The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

Three years ago in February 2020, my wife and I were cruising around Antarctica, a long way from the pandemic hitting the rest of the world. Although the coronavirus was first detected in Wuhan, China, in December 2019, it was initially considered more like the earlier SARS and MERS, and cautionary checks before boarding the ship at King George Island in the South Shetlands were cursory. Throughout the trip, nobody wore masks or routinely disinfected their hands, even as we waited for the shared buffet three times a day, and we mingled with the 100 other passengers like we were old friends. There was no COVID-19 onboard or in Antarctica at this time and we were welcomed into scientific bases without any checks. We played with the polar bears (we took them with us to prove they existed in Antarctica) which were a hit with other passengers who queued to take photographs.

As we toured islands and historic sites, news drifted in that this virus was more serious. We joked that we might be the last surviving people on earth, isolated from humanity in our floating prison, unable to land anywhere and gradually running out of power and food. Back in Chile for the flight home to Australia, we escaped their border closure by only two days, and walked through Australian customs as normal, unaware of what was about to hit. Within a few weeks, tourists on the same ship were denied disembarkation in The Falklands and Argentina before pushing up the East Coast of South America and becoming stranded outside Montevideo in Uruguay. Passengers even thought they would die as they were locked in their cabins on a ship staffed by ailing crew members for a month.

"An Australian cruise company is working to disembark a stricken Antarctic cruise ship on which about 60% of the passengers and crew have been infected with coronavirus. The Greg Mortimer has been anchored 20 kilometres (12 miles) off the coast of Uruguay since 27 March, but authorities in the South American country had until now refused to allow passengers off."

Within weeks in Australia, lockdowns and strict rules about going to work, gatherings and leaving home would change some of our habits forever. Stockmarkets fell heavily as investors fretted about the impact on businesses and global trade, with the ASX200 losing 30% between 20 February and 16 March 2020. And then the cavalry rode in, with Australia's Reserve Bank announcing a wide range of measures to support the market, including buying bonds from banks, reducing the cash rate to 0.1% and offering a Term Funding Facility (TFF) to banks at 0.1% for three years. Of course, bankers love residential property, and instead of lending to businesses as the Reserve Bank hoped, the banks (with CBA leading the charge) turned $188 billion of term debt into fixed rate mortgage loans at 2% or less, and 2020 and 2021 saw a boom in residential prices rarely seen in Australia.

Three years is the crucial elapsed time, not only since our Antarctic adventure, but since enthusiastic borrowers started funding loans at 1.88% fixed for three years and bid up house prices to 'whatever it takes'. No doubt they figured their loan rate might rise by 1% to 2% a few years later, but nobody - least of all Reserve Bank Governor, Philip Lowe - expected the rate would become 6% to 7%. On $1 million, that's around $40,000 in after-tax dollars.

I rate the TFF as the most egregious and unnecessary policy, especially on top of everything else. Major banks were not facing funding problems but the $188 billion fuelled an auction bidding frenzy in 2021 that placed home ownership further out of reach of many young people. The Reserve Bank facilitated an 'up 30% down 10%' in residential property prices when a steadier market would have benefitted everyone.

S&P Global Ratings expects mortgage arrears to "meaningfully increase" due to this fixed to variable switch.

"The largest concentration of outstanding fixed-rate loans is set to roll over to variable rates in H2 2023. Many borrowers have split loans, with both variable and fixed rate components."

In a more encouraging conclusion, S&P forecasts interest rates will start to decline in 2024.

Retail sales remained robust throughout 2022, but they will hit a wall of reality as these borrowers desperately hang on to their homes. In a sign of the belt tightening to come, Australians cancelled 1.3 million streaming services in the December 2022 quarter. There is no 'hand back the keys and walk away' in Australia as there is in the US, and if a property is sold for less than the value of the debt, the banks will come looking for the shortfall. Everybody, including the banks, wants to avoid that.

By the time we publish the next edition on 9 February, we will know the first interest rate decision by the Reserve Bank for 2023. I expect they will increase cash to 3.35% to show their resolve to halt inflation, together with firm words in their statement, but then take a break to see what nine consecutive increases will achieve. Pushing up towards a terminal 4% will inflict even more pain on borrowers during 2023. The central bank should let economic activity ease without pushing for a recession and 10 consecutive rate increases would be overkill.

Overnight, the US Fed increased its benchmark rate by 0.25%, moving the target to 4.5% and 4.75%, and although this was less than previous increases, Chairman Powell indicated a policy firmness to control inflation. The market took it well with equities rising and bond rates falling, the key 10-year US Treasury rate down 0.1% to 3.4%.

It was not only banks and borrowers who reacted to the central bank largesse over 2020/2021. Fund managers were forced to decide which companies would benefit from changing behaviours, and global companies such as Peloton with its sophisticated home bike systems, Zoom for videoconferences, DocuSign for online signing and Spotify and Netflix for entertainment at home rose dramatically. Many investors benefitted before valuations came crashing down in 2022 (the USD amount below shows value of USD10,000 invested in the IPO, and companies such as Tesla and Netflix have still rewarded early funders despite the recent falls).

In Australia, it is unlikely that any other fund manager studied the science and shared their knowledge with investors as much as Hamish Douglass of Magellan. He told his large online audience that he was reading a couple of scientific papers a day, and his justified concern led him to adopt a defensive portfolio in 2020. As markets recovered strongly, especially the major tech stocks, Hamish underestimated a vital force working against Covid-19: Don't Fight the Fed. There was so much cheap money sloshing around and low interest rates meant valuations of companies with earnings far into the future were suddenly off the charts. The consequences of this miscalculation for Magellan and Hamish became more painful as the rally continued, but it was not for lack of understanding the nature of the pandemic.

Amid all the talk of transitory inflation in 2020 and 2021, Firstlinks published warnings by Professor Tim Congdon of the Institute of International Monetary Research not to ignore the money supply. Congdon argued we had forgotten some basic economic principles, and he wrote here as early as April 2020:

"The Federal Reserve’s preparedness to finance the coronavirus-related spending may prove suicidal to its long-term reputation as an inflation fighter ... If too much money is manufactured on banks’ balance sheets, a big rise in inflation should be expected."

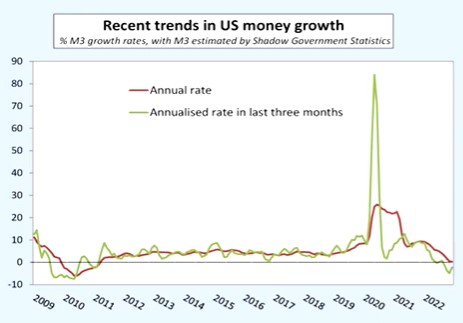

Markets ignored him as did global central banks. Tim's updated chart of US money growth, as shown below, illustrates the Federal Reserve actions in 2020 led to extraordinary money supply changes which have since delivered on Congdon's predictions. He says "I must protest" in his critical assessment of central bankers, leading economists and people with far-fetched ideas on what is causing inflation with no mention of the money supply, and he makes forecasts for 2023.

The increase in inflation forced interest rates higher and equity markets lower, and this Bank of America chart shows how most investors suffered as the traditional protection of bonds failed to materialise. How could prices rise even further when bond rates were already zero or negative? What were we blindly hoping for?

Congdon wasn’t alone in predicting inflation in 2020. Russell Napier, a go-to strategist for many of the world’s largest hedge funds and institutional funds, and author of the renowned book, Anatomy of the Bear, had similar warnings. Unlike Congdon, though, Napier thinks inflation will prove structural and investors will need to adjust to a world where economies aren’t guided by free markets anymore, but governments.

The euphoria in stockmarkets in January 2023 flies in the face of messages the central banks are giving to halt inflation. Writing in the Weekend FT on 28 January, Katie Martin reports on her visit to the World Economic Forum in Davos. Among the largest investors in the world, she says it was hard to find anyone buying into the optimism.

"Nicolai Tengen, head of Norway's enormous $1.3 trillion oil fund, is among the party poopers. With a dash of Nordic straight talking, he told me the fizzing market conditions that stemmed from the global injection of monetary stimulus after the outbreak of Covid had pulled a lot of 'crap' in to stock exchanges ... investors should accept that the Fed may very well restart rate rises and that a very long, slow grind of low returns lies ahead."

In my other article this week, the flows from Australian investors over the last couple of years are shown in a series of charts. Money surged into equities in 2021 and bond funds did well for inflows at the worst time for investors hoping for capital protection.

Last week was lively for comments, with about 120 on three articles. Thanks for the debate with plenty of different opinions. Doug Drysdale's experience as an executor was a warning not to overlook the complexity of superannuation and its relationship with an estate. A few critical points:

- There are limits to the people who can be defined as beneficiaries of super, including your spouse or partner, your children, financial dependants or your executor. It does not normally include grandchildren, other family members or friends.

- Your super does not automatically comprise part of your estate, and your super is held by the trustee of your super fund on your behalf, so the decisions of the trustee are crucial.

- This is why nominating a beneficiary to receive your super is important, as it may go to someone you do not want it to if left to the trustee's discretion.

Graham Hand

Also in this week's edition ...

Kaye Fallick looks at recent media articles mocking a couple with $1 million in assets who asked whether they would qualify for the Age Pension. She says the articles failed to address a key issue: whether the Age Pension system is still fit for purpose after being largely untouched since its inception at the beginning of last century.

Meanwhile, the retirement plans of Australians have changed following Covid, according to a new global survey by State Street Advisors. Australia stands out globally with 34% of respondents indicating a changed retirement outlook compared to 25% in the US, UK and Ireland.

And Michael McAlary believes that Covid has irrevocably changed other things in the investment world too. He thinks the 60/40 portfolio has reached its endpoint, the 'Fed Put' is gone for good, and moves away from US dollar transactions from countries outside the US will continue.

Growth stocks were obliterated last year, and Francyne Mu has been rummaging through these companies to find those that have strong competitive advantages and are now reasonably priced. She thinks she's unearthed three future gems in the US.

In the weekend update by Morningstar, Sarah Dowling offers a guide to the ASX reporting season, and Lukas Strobl reports that while Meta has more than doubled since November, Morningstar still sees upside.

Lastly in this week's White Paper, Franklin Equity Group explores five recent innovations, including renewables accessing deeper waters and artificial intelligence in the digital realm.

***

Weekend market update

On Friday in the US, hot economic data set the stage for broad-based weakness as stocks rolled lower by 1.1% on the S&P 500 while Treasury yields rose across the board, headlined by a 21 basis point leap in the two-year note to 4.3%. A near 1% pop in the dollar index put the brakes on key commodities with WTI crude sinking to $73 a barrel and gold hammered by nearly 3% to $1,879 per ounce, while the VIX retreated back towards 18.

From AAP Netdesk: The local share market finished at a fresh nine-month high on Friday after its third straight day of gains. The benchmark S&P/ASX200 index on Friday finished up 46.5 points, or 0.62%, to 7,558.1. The broader All Ordinaries on Friday rose 43.3 points, or 0.56%, to 7,771.8.

The Australian half-year earnings season starts next week with reports from the likes of Transurban, Suncorp, Mirvac, Boral and AGL.

Another theme playing out on Friday was the US dollar rebounding after weeks of declines. Blood products giant CSL, which makes most of its money in US dollars, climbed 3% to $313.81. Cochlear and Fisher & Paykel Healthcare both climbed more than 2%.

But the stronger greenback put pressure on dollar-priced commodities like gold and iron ore. Northern Star retreated 4% and Evolution fell by 3.3%.

Among the big three iron ore mining giants, BHP declined 1.9% to $47.91, Fortescue dropped 1.3% to $21.95 and Rio Tinto fell 2% to $122.94.

All the big banks were higher, led by ANZ which climbed 2.3% to $25.75. Westpac gained 1.8% to $23.92 and NAB and CBA both added 1.3%, to $31.90 and an all-time high of $111.15, respectively.

IAG fell 2.1% to $4.73 after the insurance giant warned its bottom line would be hit by last weekend's flooding in Auckland and claims inflation.

It now expects a full-year insurance margin of about 10%, versus expectations of 14-16%, after receiving more than 15,000 claims related to the storm in New Zealand's largest city.

Looking forward, on Tuesday the Reserve Bank will hand down its latest decision on interest rates.

Markets were pricing in a 75% chance the RBA will hike rates by 25 basis points to 3.35%, and a 25% chance it will keep them unchanged at 3.1%.

From Shane Oliver, AMP:

- Global share markets rose again over the last week continuing their rally seen so far this year, helped by confirmation that central banks led by the Fed are becoming less hawkish, albeit with mixed earnings news from US tech companies. For the week US shares rose 1.6% despite a fall back on Friday in response to stronger than expected US jobs data which reignited concerns about rate hikes, Eurozone shares rose 2.1%, Japanese shares rose 0.5% but Chinese shares lost 1%. Reflecting the positive global lead Australian shares rose another 0.9% for the week led by health, IT, property and retail stocks with the ASX 200 now just 0.9% below its all-time high. The $A fell back below $US0.70.

- After a nice six week break - where markets were sort of left on their own to interpret data and assess the outlook and in the process pushed shares up and bond yields down - central banks are back in action. It’s a bit like the parents returning after the kids were home alone for six weeks – but so far so good with the Fed, Bank of England and the ECB all leaning less hawkish than they were late last year, albeit less so for the ECB.

- The Fed of course is key given its influence globally. It hiked again but is sounding a lot less hawkish and open to a cut this year. As widely expected, the Fed downshifted to a 0.25% hike which took its Fed Funds rate to 4.5%-4.75%. The Fed is still hawkish in that it still anticipates “ongoing increases” in interest rates, still sees the labour market as tight and with Chair Powell wary of easing too soon. But against this Powell noted that the “disinflation process has started”, he didn’t push back against the easing in financial conditions, and he indicated a willingness to ease rates if inflation falls faster than the Fed anticipates (which is what we and the markets are expecting). So it was less hawkish than feared. We expect another 0.25% hike in March but since we expect inflation to fall faster than the Fed does – we expect this to be the peak for the Fed ahead of rate cuts later this year. The stronger than expected January payroll report in the US adds a bit of upside risk to this, but we expect US jobs data to slow going forward.

- The Bank of England hiked by 0.5% to 4% but indicated it could be finished hiking. Its still concerned by the risk of more persistent inflation but removed a reference to the possible need for more “forceful” action with Governor Bailey indicating it could be finished if data gives no further cause for concern.

- The ECB hiked by another 0.5% too taking its main refinancing rate to 3%, but even it signalled it may be getting near the top. The ECB is the most hawkish of the three – because it started rate hikes latter.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website