Last year was a tough year for global earnings. The pandemic shook up stock markets, with large earnings drawdowns across the world. In particular, global small and mid-cap (SMID) stocks were hit hard, with earnings falling by more than 50% in 2020.

This year, we are seeing strong recoveries in revenue and earnings as economic growth picks up and pandemic concerns subside. Small and mid-cap stocks are well placed to see a strong rebound, similar to what we saw after the ‘dot-com’ and GFC market drawdowns.

However, the upgrade cycle for global SMID cap companies still looks to have a long way to play out.

Within the SMID cap sector, we see several high-quality companies that have emerged even stronger since the onset of COVID and are well placed for outperformance. We call these the ‘COVID Opportunists’.

This article will delve into these companies and look at why they are dominating their industries and the global SMID cap market for investors.

The strong getting stronger

In a year where earnings fell by half for the broader SMID basket, the below six companies which are currently held in our Global SMID portfolios managed to grow revenue by over 15% and earnings by over 30%, on average.

These COVID Opportunists took advantage of the environment to build on their already strong franchises. Their earnings are driven by strong underlying franchises and not just economics. They are less cyclical than many other companies in the market. They have deployed capital well with high sales and exceptional earnings growth.

Here is a selection of 6 global SMID caps and why we believe will keep getting stronger:

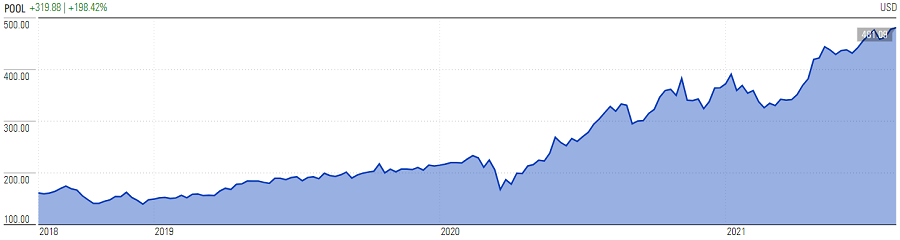

1. Pool Corp

The world's largest wholesale distributor of swimming pool supplies, equipment, and related products, Pool Corp operates about 400 service centres throughout the Americas, Europe, and Australia and serves some 120,000 wholesale customers. The company is 20 times larger than its nearest competitor and enjoys huge network advantages.

Source: Morningstar as at 9 August 2021.

Unlike a lot of distributor businesses that rely on M&A, Pool Corp is mainly an organic growth story and management has a proven track record of delivering solid organic growth (6-8%) and exceptional shareholder returns.

Pool Corp benefited from consumers being at home and more pool usage during COVID, boosting its maintenance revenue (60% of total revenue). Families chose to invest in backyard pools and outdoor living which benefitted the company with revenue from refurb and remodelling (25% of total revenue). New construction activity (15% of total revenue) is picking up along with the strong housing market in the US.

The company’s strong backlog combined with favourable end market conditions, give us confidence that solid growth will continue.

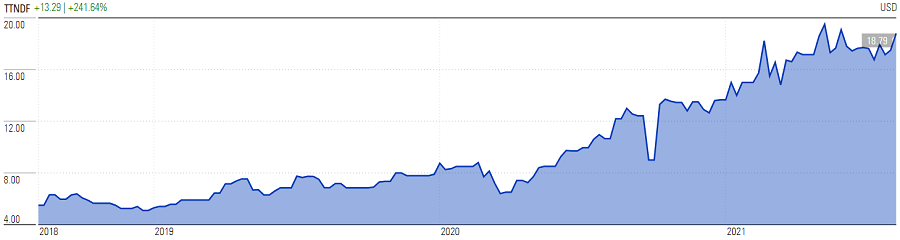

2. Techtronic Industries

Techtronic Industries is a cordless power tool provider with leading market share in both consumer and commercial markets with brands including Hoover, AEG, Ryobi and Milwaukee.

It has seen seven consecutive years of 20%+ growth in the Milwaukee brand, driven by strong new product launches, especially heavy-duty tools in professional end markets, and more widely, one-third of its revenue is driven by new products.

Source: Morningstar as at 9 August 2021.

While the company benefited massively from people working from home during COVID, we believe in a robust growth trajectory for the stock post COVID through the recovery in the commercial market, as well as accelerating market share gains.

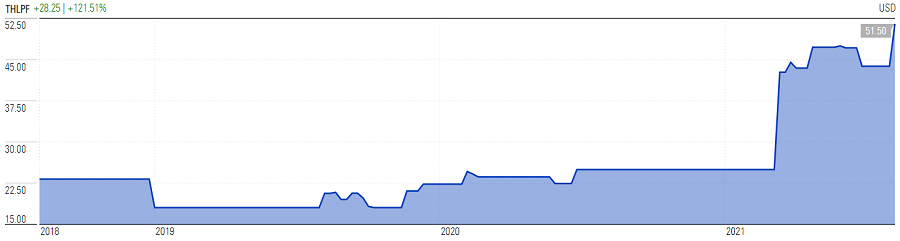

3. Thule

A Swedish business and a global leader in bicycle racks, roof boxes, and cargo carriers, Thule benefitted from COVID through staycations and an upward tick in biking. It is expanding into related outdoor leisure markets using the strength of the Thule brand name.

Source: Morningstar, as at 9 August 2021.

The staycation trend has a long way to play and ongoing supply chain constraints in bikes and RV related categories will help to extend the brand strength seen during COVID for more years to come.

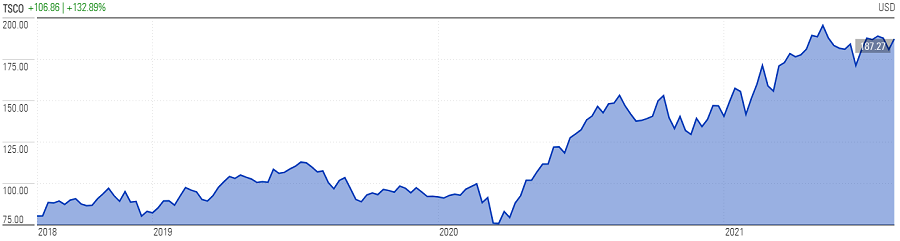

4. Tractor Supply

Tractor Supply is the largest retail farm and ranch store chain in the US with over 1,900 stores in 49 states. It thrived in the face of adversity. The business picked up 9 million new customers in 2020 and those customers keep coming back.

Its US customer base has an average income above the US national average income and cost of living that is below national average, providing more disposable income.

As a business, Tractor Supply benefits from little competition, strong management with exceptional track record of execution, high visibility in unit growth and continued initiatives to drive margins higher.

Source: Morningstar, as at 9 August 2021.

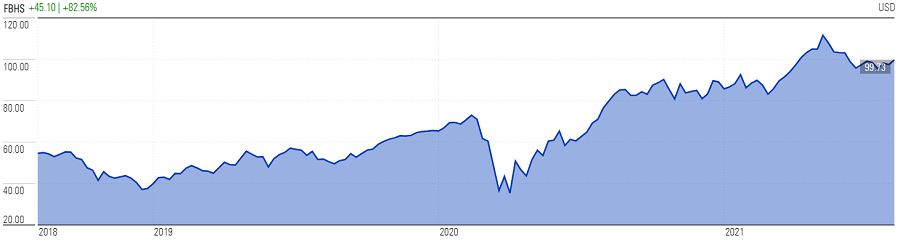

5. Fortune Brands Home & Security (FBHS)

FBHS produces a range of home improvement products including cabinets, doors, locks, decking, fencing and plumbing solutions.

FBHS has benefitted from consumers being in lockdown and choosing home improvements and DIY in place of travel. Looking forward, we believe there is a strong under-appreciated housing recovery underway in the US over the next few years, and FBHS is well placed to benefit from this.

Source: Morningstar, as at 9 August 2021.

With a strong macro backdrop, good opportunity to expand margins, and upside from successful capital deployment, we see good upside to earnings over the next few years, which does not look to be accounted for in the current valuation.

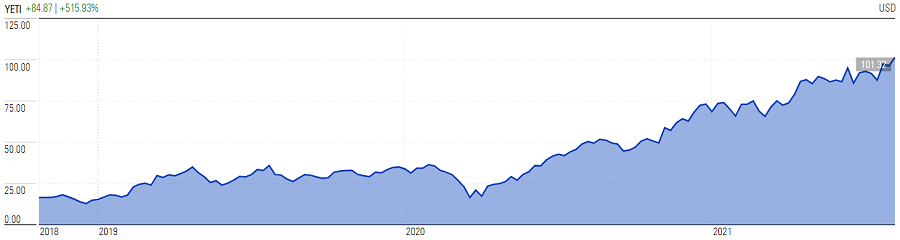

6. Yeti

Yeti Holdings designs, markets, and distributes branded products for the outdoor and recreation markets, including drinkware, coolers, bags and apparel.

Demand for Yeti’s products was incredibly strong during the COVID period. US consumers spent more discretionary dollars on ‘outdoor living’ and this trend is continuing as lockdowns persist and US consumers decide to have more localised and outdoor type holidays.

Yeti has also benefited from a very strong online presence and loyalty program, with sales through its direct channel (both Yeti.com and Amazon), growing by 46% in FY20, reaching close to 60% of total company sales.

Source: Morningstar, as at 9 August 2021.

International (outside US) markets provide an excellent long-term growth opportunity for Yeti. In 1Q21, international sales grew over 100% y/y but still make up less than 10% of total company sales.

Yeti generates gross margins over 50%, strong ROE and positive free cash flow despite still being early on in its expansion phase. We see good upside to earnings for many years to come.

Looking ahead

While the backdrop for global markets remains supportive for a strong earnings recovery, we should expect volatility as global corporates deal with a range of external risk factors such as new COVID variants, supply chain issues, cost inflation and the risk of rising interest rates from current depressed levels.

In this environment, it is important to focus on the underlying fundamentals of companies and invest in the names that are well placed to handle any external disruptions. There are many high quality global SMID companies that should emerge even stronger in a post COVID world.

Ned Bell is Chief Investment Officer and Portfolio Manager at Bell Asset Management, a Channel Capital partner. Channel Capital is a sponsor of Firstlinks. This information is not advice or a recommendation in relation to purchasing or selling particular assets. It does not take into account particular investment objectives or needs.

For more articles and papers from Channel Capital and partners, click here.