Roger Dargaville, Monash University

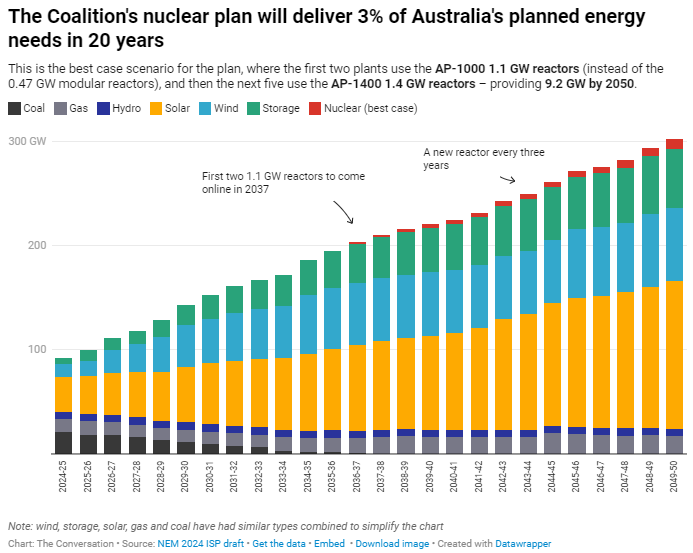

Peter Dutton has announced that under a Coalition government, seven nuclear power stations would be built around the country over the next 15 years.

Experts have declared nuclear power would be expensive and slow to build.

But what might happen to energy prices if the Coalition were to win government and implement this plan?

How might we estimate the cost of nuclear?

By 2035, 50–60% of the existing coal-fired fleet will very likely have been retired, including Vales Point B, Gladstone, Yallourn, Bayswater and Eraring – all of which will have passed 50 years old.

These five generators contribute just over 10 gigawatts of capacity. It’s probably not a coincidence that the seven nuclear plants proposed by Dutton would also contribute roughly 10 gigawatts in total if built.

Neither my team at Monash University nor the Australian Energy Market Operator has run modelling scenarios to delve into the details of what might happen to electricity prices under a high-uptake nuclear scenario such as the one proposed by the Coalition. That said, we can make some broad assumptions based on a metric known as the “levelised cost of electricity”.

This value takes into account:

- how much it costs to build a particular technology

- how long it takes to build

- the cost to operate the plant

- its lifetime

- and very importantly, its capacity factor.

Capacity factor is how much electricity a technology produces in real life, compared with its theoretical maximum output.

For example, a nuclear power station would likely run at 90–95% of its full capacity. A solar farm, on the other hand, will run at just 20–25% of its maximum, primarily because it’s night for half of the time, and cloudy some of the time.

CSIRO recently published its GenCost report, which outlines the current and projected build and operational costs for a range of energy technologies.

It reports that large-scale nuclear generated electricity would cost between A$155 and $252 per megawatt-hour, falling to between $136 and $226 per megawatt-hour by 2040.

The report bases these costs on recent projects in South Korea, but doesn’t consider some other cases where costs have blown out dramatically.

The most obvious case is that of Hinkley Point C nuclear plant in the United Kingdom. This 3.2GW plant, which is being built by French company EDF, was recently reported to be now costing around £34 billion (about A$65 billion). That’s about A$20,000 per kilowatt.

CSIRO’s GenCost report assumed a value of $8,655 per kilowatt for nuclear, so the true levelised cost of electricity of nuclear power in Australia may end up being twice as expensive as CSIRO has calculated.

Other factors play a role, too

Another factor not accounted for in the GenCost assumptions is that Australia does not have a nuclear industry. Virtually all the niche expertise would need to be imported.

And very large infrastructure projects have a nasty habit of blowing out in cost – think of Snowy 2.0, Sydney’s light rail project, and the West Gate Tunnel in Victoria.

Reasons include higher local wages, regulations and standards plus aversion from lenders to risk that increases cost of capital. These factors would not bode well for nuclear.

In CSIRO’s GenCost report, the levelised cost of electricity produced from coal is $100–200 per megawatt-hour, and for gas it’s $120–160 per megawatt-hour. Solar and wind energy work out to be approximately $60 and $90 per megawatt-hour, respectively. But it’s not a fair comparison, as wind and solar are not “dispatchable” but are dependent on the availability of the resource.

When you combine the cost of a mix of wind and solar energy and storage, along with the cost of getting the renewable energy into the grid, renewables end up costing $100–120 per megawatt-hour, similar to coal.

If we were to have a nuclear-based system (supplemented by gas to meet the higher demands in the mornings and evenings), the costs would likely be much higher – potentially as much as three to four times if cost blowouts similar to Hinkley Point C were to occur (assuming costs were passed on to electricity consumers. Otherwise, taxpayers in general would bear the burden. Either way, it’s more or less the same people).

But what about the impact on your household energy bill?

Well, here the news is marginally better.

Typical retail tariffs are 25-30 cents per kilowatt-hour, which is $250–300 per megawatt-hour. The largest component of your energy bill is not the cost of generation of the electricity; rather, it’s the cost of getting the power from the power stations to your home or business.

In very approximate terms, this is made up of the market average costs of generation, transmission and distribution, as well as retailer margin and other minor costs.

The transmission and distribution costs will not be significantly different under the nuclear scenario compared with the current system. And the additional transmission costs associated with the more distributed nature of renewables (meaning these renewable projects are all over the country) is included in the estimate.

According to my back-of-the-envelope calculations, your retail tariff under the nuclear scenario could be 40–50c per kilowatt-hour.

But if you are a large energy consumer such as an aluminium smelter, you pay considerably less per kilowatt-hour as you don’t incur the same network or retailer costs (but the cost of generating electricity in the first place makes up a much bigger proportion of the total cost).

So if the cost of electricity generation soars, this hypothetical aluminium smelter’s energy costs will soar too.

This would be a severe cost burden on Australian industry that has traditionally relied on cheap electricity (although it’s been a while since electricity could be described as cheap).

A likely increase in energy costs

In summary, in a free market, it is very unlikely nuclear could be competitive.

But if a future Coalition government were to bring nuclear into the mix, energy costs for residential and especially industrial customers would very likely increase.

Roger Dargaville, Director Monash Energy Institute, Monash University

This article is republished from The Conversation under a Creative Commons license. Read the original article.