The speed of transformative changes in technology and society is ricocheting through the retail sector. The retailing environment is currently the most challenging it has ever been, driven by both structural and cyclical headwinds.

The arrival of international retailers in recent years has reshaped the retail landscape – Zara, H&M and Uniqlo to name a few. At the same time, local retailers such as Dick Smith, Payless Shoes and Rhodes & Beckett have disappeared from the scene. The latest ABS retail sales numbers reveal anaemic retail spending, while online retail spending continues to gain momentum.

Amazon’s imminent arrival is sending shock waves through the retail community despite bullish responses from the likes of Gerry Harvey, who said, “Amazon in Australia, it is not going to be as easy as the US … most of the retailers there rolled over but they won’t here.”

However, the newly-anointed CEO of Wesfamers, Rob Scott, was a little more conciliatory. "We have been expecting this for a long time. We have a healthy sense of paranoia. We are not complacent around the competitive risks."

Market factoring in changes

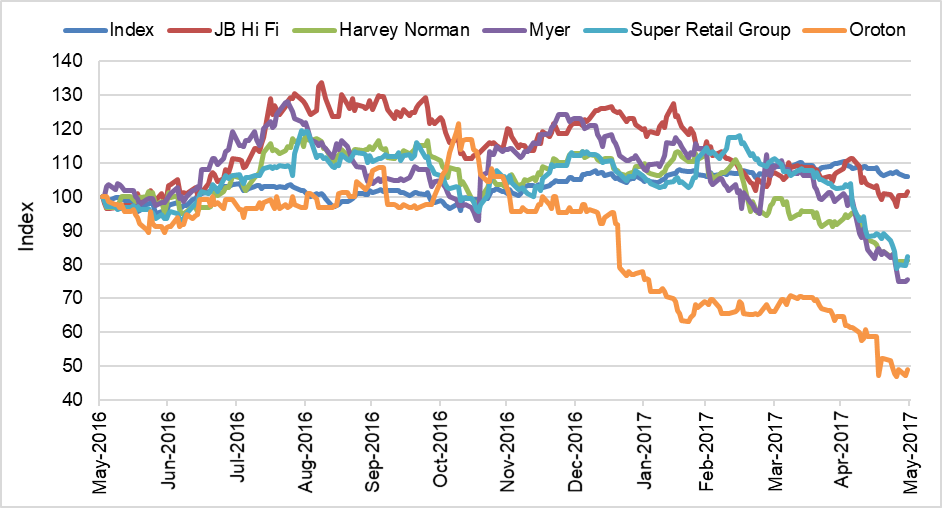

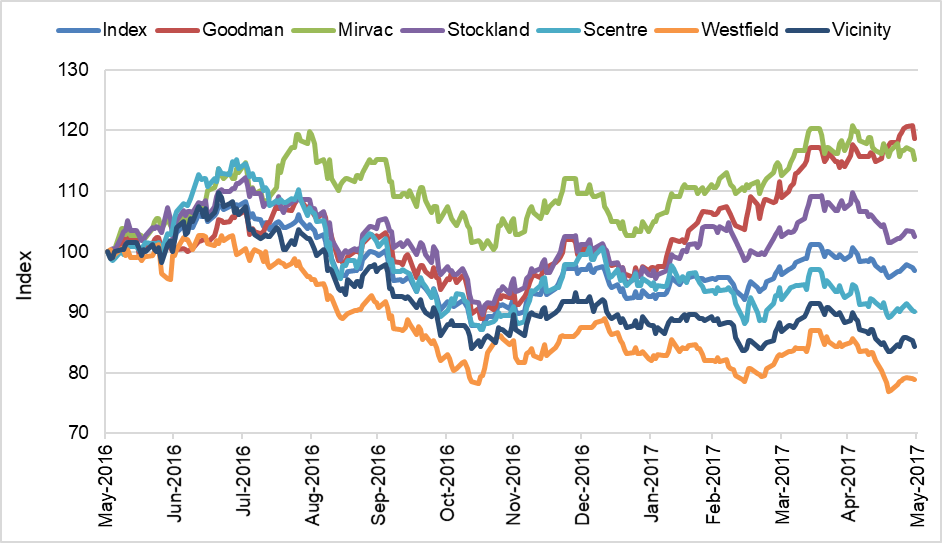

Figures 1 and 2 highlight the relative underperformance of retailers and the listed retail A-REITs in the past 12 months, as investors become increasingly concerned about how both components of the retail marketplace respond to the significant headwinds.

Figure 1: Performance of listed retailers: 12 months to 31 May 2017

Source: IRESS

Given retail assets comprise more than 55% of the listed A-REIT sector, it is not surprising that the relative performance of the A-REIT sector has been impacted. Westfield, Vicinity and Scentre, the three largest retail A-REITs, have all significantly underperformed the Index in the past year.

[Register for our free weekly newsletter and receive our latest ebook, Cuffelinks Showcase]

Register

Figure 2: Performance of listed A-REITs: 12 months to 31 May 2017

Source: IRESS

A revamp of retailing strategies

Retailers are revisiting their whole retail strategy from store network to customer experience within the store. The longstanding model of rolling stores out in every shopping centre has been revised with fewer but more innovative retail stores located in the larger, more productive ‘destination’ centres that offer consumers more than just a retail experience.

Victor Gruen, who in 1956 designed the first shopping mall in the US, the Southdale Centre in Edina, Minnesota, believed that “The merchant has always been and will always be most successful where his activity is integrated with the widest possible palette of human experiences and urban expressions.”

Southdale incorporated many of the features that have become synonymous with today’s modern shopping centre. including enclosed and climate controlled, anchor stores at either end of the mall, escalators connecting different levels and a public area in the middle.

Gruen was a passionate advocate of the shopping centre as a community centre, a hub of activity that extended beyond just pure retail. In 1960, Gruen wrote in his book titled Shopping Towns USA:

“Good planning, however, will create additional attractions for shoppers by meeting other needs which are inherent in the psychological climate peculiar to suburbia. By affording opportunities for social life and recreation in a protected pedestrian environment, by incorporating civic and educational facilities, can fill an existing void. They can provide the needed place and opportunity for participation in modern community life that the ancient Greek Agora, the Medieval Marketplace and our own Town Squares provided in the past.”

By the mid 1970s, Gruen had become disillusioned with what shopping centres had become. He felt “the new malls had no community, they are not places for people to bloom and grow and share. The mall has become a monument to consumerism, not a community …”

Imagine what Gruen would have thought of how shopping centres continued to evolve over the next 30 years. Large, bland centres offering almost identical product, inward focused with their back turned on the surrounding community.

Shopping centres must create a unique experience

Yet Australia’s major shopping centre landlords are recognising what Gruen envisaged almost 60 years ago. Our shopping centres need not be just a place of selling, but a place where the retail space is complemented by entertainment, cultural and community services. Shopping centres need to be recast. They need to recognise people want not just a transaction. They need to create a unique customer experience, one that engages with consumers, embraces technology to enhance the experience and inspires people to visit not because they have to, but because they want to. In effect, they need to become a community gathering-place where people shop, play, work and live.

Some of the best shopping centres in the country are becoming mixed-use spaces comprising hotels, residential and community facilities. The powerhouse Chadstone Centre, Australia’s largest shopping centre, has introduced the first Legoland Discovery Centre, is adding a hotel and 17,000 square metres of office tower. Scentre, owner of the Westfield centres in Australia, is looking at residential and other entertainment options to complement their retail space.

When it comes to retail disruption, we expect the biggest impact will be on sub-regional and lower quality centres. These centres tend to have a higher exposure to discount department stores, limited space to incorporate non-retail drawcards, and lower productivity of their retail space.

Investors looking at the retail sector are at a cross-road. Not all retailers and centres will survive the onslaught of Amazon, other online retailers and shifts in consumer preferences. The gap between the winners and losers will widen and picking winners will be lot more difficult.

Adrian Harrington is Head of Funds Management at Folkestone (ASX:FLK). Folkestone offers a range of both listed and unlisted property investments, and is a sponsor of Cuffelinks. This article is general information that does not consider the circumstances of any individual.