The Weekend Edition includes a market update plus Morningstar adds links to two recent highlights from the week.

Weekend market update

From AAP Netdesk: Shares had their best week of the year on the ASX as investors turned their attention from rate rises to the Australian earnings season. A gain of about 0.5% on Friday ensured investors finished the week ahead after a dismal January marred by rate rise concerns. The banks were mostly better. Westpac was best of the big four and rose 2% to $21.52. In mining, BHP dropped 0.5% to $46.81. Fortescue and Rio Tinto each rose less than 1% to $21.34 and 114.61 respectively.

Earnings will flood the market next week. The Commonwealth Bank is due to report first-half figures on Wednesday. Thursday will be particularly busy and will include AGL, AMP and NAB.

In Friday's trade, the benchmark S&P/ASX200 index closed up 42 points to 7120.1 points. For the week, the market rose 1.9%.

In company news, News Corp improved sales and earnings in its second quarter largely due to real estate and advertising. News Corp was up 5% to $33.38. REA Group, which recently purchased Mortgage Choice and REA India, gave first-half earnings and improved profit and sales thanks to a buoyant Australian property market. AMP will leave the New Zealand stock exchange after Friday and trade solely on the ASX.

From Shane Oliver, AMP Capital: Global share initially rose from oversold conditions helped by good US earnings results, but rate hike expectations particularly in Europe and in the US after very strong US payrolls and divergent tech sector earnings news added to volatility. Despite a hit from an earnings miss by Facebook, US shares rose 1.6% for the week and Japanese shares gained 2.7%, but Eurozone shares lost 0.5% as the ECB turned more hawkish.

Long-term bond yields rose sharply with German 10-year yields rising above zero for the first time since 2019 and Japanese 10-year yields rising to a five year high. Oil prices rose to their highest since 2014 on expectations for strong demand and geopolitical tensions and look like they are on their way to $US100 a barrel. Metal and iron ore prices also rose. The $A rose as the $US fell.

Fears of aggressive Fed tightening declined a bit earlier in the week as various Fed speakers pushed back against expectations for a 0.5% March rate hike, but returned later in the week as January payrolls came in much stronger than expected and wages growth surged more than expected.

The RBA’s preparedness to be 'patient' may be justified for a few months and is not inconsistent with our own base case that they won’t start raising rates till August. But it does remind me of Fed Chair Powell’s comment in November that “it’s appropriate to be patient” in terms of when rates would go up … and of course now the Fed is on track for rate hikes starting next month!

And with unemployment now expected to push below 4% and underlying inflation likely to push above the top of the target range, the RBA is running the risk of waiting too long to start monetary tightening which in turn will then risk allowing much higher inflation to become entrenched as inflation expectations increase, making it harder to get back under control again. This is the risk that central banks like the Fed may now be facing. Wages are usually a lagging indicator so waiting for them to rise significantly before hiking runs the risk that the first hike comes too late to head of a blow out in inflation expectations.

Cheap financing for banks ended in June, the 0.1% yield target ended in November and now QE will end in the week ahead. The big question is now whether the RBA will decide at its May meeting to roll over its bond holdings as they mature and so maintain their balance sheet or let them rundown – which would amount to quantitative tightening. I expect a bit of the latter to allow 'patience' on rates to run a few months more.

***

The German word 'schadenfreude' means the pleasure derived from another person's misfortune. The English language has appropriated the word, in the same way it nicked kindergarten, pretzel and doppelganger, although some claim the English 'epicaricacy' has a similar meaning. It's my guess that many people feel a level of satisfaction at the angst (another German word) now experienced by buyers of hot tech stocks, overhyped IPOs, Bitcoin, stonks and memes that thrived in 2020 and 2021 but are struggling in 2022.

Many US tech stocks that are supposed to be the next big things challenging the FAANGs have given back much of their gains. Twitter is down 50% from 12-month highs, Paypal has lost 40%, Spotify is down 32% and each of eBay, Nvidia, Salesforce and Adobe have shed over 20%. Even with a recent bounce back, Tesla is down 22% in three months (see Morningstar article later). Facebook (Meta) shedding 26% on Thursday (NYT) was in contrast to solid results from Alphabet, Apple and Amazon. Perhaps the FAANGs will become the AAAs.

In Australia, investors could not get enough of stocks that were supposed to benefit permanently from the pandemic and investors pushed them to all-time highs. Many have since fallen out of fashion and are well off their 12-month highs, such as Kogan ($18.01, now $$6.38), Accent Group ($3.08, now $2.03), Airtasker ($1.97, now $0.84), Appen ($25.46, now $10.38), BlueBet ($3.03, now $0.95), IOUPay ($0.85, now $0.20), Marley Spoon ($3.22, now $0.72), Nearmap ($2.79, now $1.35), Nuix ($10.35, now $1.51) ... on it goes. Jump on bandwagons and it's easy to fall off.

If you missed out on the IPO of some of these companies because you did not know anyone on the inside, enjoy your schadenfreude.

Investors often buy the good side of the story and then face a reality check. Kogan boasted a 90% growth in sales, but the market learned about narrower margins, supply constraints, high inventories and rising marketing costs. Here's Kogan for the last three years, showing how critical the entry price was. The three-year return is a healthy 51% but what a ride!

It is estimated that a million Australians have started investing or trading in the stockmarket since the start of COVID, encouraged by lockdowns, social media ramping and plenty of cash in the bank. For a long time, the profits were easy, and some people even quit their jobs. It's time to reassess.

This week's focus is on risk tolerance and loss aversion. Everyone knows the cost of participation in the long-term gains from equities comes with the risk of greater price volatility in the short term, and only you know if you have the temperament to stick it out when the market sells off.

The Australian market recently fell by 10%, although it has recovered 4% at time of writing. The most common advice is to look past the noise, but Christine Benz describes four circumstances where it might be appropriate to sell. It depends on where an investor sits in a long-term investing journey.

John Leske spent 20 years as a financial adviser and developed five checks on the personal financial health of his clients. He describes his framework which is a good guide for anyone wanting to measure their financial health.

During the GFC, bank hybrids fell heavily in price as bank share prices tanked, although not by as much. Norman Derham runs the numbers on recent bank and bank hybrid prices to see if changes to hybrid structures seem to have made them more resilient.

As investors look for alternatives to term deposits and low-yield bonds, they must decide how far up the risk curve they are willing to go in the search for yield. Andrew Lockhart explains why corporate debt carries acceptable risks for the rewards.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport. Competition from traditional automakers is highlighting lofty valuations on Tesla and others, writes Jakir Hossain. And in the Year of the Tiger, what's next for Chinese stocks? Lukas Strobl speaks to JPMorgan Asset Management strategist Mike Bell about what's ahead.

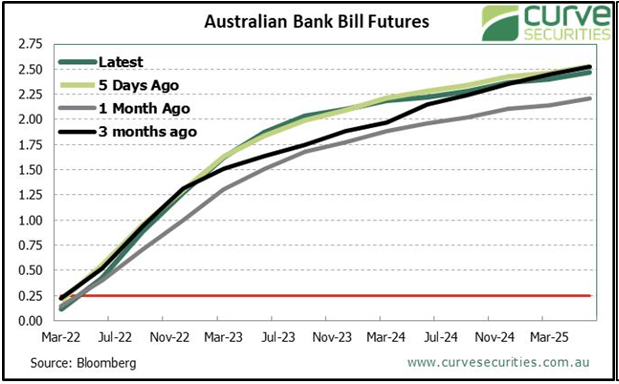

The Reserve Bank continues to show little sympathy for investors living on cash and deposit income, as it signals a resolve to hold cash rates down even in the face of rising inflation. Lowe by name and low by nature. We report on Governor Philip Lowe's statements and speeches this week where he stands firm waiting for inflation and wages numbers to confirm a longer-term trend. In fact, he sees 2022 as an historic moment to push unemployment to 50-year lows while managing inflation. However, the market disagrees, pricing in a continuous series of rate increases starting with four this year.

Nothing divides opinions, and perhaps generations, as much as Bitcoin. Cryptos are either the next tulip bubble or the currencies of the future, and everything in between. The doubters say anything with a 12-month range of $A38,000 to $A93,000 cannot be a means of exchange. Dan Annan is firmly in the other camp, and he explains how cryptocurrencies work and the activities of 'miners'.

Firstlinks has been criticised for not understanding the potential of cryptocurrencies, which is fair enough, but it is too volatile and unpredictable for a major role in retirement investment (although SMSFs held $228 million in cryptocurrencies at September 2021, according to the ATO). Many traders and speculators and true believers have done well, but one thing is for sure. Famous actors and footballers are unlikely to be the best place to go for guidance on investing. Somehow, I doubt Matt Damon or Neymar know much about crypto, although this is a great marketing video.

This week's White Paper from Epoch Investment Partners examines China's 'common prosperity' and its impact on large tech companies. With the US looking to delist some Chinese companies by 2024, equity market decoupling is destined to accelerate.

The Comment of the Week among many differences of opinion comes from Pippa on Ashley Owen's article on wealth inequality.

"Very interesting visuals and although Australia does relatively well on the inequality scale, look at the widening gap in income trend since the 1980s. So much for the promises of trickle down economics and globalisation. Goes a long way to explaining the rise of populism as the masses wake up to the fact they’ve been hoodwinked."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

VanEck China Investor Symposium: What to expect in the Year of the Tiger, 10 February 2022

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website