This is a long and technical discussion between myself and Alun Stevens of Rice Warner Actuaries. We have different interpretations of APRA's APS210 regulations on bank liquidity, based on different feedback from APRA and our industry experience. It's an important subject for people close to the issue, but not likely to be of general interest in this amount of detail. We post the debate in the interests of highlighting the issues.

Part 1, Original article by Graham Hand

There is a major disconnect in the Australian financial system which the regulators are doing little to correct. Much of the nation’s saving is in the superannuation system (currently $1.5 trillion and heading for $6 trillion by 2030) while much of the nation’s funding need is in the banking system (total loans of the four major banks of $1.8 trillion are greater than their deposits). The obvious solution is to make it easier for publicly-offered super funds to invest in bank deposits, but some recent regulations operate in the opposite direction. Furthermore, they create more incentives for investors to set up SMSFs at the expense of publicly-offered super funds.

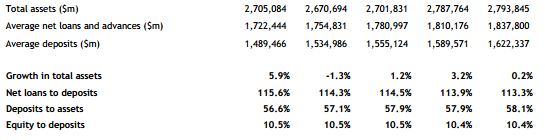

Consider the aggregated balance sheets of our four major banks:

Sep 2011 Dec 2011 Mar 2012 Jun 2012 Sep 2012

Source: Quarterly Bank Performance, APRA, issued 21 February 2013

The ratio of deposits to total assets of the major banks is only 58%, and the amount of their loans is 113% of their deposits. The funding shortfall comes primarily from two sources: wholesale short term money markets ($205 billion), and longer term bond markets, mainly offshore ($465 billion). In times of market distress such as during the GFC, the reliability of offshore funding falls away, and short term wholesale sources quickly seek the greater security of government paper. So it is in the interests of bank funding stability that they finance themselves more from stable, long-term retail sources, such as deposits from the superannuation system (including retail platforms and wraps).

Unfortunately, the proposed Australian Prudential Regulation Authority (APRA) Prudential Standards on Bank Liquidity (APS210) discourage this meeting of large super funds and bank deposits.

Same investment, different liquidity treatment

To see how the liquidity regulations work, let’s take a quick quiz, looking at Mrs Walsh making the same investment three different ways. There’s one rule: ‘retail’ is good and ‘wholesale’ is bad.

Question 1. When Mrs Walsh, a long time Westpac client, walks into Wagga Wagga branch and deposits $10,000 in an at call Westpac deposit, can the bank classify it as a long term retail deposit?

Answer 1. Yes, the liquidity rules treat this as a retail deposit, which is wonderful because the bank does not need to allow for Mrs Walsh’s ability to take the money out the next day. The bank does not need to hold any expensive liquidity to support the deposit, so Westpac loves this type of money and will pay Mrs Walsh an attractive rate. Smiles all round.

Question 2. When Mrs Walsh, a long time Westpac and BT Investment Management client, walks into Wagga Wagga branch and deposits $10,000 in an at call Westpac deposit offered on BT’s super platform, can the bank consider it a retail deposit?

Answer 2. No, the liquidity rules classify this as ‘wholesale’ because the super fund has a trustee which is not a ‘natural person’ making the deposit. Westpac must hold low-yielding liquid assets to support this deposit, and it has suddenly lost its ‘sticky’ characteristics. Westpac doesn’t like it and so offers a lower rate to the super fund. Frowns all round.

Following so far?

Question 3. When Mrs Walsh, a long time Westpac client and recent proud owner of an SMSF, walks into Wagga Wagga branch, and in the name of the corporate trustee of her SMSF, deposits $10,000 in an at call Westpac deposit, can the bank consider it a retail deposit?

Answer 3. Yes, because although the investment is held in the name of a corporate trustee, not a ‘natural person’, APRA has granted special treatment for SMSFs. Again, Westpac is not required to hold expensive liquidity to support this deposit. Good rates and more smiles.

Still following? The obvious bunnies missing out are the large public super funds and their clients.

In Cuffelinks Edition 2, we demonstrated how the government deposit guarantee does not apply for investors using publicly-offered super funds to deposit funds in banks. Now, the effect of APS210 is that deposits made via the same public super funds will be considered volatile, wholesale money on which banks will be less willing to pay competitive interest rates. SMSFs have a special exemption which categorises them as stable, retail depositors.

The lack of significant superannuation industry lobbying against the terms of the government guarantee and the liquidity rules is mysterious because they make little practical sense, either from the bank, superannuation or good liquidity management perspective. The days are long gone when the super industry could ignore what is happening with bank regulations, as retail investors have flocked into billions of dollars of bank deposits on super platforms in the last few years.

In fact, most of the major retail fund managers did not offer bank term deposits or bank cash accounts on their platforms until 2008 or later, and many industry funds still do not give their customers a range of term deposits to select. Their customers who want cash or term deposit exposure must choose managed funds such as cash trusts that invest in such instruments.

Even before APS210 hits, there are two problems for publicly-offered super fund investors that direct bank depositors and SMSFs can avoid: the first is that administrators of large super funds take a platform management fee; and the second is that large super fund investors are unable to take advantage of special ‘blackboard’ deals offered by banks. For example, although the cash rate is only 3%, it is not difficult for a bank customer or SMSF to earn 4.5% on a bank deposit. Such rates are not available in the wholesale money market because the banks only pay up for deposits classified as genuine retail. Large publicly-offered super cash funds are already uncompetitive compared with term deposits, and APS210 will only make it worse.

How do the new liquidity regulations create this outcome?

(Note, this is not about bank capital, that is a different set of regulations).

Under the direction of the Bank for International Settlements and Basel III, APRA is introducing a new standard called the Liquidity Coverage Ratio (LCR). It requires banks (and other Authorised Deposit-taking Institutions) to hold High Quality Liquid Assets (HQLAs; basically government securities) against liabilities maturing within 30 days, or any term deposit where the investor has the right to redeem early. Retail deposits are considered ‘sticky’ and the most stable of deposits, and do not need to be included in the 30 day maturity bucket, even if they are at call. Retail deposits must come from a ‘natural person’, not a trust.

Banks will be willing to pay more for retail deposits because they do not need to hold HQLAs against them, which is estimated to cost up to 80bp pa due to the lower yield on government securities. This is the potential disadvantage facing institutional super funds. Recent announcements from Basel indicate some relaxation regarding which assets qualify as HQLAs, opening the door to better returns, but APRA is reluctant to ease the rules in Australia.

What about those institutional super funds which offer bank deposits on their super platforms or wraps, where a retail investor directly selects a deposit issued by a specific bank? Surely this is a retail deposit, as it is a retail investor making the decision, not a fund manager. It would be almost impossible for the trustee to act against the instructions of the depositor, at least within the defined 30 day period.

At first glance, it appears these deposits will receive favourable APRA treatment as retail, as the Discussion Paper on Basel III, page 18, states:

“APRA recognises that there are some deposits that are acquired by an ADI through an intermediary but can be retail in nature where the natural person retains control. Subject to meeting certain conditions, as outlined in draft APS210, ADIs can treat these deposits as retail for determining cash outflows under the LCR scenario.”

So far so good. But what are these “certain conditions”? A massive sting in the tail, that’s what. The criteria to gain the favourable retail treatment include: the natural person must retain all legal rights, which cannot be transferred to an intermediary. The intermediary can have no duty to make investment decisions on behalf of the natural person.

In Australia, all superannuation money must be invested through a trust that complies with the Superannuation Industry (Supervision) Act 1993 (SIS Act). All super funds are trusts with a trustee. Therefore, all natural persons putting money in a super trust must be transferring rights to an intermediary (but with a special carve out for SMSFs), and all money invested by institutional super funds will be considered as coming from a financial institution.

Both the Basel rules and APRA judge money from financial institutions to be ‘hot’ and an unstable source of funding, and the regulations will discourage banks from raising this type of money, and provide another boost to SMSFs.

It’s not a good prospect for publicly-offered super funds as investors seek the security of bank deposits, and it will do nothing to reduce the reliance of our banks on wholesale and offshore funding. We should be designing the system to put super money and bank deposits together, not force them apart.

Part 2. Alun's reply to me.

Graham, I am confused by this. I don't follow banking prudential standards that closely as I have enough to watch in other areas. The article mentions 'Proposed' APS210. Is this a revised version?

The reason I ask this is that wholesale term deposits offered via APRA regulated superannuation funds are treated as retail for the purposes of bank capital requirements. The proviso is that the fund must be able to separately identify each member holding (which they all can do quite easily). The individual member amounts are aggregated into a single wholesale deposit which is regarded as retail for bank capital purposes.

In other words in your question 2, the depositor would be treated exactly the same as in the other two scenarios.

These wholesale deposits don't qualify for the government guarantee though, but this is a Treasury matter.

I was under the impression that the same approach applied to cash accounts.

Can you please clarify.

Part 3. My reply to Alun

Hi Alun

Thanks for the question, there are a few points here:

1. You mention 'bank capital requirements' a couple of times. This article has nothing to do with bank capital, it is about bank liquidity. Completely different set of regulations.

2. There is a draft APS210 but it is not yet issued in final form. My article is about the proposed APS210 which all banks are now preparing for. You can read the draft on: http://www.apra.gov.au/adi/Documents/Draft_APS_210_November_2011.pdf , see Clause 30 of Attachment A in particular.

3. On liquidity, there is nothing in the proposed regulations or any guidance from APRA that allows separate identification of retail accounts to result in 'retail' treatment. I welcome being corrected on this if you can point me to the relevant Prudential Standard.

4. As far as APRA is concerned, the large super fund is a trustee depositing a wholesale amount with the bank. They don't care if it is made up of thousands of smaller retail amounts (which as you say, are easy to identify as every investor must be on a registry of some kind).

5. The crucial section of APS210 is about the criteria to gain favourable retail treatment: "the natural person must retain all legal rights, which cannot be transferred to an intermediary. The intermediary can have no duty to make investment decisions on behalf of the natural person." In superannuation, the depositor (the natural person) always transfers legal rights to an intermediary, the trustee. That's how all super works legally. Therefore, the deposit cannot count as retail.

That's the problem for large super funds, and they should be lobbying APRA to change it.

(We can also have a discussion on LCRs and NSFRs but that would have doubled the length of an already complex article).

Cheers, Graham

Part 4. Alun's reply to me.

Graham, we are talking at cross purposes to some extent. Liquidity risk and capital requirements are inter-related. We are not saying different things. The issue is that wholesale deposits are regarded as more volatile than retail deposits and therefore require more rigorous liquidity management and greater capital protection. This naturally increases the price of the wholesale deposits.

The point I am making is that your comments in your point 4 and 5 above are not correct. APRA does in fact look through the custody and trustee structure to the actual decision making. As an example, the TDs that are offered via the member directed investment services of AustralianSuper, CARESuper and legal super and those soon to be offered by HOSTPLUS, Telstra Super and by a number of other funds which I am not at liberty to name are all regarded as retail by APRA despite being owned by the respective custodians on behalf of the respective trustees on behalf of the respective members. The actual contractual instruments between the funds and their particular banks are all wholesale contracts.

The fact that the trustee is the owner of the assets in law does not necessarily mean that they have an unrestained right to deal in the assets and the members have no rights. All IDPS and IDPS-like structures essentially cede certain decision making to the members with the trustee retaining a 'reserve power' over the assets. In essence the trustee agrees not to override the members' decisions except in default situations.

The critical issue with respect to liquidity of deposits is the decision to withdraw. This decision will not be made by the trustee. It will be made by the individual members. The decision therefore to terminate a nominally wholesale deposit can only be made by the possibly hundreds of members acting in concert. The trustee cannot just terminate the wholesale contract and say to the members, 'well chaps, here is your money, you better do something with it'.

The structure of these services essentially satisfy all the requirements of Clause 30 of Attachment A of APS210. APRA does not regard the reserve powers of the trustee as removing the members' "rights regarding the placement, withdrawal or other movement of the funds". The member exercises these rights in practice and the retention of the rights by the trustee in default situations is not regarded as a problem. The deposit is obviously disclosed and the trustee only makes investment decisions in default situations.

The funds are not lobbying APRA because they have already dealt with this issue.

The other point I made is that despite APRA regarding these arrangements as retail, Treasury does not. They do not qualify for the government guarantee at the individual member level. I understand that discussions and negotiations are ongoing.

This does lead to the anomalous situation where a deposit by the investment team of one of these funds as part of a managed portfolio will be treated as wholesale and will receive wholesale rates whereas the deposits by the individual members as part of the member directed investment services will be regarded as retail and will receive the higher retail rates even though they may well be in identical deposits.

Part 5. My reply to Alun

Hi Alun

I appreciate your input on this point but we have several differences of opinion. I have discussed this with one of the major banks and they support my interpretation. I will address where I believe you are incorrect.

1. You say, "The trustee cannot just terminate the wholesale contract and say to the members, 'well chaps, here is your money, you better do something with it'." and "This decision will not be made by the trustee. It will be made by the individual members."

These statements are not correct. Trustees make decisions on behalf of members all the time. Consider, for example, the suspension of redemptions on mortgage funds a few years ago. The Trustee did not ask the member for permission or what they thought. The trustee decided and told the members. In the case of the super deposits, APRA's view is that the trustee could decide to switch the money from one bank to another and no instruction is needed from the client. That is why they judge super money as coming from a wholesale client. A trustee can override a member direction if the trustee believes it is acting in the member's best interests.

2. The language of APS210 is clear, as I have quoted, and nowhere does APRA say that the trustee of a super fund can 'look through' to its retail investors for retail treatment. Of course, it is not the super fund's decision how a deposit will be classified. It does not matter what any of the industry funds you quoted think, it is the banks' liquidity report that matters. Here, the bank may have a view but it is APRA's determination which will decide the treatment.

3. You are confusing the role of a custodian and a trustee, and you cannot give them the same treatment as you do when you say, "APRA does in fact look through the custody and trustee structure to the actual decision making."

A custodian in an IDPS has no control over the assets. In fact, ASIC's RG 148.13 says that to be treated as an IDPS, the arrangement "must involved the clients having the discretion to make all investment decision". An IDPS is a serice for custody and reporting. In contrast, the trustee of a super does have the power to make investment decisions.

You cannot point to an IDPS and say that proves your point about a 'look through' on a super fund. They are different responsibilities. I am talking about trustees in super funds, not asset custodians in IDPS arrangements.

For example, with AustralianSuper's Member Direct, they say, "All investments in the AustralianSuper Member Direct investment option, including listed securities, term deposit/s and cash will be registered in the name of JP Morgan Nominees Australia Limited, as custodian, for AustralianSuper Pty Ltd as Trustee of AustralianSuper." AustralianSuper is the trustee and the trustee can act on the investments in a way the custodian cannot.

We are just talking about superannuation here, and I repeat my previous points on the structure of superannuation. All super funds are trusts with a trustee. APS210 says that to achieve retail treatment, "the natural person must retain all legal rights, which cannot be transferred to an intermediary." They must in law pass legal rights to a trustee.

Show me the part of APS210 where APRA says it is willing to look through a trustee to the retail investor, because at the moment in APS210, they say the opposite. And to my knowledge, they show no signs of changing their minds in the final version of the regulations.

(As an aside, I also note that you are referencing term deposits, which provided they are for 31 days or more, fall outside the Liquidity Coverage Ratio calculation. My article was about at-call deposits. However, it is still in the interests of the super industry to have retail classification for term deposits as this will assist on another calculation, the Net Stable Funding Ratio (NSFR). But let's not complicate the basic point we are discussing above).

Cheers, Graham Hand

Part 6. Alun's reply to me

TDs, as you say are not the same as At Call deposits. However, they are deposits and have the same issues with respect to being classified as wholesale or retail.

I am not trying to argue that APRA should look through the trust structures and allow some wholesale contracts to be regarded as retail for prudential purposes. I am simply telling you that they already are doing so. This is already their practice with respect to superannuation funds offering member directed investment options. This is simply a fact.

APRA is looking through the trust structures of the funds I named and allowing the originating banks to treat their wholesale TDs as retail for prudential purposes.

I also provided a relatively high level explanation as to why this is which is that the trustees do not have absolute control of the investing process. The law here extends beyond just trust law to contract law and consumer law and to the definition of the member's beneficial entitlement. Also, having had members state quite clearly and unequivocally what their interest is (ie by making a specific investment), any trustee action in overriding this could in and of itself be regarded as being against that interest and therefore a breach of the trustee's duties and therefore not lawful.

My real point was that given that APRA is already looking through superannuation fund trust structures and authorising banks to treat their wholesale term deposits as retail for prudential purposes, why would they not also do this for At Call deposits?

Part 7, My reply to Alun

Hi Alun

OK, my turn:

1. I am describing the future liquidity regulations, which banks are preparing for now. Just because a liquidity treatment was adopted in the past and at the moment (such as look through to retail investors) does not mean it will be in the future under APS210. So to say something is 'already their practice' and 'they already are doing so' does not address my issues. I have always been writing about the proposed regulations.

2. The term of the deposit is not relevant to the point here. We are discussing whether a deposit qualifies as retail or wholesale, and whether it is at call or six months is not the issue. Of course, the six month TD would fall outside the 30 day LCR calculation, but that does not mean it qualifies as retail.

3. I have argued your second-last point with APRA (about retail investors making a specific investment) and have written a detailed submission to them. So I understand what you are arguing. To date, APRA has disagreed. You would need to give them a legal opinion that the trustee cannot override an instruction from a retail investor, and in my experience with lawyers, they will not say this. The trustee retains a fiduciary duty.

The bottom line for me is do the super funds you refer to have a written confirmation from APRA that the proposed (not past) liquidity regulations will recognise retail pass-through of a deposit from a superannuation trustee. If you can confirm you have seen this in writing (which in my experience APRA has refused), then you must be dealing with a different person in APRA.

Thanks for the discussion, I hope you are right.

Graham Hand

Part 8, Alun's reply to me

Graham, I am not dealing with APRA. I am dealing with the banks that have been authorised by APRA. I have now confirmed with my wholesale banking contacts that:

a. At Call and Term Deposits created via wholesale contracts but controlled by members in member direct investment services (what I referred to as IDPS like) are regarded by APRA as retail for prudential purposes.

b. APRA has provided the banks in question with a written determination of this position and they act accordingly.

c. The written determination from APRA is based on their assessment of the services in respect of APS210 clause 30 of Attachment A (Nov 2011 Draft version). The approval is to the banks and not the funds.

d. There is no indication that APRA's position will change. They are apparently comfortable with the position.

The issue is quite specifically the level of control of the investment decision exercised by the individual member. There are any number of trusts that provide the member with total control of these decisions except in default situations. For instance, contemplate the situation where the beneficial entitlement of the member is defined as being the value of investments selected by that member from a list and paid for by funds held to that member's account. This would be supported by rules that provide the member with the entitlement to do this, that obligate the trustee to assist the member in this entitlement, that indicate that the selection decision is entirely that of the member and not that of the trustee (to protect the trustee).

There are many funds that have provisions equivalent to these.

These types of provisions are not essentially different from the provisions relating to binding nominations of beneficiaries. The trustee is obligated to follow the nomination (despite the general position of Trustees as omnipotent) unless it is incapable of being carried out when a default decision making process comes into effect.

Part 9. My reply to Alun.

Hi Alun, I've also confirmed with my banking contacts that your interpretation is not what APRA is saying to them about the rights of an investor where a trustee is the actual investor for a large super fund. But given your version is now on the public record (this group has over 3,000 members), we will seek clarity from APRA.

I also understand the final version of APS210 is due before the end of April 2013 so it will be clearer one way or the other soon.

Thanks for the lively exchange. Graham

(The latter communications were originally on the LinkedIn group, Self Managed Super Fund (SMSF) Professionals).