The Productivity Commission produced the following infographic to summarise its report on superannuation for post-retirement. We have inserted comments to highlight some interesting features.

The full research papers are linked here.

The complete infographic is linked here.

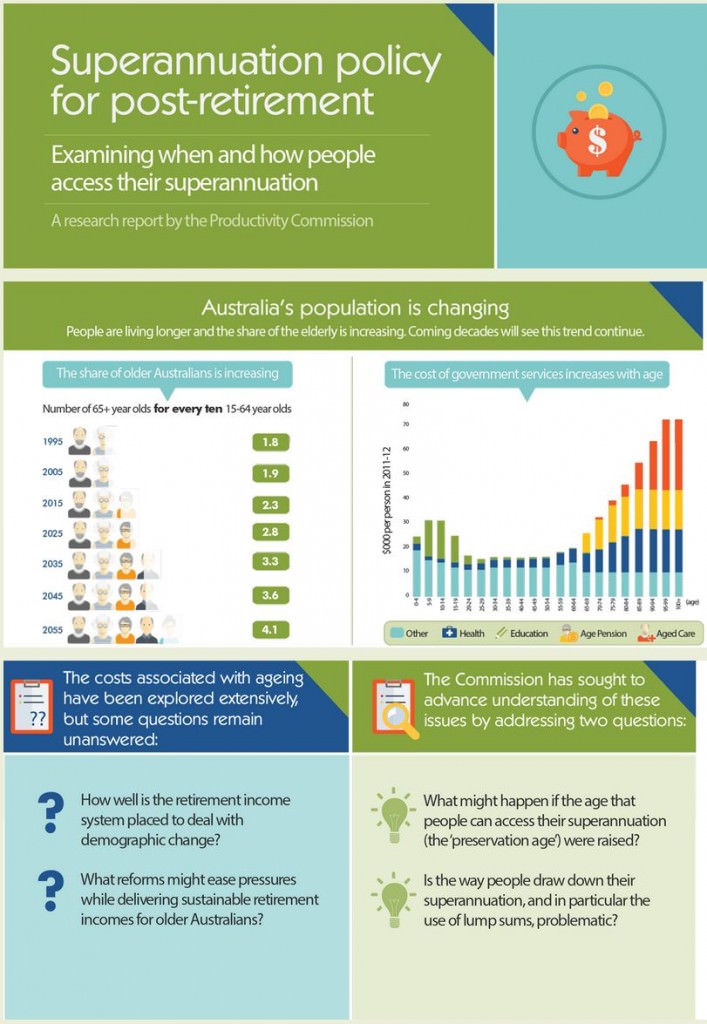

Note: Fewer workers to pay for services, especially pensions and health, demanded by people 65+. And there will be so many older people, they will have the political clout at the ballot box.

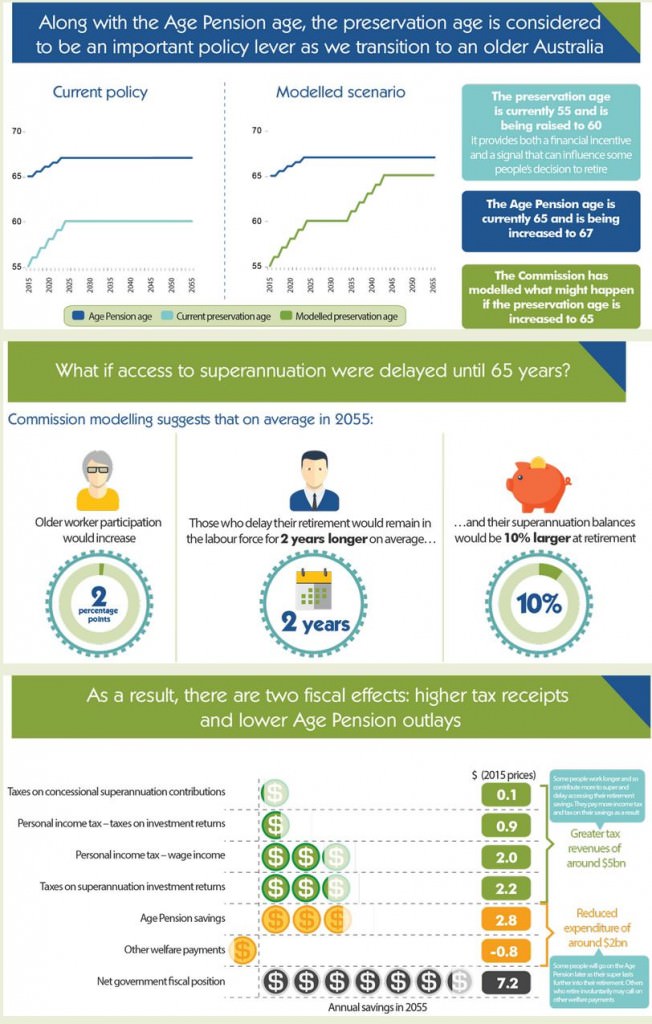

Note: Although super access increases in this analysis to 65 years, there is only a 2% increase in older worker participation. Who will provide the jobs for all these older people? What about those who have had physical jobs they can no longer manage? Not much sign of employers wanting to hire 60-year-olds at the moment.

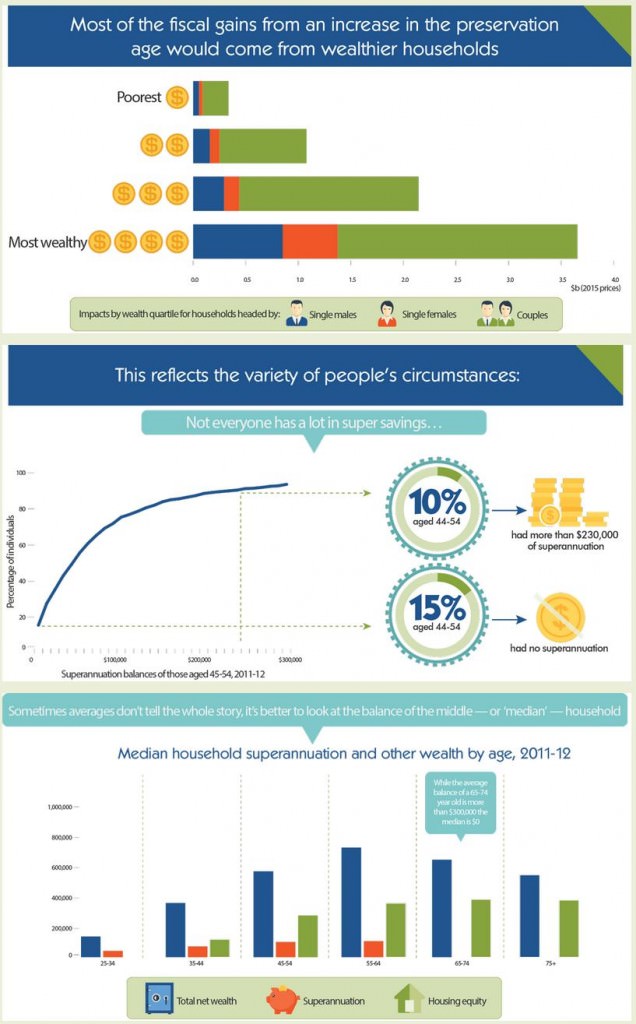

Note: In 2012, older Australians had little superannuation, most wealth in home equity.

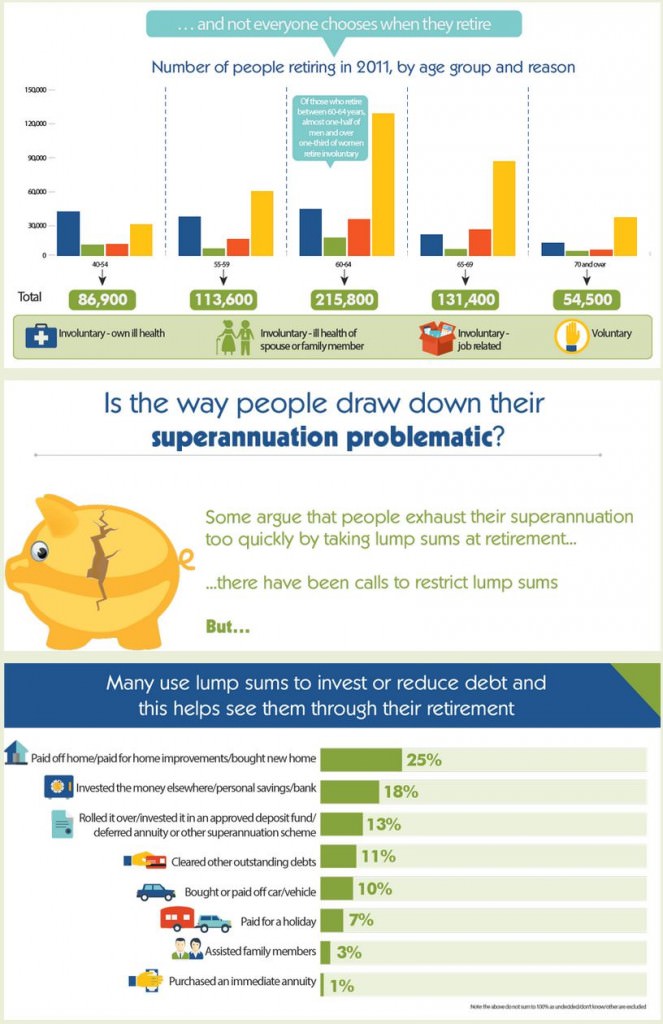

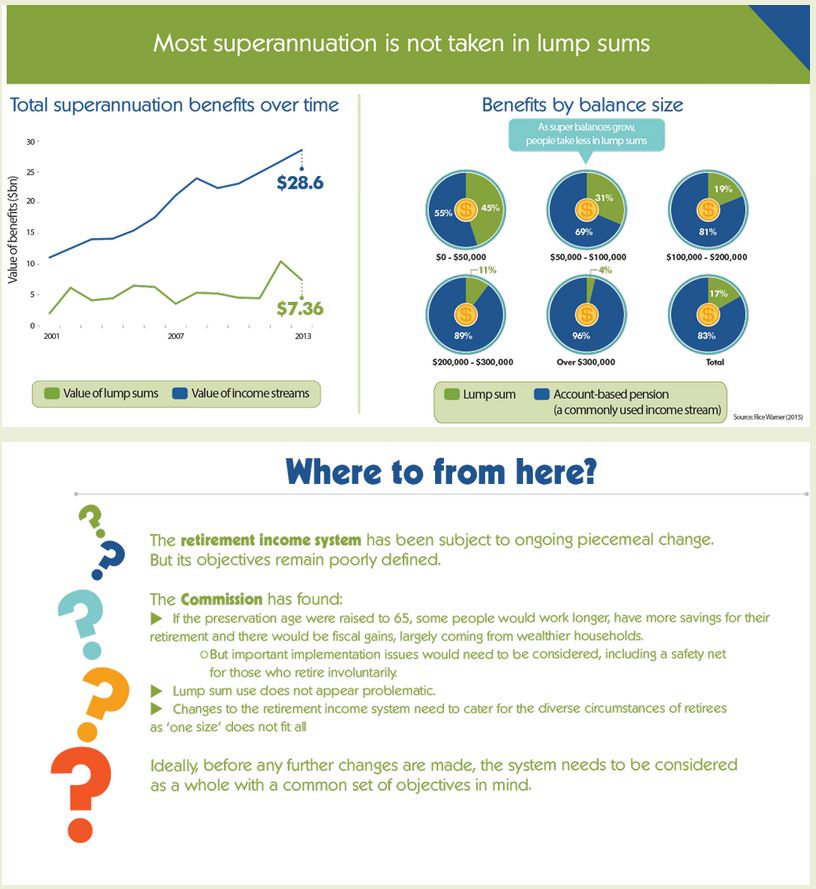

Note: A large proportion of people do not retire voluntarily. Contrary to a popular view, retirees are not drawing large lump sums and wasting the money.

Note: The tendency to take a large proportion of super as a lump sum is most common among low balances, and only 4% for amounts over $300,000.

Source: Productivity Commission, Superannuation Policy for Post-Retirement.

Graham Hand is Editor of Cuffelinks and he will be presenting on 'Risk & Asset Allocation in SMSFs' at the Australian Investors Association's National Conference held from 2 to 5 August 2015 on the Gold Coast. For full details, see the conference programme.