With only a few weeks left until 30 June, it's time to check your SMSF is in order and you are making the most of the strategies available to you.

Be careful not to allow your accountant, administrator or financial planner to reset any pension that has been grandfathered under the pension deeming rules that came in on 1 January 2015 without getting advice on the consequences. Point them to this document.

1. Watch the timing

If you are making a contribution, the funds must hit the SMSF's (or any super fund's) bank account by the close of business on the 30th June (a Tuesday in 2020). Some clearing houses hold on to money before presenting them to the super fund.

In addition, pension payments must leave the account by the close of business unless paid by cheque in which case the cheques must be presented within a few days of the EOFY. There must have been sufficient funds in the bank account to support the payment of the cheques on 30 June 30.

Get your payments in by Friday 26 June or earlier to be sure (yes I’m Irish).

2. Review your Concessional Contributions (CC) options and new rules

The big news is the government has changed the contribution rules from 1 July 2020 to extend the ability to make contributions from age 65 up to age 67. Read more here. Maximise contributions up to CC cap of $25,000 but do not exceed your limit.

The sting has been taken out of excess contributions tax but you don’t need additional paperwork to sort out the problem. Check employer contributions on normal pay and bonuses, salary sacrifice and premiums for insurance in super as they may all be included in the limit.

3. Consider using the ‘carry forward’ CC cap

Broadly, the carry forward rule allows individuals to make additional CC in a financial year by utilising unused CC cap amounts from up to five previous financial years. Eligibility requires a total superannuation balance just before the start of that financial year of less than $500,000 (across all your super accounts).

This measure applies from 2018-19 so effectively, this means an individual can make up to $50,000 of CC in a single financial year by utilising unapplied unused CC caps since 1 July 2018.

4. Review plans for Non-Concessional Contributions (NCC) options

From 1 July 2020, the new age limit of 67 will apply to NCCs (that is, from after-tax money) without meeting the work test. You have the option of making $100,000 NCCs per year up to 67. Check out ATO superannuation contribution guidance .

Hopefully this month (tabled for 18 June 2020 sitting), Parliament will also pass legislation allowing use of the 'three-year bring forward rule' up to age 67.

Current Option if turned 65 in 2019-20: NCC of $100,000 or $300,000

Proposed Option: NCC $100,000, NCC $100,000 2012-21, NCC $300,000 2021-22

NCCs are an opportunity to move investments into super and out of a personal, company or trust name.

As many shares have been hit by COVID-19, you may find it a good opportunity, for personal tax reasons, to move some assets into super.

If you have sold your home in the last year and you are over 65, consider eligibility for Downsizer Contributions of up to $300,000 for each member.

5. Calculate co-contributions

Check your eligibility for the co-contribution, it's a good way to boost your super. The limits have changed based on your income and personal super contributions, so use the super co-contribution calculator.

6. Examine spouse contributions

If your spouse has assessable income plus reportable fringe benefits totalling less than $37,000 for the full $540 tax offset or up to $40,000 for a partial offset, then consider making a spouse contribution. Check out the ATO guidance here.

7. Give notice of intent to claim a deduction for contributions

If you are planning to claim a tax deduction for personal concessional contributions, you must have a valid ‘notice of intent to claim or vary a deduction’ (NAT 71121).

If you intend to start a pension this notice must be made before you commence the pension. Many people like to start pension in June and avoid having to take a minimum pension in that financial year but make sure you have claimed your tax deduction first. The same notice requirement applies if you plan to take a lump sum withdrawal from your fund.

8. Consider contributions splitting to your spouse

Consider splitting contributions with your spouse, especially if:

- your family has one main income earner with a substantially higher balance or

- if there is an age difference where you can get funds into pension phase earlier or

- if you can improve your eligibility for concession cards or age pension by retaining funds in superannuation in the younger spouse’s name.

This is a simple no-cost strategy I recommend for everyone here.

9. Act early on off-market share transfers

If you want to move any personal shareholdings into super (as a contribution) you should act early. The contract is only valid once the broker receives a fully-valid transfer form so timing in June is critical. There are likely to be brokerage costs involved.

10. Review options on pension payments

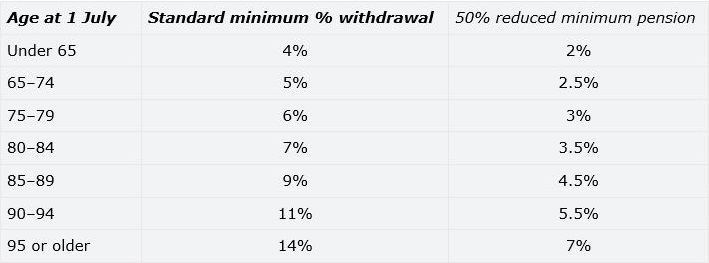

The government has brought in the Temporary Reduction in Minimum Pensions as part of the COVID-19 response. Ensure you take the new minimum pension of at least 50% of your age-based rate below. If a pension member has already taken pensions payments of equal to or greater than the 50% reduced minimum amount, they are not required to take any further pension payments before 30 June 2020. For transition to retirement pensions, ensure you have not taken more than 10% of your opening account balance this financial year.

Minimum annual payments for pensions for 2019/20 and 2020/21 financial years.

If a pension member has already taken a minimum pension for the year, they cannot change the payment but they can get organised for 2020/21. So, no, you can’t sneak a payment back into the SMSF bank account!

If you still need pension payments for living expenses but have already taken the 50% minimum then it may be a good strategy for amounts above the 50% reduced minimum to be treated as either:

- a partial lump commutation sum rather than as a pension payment. This would create a debit against the pension members transfer balance account (TBA). Please discuss this with your accountant and adviser asap as some funds will have to report this quarterly and others on an annual basis.

- for those with both pension and accumulation accounts, take the excess as a lump sum from the accumulation account to preserve as much in tax exempt pension phase as possible.

11. Check your documents on reversionary pensions

A reversionary pension to your spouse will provide them with up to 12 months to get their financial affairs organised before making a final decision on how to manage your death benefit.

You should review your pension documentation and check if you have nominated a reversionary pension in the context of your family situation. This is especially important with blended families and children from previous marriages that may contest your current spouse’s rights to your assets. Also consider reversionary pensions for dependent disabled children.

The reversionary pension has become more important with the application of the $1.6 million Transfer Balance Cap (TBC) limit to pension phase.

12. Review Capital Gains Tax on each investment

Review any capital gains made during the year and over the term you have held the asset and consider disposing of investments with unrealised losses to offset the gains made. If in pension phase then consider triggering some capital gains regularly to avoid building up an unrealised gain that may be at risk to legislation changes.

13. Collate records of all asset movements and decisions

Ensure all the fund's activities have been appropriately documented with minutes, and that all copies of all statements and schedules are on file for your accountant, administrator and auditor.

In particular, review your Investment Strategy and ensure all investments have been made in accordance with it and the SMSF Trust Deed, including insurances for members. See my article on this subject here.

14. Arrange market valuations

Regulations now require assets to be valued at market value each year, including property and collectibles. For more information refer to ATO’s publication Valuation guidelines for SMSFs.

On collectibles, play by the new rules that came into place on 1 July 2016 or remove collectibles from your SMSF.

15. Understand COVID relief on in-house assets

If your fund has any investments in in-house assets you must make sure that at all times the market value of these investments is less than 5% of the value of the fund. Do not take this rule lightly as the new SMSF penalty powers will make it easier for the ATO to apply administrative penalties (fines) for smaller misdemeanours ranging from $820 to $10,200 per breach per trustee.

Due to COVID, the ATO will not take action against SMSFs where:

- at 30 June 2020 the market value of an SMSF’s in-house assets is over 5% because of the downturn in the share market

- the trustee of the SMSF prepares a rectification plan

- by 30 June 2021, the rectification plan either cannot be effectively implemented because of market conditions or does not need to be implemented because the market recovers and the 5% test is again satisfied at 30 June 2021.

16. Document COVID-19 rent relief

If you have provided rent relief to a tenant, related or not, ensure it is documented including the reasoning behind the trustee decision and the details of the relief provided.

The ATO has provided a non-binding practical approach of not applying resources to this issue for FY2020 and FY2021. However, this announcement while positive, should not be relied on given the considerable downside risks. Auditors will want full documentation.

17. Check the ownership of all investments

Make sure the assets of the fund are held in the name of the trustees (including a corporate trustee) on behalf of the fund. Check carefully any online accounts and ensure all SMSF assets are separate from your other assets.

We recommend a corporate trustee to all clients. This might be a good time to change, as explained in this article on Why SMSFs should have a corporate trustee.

18. Assess estate planning and loss of mental capacity strategies

Review any Binding Death Benefit Nominations (BDBN) to ensure they are valid, and check the wording matches that required by the Trust Deed. Ensure it still accords with your wishes.

Also ensure you have appropriate Enduring Power of Attorney’s (EPOA) in place to allow someone to step into your place as trustee in the event of illness, mental incapacity or death.

Check your Trust Deed and the details of the rules. For example, did you know you cannot leave money to stepchildren via a BDBN if their birth-parent has pre-deceased you?

19. Review any SMSF loan arrangements

Have you provided special terms (low or no interest rates, capitalisation of interest etc) on a related party loan? Review your loan agreement and see if you need to amend your loan.

Have you made all the payments on your internal or third-party loans, have you looked at options on prepaying interest or fixing the rates while low? Have you made sure all payments in regards to Limited Recourse Borrowing Arrangements (LRBA) for the year were made through the SMSF trustee? If you bought a property using borrowing, has the Holding Trust been stamped by your state’s Office of State Revenue.

20. Ensure SuperStream obligations are met

For super funds that receive employer contributions, the ATO is gradually introducing SuperStream, a system whereby super contributions data is made electronically.

All funds should be able to receive contributions electronically and you should obtain an Electronic Service Address (ESA) to receive contribution information.

If you change jobs your new employers may ask SMSF members for their ESA, ABN and bank account details.

Don’t leave it until after 30 June. Review your SMSF now and seek advice if in doubt.

Liam Shorte is a specialist SMSF adviser and Director of Verante Financial Planning. He is also a Director of the SMSF Association and he writes under the social media identity of 'The SMSF Coach'.

This article contains general information only and does not address the circumstances of any individual. It is based on an understanding of relevant legislation and rules at the time of writing, which may change.