In preparing for retirement, the investor journey used to be simple. Individuals would focus on growing their superannuation accounts, and as retirement approached, advisers encouraged them to switch systematically from risky assets to less risky assets, say, from equities to bonds. At retirement, they would focus more on capital preservation and often hold healthy levels of cash, term deposits or perhaps annuities.

But the investor journey has changed. People are living longer and interest rates are low. People may need to generate growth in their superannuation for longer, not just in the period up to retirement. Multi-asset funds could play a role in helping investors grow their pension pots both before and after retirement. They can offer the potential for more consistent returns than single growth asset classes, such as equities. This is relevant whether an investor is following a traditional shift from risky to less risky assets or other ways to construct a portfolio that supports their specific needs in retirement.

Different types of multi-asset funds for post-retirement

Many different types of strategies might be labelled as multi-asset, with a wide range of risk/return objectives. Some are based on quantitative or systematic processes, while others will be more qualitative in nature.

Investors often want a more conservative post-retirement portfolio than pre-retirement. They want to generate returns to match or exceed their specific income needs. Depending on the individual investor’s circumstances, multi-asset funds with a greater focus on managing volatility and downside risk – such as those with an absolute return target set against a specified time frame – could be taken into consideration. Some investors may prefer a multi-asset fund with a higher return target with a greater short-term volatility, but these higher risk funds may not be appropriate for all investors.

We believe an effective multi-asset portfolio should consider investing beyond mainstream equity and bond markets. By incorporating holdings that are less sensitive to overall market direction, a portfolio can access a broader range of risk premia, enabling a degree of diversification which traditional strategies cannot match.

A multi-asset fund may be placed alongside other strategies or approaches in a wider portfolio that is tailored to meet the investor’s specific needs and objectives.

Merits of actively-managed funds versus strategically-managed funds

In our opinion, multi-asset portfolios with a strategic asset allocation, where the target allocations are set for the long term, are deficient. Conventional approaches rely on a long-run assessment of return expectations, risk and cross-asset relationships to drive the allocation. We believe it is impossible to forecast the necessary critical inputs of returns, volatility and correlations with the degree of accuracy needed to have confidence in the outcome. The practical implications are large swings in performance, which is the last thing an investor wants when approaching, or after, retirement.

We advocate a more dynamic and flexible approach that places a greater emphasis on active asset allocation: understanding which environments are conducive for positive asset class performance (or associated with poor performance) is, in our view, more achievable than forecasting inputs with the degree of accuracy required by a strategic asset allocation approach.

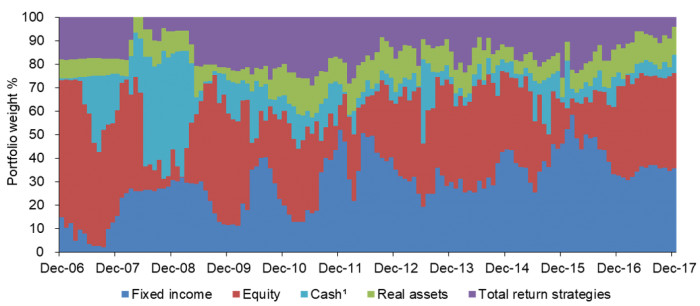

The diagram below shows the frequency with which we change the asset allocation mix under this dynamic approach.

Source: Insight as at 31 December 2017. Positions are shown on a net basis. Cash: Includes cash at bank, FX forwards and money market instruments.

A strategic blend of passive funds will rely entirely on market-based returns across the underlying asset classes. A multi-asset fund with a wider opportunity set – including the flexibility to invest in strategies that rely less on rising markets – has the potential to generate more consistent returns over time.

Examples of such ‘less directional’ strategies include relative value positions, which generate a profit or loss based on the spread of performance between two segments of the same asset class or markets – for example, a position that favours US treasuries relative to German bunds, or the euro relative to the US dollar. Strategies with the potential to generate returns if markets trade sideways are another example. Some real assets, such as infrastructure, also offer the potential for attractive, steady returns over time.

Some investors are wary of allowing the use of derivatives. However, if used appropriately, they add value and help in managing risk. In particular, they can assist multi-asset managers to switch exposures more swiftly and cost-effectively than if they invest in physical assets. The use of derivatives also allows investors to access sources of return that would otherwise be unavailable.

Choosing the right mix of returns versus risk

Individual investors approaching retirement are typically more sensitive to large negative movements (drawdowns) in their superannuation account than earlier in their lives. This drawdown can undermine confidence in retirement plans and impact their ability to fund lifestyle choices.

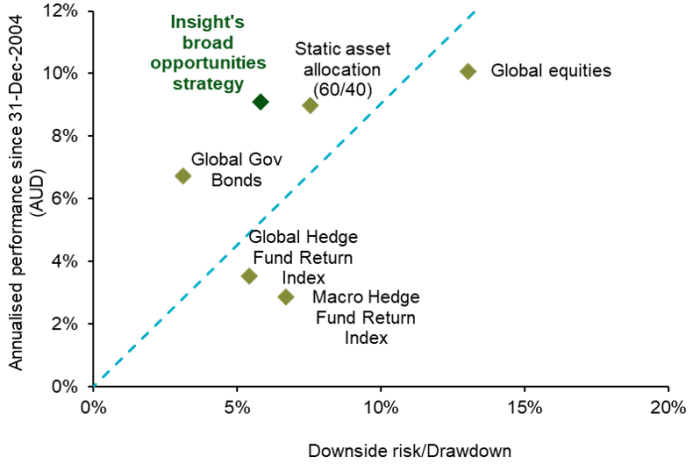

The right multi-asset portfolio could give the potential for growth over the longer term but with lower volatility than a narrower set of growth assets alone. For example, the diagram below shows the performance and maximum drawdown of various global equities, bond and hedge fund strategies against Insight's multi-asset mix since inception in 2004 (included to illustrate how using alternatives and dynamic allocations can add value).

Source: Insight and Bloomberg as at 31 December 2017. Returns shown gross of fees in AUD. The long-term track record of the Insight broad opportunities strategy has a base currency of USD. This performance record has been adjusted by interest rate differentials to derive an AUD proxy. Static asset allocation is based on a 60% global equities and 40% global government bonds allocation. Global equities represents MSCI World Index, net, hedged into AUD. Global Gov bonds represents JP Morgan GBI index hedged into AUD. Drawdown is calculated as the largest peak-to-trough change in the period, based on monthly data.

Lower volatility in returns also means investors are less likely to need to pre-determine a trigger date for switching into lower-returning assets as they should reduce the substantial drawdowns evident when investing largely in growth assets such as equities.

Multi-asset funds in the post-retirement, decumulation phase

After retirement, investors need to withdraw income from superannuation to live on. This can have a significant effect on their portfolio’s long-term potential. ‘Dollar cost ravaging’ is a term used to describe the impact of regular withdrawals after a portfolio has lost value – more assets need to be sold to generate the same amount of income, thereby damaging their super’s potential for future growth. It may be possible to manage the timing of withdrawals to lessen their long-term impact, but investors will typically expect to make regular withdrawals and are unlikely to have the flexibility to leave their pots to recover losses before taking out income.

Investors should be aware of the factors that could lead them to draw down more than they expect. Significant risks include:

- longevity – that they live longer than they expect

- inflation – that the cost of living rises by more than forecast

- increase in spending needs – for example, to cover unexpected healthcare costs.

As their aim is to provide more consistent growth over time, multi-asset funds can sustain a liquidity buffer that can fund regular withdrawals and mitigate their impact on the portfolio’s longer-term growth potential. They can also provide some element of real returns which would help with the rising cost of living.

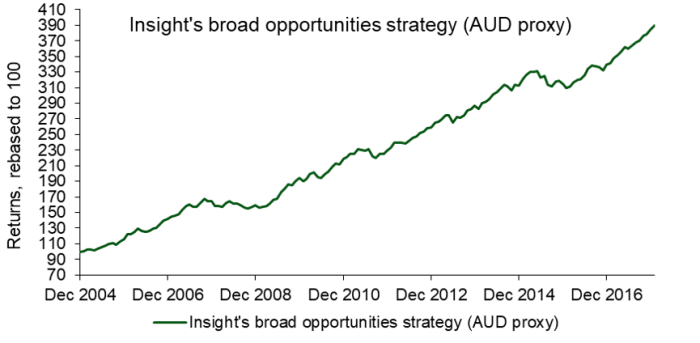

Source: Insight Investment as at 31 December 2017. The Insight broad opportunities strategy performance has been adjusted by interest rate differentials to derive an AUD proxy. These returns are gross of fees. Inception date 31 December 2004.

Matthew Merritt is Head of Multi-Asset Strategy Team at Insight Investment. This article is general information and does not consider the circumstances of any individual. Insight Investment is a sponsor of Cuffelinks.