Banks played a pivotal role in the early part of the pandemic. They were often the first port of call for customers as the spectre of lockdowns loomed. Governments turned to the banks to help implement support measures and act as a crucial intermediary between themselves and the economy, insofar as an economy is the sum-total of its individual actors.

Having spent the 10 years prior to the pandemic fortifying capital buffers and improving liquidity and solvency measures, banks were well-placed to perform this central role. The Basel capital reforms contributed to a 40% increase in average total capital during the 13 years to 2019, before the start of the pandemic.

Excellent capital strength

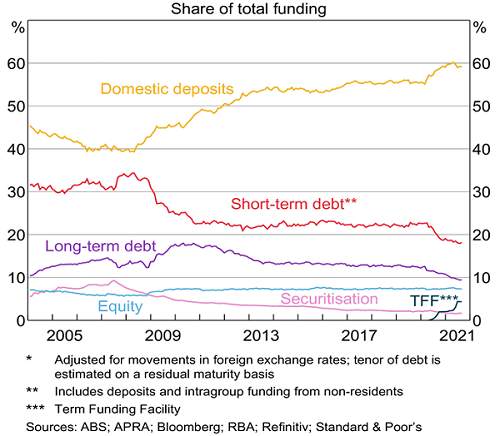

Australian banks rank in the top quartile globally when it comes to capital levels, but more recent policies have accelerated improvements in other parts of the balance sheet. For example, Australia is now much less reliant on foreign investors funding loan books, replaced by growing deposits from households, targeted short-term funding known as the Term Funding Facility or TFF, and a quantitative easing programme by the RBA that is purchasing government bonds (of which the banks are some of the largest holders).

Australian bank funding mix

Firm footings and calm heads find a pathway forward

Strong foundations and swift action from governments at the outset of the pandemic gave banks much needed time to assess their exposures. They were able to quickly identify those customers that were at most risk of hardship and, most importantly, offer space and time to tailor support packages that eliminated the need for foreclosures or forced asset sales.

These actions were good business practice both financially and reputationally. In Australia, following the confronting Hayne Royal Commission, the events of 2020 and 2021 provided opportunities for the sector to mend and solidify connections to customers and communities. Some examples of this support included:

- Repayment holidays of up to 12 months to provide space to manage cashflows while employees were stood down or while businesses were forcibly closed.

- Structuring advice to ensure that at-risk customers had the right product for their needs.

- Reluctance to enforce foreclosure provisions without considering all other options first.

This came with a temporary financial cost to the banks, but one that they were willing to shoulder as part of a wider pandemic response. The banks’ actions had positive spill-over effects in terms of confidence across the economy, not to mention in property markets, allowing individual and corporate customers to visualise a path to recovery that was able to be actioned once movement restrictions eased.

Bullish outlooks, just not for lending – yet

There is a strong platform in place for strong economic growth in 2022. Consumption is expected to revert to pre-pandemic patterns and levels over the next two years as international borders reopen, tourism returns and movement restrictions ease.

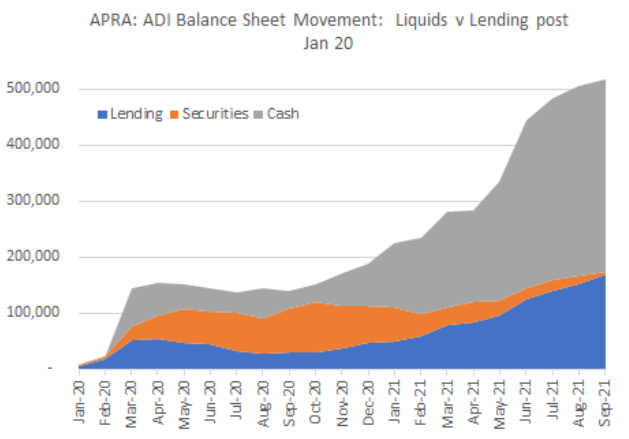

Households will be comfortable to increase economic activity due to high savings. However, from the banks’ perspective, elevated holdings of cash and liquid assets has negative implications for credit demand. Cash held in bank accounts effectively earn zero interest, so as the pandemic recedes the desire to hold excess cash will fade.

Australian bank balance sheet changes

Source: APRA, Westpac

It isn’t all bad news for credit demand. Owner-occupied residential borrowing is rising into the end of 2021, exacerbating the challenges for first-home buyers. This does create some hope for lending growth, but competition for high quality borrowers is intensifying. Recent Australian bank results demonstrate how difficult it is to attract the best borrowers, with ANZ admitting that its residential lending had materially lagged system growth despite buoyant market conditions.

Another major headwind for credit demand has been the impact of Buy Now Pay Later (BNPL) offerings, and the emergence of fintech start-ups across the financial ecosystem. Millennials and Gen Z customers are increasingly shying away from traditional bank products, preferring technology-based solutions. This disruption is a common theme globally as large, siloed financial institutions are being outmaneuvered by nimble start-ups that are attracting plentiful capital to support their growth ambitions.

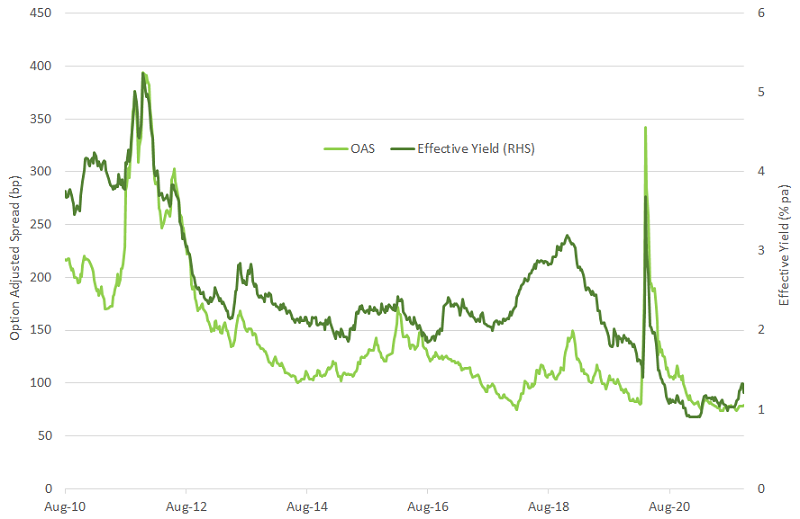

No such hesitancy for credit investors

Fixed income and credit investors know exactly how long-suffering depositors are feeling. Credit spreads for a broad index of global banks have settled at more-than-decade lows around 75 basis points, even tighter than pre-pandemic. Effective yields of a little over 1% seem miserly, especially as price inflation in everything from food to gasoline has jumped quickly in recent months.

ICE/Bank of America Global Large Cap Banking Index

Source: Bank of America, ICE

However, yields and spreads make more sense once you consider that most large banks have reported only a fraction of the losses expected to have occurred because of the pandemic. This has protected capital and allowed profitability to be maintained. Moderate interest rate increases would be a further benefit from a profitability perspective.

At Daintree Capital, we continue to believe that hybrid securities are a smart way to gain exposure to the world’s best banks. Offering spreads of between 2.5% and 4.0% above risk-free rates, hybrids provide a compelling alternative to securities rated higher in the bank balance sheet for a modest increase in risk profile but with better spreads. While all assets are currently expensive on an historical valuation basis, we believe that hybrid securities provide an appropriate balance between quality, income, and resilience to cyclical volatility.

GFC lessons helped during COVID

The nature of the two most recent crises are quite different, but the lessons learnt from the GFC and subsequent improvements, particularly in the banking space, have set the stage for a robust recovery.

During 2020 and 2021, we saw the benefits of 10 years of work via the Basel reforms achieve good outcomes for people and business, while simultaneously protecting bank bondholders and shareholders. The financial system, anchored by the banks, has already begun to transition from a defensive posture during the acute phase of the pandemic toward a more constructive footing, asking now “How can we help our customers to thrive?” rather than “How can we help our customers to survive?”.

In this respect, they face challenges not just from each other, but from a vibrant fintech sector that is having success attracting younger segments of society. Overall, we see large global banks as viable long-term investment propositions, but the unique features of hybrid securities mean that in the current environment they provide the best risk-adjusted return in the bank capital stack.

Brad Dunn is a Senior Credit Analyst at Daintree Capital. This article contains general information only as it does not take into account the objectives, financial situation or needs of any particular person.