The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

UniSuper’s John Pearce manages $150 billion in assets and understandably has a lot on his mind.

In mid-February, he flagged a potential correction ahead, which has proven remarkably prescient. Back then, he said he expected a flat year for equities but wouldn’t discount the possibility of a correction of 10% or more. However, he invested for the long term, and on this basis, he remained optimistic given the growth in the global economy, subdued inflation, strong employment, and the tech revolution:

“… if we do get that correction, UniSuper will be using it as a buying opportunity. We've got plenty of cash, and we intend to load up on assets when the price is right.”

Now, he’s not so sure. He says Donald Trump has effectively declared an economic war with his tariff hikes:

“The current crisis, it’s man-made. And it’s made pretty much by a single man. We know what the solution is here, the solution is for rational people to get around and understand the havoc that they have created and get to a sensible compromise. We know what the solution is, and let’s hope that common sense prevails.”

Yet, he’s not banking on it. Pearce says the market has gone into meltdown because of the magnitude and breadth of the tariff increases. China copping whopping tariff rises hasn’t surprised. What has is that few have been spared Trump’s wrath. Even Australia, a staunch American ally, is facing a 10% tariff, and we got off lightly.

Pearce says tariffs are bad for global trade and are a tax on the US consumer. And the reason that markets have plummeting is because the odds of a US recession, and perhaps a global one, have gone up.

What will happen from here?

Pearce foresees a wide range of possible outcomes. At the pessimistic end, there might be a long drawn-out battle. That’s where the likes of Europe and China don’t come to the negotiating table. And we’re already seeing that with China, which has announced retaliatory tariffs.

At the optimistic end, there have been a few countries which have come to the negotiating table. Vietnam says it will cut all tariffs on American imports to zero. And India says it won’t retaliate but expects a bilateral agreement.

Pearce is leaning towards a long drawn-out battle. However, whichever way it goes, a lot of damage has already been done, with companies putting off investments and consumers getting nervous – both of which have already resulted in softening US economic growth.

There are potential positives

Pearce is not all doom and gloom, though. If Europe and China don’t come to the negotiating table, they’ll likely have to stimulate their own economies. We’ve already seen that with Germany, which has announced plans to significantly increase government spending on defence and infrastructure. And China is also making noises around stimulus, which could be positive for economies outside of the US, such as Australia.

Reducing US stock exposure

Pearce admits that he has some big asset allocation decisions to make. Priority number one is what to do with his large exposure to US assets.

Previously, he’d been a believer in American corporate exceptionalism, given its technology strengths. But Trump threatens all of that.

He says UniSuper is questioning its commitment to America and that, “I think we’ve seen peak investment in US assets.”

He expects to reduce US stock exposure “over time”, though now is “not the time to be reducing that exposure”, given how far and fast the market has fallen.

Should you follow suit?

Is it sensible for the average investor to follow John Pearce’s lead and rethink their US stock allocation? I think it is.

Unlike Pearce, I’ve questioned the notion of US market exceptionalism over the past 12 months. Steep valuations, increasing concentration in the Magnificent Seven, record-high corporate profit margins, extreme institutional allocations to US stocks, speculative retail investor behaviour in AI and other tech-related companies, all pointed to a trend that had gone too far. Meanwhile, other countries had been largely left for dead, including Europe and those in Emerging Markets.

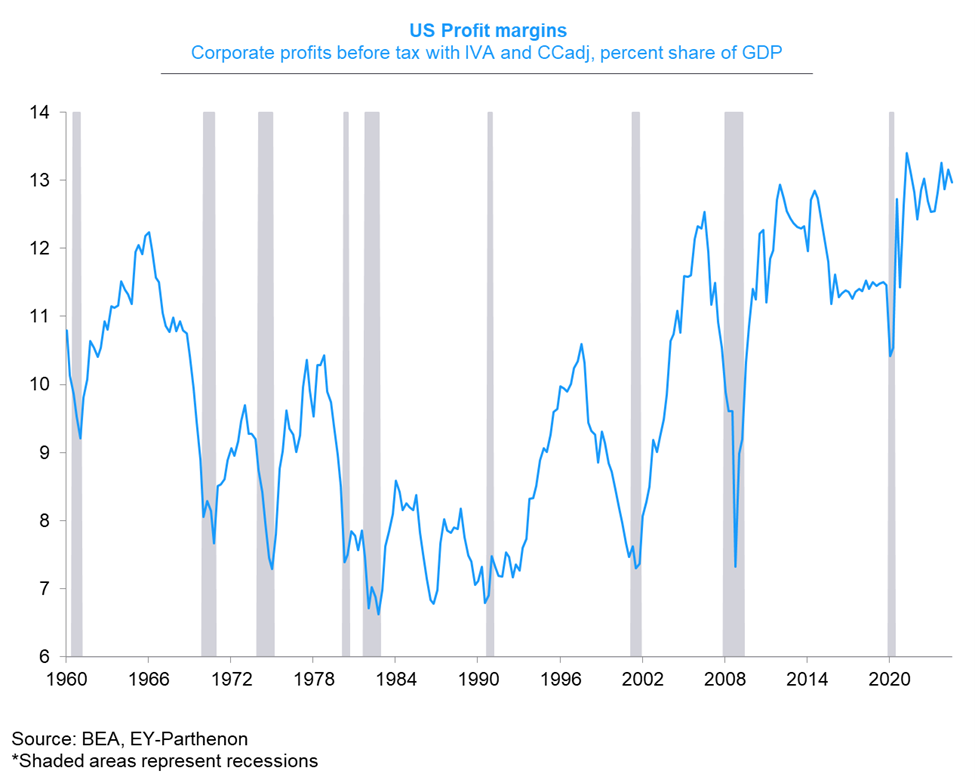

The problem is that the US remains expensive versus history, institutions like UniSuper are only just starting to reweight holdings out of America, retail investors remain overloaded with US shares, and corporate margins remain at peak levels.

It’s the latter point where the greatest risk to US equities lies. Corporate margins have been abnormally high for more than a decade, and with the switch away from globalisation, US tech firms could struggle to maintain their high margins.

You can now understand why all the US tech billionaires lined up at Trump’s inauguration in January. Staying close to those in power might ensure that their companies maintain their monopolies and oligopolies. Unfortunately for them, it hasn’t worked out as planned.

If corporate margins mean revert, that will prove a long-term drag on US earnings. Combined with still elevated valuations, it doesn’t paint an optimistic picture for the US market over the next decade.

Meanwhile, other parts of the world remain cheap and countries like Germany are spending big, which could revitalise their economies.

Therefore, the global switch out of US equities into other markets may have only just begun.

*Disclosure: UniSuper is a Firstlinks sponsor.

****

In my article, I look at famed investor Howard Marks' remarks that this is the biggest upheaval in markets he's witnessed in his 50-odd year career. We've switched from a globalised to a fragmented world, and this has changed the rules of the investing game, he believes. He says the new environment demands a different investment approach.

Meanwhile, a lot of investors are wondering whether it's sensible to start buying stocks amid this market volatility. To help with this, Ashley Owen has analysed almost 40 corrections of 10% of more in the Australian share market since 1920. And he answers the question: what would have happened in each case had you 'bought the dip'?

The uncertainty sowed by falling share markets can make investors panic and commit costly errors. Leigh Gant says that following the advice of an ex Navy SEAL commander can help you stay composed and focus on what really matters.

And Greg Canavan has gone back to re-read Charles Kindleberger's classic book, Manias, Panics and Crashes. The book details different booms and busts throughout history, and the commonalities between each episode. Greg thinks the recent AI-fuelled boom followed the classic patterns of the past and recent market ructions may be the beginnings of another bust.

James Gruber

Also in this week's edition...

For those of you who may be tired of hearing about tariffs and market ups and down, we have several articles with alternative topics.

Roger Montgomery explores why sales of electric vehicles - hailed as the future of the automotive industry - have stalled both in Australia and globally.

According to Magellan's Lucina Martin, travel is about to be transformed by a new technological force: AI-powered travel agents. These agents will independently navigate websites, make decisions, solve problems and adjust your travel itinerary on your behalf – just like a personal assistant.

Property investment in SMSFs is a popular strategy for retirement wealth. Compliance is essential to avoid risks like the sole purpose test, non-arm’s length income, and property development issues, says Shelley Banton.

Two extra articles from Morningstar this weekend. Johannes Faul explains why Woolies has a sustainable edge over Coles and Tom Lauricella looks at what sustained tariffs on China could mean for Apple.

Lastly in this week's whitepaper, RQI looks at corporate culture, and how though it's intrinsically important to companies, it's also notoriously difficult to measure.

****

Weekend market update

In the US on Friday, stocks enjoyed a strong bid, rising 1.8% on the S&P 500 to wrap up a wild week with a tidy 5.7% advance. Treasurys remained mostly weaker as 2- and 10-year yields jumped 12 and 8 basis points, respectively, to 3.96% and 4.48%, though the long bond managed to tick to 4.85% from 4.86% Thursday. WTI crude climbed towards US$62 a barrel, gold ripped higher again to US$3,235 per ounce, bitcoin advanced to just under US$84,000 and the VIX settled just below 36, down 11 points from last Friday.

From AAP:

Australian shares on Friday edged lower after a wild week of swings. The S&P/ASX200 lost 0.82% to 7646.5, while the broader All Ordinaries fell 0.76%, to 7853.7. The top 500 finished the week almost flat, after a week of daily swings of more than $100 billion as US tariff announcements wreaked havoc on markets.

Ten of 11 local sectors finished lower on Friday, led by health stocks, down 2.7%, utilities, which lost 2.1%, and energy stocks, which fell 1.8%.

Financials bled 0.9% lower, with only the CBA keeping its head above water as NAB, Westpac and ANZ gave up more than 1.7% each. The sector finished the week about 0.6% lower, grinding back losses after tanking more than 7% on Monday.

It was a similar story for materials stocks, which fell as much as 8.7% at the start of the week but managed to finish just 0.8% lower. The sector has lost about 4% since the broad-based "Liberation Day" tariffs were announced on April 2 by US President Donald Trump.

Gold miners bucked the trend and were the best performers of the top 200, as investors sent the safe haven to new highs, with gold futures trading at more than $US3,200 an ounce. Also in gold's favour was a decline in other risk-off assets, as investors and governments sold off the US dollar and US bonds, sending yields higher.

The defensive consumer discretionary sector managed a 0.4% gain on Friday and was up 2% for the week, as Woolworths jumped more than 5% since Monday's open.

Looking to next week, the Reserve Bank will release its April meeting minutes on Tuesday and Australian unemployment data will come out on Thursday.

Traders will closely watch US earnings season for forward guidance from market giants including Johnson & Johnson, Citigroup and Bank of America for indications of a economic and financial uncertainty.

From Shane Oliver, AMP:

Share markets had a roller coaster ride over the last week – first plunging on the back of ongoing worries about Trump’s tariffs before rebounding mid-week after Trump delayed some of the tariffs for 90 days before falling again as investors realised that the average US tariff would be higher than announced on 2nd April and as signs of stress in the US bond market remained. This left US shares up 5.7% for the week but Eurozone shares down 1.4%, Japanese shares down 0.6% and Chinese shares down 2.9%. The Australian share market fell 0.3% with falls led by resources, health and financial shares. From their closing highs to their recent closing lows US shares have had a fall of 19%, global shares 17%, Eurozone shares 15% and Australian shares 14%.

Clearly the US has been bearing the brunt of it as Trump has put it into a trade war with the rest of the world whereas the rest of the world is only in a trade war with the US. And it’s been made worse in the US because of a gathering loss of investor confidence in its economic policies and its safe haven status. Reflecting the latter, bond yields rose sharply in the US and this flowed on to bond yields in other countries. Metal prices rose but oil and iron ore prices fell as did Bitcoin and the $US (which is now below its September low last year before Trump’s election prospects began to improve). Gold continues to be the main safe haven reaching a new record high. And even the $A rose thanks to the falling $US.

Trump blinks in the face of market stress as people were getting “a little bit yippy…afraid”. After weeks of increasing mayhem Trump blinked Wednesday and announced a partial backdown on his tariff plans by pausing all reciprocal tariffs at the 10% minimum for 90 days and dressed it up as a victory by announcing that more than 75 countries are “calling us up, kissing my …. dying to make a deal”. The reality of course is that Trump was getting nervous as shares were on the brink of a bear market, which headlines would blame on him, and most importantly the US bond market was (and still is!) showing increasing stress with a sharp back up in bond yields (0.5% in two days) driven by a loss of confidence in US Treasuries and US dollars as a safe haven, rumours of China and other countries selling bonds and hedge funds unwinding long cash Treasuries/short Treasury futures positions in the face of rising volatility. Rising bond yields make it harder for Trump to finance massive US debt and cut taxes at the same time and the sell off was (and still is) feeling a bit like the surge in UK gilts in the face of Liz Truss’ policies.

The good news is that Trump clearly has a pain threshold and that share and bond markets are still able to impose some constraints around his policies. We expect this to become more apparent in the second half of the year forcing Trump to back down further on tariffs and pivot towards the positive aspects of his agenda, ie tax cuts and deregulation, helping to support a more sustained recovery in share markets.

However, it’s way too early to say that we have seen the low in shares as there is a long way to go with the tariff battle, stress is continuing to build in US asset markets and much damage has already been done to the growth & profit outlook. In particular:

- The average US tariff on imports is now around 30% (before allowing for any switching) which is higher than the 25% estimated after the 2nd April announcement and way up on 3% back in January because the tariff on imports from China (13% of US imports) is now 145%, other countries are now 10% and there are 25% tariffs on imports from Canada and Mexico and on steel cars and aluminium.

Source: US ITC, AMP

- The pause is only for 90 days - while small countries may come to deals quickly, large countries like China, the EU, Canada and Mexico may be less inclined to give in to unreasonable US demands. And many countries may no longer trust Trump.

- There is still no sign of any talks with China and the US/China tit for tat trade war has continued, with China raising its tariff on US imports to 125% after Trump raised the US tariff on imports from China to 145%. Fortunately, its said that it may not match further US tariff hikes but only because US goods are “no longer marketable in China”.

- The huge reliance now on tariffs on China will likely diminish the revenue they will actually raise making it harder for Trump to pay for income tax cuts as the 145% tariff will lead to a sharp fall in imports from China over time. Reagan popularised the Laffer Curve and now Trump appears to be ignoring it!

- Trump is vowing more sectoral tariffs eg on pharmaceuticals.

- Because of his erratic announcements Trump has injected a permanent sense of unpredictability into US economic policy which will make it very hard for other countries and businesses to make decisions. Can Trump be trusted? Policy uncertainty is a key problem in economics.

- Despite a brief reprieve on news of Trump’s backdown, US bond yields have resumed their rise and the $US has resumed its fall suggesting that Trump’s policy uncertainty is causing an ongoing loss of confidence in the US resulting in capital outflows. This is highly unusual in that US bonds and the $US normally rally in times of uncertainty. US exceptionalism may be coming to an end. While the Fed’s Susan Collins indicated that the Fed was prepared to help stabilise the bond market this does not appear imminent as she said the bond market is still functioning well with no liquidity concerns and its hard to see the Fed jumping in with QE given inflation worries.

- The gyrations in US tariff policy of the last two months means that lots of damage has already been done to economic confidence which will be hard to quickly reverse and will flow through to spending, hiring and investment such that weaker hard economic data and profits ahead looks inevitable.

- And big one day bounces like we saw in the last week are common in share market downturns as investors turn short and have to close positions when there is any good news. There were even bigger one day bounces in October and November 2008, but shares didn’t bottom in the GFC till March 2009. The key is to watch any re-rest of the lows.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Monthly Investment Products update from ASX

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website