SMSF investors continue to face inflationary pressure not seen in decades. And it could influence investment performance if the potential effects are not considered.

It has been more than 30 years since the Consumer Price Index (CPI) reached 7%. The effects of rising inflation and subsequent central bank interest rate decision making were plain to see by the end of 2022. Having surprised markets by another 25bp hike in June, the RBA noted in their recent statement, that while inflation in Australia has passed its peak, it is still too high and that it will be some time before it is back within their target range of approximately 2-3%. And the Governor noted upside risks to the inflation outlook has increased and “the path to achieving a soft landing remains a narrow one”.

Additionally, the vulnerability of global capital markets from negative shocks remains. The most recent example being the collapse Silicon Valley Bank (SVB), coupled with Credit Suisse a few days later. Investors started to call into question the stability of the banking industry which helped move gold over the US$2,000 level, and coupled with a weakening FX rate, gold recorded its highest ever price in Australian dollars on May 4, 2023, at A$3,052/oz.

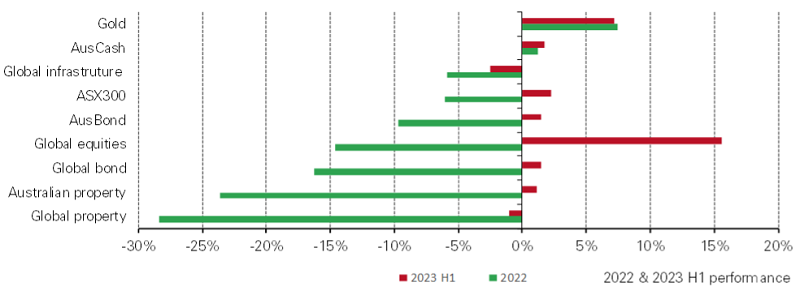

2022 and H1 2023 returns from major assets in Australian Dollars*

Source: Bloomberg, World Gold Council. *As of 31 December 2022. 2023 Y-t-d refers to 30 June 2023. Based on LBMA Gold Price PM, AusBond Bank Bill Index, AusBond 0+ Composite Index, Bloomberg Barclay Global Agg, ASX300 Index, MSCI World Index, ASX300 A-REIT Index, FTSE EPRA/NAREIT Developed ex-Australia Index, FTSE Developed Core Infrastructure Index. All calculations are in AUD.

Where could this lead?

With the upside risk to future inflation rising and local economic outlook dimming, the traditional warning signs of stagflation exist. Stagflation is defined as an economic cycle characterized by slow growth and a high unemployment rate accompanied by high inflation. The most notable period in Australia occurred in 1975 when a recession begun after the price of oil quadrupled.

In addition, the global geopolitical landscape is potentially hindering economic recovery efforts worldwide. The ongoing situation in Ukraine, and tensions between the US and China, might continue to impact financial markets. Over the coming 18 months elections in the US and EU are scheduled. There is additionally the prospect of the UK, Russia and Ukraine going to the polls. All of these events pose risk to the fragility of the economy with some being higher than others.

What should an SMSF investor be considering?

Does your SMSF have enough protection over stubborn high inflation and other possible market events? While property is a stable long term inflationary hedge, it has had considerable setbacks over the past 24 months. Additionally, the sustained interest rises imposed by the RBA to combat inflation, may pose challenges Property is illiquid too meaning that while the long-term return on investment will still remain positive, it cannot help to hedge portfolios in the short and/or medium term.

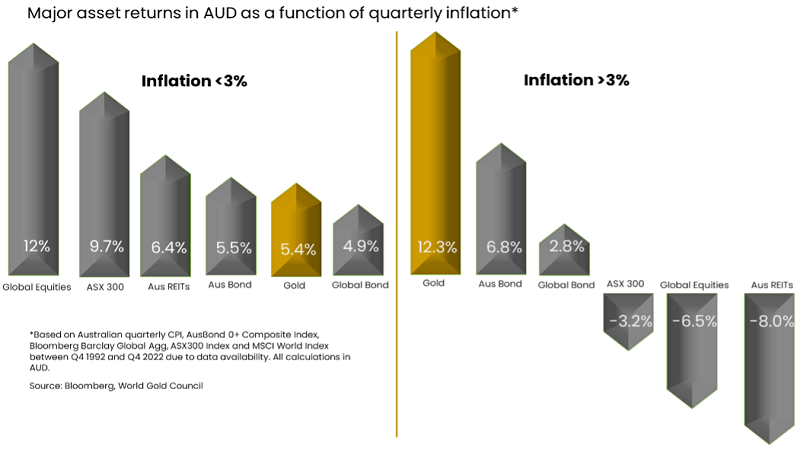

Another inflationary hedge asset, which is often overlooked by some SMSF investors, is Gold. It has long been considered the hedge against inflation and market events. It can also provide accessible liquidity if and when needed. Historical data confirms its status with an annualised return of 7.6% in AUD over the past 20 years, it has outpaced the Australian and world CPIs even in calmer economic times.

And should stagflation arise?

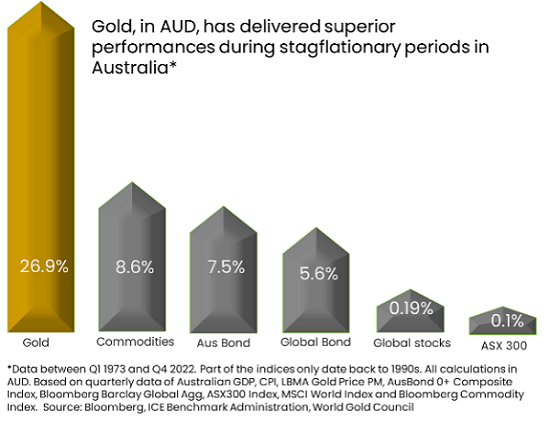

During stagflation periods, financial markets have seen heightened volatility while both commodities and gold fared well. Historical data reveals that investment portfolios have benefited from gold’s attractive returns during such periods.

As aforementioned potential risks arise, gold may have a significant role to play over the coming years to help protect and sustain portfolio performance. Our recently published investment update concluded that a portfolio comprising of assets typically held by an SMSF would have achieved higher risk-adjusted returns and lower drawdowns with an allocation to gold over a 3, 5, 10 and 20-year period.

At the very least, SMSF investors should review their existing investment strategy and ensure that it has the right protection over high inflationary pressures, and to gain a greater understanding how it could potentially perform should stagflation hit home.

World Gold Council is a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.