The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two highlights from the week.

For a Government that ran a small-target strategy prior to the election, this week's 100-days-in-office milestone for Anthony Albanese and his team was a reminder of how much is on the table in only a few months. While some policies around the jobs summit and the Indigenous Voice to Parliament were expected, unanticipated changes in the financial services landscape are coming thick and fast. Anyone who hoped superannuation and financial advice would go through a period of stability had better strap in for the ride.

Last week, at the annual Superannuation Lending Roundtable, Treasurer Jim Chalmers created plenty of industry angst when he advocated that the $3.4 trillion super sector should invest more in local social and nation-building investments such as housing and clean energy. There is an obvious potential conflict with generating the best returns for members, and he overlooked that about $900 billion is in SMSFs which are not likely to invest much in these projects without the right incentives.

The Treasurer also revived the seven-year-old commitment from the previous Government to legislate a purpose for superannuation. It's likely to say that super is for income in retirement. There is an attempt to rewrite history here as potentially hundreds of thousands of Australians do not see their superannuation this way. Entirely within the rules, people have been encouraged by successive governments to put money into super as a savings vehicle, and many have no intention of spending it all in their retirement. Making a statement about the objective of superannuation will not change anything for these people.

The Government has even announced a review of the Your Future, Your Super regulations and the performance test for super products.

But most notable was the release of the Quality of Advice Review - Consultation Paper - Proposals for Reform (a process started by the previous Government). If adopted, the proposals will have a profound impact on financial advice. We summarised the current predicaments in a 'whither or wither' article on financial advice a couple of weeks ago, but the Consultation Paper prepared by lawyer Michelle Levy will put financial advice back on a growth path. It proposes a relaxation of many regulations which have stifled financial advisers and forced many out of the industry. The challenge for the final paper (submissions are accepted until 23 September 2022) will be to strike the right balance between making more advice available while not compromising the protections built into the system for 20 years. They exist for a reason.

Consider a couple of highlights which have already attracted praise and criticism. The biggest change is the removal of the best interests duty, which is currently extremely broad in its application, including (from section 2.1 of the Review):

"Chapter 7 of the Corporations Act requires a person who provides personal advice to a retail client to ... a) act in the best interests of the client in providing the advice ... d) give priority to the client's interests if there is a conflict between the interests of the client and the provider or the interests of the client and the interests of an associate of the provider."

This will be replaced under the proposals by a 'good advice' requirement:

"A person who provides personal advice should be required to provide 'good advice’. 'Good advice' is advice that would be reasonably likely to benefit the client, having regard to the information that is available to the provider at the time the advice is provided."

It is far from straightforward what 'good advice' means. A person can visit five financial advisers and receive six opinions.

Then section 6.3 says:

"Proposal to remove the requirement for SOAs (Statements of Advice)

I query whether consumers want written advice at all, especially when the advice is simple or limited or when they have a regular relationship with the provider. In my view, the law should encourage and allow providers to provide advice in the way that best suits their customers."

Moving from the current administrative headache all the way to providing no written record of the advice is a radical step. Reactions were varied depending on whether they represented the industry or consumers. For example, the SMSF Association called the changes a “breath of fresh air”:

“We have also stressed that how advice is provided to clients needs to be commensurate with the level of complexity and the number of issues to be addressed. Simple, single-issue pieces of advice should be able to be delivered through a simple letter of advice. Currently, SOAs are risk management documents with a significant amount of their content compliance oriented. They have stopped being a consumer-centric document for the provision of financial advice and information."

Critics argue the concept of ‘good advice’ is too vague, and it might allow conflicted advice that promotes second-tier products that are only good in comparison to something worse. The obvious targets are banks cross-selling their own funds or financial advisers pushing funds where the issuer pays a selling fee. Michelle Levy conceded some form of best interests duty may be required for complex advice or where a commission is paid.

The Chief Executive of Choice, Alan Kirkland, said:

“We have grave concerns. If the government removes the best interests duty, as proposed in this report, we’ll go back to the bad old days. The Review’s proposals to weaken consumer protections will fuel a revival of vertical integration, by making it easier for large banks and super funds to use their data to flog products to existing customers.”

A brief comment on why the stockmarket is so spooked by Fed Chairman Jerome Powell's speech at Jackson Hole last week. It was the strength of his words, including "greater pain", which has caused the sell off:

"Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

Also in this week's edition ...

We interview Daniel Shrimski from the $10 trillion global fund manager Vanguard. Vanguard manages three times the amount in the entire Australian super system, considered one of the best in the world. He outlines their plans to move more into retail and adviser segments and out of institutional management.

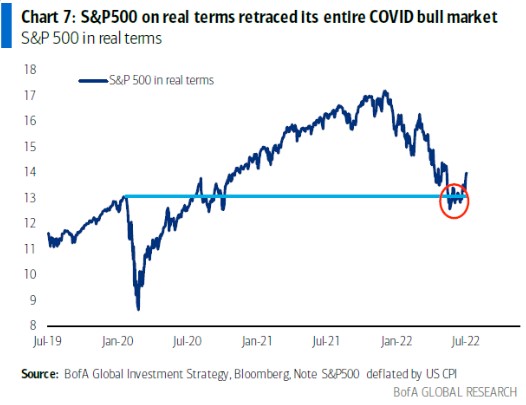

One of the few bright spots this year in investment portfolios is the energy sector, but some analysts are questioning its long-term merit. Shane Woldendorp from Orbis explains why it has years to run. It is sobering to realise that the US market has now given back in real terms (adjusted for inflation) all the rapid gains it made after COVID hit in early 2020. Those who stayed out in the pandemic and kicked themselves for missing the run up can relax a little.

With reporting season coming to a close in Australia, Jun Bei Liu of Tribeca summarises her main conclusions and companies that stood out to her.

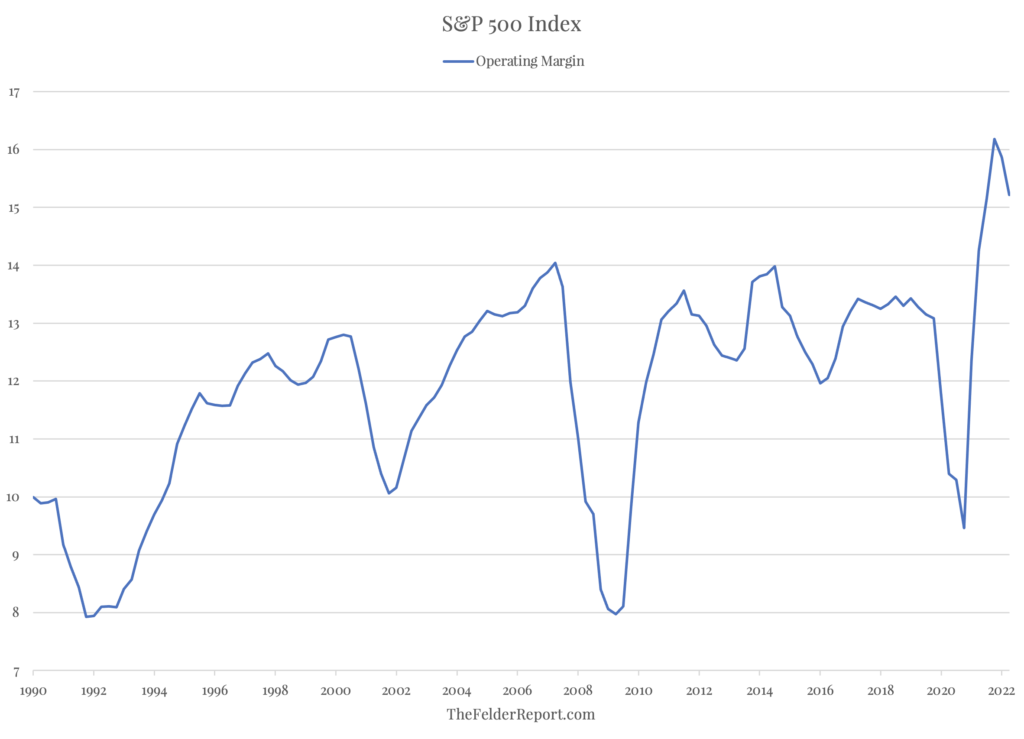

Many investors watch only Price/Earnings ratios, but it only has relevance if the earnings are sustainable. Investors need to watch company results to learn whether margins are under pressure, and this chart from Jesse Felder in the US suggests the elevated margin levels are rolling over.

This week, the former President of the Soviet Union, Mikhail Gorbachev, died. He won the Nobel Peace Prize in 1990, helped to end the cold war and hoped his country and its people would be more open and free. Until a couple of years ago, the drive towards greater globalisation and trading and cooperation between countries seemed ongoing, and there were few signs of serious conflict. Russia and China have changed all that, and Michael Collins from Magellan says the change will drive down living standards and growth for everyone.

As we described last week, retail investors in Australia hold a large proportion of the $40 billion in bank hybrids (sometimes called T1 securities) issued on the ASX. But Phil Strano from Yarra Capital reports that T1 paper issued by Australian banks offers better yields in offshore markets (issued in foreign currency so hedging or accepting FX risk is required). Investors can access the securities via funds or fixed interest brokers.

Many Australian equity funds have the ability to 'short' the market, but it comes with criticisms of its impact on prices and risk. Sean Roger of Perpetual gives a simple explanation of how long-short funds operate. and he answers the criticisms.

Two articles from Morningstar for the weekend edition. Christine St Anne checks the reporting season for A-REITS (listed property trusts) and finds some bright spots, while Nicola Chand talks to analyst Shaun Ler about his views on Zip Co (once a market darling) and the problems facing the Buy Now Pay Later (BNPL) sector.

Please note the special offer from Morningstar for the upcoming Conference for Individual Investors on 13 October 2022, where I will be hosting a panel on asset allocation. The first 50 Firstlinks readers to register using the code below receive a free ticket, and even those who miss this offer receive a discount of over 80%. Check the full agenda, it should be a great day at the ICC.

Graham Hand

Weekend market update

On Friday in the US, the S&P500 fell another 1.1% and NASDAQ lost 1.3%.

From AAP Netdesk: The Australian share market closed the week modestly lower, dragged by the mining sector as China's economic problems weigh on Australia's iron ore giants. The benchmark S&P/ASX200 index on Friday finished 12 points lower at 6,829, a 0.25%. For the week the ASX200 index fell 3.9%, its worst weekly performance in 12 weeks. The Materials sector dropped every day this week for a total decline of 10.3%, its worst week since March 2020.

Elsewhere on the day, the financial sector was up 0.7%, with all the big banks rising. Macquarie climbed 1.6% to $177.20, CBA gained 0.9% $96.95, ANZ added 0.5% to $22.75 and both NAB and Westpac advanced 0.8%, to $30.54 and $21.40, respectively. AMP fell 1.7% to $1.145 after Unisuper and Cbus Property elected to move management of the Pacific Fair Shopping Centre on the Gold Coast to rival GPT Group. AMP is selling its real estate business and the move will reduce the amount Dexus is paying for it by $50 million. In the energy sector, Woodside rose 0.5% and Santos gained 0.8%.

Next week in Australia, the Reserve Bank is set to raise rates again on Tuesday with important second-quarter GDP data being disclosed on Wednesday.

From Shane Oliver, AMP: Global share markets remained under pressure over the last week on the back of continuing hawkish comments from the Fed and ECB and ongoing concerns about recession. For the week US shares fell 3.3%, Eurozone shares fell 1.4%, Japanese shares lost 3.5% and Chinese shares lost 2%. Australian shares had remained a bit more resilient than global shares (helped by mostly positive earnings reports) but are now coming under pressure too. Bond yields rose sharply as higher short-term interest rates for longer were factored in. Oil, metal and iron ore prices fell with iron ore particularly hit by fears around new lockdowns in China.

Share markets ran ahead of themselves in the rally from their June lows into their mid-August highs recovering just over half of their earlier decline helped by mostly good earnings reporting seasons in the US and Australia.

Shares remain are at high risk of further falls in the short term: central banks including the RBA remain hawkish; recession fears remain high running the risk of significant earnings downgrades; September has been the weakest month of the year for US and Australian shares particularly when markets are already in a downtrend; and geopolitical risks remain high over Taiwan, Ukraine and the US mid-terms.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website