One of the joys of managing your own investments is that you don’t suffer the constraints that professional investors have to deal with. As a do-it-yourself investor, your only major constraints are time and cashflow. Professional investors may have more sophisticated tools and resources, but they primarily invest within a specified universe and are benchmarked monthly, quarterly and annually against their peers. As a DIY investor, you can invest in whatever you choose, and the only benchmarks that matter are your personal goals and objectives.

We saw that retail investors stayed focused on their personal objectives in 2022. The clearest signal that investors were not going to chase returns in an increasingly challenging environment is the steady increase in cash held by investors from late 2021, through to now. nabtrade’s cash allocation is currently at a record high, and grew throughout 2022, except for small outflows in June when the ASX200 bottomed, and investors took the opportunity to top up preferred holdings. This contrasts with 2020, when Covid’s impact became apparent – cash outflows peaked as investors took advantage of dramatic falls in share prices across the ASX and global markets more broadly.

Cash has a new meaning in 2023

Retirees, who have struggled to generate income from their portfolios without moving up the risk spectrum over the last decade, can return to defensive assets should they wish. For most nabtrade investors, cash is a hedge against a downturn, and a holding account, should one or more share bargains present themselves. Clearly most investors are not seeing sufficient value in the sharemarket to reduce their hedge.

The last 12 months has seen a significant shift in focus from bargain hunting in 2020, when buys accounted for 80% of all trades placed on nabtrade from March to June, to wealth accumulation in 2021, to wealth preservation in 2022. The proportion of buy trades has fallen steadily as the market climbed through 2021, and then wobbled through 2022. One would expect to see more buying than selling over time, as investors are growing their wealth (and retirees generally attempt to preserve, rather than draw down, their capital), so even short-term increases in selling tend to indicate genuine concern about the future direction of share prices.

Trading volumes down

Another indicator of investor caution is a significant fall in trade volumes over 2022. As the year ended, volumes were roughly half, on average, the most traded days of 2020. Given that total investor numbers have doubled since pre-Covid, this is quite telling. A fall in volume doesn’t necessarily indicate bearishness, but it clearly indicates that investors are not seeing a great deal of value on the sharemarket and are not going to chase returns. Any pullback on the ASX has been relatively modest compared with the Covid crash, and investors are no longer excited about ‘buying the dip’ when a rising interest rate environment has increased headwinds for equities. With cash accounts paying 3% or more, the potential downside risk in sharemarkets is far less palatable than it was when rates were close to zero.

In addition to lower trading volumes, different types of investors are responding differently to this market. While most new nabtrade investors over the last two years have been buying ETFs to hold for the long term, not trading their cash away on YOLO stonks as popularised in the US, these young investors stayed on the sidelines in 2022. They are generally still holding their Covid share purchases, but are less likely to trade than older, more experienced investors who are continuing to find opportunity despite the volatility. Interestingly, some of our most active and sophisticated traders are more active than ever, but this seems a market that favours experience over enthusiasm.

Materials and energy popular

The range of stocks traded in 2022 narrowed significantly relative to previous years and focused on just two sectors – materials and energy. Fortescue Metals Group (FMG) remains extremely popular with traders as a pure iron ore play, while BHP (BHP) is simply too big to ignore.

Source: Morningstar

Beyond these two, however, the battery metals sector was the big favourite for traders and investors. Lithium producers and hopefuls featured heavily in the top 10 traded stocks throughout the year, with Pilbara Minerals (PLS), Core Lithium (CXO) and Allkem (AKE) the most favoured. These have the advantage of being liquid enough to attract the attention of traders, and at the forefront of a long-term trend in decarbonisation for investors, although the trade sizes remain modest, suggesting this sector is not a core holding for most – just some fun money.

The price action and excitement in the materials space have crowded out other sectors that would generally feature heavily. The most consistent buy of the year was exchange traded funds (ETFs), with Vanguard’s Australian Share Fund (VAS) by far the most popular. Investors have learned to watch daily price movements in the US and take their leads from the futures market, as buying spikes dramatically when the ASX is sold off and falls away on strong days. For accumulators, this is a clearly a long-term wealth creation strategy; most of these investors are young, do not actively trade their holdings and focus on one or two specific ETFs to build their portfolio.

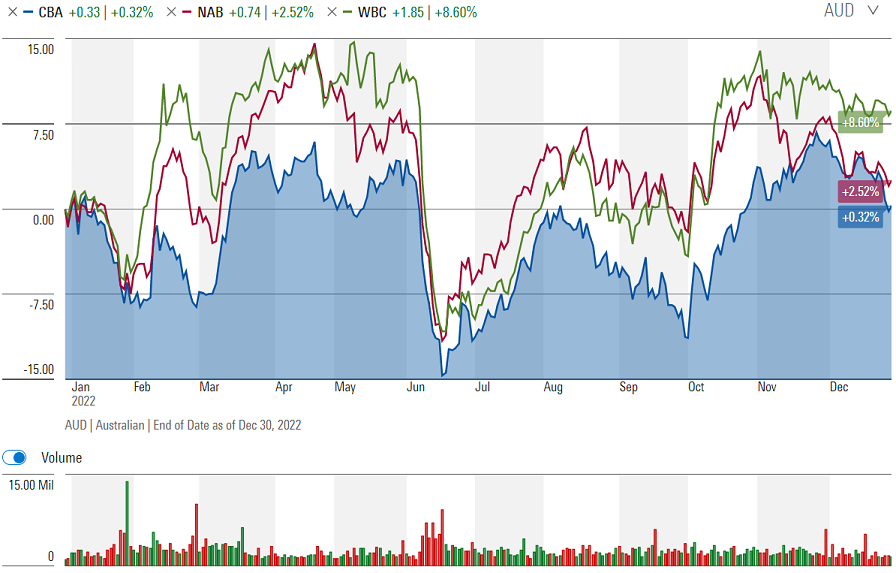

Reluctance to increase bank holdings

Financials are always popular as income-focussed investors appreciate the relatively stable fully franked yields of the big four, but as most investors bought banks aggressively during the Covid crash, many are reluctant to add more to their holdings. Of the big four, Commonwealth Bank (CBA) is the second largest holding, and frequently trimmed above $104, while NAB (NAB), by far nabtrade investors’ largest holding, was trimmed above $31 and bought below $30. Westpac (WBC) has been the most popular bank buy over the last 18 months as investors hope for a resurgence that is yet to eventuate, but overall bank volumes are well below average.

Source: Morningstar

Those investors who remained active in 2022 were happy to take profits in sectors that have outperformed, with energy being the most obvious example, but less enthusiastic to rotate into sectors that have underperformed. There was a total lack of interest in fallen angels – stocks like Magellan Financial Group (MFG), which fell more than 70% over twelve months, and Zip Co (ZIP), down more than 80%, found few buyers, and even saw sellers as investors come to terms with the likelihood that they will never return to their highs.

Overall, nabtrade investors appear to have focused on preserving their capital in 2022 and remain cautious about the outlook in 2023. The flexibility of being able to go to cash when desired and rotate in and out of sectors offering different outlooks, has given investors the opportunity to consolidate and even capitalise in a period of heightened volatility.

Gemma Dale is Director of SMSF and Investor Behaviour at nabtrade, a sponsor of Firstlinks. Stock charts as at 30 December 2022. This material has been prepared as general information only, without reference to your objectives, financial situation or needs.

For more articles and papers from nabtrade, please click here.