There is much written about office, industrial, and retail property, but the proliferation of specialised real estate investment trusts (REITs) is also becoming a noticeable factor in local and global markets. Historically, many investors viewed these trusts sceptically, though there is now a growing recognition of the strong fundamentals of many specialised property types.

A specialised property category that has traditionally been lucrative for Phoenix Portfolios is pub properties. Australians love going to the pub, and it is estimated that there are 9,500 licensed venues across the nation, representing a market size of more than $15 billion.

Pubs are an often-misunderstood, niche investment. The properties have traditionally been housed in unique structures with unusual dynamics but they provide solid investment opportunities for those willing to take the time to understand their intricacies. Pubs can be some of the safest investments, with secure income streams.

Real old school

In the mid-1800s, John and James Toohey (yes, the founders of their eponymous beer) took control of a site – previously a schoolhouse – on the corner of Flinders and Swanston Street in East Melbourne and opened the Princes Bridge Hotel. Irish diggers and cousins Henry Young and Thomas Jackson later took over the pub, and unimaginatively renamed it Young and Jackson. People from all walks of life have been socialising, eating, and drinking in this building for more than 150 years. Despite all the changes to technology, communication, transportation and so much more, the Young and Jackson pub of today would be eminently recognisable to those who patronised it in the 1800s.

A refreshing ALE

The Cromwell Phoenix Property Securities Fund (PSF) previously held a stake in ALE Property Group (which traded under ASX:LEP), which had ownership of the Young and Jackson. LEP owned more than 80 pub properties leased to ALH Hotels, which was majority owned by Woolworths (ASX:WOW), but now mostly owned by Endeavour Group Limited (ASX:EDV) after a spinout transaction completed in June 2021. EDV also owns BWS and Dan Murphy’s, and has a market capitalisation of approximately $11.5 billion.

LEP was spun off from Fosters Group in 2003. It became Australia’s first pub rental securitisation and the nation’s first listed pub trust. One of the unique characteristics of the LEP portfolio was the presence of an uncapped market rent review for the properties in 2028. Due to the outperformance of the ALH operating business and long-term nature of the leases, the portfolio was rented significantly below market levels. In 2021, LEP suggested under renting was 35.6% - a figure which may have understated the true amount. LEP had also been curating their portfolio of assets, selling those that were over rented at significant premiums to book values.

Due to the nature of the portfolio, Phoenix considered its cash flows to be amongst some of the lowest risk in the sector, with significant upside over the longer term. That proved to be the view of at least one other market participant, with funds managed by Charter Hall Group (CHC), including Charter Hall Long WALE REIT (CLW), announcing a proposal to acquire LEP in September 2021. The proposal included consideration in the form of both cash and CLW securities and represented a 25.2% premium to the prior day’s closing price. Securityholders approved the proposal, and we successfully exited the investment in LEP.

A hero in a red cape: Redcape

Redcape Hotel Group (previously ASX:RDC) was another pub owner with a unique structure. RDC traded at what is known as an OpCo/PropCo, whereby RDC was the owner of both the pub operating entity (OpCo) and the entity which owns the pub property (PropCo).

RDC traded at a consistent discount to its director’s net asset value (NAV), frustrating its external manager. To combat this, in August 2021, RDC announced a complex transaction in which RDC shareholders could chose to redeem their investment for $1.15 per share, or remain invested in an unlisted fund with quarterly liquidity windows, presenting an opportunity to redeem at a pre-set (and reducing) discount to director’s NAV. As an indication, RDC traded at less than $1.00 per share prior to the transaction’s announcement, compared to the director’s NAV of $1.31 per share.

At the time of the announcement, the NAV was considered conservative and redeeming RDC units with reference to a future NAV represented an attractive investment opportunity. Furthermore, given the operating business and commitment to pay out earnings quarterly, there would be a strong running yield generated by holding the unlisted investment.

The actual results surpassed expectations and we redeemed the investment on 30 June 2022 at a unit price of $1.5277. After becoming an unlisted fund in November 2021, the portfolio also received 6.55 cents in distributions from RDC. The portfolio’s cost base for RDC was approximately $1.12 per unit, meaning the investment returned a total of a just over 42% during its short holding period, representing an internal rate of return (IRR) of 61%. During this period, the S&P/ASX 300 Accumulation Index returned -15.8%.

How about today?

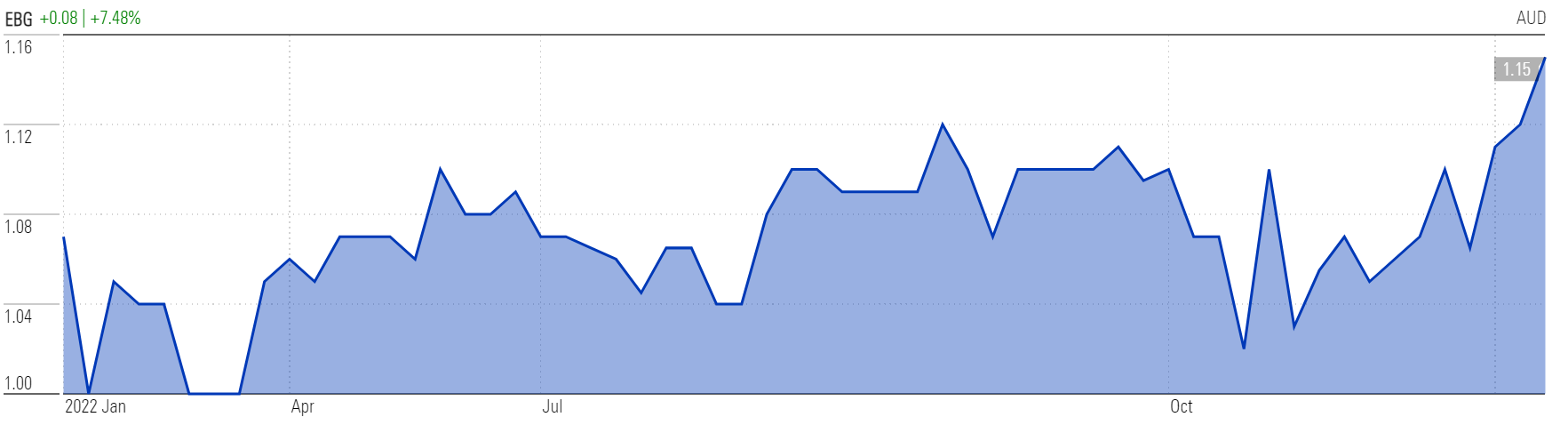

PSF has two current holdings with pub exposure: the small Queensland-based Eumundi Group Limited (EBG) is a long-term holding, with a strong management proposition, that we remain comfortable with.

Source: Morningstar

The other holding is Hotel Property Investments (HPI), which was a meaningful contributor to performance of PSF in the December quarter. HPI owns 62 pub properties, predominantly leased to Australian Venue Co (AVC), which is owned by private equity firm KKR.

AVC traces its origins to Coles’ past ownership. HPI’s large exposure to Queensland is no mistake. Under Queensland law, to apply for a detached bottle shop license, the licensee must operate a 'commercial hotel' (in common language, a pub) within 10 kilometres of the proposed bottle shop. As Coles desired to operate bottle shops in Queensland it also needed to be a pub operator, hence its ownership of AVC. Under a complex transaction, KKR took ownership of AVC in a manner which allowed Coles to continue operating its bottle shops. Under KKR’s ownership, AVC has grown rapidly and produced fantastic financial results.

At the start of the quarter, HPI traded at $2.93 per share, or a 30% discount to its net tangible asset value. HPI has also periodically engaged small scale sales of some properties at premiums to book value. In late 2022, entities associated with Tony Pitt’s 360 Capital Group purchased a 13.8% stake in HPI at prices as high as $3.67 per share. Those familiar with Tony Pitt’s history know that corporate activity is likely to follow. HPI was the second-best performing security in the REIT index over the quarter (only behind URW) rising 24.6%, closing at $3.56 per share.

Source: Morningstar

Finding a niche

For many, not much time is devoted to specialised, niche investments, but the best ideas are often found by looking at smaller, more complicated opportunities. Over time, the pub sector has represented one such opportunity.

Stuart Cartledge is Managing Director of Phoenix Portfolios, a boutique investment manager partly owned by staff and partly owned by ASX-listed Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.