- Report breaks down gender and generational approach to investing

- Gen Z most driven by performance - 42% check their investments daily

- Millennials most avid buyers of cryptocurrency – 20% own a digital currency

- Gen X most financially organised – 55% have a written financial plan

- Men 51% more likely than women to have investments

- Seven-in-10 Australians polled don’t have a financial plan

- ETFs almost on par with Australian shares as the top investment choice

Vanguard Australia has released a report on Australian attitudes and approaches to investing, showing that while half think about their financial future and lifestyle almost daily, some 70% don’t have a financial plan. Its findings explore Australians’ financial education, investments approach and future outlook.

Two-in-three Australians polled have made an investment, with males 53% more likely than females to have invested.[1] Gen X had the highest engagement –77% of the cohort had made an investment at some stage – followed closely by Millennials (69%) and Gen Z (49%).

Reflecting the well documented rise in investing activity during the pandemic, particularly amongst individual investors, one quarter (25%) of all respondents made their first investment in 2020 and another quarter (22%) in 2021. The report showed 82% of Gen Zs and 49% of Millennials responding to the survey made their first investment during this period[2]

The steep growth in popularity of exchange traded funds (ETFs) was also evident in the results with a quarter of those surveyed saying they held them as an investment, only slightly behind Australian direct shares. Overall, the top five investments cited were domestic shares (47%), ETFs (42%), property (29%), managed funds (28%) and term deposits (27%).

Perhaps unsurprisingly younger generations were more likely to invest in cryptocurrencies. Millennial (20%) and Gen Z (15%) respondents were more likely than their Gen X (10%) counterparts to hold digital currencies.[3]

Barriers to investing

The survey also highlighted that in addition to the anticipated barrier of lack of investible income, a lack of knowledge and confidence holds people back from investing. Top barriers to investment included insufficient funds (50%), lack of understanding (21%) and worry of making a bad investment (20%). Interestingly, more men (10%) than women (6%) cited an overall lack of personal interest in investing as a barrier.

The report also highlighted many are misinformed about the amount of funds they need to begin investing in their futures. While seven-in-10 believed they needed more than $1,000 to start investing, 35% believed they needed more than $10,000.[4]

Vanguard’s Head of Personal Investor, Balaji Gopal said “The survey highlights that many people hesitate to get started investing because of the misconception that you need a substantial amount of money.

‘However, investing beyond bluechip shares and property, which historically has been the mainstay for Australians investors outside of super, has become far more accessible in recent years. Retail investment platforms, such as Vanguard’s Personal Investor, now provides affordable access to funds and ETFs that place powerful asset allocation approaches that used to be the domain of professional investors due to high investment minimums, well within reach of everyday Australians,” said Mr. Gopal.

Reflecting on the prevalence of crypocurrency investing in the results, Mr Gopal said “We do urge caution against speculating in Bitcoin and other cryptocurrencies, which are largely unregulated and accompanied by a number of considerable risks including the potential loss of investment entirely in some instances.”

Investing behaviours and planning for the future

When surveyed on investment strategies, pleasingly respondents largely displayed positive investing behaviour through investing regularly, buying more than they sell, and tending to invest regularly and for the long term. Some 44% invest on a weekly or monthly basis, while only 25% sold in the same period. One-in-three who invest said they plan to hold for the long-term, however women were 34% more likely than men to hold long term.[5]

The survey also investigated financial planning and optimism for the future. The data showed seven-in-10 Australians haven’t formally planned for their future. For those who did, men (36%) were more likely than women (21%) to have a written plan.

Of those with a written financial plan, men (72%) were again more likely than women (60%) to engage the help of a financial adviser when making investment decisions.

“It’s Vanguard’s long held view that planning, discipline, keeping costs low and maintaining a long term perspective are the key things that give investors their best chance for success, said Mr Gopal.

“While it’s encouraging that this survey highlights how engaged Australians are in investing, and displaying some sensible investing behaviours, it’s troubling that so many seem to be doing so without first considering a financial plan or some view of a goals they are seeking to achieve. Without a plan it’s all too easy to get seduced by the daily hype or rattled by short term market bumps.”

Looking at where people seek investing information, Gen Z (47%) and Millennials (36%) sought the opinion of friends and families the most, while Gen X looked to the media (21%), and social influencers (11%) for information.

Despite the lack of planning, half (48%) of respondents think about their financial future and future lifestyle almost daily. Just under a third (21%) said they were investing to enable them to travel, while 25% were investing to purchase property.

25 years of Vanguard Australia, 1 year of Vanguard Personal Investor

2021 marks 25 years of Vanguard serving investors and their advisers in Australia and one year since launching Vanguard Personal Investor – a new investor platform providing direct access to Vanguard's extensive range of managed funds and ETFs. The platform caters to a broad range of investors, from those starting out who can take advantage of a low minimum entry point of $500, to the more established and experienced SMSF investors.

“We have learned a lot about our investors needs and preferences in the last 12 months since we launched Personal Investor. We are continually refining our offer to meet those needs with smart solutions and additional functionality. We have also added additional account access and are excited about further developments due to launch later this year.

“Reflective of this new consumer research, we are also seeing some good early signs that Vanguard Personal Investors are smart investors, just like the thousands of individual investors we have served in Australia for decades, and the tens of millions of investors worldwide. Tuned in to costs, diversifying and saving regularly, and challenging Vanguard to continue to innovate and improve on their behalf,” said Mr Gopal.

[1] Three-quarters (74%) of males have made a financial investment versus just under half of females (49%).

[2] 2020–2021.

[3] State breakdown of digital currencies investments: NT (37%), WA (20%), SA (19%), QLD (14%), VIC (12%), NSW (11%), TAS (10%), ACT (<1%)

[4] 71% of respondents believed they needed $1000 or more to start investing. Of these, 35% of respondents felt they needed $10,000.

[5] 39% of women and 29% of men plan to hold their investments for a long-term period of time (3-10 years).

About the research

Audience

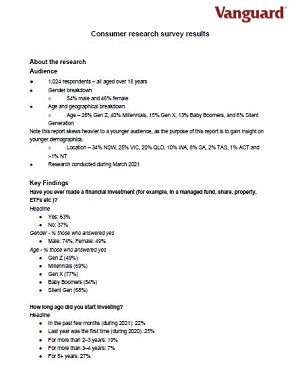

- 1,024 respondents – all aged over 18 years

- Gender breakdown

- Age and geographical breakdown

- Age – 26% Gen Z, 40% Millennials, 15% Gen X, 13% Baby Boomers, and 6% Silent Generation

- Note this report skews heavier to a younger audience, as the purpose of this report is to gain insight on younger demographics.

- Location – 31% NSW, 25% VIC, 21% QLD, 10% WA, 8% SA, 2% TAS, 1% ACT and <1% NT

- Research conducted during March 2021

Additional findings: Male v. female breakdown

- Financial advice – Women (43%) are more likely to base their investment decisions on the advice of family and friends over that of financial advisers, than men (33%)

- Written financial plan – Men (36%) are more likely than women (21%) to have a formal financial plan

- Engage a financial adviser – Men (72%) are more likely than women (60%) to engage a financial adviser

- Planning financial decisions – Men make financial decisions on a long (30%) or medium (30%) term basis whereas women make financial decisions on a monthly (38%) or medium (30%) term basis

- Barriers to investing for both men and women:

- Insufficient funds (50%)

- Lack of information or knowledge (21%)

- Worried about losing money (19%)

Additional findings: Generational breakdown

- Planning financial decisions

- Gen Z primarily make financial decisions on a medium-term basis (44%)

- Millennials primarily make financial decisions on a medium-term basis (29%)

- Gen X and Baby Boomers primarily make financial decisions on a long-term basis (38% Gen Z; 50% Baby Boomer)

- Barriers to investing: Insufficient funds to make the initial investment

- Gen Z (38%)

- Millennials (31%)

- Gen X (26%)

- Baby Boomers (26%)

- Barriers to investing: Lack of information or knowledge

- Gen Z (27%)

- Millennials (21%)

- Gen X (32%)

- Baby Boomers (1%)

- Insufficient funds after paying day-to-day expenses

- Gen Z (18%)

- Millennials (20%)

- Gen X (16%)

- Baby Boomers (19%)

- Worry about losing money or making a bad investment

- Gen Z (15%)

- Millennials (17%)

- Gen X (15%)

- Baby Boomers (41%)

Additional findings: Milestones saving or investing for

- Domestic or international trip (22%)

- Purchase of an investment property (13%)

- Purchase of a first property (12%)

Additional findings: Geographical breakdown

- State-based breakdown of those who don’t have a financial plan

- NT (80%), TAS (78%), QLD (77%), WA (77%), VIC (71%), SA (71%), NSW (64%), ACT (46%)

Additional findings: Optimism on financial future

- State-based breakdown of those most optimistic about their financial future

- ACT (46%), NT (40%), NSW (35%), WA (33%), VIC (31%), QLD (29%), SA (28%), TAS (26%)

Generation Breakdown

- Silent Generation: 1945 and under (75 plus)

- Baby Boomers: 1946 –1964 (75-57 years old)

- Gen X: 1965 – 1980 (56-41)

- Millennials: 1981 – 1996 (40-25)

- Gen Z: 1997 – 2009 (24-12)

- Gen Alpha: 2010 – now (11 and under)

Download the summary of survey results here