We have greeted this year’s equity market rally with some trepidation. While strategic asset allocations have done well, we have been cautious as equity markets diverge from economic fundamentals.

Initially, each month of divergence increased our concern about market levels, especially as investors were being ‘paid to be patient’ by cash and short-term bond yields. Eventually, the balance between tactics and strategy made us recognise that the near-term momentum of equities was too strong to fight, even as we held onto our medium-term outlook. By midyear, we were ‘shifting to neutral’.

But a ‘neutral’ view doesn’t mean a portfolio has to be static. We specified that the engines are still running, and maintained the view that we would likely go underweight again at some point.

The message: This is not yet the time to be making major calls on asset or risk allocation. Any signs of a deepening of the economic slowdown “will show up in credit markets before they show up in equities”, we wrote in July. So, have we seen catalysts for movement? And if not, what can investors do in the meantime?

Triggers to act?

So far, there has been little to spark concern.

High levels of U.S. credit card and auto loan debt have attracted some attention, but while the dollar amount may be breaking records, the debt as a proportion of wealth does not appear to be at worrying levels.

There has been an uptick in corporate defaults, including the notable bankruptcy of the once-dominant, 100-year-old U.S. freight-trucking company, Yellow. The recent decision by Moody’s to downgrade ratings and outlooks on a swath of U.S. regional banks is a reminder that that crisis hasn’t entirely gone away. For those of a very gloomy disposition, Fitch’s downgrade of the U.S. government could be a ‘straw in the wind’, we don’t see it as a major event.

All that said, index-level high-yield spreads have tightened, and if anything, the most worrying thing in today’s credit markets is arguably the recent spread compression in complex and securitised markets, indicating a stretch for yield. These are factors that make us cautious at the margin in high yield, but are not yet enough to trigger wider sell-offs.

In equity markets, we remain concerned about valuations, and our ‘prior belief’ is that we will move to a short position in the future. The key question is what the market needs to see in the fundamentals to trigger a correction.

In our view, the answer is margins being squeezed by wage and other cost increases that companies can no longer pass on. Second-quarter earnings reports showed a little of that, but this was generally restricted to sectors like communication services, healthcare and utilities, which are known for their high operational leverage.

How to generate returns

With no clear reason to change gears, what can be done to eke out incremental excess return opportunities?

One place to look is within, rather than among, asset classes.

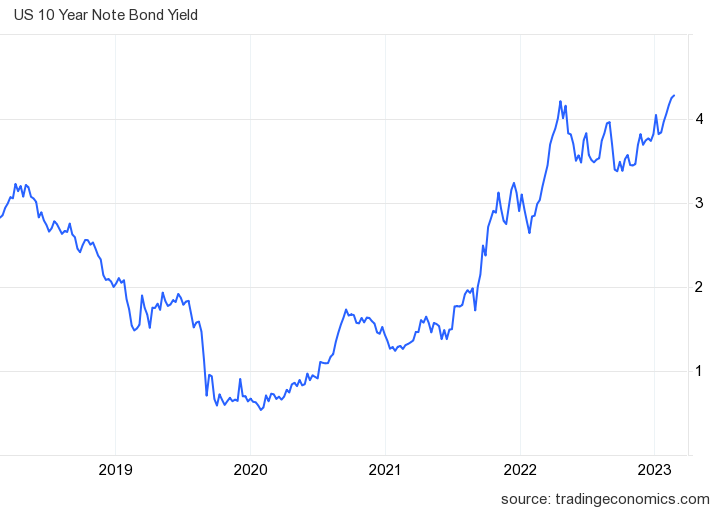

Since April, our Fixed Income team has been saying that it expects core government bond yields to trade in a range this year—between 3.15% and 4.15% for the US 10-year Treasury, for example. With yields currently above this range, the team has identified lengthening duration as a potentially attractive tactical position.

In equities, regional tilts can be explored. Japanese equities still appear attractively valued in a policy environment that remains very accommodative next to other developed markets, even after the Bank of Japan’s recent adjustments to yield-curve control.

By contrast, European data, especially in manufacturing, continue to trend weaker, and the recent bank-tax saga in Italy is a reminder of the potential for greater government involvement in markets.

We have also become more cautious on China, in both debt and equity, as it struggles with deflation and the overhang of property debt and falling local government income. A broad, government-led stimulus program could be a positive surprise, but our teams on the ground continue to expect more targeted measures.

In private markets, there are several places where liquidity and capital scarcity make for attractive long-term return potential, whether that be specialized niches like preferred stock or mid-life co-investments or better-known markets such as private equity secondaries. More generally, as Elizabeth Traxler highlighted on our recent Asset Allocation Committee webinar, deal models focused on truly enhancing a business are much more likely to succeed than those predicated on high leverage.

Other possible opportunities

Another place to look is where markets may have taken their eye off the ball and failed to price for potentially disruptive economic events.

As both inflation and commodity prices declined during the first half of this year, we continued to recommend commodities in portfolios, where appropriate. This was because we still considered the supply-and-demand balance to be fragile and at risk from unexpected disruptions, making commodities an underpriced hedge against an unwanted return of rising inflation.

We haven’t seen any such disruption feed into inflation data yet, but there has been a recent comeback for commodities, accompanied by a steady rise in longer-term US and European inflation expectations.

The fact that European gas prices had fallen almost 90% from their 2022 high is one reason they were able to surge almost 40% in one day on news of a possible workers’ strike at liquid natural gas plants in Australia. Oil has rallied hard to a nine-month high through July and August, on the back of supply cuts. Copper has also been edging higher, and could be sensitive to any stimulus measures out of China.

No time for major calls

The most recent comments from the European Central Bank and Bank of England have moved them into the fully ‘data-dependent’ camp, alongside the Federal Reserve. That stance reflects that the growth-and-inflation cycle appears to be turning and the full effects of their past decisions have yet to be felt. They feel it is not time to be making big policy calls. It’s a time for marginal tweaks in response to day-to-day information.

Investors find themselves in the same uncertain environment, at the same apparent turning point, so it’s no wonder a similar stance suggests itself. This is no time to be making major calls on asset or risk allocation.

Niall O’Sullivan is Chief Investment Officer, Multi Asset Strategies – EMEA at Neuberger Berman, a sponsor of Firstlinks. This information discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is not intended to be an offer or the solicitation of an offer.

For more articles and papers from Neuberger Berman, click here.