The Weekend Edition is updated to include an end-of-week market summary, plus Morningstar adds free links to two of its most popular articles from the week.

When we surveyed our readers, 72% said they would like to read more articles on stock picks, so the weekend selections include new stock-specific ideas. It's also a chance for a catch up on articles you may have missed. Previous editions are here and contributors are here.

***

Weekend market update

From Shane Oliver, AMP Capital: Share markets mostly rose over the last week helped by good earnings, dovish central banks and expectations that the softer than expected US jobs report for April will help keep the Fed accommodative. For the week US shares rose 1.2% to a new record high (but with the tech heavy Nasdaq losing 1.5%), Eurozone shares rose 1.5% to their highest since 2000 and Japanese shares gained 1.9%. Chinese shares bucked the trend and fell -2.5%.

Helped by the positive global lead and a dovish RBA the Australian share market also rose 0.8% making a new recovery high with very strong gains in materials, energy and financial stocks. While the ASX200 has worked off technically overbought conditions after its early April surge, it’s now just 1.1% below its all-time high from February last year with a good chance of bursting through to a new record high soon. Bond yields fell, but oil, metal and iron ore prices rose with the latter reaching a new record high. The $A rose as the $US fell.

From the AAP Netdesk: Major technology providers Afterpay and Appen lost about 20% of their share price as a terrible week for IT shares continued on Friday. Investors abandoned technology stocks for those expected to do better in a post-pandemic economy. Three of the big four banks reported first-half earnings this week which showed profits bouncing back from the pandemic.

***

This time last year, we were debating the shape of the recovery in alphabetic terms. Popular choices were the L, where the economy fell and stayed down for a long while, and the U, where the fall was followed by a period on the floor before a decent rise. Others offered the W, a series of rises and falls as pandemic waves took over, and the K, a widespread drop followed by strong rises and falls across sectors and economies. Now it looks like a tick or a swoosh are better analogies.

In Australia, the improvement in the Budget will fully reveal itself on 11 May, when unexpected revenues will allow Treasurer Josh Frydenberg to spend as if it's an election Budget ... which it is. For example, this chart from Ausbil clearly shows the V becoming a tick as 2021 unfolds.

Australian Real GDP Growth Forecasts

And the deficit improvement is substantial:

"Deloitte Access Economics estimates that deficits will be almost $100 billion smaller over the four years to 2023-24 compared with the latest official estimates. However, the size of the deficits are substantial – with the underlying cash deficit estimated at $167 billion this financial year and $87 billion next financial year. Government debt has also surged, which is of less concern in a low interest rate environment."

RBA Governor, Philip Lowe, said this week that the forecast for Australian GDP growth was revised up to 4.75% this year and 3.5% over 2022, when some were expecting a slowdown. Unemployment is expected to decline to around 4.5% at the end of 2022, raising the possibility of interest rate rises if there are inflationary signs.

In our articles this week, two fund managers believe the stock market still offers great momentum and future gains on the back of this growth.

Tim Toohey describes how consensus growth forecasts have been improving almost every month, but he believes they are still too conservative, as growth will surge over 2021.

Then Heath Behncke says any sell off of the big tech companies is a buying opportunity, and calling them 'growth' companies that will be left behind in the 'value' tilt is missing the quality of these great businesses.

What most investors a year ago underestimated was the response to the massive government programmes, the unlimited central bank stimulus, accommodative bank lending and the spending reaction to being locked up. Governments and bankers around the world realised there did not seem to be a limit to the largesse.

Critics were few. While some recognised an eventual day of reckoning, nearly everyone supported the need to spend during a pandemic. Then former US Treasury Secretary under Bill Clinton, Larry Summers, finally came out recently as President Joe Biden added another couple of trillion to his wish list, taking it over US$6 trillion (or was it US$8 trillion?) over coming years. Summers called it "the least responsible in 40 years" on fears of overstimulating and pushing up inflation. Biden responded by calling his programme "big and bold".

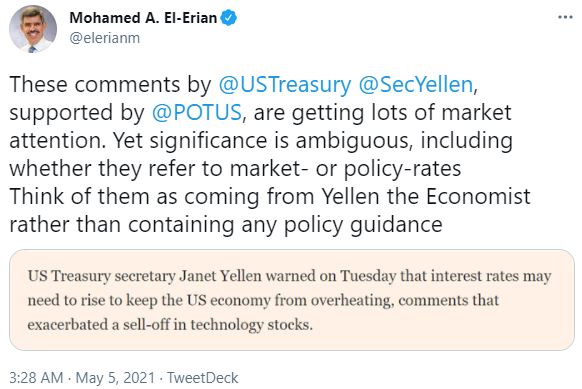

Yet did we see a chink in the armour of the dovish and current US Treasury Secretary, Janet Yellen, which hinted at rising rates? It contributed to a modest sell off in large US tech stocks, although she has since tried to walk away from her comments.

It's far from a set back for FAANG believers. For example, Apple shares have risen so much since the 1980 float at US$22 that the company has undergone five stock splits to keep the price manageable for new investors. When we see today's price of about US$130, it's easy to think it has not done much over 40 years. But we need care making comparisons over time, and allowing for the splits puts today's price at about US$22,000. Anyone for a 100,000% return? What, it fell 2%, oh dear!

Adjusting for stock splits in this Morningstar chart of the Apple price since 2000, there was no need to get in for the first 20 years to make a killing.

And that's what Warren Buffett did. He held off buying Apple shares, and famously eschewed tech stocks, until only five years ago, when he bought 10 million in 2016. He has since made far more investments and is up US$100 billion so far, and Apple has become by far his largest position.

But he warns that this type of individual stock picking is not the best strategy for inexperienced investors, and he and Charlie Munger are totally bemused by Bitcoin and Robinhood. He's been criticised many times in the past and his fund has struggled recently (see chart below), but as Emma Rapaport writes, his advice on how to invest is always worth reading. His tables on the difference between the top stocks in 1989 and now are revealing.

Two articles look at a bigger picture and perspective. Phil Ruthven provides fascinating charts on the composition of the Australian economy in contrast to the US, and explains why our market is underperforming. We have many great companies but not enough, and in the wrong sectors.

And Ashok Bhatia also supports the case for risk assets as economies undergo a transition to sustained and high economic growth but with volatility and changing correlations between asset classes.

And looking further to the future, but firmly in the present in how investors can benefit from a global trend, two articles on climate change. Richard Montgomery shows how a major thematic such as this can be backed by investing now, while Alex Debney describes how renewables are not only evolving but are already cost competitive, while there are challenges for investing in this opportunity. As Buffett said at his AGM last week, it's a lot more difficult to pick the winning companies than the winning industries.

This week's White Paper from Vanguard goes into more depth on 'value versus growth' as it will be a major factor in winning portfolios. Vanguard sees strong reasons for a value tilt. Do you lean towards the tech and disruptive 'growth' stocks or the more traditional 'value'?

Finally, sad to hear about Melinda and Bill Gates separating after 27 years of marriage. The increasing longevity we often discuss in a superannuation context is contributing to what are called 'grey divorces'. Most people who reach Bill Gates' age of 65 now realise they will probably live 20 to 30 years longer than their grandparents did, and they think more about how they want to spend those years, as Gates explained on Twitter.

At least we know they are such decent people that we will not have a public spat over the money, and continue their great charitable work.

***

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Morningstar senior editor Lex Hall we caught up with Jun Bei Liu who is upbeat about Australia’s recovery and sees opportunities across every sector. Elsewhere, in the first of a three-part series, Morningstar data journalist Lewis Jackson has crunched the numbers on that perennial debate: which asset class offers better returns, property or shares?

***

Finally, the Comment of the Week on the Ruthven article from Dane:

"It's mind boggling that investors can have over half their equity exposure in a skewed market that represents 2-3% of the investable universe. 'Home bias' on steroids. This article is quite revealing. Shows there is some work to do if we wish to become a dynamic economy and produce more national champions that compete on a global stage. What always stands out to me is that if you compare the top 20 stocks on the ASX there has been almost no change for decades, save for a few buy-now-pay later stonks. Whereas the US market has completely evolved."

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website