The new United States Energy Secretary, Chris Wright declared at the recent Alliance for Responsible Citizenship (ARC) conference in London, that he "would love to see Australia get in the game of supplying uranium and maybe going down that nuclear road themselves”, and that he was “thrilled to see recent efforts in the news recently of the development of shale gas in Australia”.

Already a large exporter of uranium, Australia could have an even greater influence in the nuclear energy market, Wright believes.

Wright also said the goal of net zero impoverishes economies. That "the aggressive pursuit of it, and you’re sitting in a country that has aggressively pursued this goal, has not delivered any benefits, but it’s delivered tremendous costs,” he said in an interview with Chris Uhlmann.

His comments at the ARC conference reflect the renewed commitment to fossil fuel driven energy security in the US under Donald Trump, and a message for Western democracies to step up to the plate on energy.

Is that it for the deal?

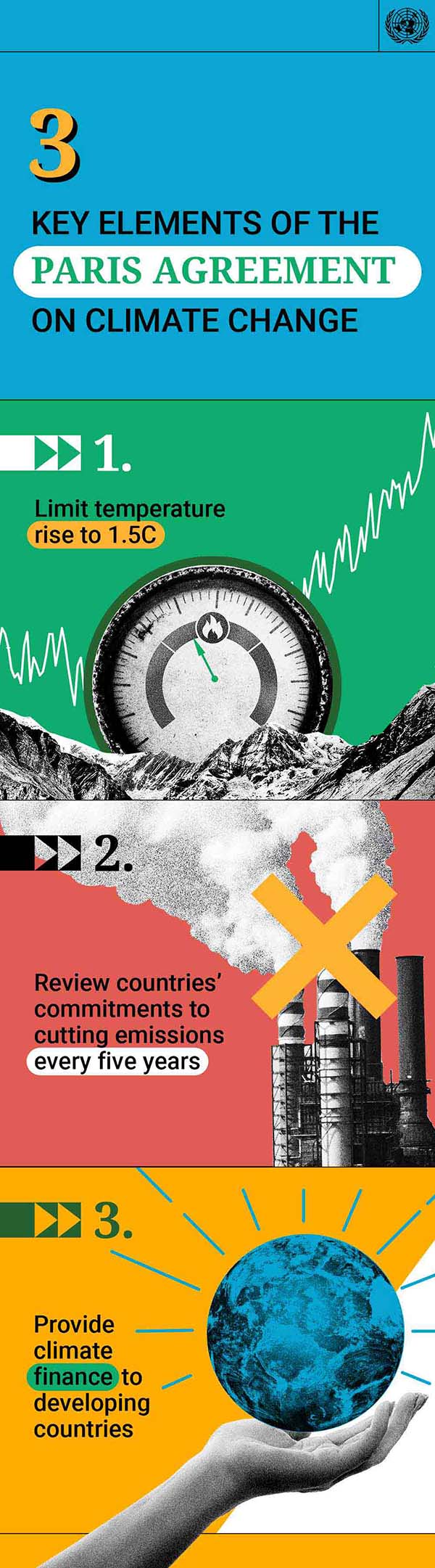

The Trump administration plans to bolster the production of fossil fuels by removing obstacles installed by the previous administration, according to Wright. That, coupled with the withdrawal of the US from the 2015 Paris Agreement on 'day one' of the second Trump presidency, prompts the question: is the Paris Agreement now dead?

Maybe not, though it could be on life support, with the departure of the world’s second largest emitter of greenhouse gases after China.

While the US Paris withdrawal under Trump in 2017 (re-joined in 2021 under Joe Biden), wasn’t terminal for the agreement, this time around it combines with aggressive fossil fuel expansion under the Trump mantra of ‘drill baby drill’, signalling to the world that fragmentation on climate and energy policy is set to escalate. In turn, this could lead to other countries moderating or even abandoning their net zero commitments.

The Paris Agreement aims to reduce greenhouse gases and limit the global temperature rise from industrial times to well below two degrees Celsius, shifting towards a net zero emissions world.

The impact of recent US moves

With the US withdrawing from Paris, and a renewed energy focus, there will be implications for global energy policy and markets.

In the short-term, the expected boost in fossil fuel production will create conditions for rising US exports which would impact global supply and prices. Short-term instability in implementing and delivering renewables derived energy will see costs remain elevated.

Medium-term implications with the US shifting back to a higher concentration of fossil fuels include that it may deter renewable energy investment, leading to higher capital costs rolling out green energy and higher electricity prices.

Recently, we have seen Andrew Forrest’s Fortescue pause green projects, blaming Donald Trump and European policy uncertainty. And in the past year in Australia, Woodside and Origin abandoned green hydrogen projects, with the Queensland Government also scrapping its billion-dollar hydrogen plan. And, the South Australian Government shelved funding for the greening of Whyalla steel.

Higher electricity prices have already been observed, particularly in Australia, to the point where the Government has provided electricity subsidies to consumers, with plans to roll out more subsidies. The intermittent nature of renewable energy, and grid upgrade and storage challenges, have contributed to rising costs.

In the long-term, we could see economies split into pro-fossil fuels and pro-net zero blocs. This could lead to trade disputes, carbon border taxes, and diverging investment focuses, which could make progress uneven and unpredictable.

But a long-term focus on R&D across existing and potential energy sources, with technology improvements for renewables in terms of storage, transmission, and grid upgrades, could eventually see economies less divergent on policy with a more even mix of energy generation. Diversification is likely to be the key to the world’s energy needs.

With the re-election of Trump, there will be implications for Australia.

If there is a deterrence effect for investment in the energy transition, costs will rise. In any case, investment hesitancy probably exists already due to a lack of bipartisanship on domestic policy, which swings between Governments of the day. To date, heavy subsidies have been required to underpin consistent private sector investment.

The US endorsement of uranium aligns with the Coalition’s plans for nuclear energy in Australia. Though short-term energy relief is unlikely with high capital costs and long lead times, nuclear could eventually stabilise the Australian energy market. Nuclear energy is being bolstered and fast tracked in other major Western economies.

The resurgence of US energy exports could undercut pricing of Australian liquefied natural gas and coal exports, but it should remain a major exporter to Asia in at least the short-term, if there is a resulting boost in demand.

And increased fossil fuel investment in the US could provide political cover for the extension of coal plant life in Australia, with evidence that aggressive renewables targets may be slipping, and costs blowing out. Already, NSW has underwritten a two-year extension of the life of the Eraring Power Station, recognising the state faced energy reliability risks as it transitions to renewable energy. Certainly, there has been increased recognition that gas will remain a key bridging fuel for possibly decades in Australia.

In the end, we all want cleaner energy, but it must be as cheap, reliable, and as abundant as possible. While the Trump administration may slow down the push to reducing emissions, it may well shake up global thinking to meet those ends.

Tony Dillon is a freelance writer and former actuary. This article is general information and does not consider the circumstances of any investor.