Looking back over my many years in the investment management industry, the importance of a handful of themes jumps out at me. First, technology has been, and always will be, an incredible driver of change. Next, understanding the human condition is as important as any investment analysis. And while market cycles today tend to be longer than they have been historically, cycles are not yet a thing of the past. Additionally, free cash flow and dividends are critical elements in sustained investment success. Finally, at this stage of the market cycle, investors may want to focus on the margin of safety rather than concentrating purely on profit margins.

Technology: From mainframes to blockchain

During my professional lifetime, technology has dramatically impacted the way markets function and allowed for much deeper securities analysis than ever before. The ability to gather and aggregate market data exploded in the 1980s, making fundamental analysis quicker, easier and better.

Early in my career, mainframe computers were the heavy iron we used to analyze companies and markets. And to illustrate just how much more productive we’ve become over the past few decades, when my dad retired from the largest maker of mainframe computers in the 1980s, that company employed around 375,000 workers. In contrast, today’s tech giants make do with workforces a fraction of that size. The combined workforce of Apple, Alphabet, Microsoft and Facebook is roughly equal to that of the mainframe maker.

The 1990s saw the widespread adoption of personal computers, driving an explosion in online day trading, while the New York Stock Exchange moved to trading stocks in increments of a penny, down from typical spreads of 1/8 of a dollar. These are huge changes that have made for deeper, more efficient markets.

This century ushered in the introduction of high-frequency, algorithmic trading, the rise of dark pools and the increasing use of 'big data'. Artificial intelligence is on the horizon, and it has the potential to disrupt our business and many others, if it achieves its full promise. Disintermediation is a continuing trend, and the prospective widespread adoption of blockchain technology in the coming few years could streamline our industry, cutting out middle men, squeezing yet more cost out of the system, advantaging asset owners.

Emotions don’t make for efficient markets

My biggest regret as an investor is that I didn’t study psychology as much as I could have. When I was training, I was taught that the capital markets were efficient, that investors act rationally and that market prices fully reflect all available information. However, in recent years, Nobel Prize–winning behavioral economist Daniel Kahneman has dispelled that notion. His seminal work, Thinking, Fast and Slow, points out that people have built-in biases that can distort their perception of markets.

The idea that we all have inherent biases is particularly salient as we approach the widespread adoption of artificial intelligence. Consequently, it’s imperative that investors guard against the possibility that their biases will be exploited by others in the marketplace.

Cycles have been getting longer but still come to an end

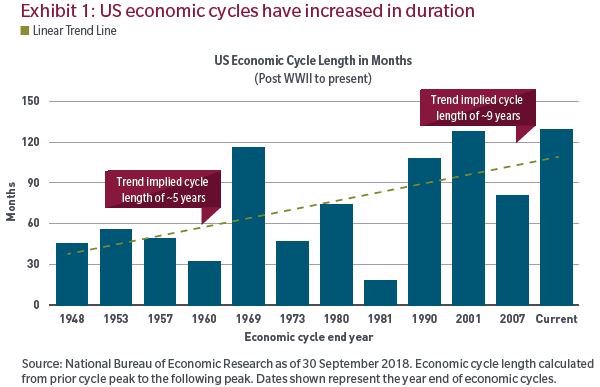

In the United States, economic cycles have been growing in length. A diversified economy, better inventory management and central bank intervention have all likely contributed to these longer economic cycles. Expansions tend to be smoother and longer while contractions tend to be short and abrupt. That said, business cycles are still likely to continue. In my view, higher interest rates and overconfidence will continue to exert themselves and may lead to many more business cycles.

However, my greatest concern about these elongated cycles is that they tend to coincide with a significant buildup in debt, calling into question the quality of underlying growth. This debt buildup, economists believe, creates a drag on potential growth, thus amplifying the importance of central bank policy in each succeeding cycle. The mounting debt overhang escalates the odds that to rekindle growth when the current cycle inevitably ends, that monetary authorities will be forced to resort to using what were once unconventional policy tools, such as quantitative easing.

Dividends matter … a lot

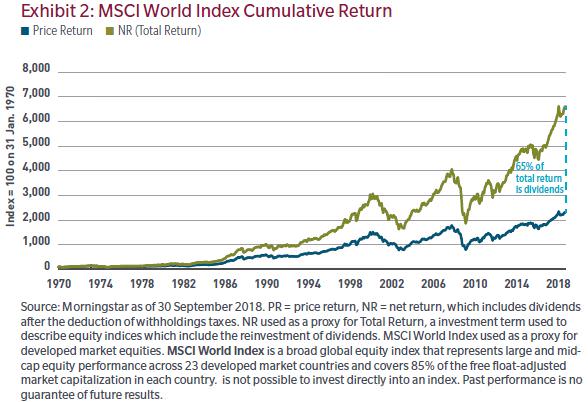

The great mathematician Albert Einstein is reputed to have called compound interest “the most powerful force in the universe”. Whether Einstein said it or not remains in dispute, but it is hard to dispute the power of compounding over long investment horizons. Earning interest on your interest and dividends on your dividends by reinvesting them can make your investments grow exponentially over long periods of time. According to our calculations, since 1970, around 65% of your total return if you’d been invested in developed-market equities would have been driven by the compounding of dividends.

And what drives dividends? Free cash flow. One of the most fundamental lessons I’ve learned is the importance of free cash flow generation in choosing equity investments. Real — or inflation adjusted — cash flow yields are one of the principal building blocks I use when building portfolios. Over much of the past decade, coming out of the financial crisis, the free cash flow generation of S&P 500 companies was extraordinary. Globalisation constrained wage gains while low interest rates and capital-light strategies drove great gains in free cash flow yield. But today free cash flow yields have reverted back to average levels from the record levels following the GFC as labor costs rise late in the business cycle and profit margins contract. To me, that’s a cause for concern.

Focus on the margin of safety

Globalisation was a big driver of profit margin expansion for much of this business cycle, but it appears that it may have peaked for the time being. Brexit and growing trade barriers are manifestations of the peak globalization, and the more constrained movement of people and products is likely to crimp profit margins as we move forward. Rising interest rates will pose challenges as well, affecting return on equity and lowering free cash flow yield.

Against the backdrop of a long, aging cycle, I think it’s time to shift the focus from profit margins to the margin of safety. Be aware that the risks rise as markets become more expensive and the cycle ages, and this is the second-longest cycle in history. While we’ve experienced an extraordinary decade of equity returns, in my view, investors may want to begin moving their asset mix toward more defensive positioning, from risky assets to higher weightings of less volatile choices such as cash and high-quality bonds.

I hope you benefit from these parting thoughts, which summarise what I’ve learned working through five full business cycles and 33 years at MFS.

James Swanson, CFA is Chief Investment Strategist at MFS Investment Management, a sponsor of Cuffelinks. This article is for informational purposes only and should not be considered investment advice or a complete analysis of every material fact regarding any investment.

For more articles and papers from MFS Investment Management, please click here.