While the rise of online shopping has clearly posed challenges for many retailers and shopping centre owners, it has been a winner for industrial property.

The growth in Australia’s global trade, the boom in e-commerce and businesses wishing to drive efficiencies and lower costs in their supply chain has driven a re-rating of industrial property by investors. As a result, its recent investment performance has been superior to that of retail and office property.

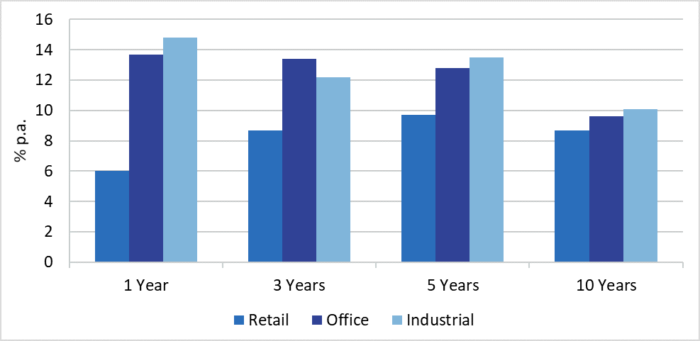

Industrial property generated a total return of 14.8% in 2018, outperforming office (13.7%) and retail (6.0%) as shown below. It’s a similar story over 5 and 10 years as well, although the outperformance is less marked.

Industrial vs retail and office property: to 31 December 2018

Source: MSCI/IPD

The outperformance is even more stark in the listed market. Industrial A-REITs, driven by the Goodman Group, generated a total return of 29.0% in 2018, while office A-REITs returned 15.1% and retail A-REITs returned negative 6.0%.

Investors increasing weightings to industrial property

The strong investment performance of industrial has not gone unnoticed by global institutional investors. Many are now re-weighting their portfolios away from retail centres into industrial property.

According to PERE (a global tracker of capital flows into property funds), logistics-focused unlisted property funds raised just over US$12 billion in 2018, accounting for 43% of the total US$28.6 billion raised globally for sector-specific funds. Retail-focused funds, by contrast, raised just US$2 billion in 2018. Wind back to 2014, and the retail and logistics sectors were virtually on par, raising US$8 billion and US$8.9 billion respectively.

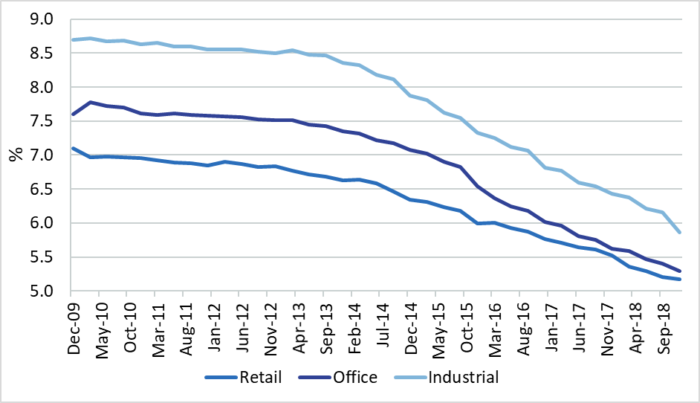

As a result, there has been a sharp drop in industrial yields, and as yields decline, values increase. Since 2009, industrial yields on average have fallen from 8.7% to 5.9%, a decline of 2.8%, as shown below. Yet for retail, yields on average have declined 1.9% from 7.1% to 5.2%. Back in 2009, the yield gap between industrial and retail property was 1.6%, versus only 0.7% now.

Industrial, retail and office yields: 2009 - 2018

Source: MSCI/IPD

E-commerce benefits industrial at expense of retail

E-commerce is on the rise. Retailing is transforming from buying in store to a delivery service, in effect, moving from mass merchandising to tailored direct selling.

Retailers are running a multi-channel (omni-channel) sales approach that provides the customer with an integrated customer experience across both bricks and mortar and online channels.

Online retail sales in Australia secured record growth in 2018, up 35% on the prior year. Online retail sales now account for around 5.5% ($17.8 billion) of total sales. Whilst the online growth has been strong, the penetration rate in Australia is still well below the US, where it is now approaching 10% of all sales.

Supply chain management is critical

Logistics and supply chain management is concerned with the transport, storage, handling, order picking, sorting, packaging and distribution of goods. Logistics facilities can serve many functions, such as business to business distribution, retail store distribution, business to consumer and e-commerce fulfillment.

Order immediacy—delivering orders within 24 hours or less—is becoming critical to the customer experience. Yet traditional retail supply chains were built to stock stores, not to achieve order immediacy.

This is changing. Logistics and supply chains are now the backbone of every retailers’ omni-channel strategy. From connected warehouses to last-mile delivery services, assisted by the adoption of leading-edge technology such as big data, artificial intelligence, robotics and drones, supply chains are becoming smarter, faster, agile and more sustainable.

Retailers and third-party logistics (3PL) firms, which provide distribution, warehousing, and fulfillment services to third party customers, are revisiting the type of facilities they need, how much space they need and where they need it. Not surprisingly, they are increasingly seeking premises which may include multi-storey racking systems and high-speed conveyor and sorting systems located close to major trade hubs (ports and intermodal rail facilities), freeway interchanges and urban in-fill areas.

Woolworths’ new state-of-the-art distribution centre in South Dandenong in Melbourne (developed and owned by Charter Hall) represents a quantum leap in the way distribution facilities are operated. The 69,217 sqm facility comprises:

- 14 kilometres of high-speed conveyors that zig-zag around the building, taking pallets from receiving dock storage racks while eight fully automated palletising stations separating pallets into cartons.

- 50 robotic heads working in pairs packing 650 cartons an hour, almost 4x faster than in a manual distribution centre. These robots not only know how to build the pallets in the safest and most stable way based on carton dimensions, weight and crushability, but also the characteristics of each of Woolworths’ 250-odd supermarkets in Victoria.

- A computer system that uses algorithms to work out how to pack more cartons on fewer pallets, reducing space in trucks and therefore cutting down on truck movements.

- Australia’s largest industrial solar panel installation with more than 3,827 solar panels installed on the 9,000 square metres roof top that delivers 1400MWh of energy (equivalent to powering 250 homes) delivering 20% of the facility’s power from solar.

According to Woolworths, the benefits are not just cost savings and increased productivity, but also an enhanced range of products instore, increased speed of deliveries to stores, better on-shelf availability and improved safety.

Demand for space is strong

According to JLL, take-up of industrial floorspace across Australia in 2018 was just under 2.5 million square metres of space. This was almost 20% above the 10-year annual average of 2.1 million square metres. The transport/logistics and retail sectors combined accounted for 60% of the total take-up of industrial floorspace.

As a result, Melbourne’s total vacancy sits at the lowest level in five years, while the amount of vacant space in outer western Sydney is at record lows.

Given the modern logistics facilities require a higher level of user specificity, with the huge investment in design of the internal mechanisms of the facility, space users therefore typically occupy these spaces for longer than for other commercial real estate. It is not uncommon for large distribution users to sign-up for 15- and 20-year leases with fixed annual increases in rent ranging from 2.5 to 4.0%.

Investment into industrial to continue

The continued growth in global trade and e-commerce and on-going supply chain modernisation will drive the demand for logistics space and underpin industrial as a legitimate investment option.

We expect to see investors continuing to increase their allocation to industrial property in the years ahead via both listed and unlisted funds.

However, it is difficult in the listed A-REIT market to get a pure industrial property play as most industrial, with the exception of the Goodman Group, is held by diversified A-REITs such as Charter Hall, Dexus and GPT. For investors wanting a pure exposure to industrial property, unlisted funds offer an attractive opportunity.

Adrian Harrington is Head of Capital & Product Development at Charter Hall, a sponsor of Cuffelinks. This article is for general information purposes only and does not consider the circumstances of any investor.

For more articles and papers from Charter Hall (and previously, Folkestone), please click here.