experiences and environments which cannot be replicated working remotely.

The dawn of the magnetic workplace

The industry term for this development is 'magnetic workplace'. Businesses will need to deliver magnetic workplaces to incentivise visitations while attracting and retaining employees. The Australian unemployment rate is approaching 50-year lows (currently at 4%), so the battle for talent is set to intensify. Further, extended periods of remote working have generated higher reports of cultural decay and growing mental health challenges resulting from lower social interaction with colleagues and ineffective onboarding and induction of new staff.

At Charter Hall, we believe a holistic perspective should be adopted for an employee experience. The asset quality, amenity and technology are essential for creating an environment which supports an employee’s productivity and wellbeing. This requires a collaborative approach that includes an asset’s offering beyond just office space and includes the retail offering and end of trip facilities (things like change rooms and bicycle racks). It can also extend to the surrounding area.

Establishing precincts that enhance the overall offer and amenity are also becoming important. Understanding this optimal offering requires a deep knowledge of our tenant customers, and not just the industries they operate in and their revenue potential, but their values, personality and culture and how we can work with them to create environments that deliver workplaces that support productive collaboration. As a business, we have certainly benefited from our on-going partnership and engagement with more than 2,500 tenant customers, many of whom have space in more than one property sector with us, to deliver quality workplace eco-systems. Nonetheless, it will be crucial that we continue to adapt and evolve in line with our tenant customers workplace requirements.

Buildings assessed in a broader context

The impacts of the pandemic also encouraged many organisations to assess other elements that resonate with their business objectives and company purpose. This has subsequently advanced the standards relating to sustainability and governance, with many tenants and investors increasing the priority on sustainable buildings. These requirements have been further amplified by the rising costs of energy.

For owners of lower quality buildings, these requirements will accelerate asset obsolescence. These landlords will need to contend with the dramatically changing requirements around workplace design and the escalating costs of repurposing these assets to remain viable. By contrast, the combination of these factors will support the continued occupier and investor demand for quality assets, contributing to the divergence of performances across the market.

Steven Bennett is Direct CEO and Sasanka Liyanage is Head of Research at Charter Hall Group, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.