The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

The 2015 screen adaptation of Michael Lewis's book, The Big Short, is a tour de force of movie making and it won the Academy Award for Best Adapted Screenplay. The nonfiction book was subtitled Inside the Doomsday Machine and describes the growth of derivatives in the US housing bubble during the 2000s. The screen writers were faced with the almost insurmountable challenge of explaining Collateralised Debt Obligations (CDOs) and Credit Default Swaps (CDS) in a popular movie, and it could have turned into a poorly-executed farce, like Bonfire of the Vanities.

Yet The Big Short handled the complexities superbly with a stellar cast. The main technique chosen used characters and real-life authorities looking to camera and frequently interrupting the narrative. It might have crashed but it works well, often humourously. The intricacies of derivatives were explained in colloquial terms, such as this on CDS:

“Let me put it this way. I'm standing in front of a burning house, and I'm offering you fire insurance on it.”

There are many subplots to the story, with three main characters, Jared Vennett (Ryan Gosling), Scion hedge fund manager Michael Burry (Christian Bale), and one of his staff, Mark Baum (Steve Carrell), realising there was a housing bubble that must pop. The repackaged CDOs were rated AAA but our heroes believed they were fundamentally exposed to house prices, and they set about finding a way to short the market (Burry was a real person, the other two were based on other people).

The actual market experience was that a few people knew something was wrong but thousands of other experts went along with the status quo, that property prices do not fall. The best brains in major investment banks thought the mavericks were stupid, and wrote the other side of the multi-billion dollar trade. Then it became a matter of whether the small players could stay alive long enough to prove their thesis. I won't spoil the rest of the movie for those who have not seen it, but we all know how it ends.

While it's an extreme example of market inefficiency, similar events face investors regularly. A company share price might be super cheap due to a panic selloff after a short-term adverse event, or a one-off market share gain is taken as long term, or a competitive advantage is really a leaky moat.

Legendary investor Peter Lynch of the Fidelity Magellan Fund (no relation to Australia's Magellan) became known for his 'Going to the Mall' strategy. He sat around shopping malls watching how people were spending, which stores were busy and which were empty or closing, as a guide to buying or selling stocks. It often led to views counter to the market.

There are two ways individual investors can run with this. The vast majority will accept that they lack the relevant skills or interest or have better things to do than sit around a mall and then investigate companies. They will leave the investing to others either in an index or active fund. Others will try to find an edge where they know more about a company or industry than most others.

Don't assume the market is right. As Oaktree Capital's Howard Marks said:

"Investing is a popularity contest, and the most dangerous thing is to buy something at the peak of its popularity."

Investors should answer this question: over the long term, the best returns come from equities but prices are volatile and losses sometimes painful, so how much of my portfolio should I allocate to equities? We suggest a way to set the appropriate level which at times requires you to ignore what the market is screaming at you. We quote from Warren Buffett's mentor, Benjamin Graham, the father of value investing, including what comes next from this book extract:

***

For millions of savers, this week's increase in the cash rate to 4.1% is stimulatory, putting more income into their hands in stark contrast to the years of struggle with zero rates. But wait ... isn't the Reserve Bank trying to slow the economy? Ah yes, it's the borrowers who are suffering. The tussle continues for Governor Philip Lowe, and there's a suspicion that the wage increase of 5.75% by the Fair Work Commission was the vital factor this month. Treasurer Jim Chalmers has attempted to push the blame away from the Government and the rumour is he will announce Lowe's replacement within the next month, perhaps someone who is not so hawkish on inflicting more pain on borrowers. So Lowe might be motivated to push hard while he's still in the chair.

Services inflation is Lowe's major concern, but the two largest contributors are 'medical and hospital services' and 'tertiary and secondary education'. Neither of those will fall due to higher interest rates. Do we want people to stop going to the doctor?

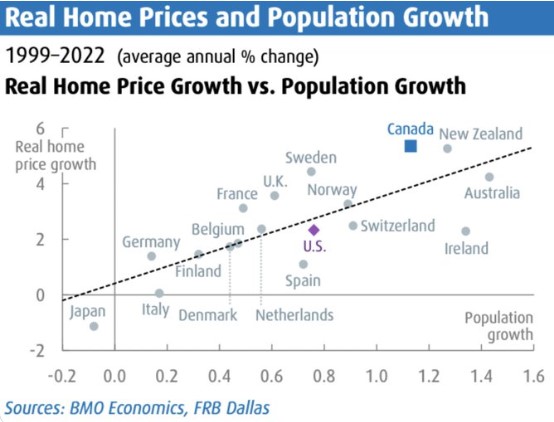

Rising house prices also played into the Reserve Bank decision, and it's a fascinating battle between lack of supply and surging migration, versus rising rates. Few people expected property prices to rise as strongly as they have in 2023, and as the chart below shows, there's a relationship between real house price growth and population growth, with Australia leading the way. While price momentum looks entrenched for a while, further rate rises will probably be the final straw for some homeowners or investors to either sell or shelve buying plans. The constraints on construction and rising rents are other factors.

The Reserve Bank decision was a day ahead of the National Accounts showing the rate rises are already biting, and Philip Lowe is making his 'narrow path' of controlling inflation without a recession even narrower. Household consumption per capita was negative in the March 2023 quarter, with GDP staying positive at 0.2% only due to population growth. Said Dwyfor Evans at State Street Global Markets:

“Quarterly growth came in at its weakest level since Q4 2018, reflecting the twin headwinds of rising inflation and higher interest rates and their combined impact on underlying demand. Weaker exports during the quarter was also a contributory factor – and speaks of a muted China re-opening impact on the Australian economy – and while the labour market remains robust, continued upside surprises on the cash rate (and related rates markets) and sticky inflation expectations will continue to weight over coming quarters.”

***

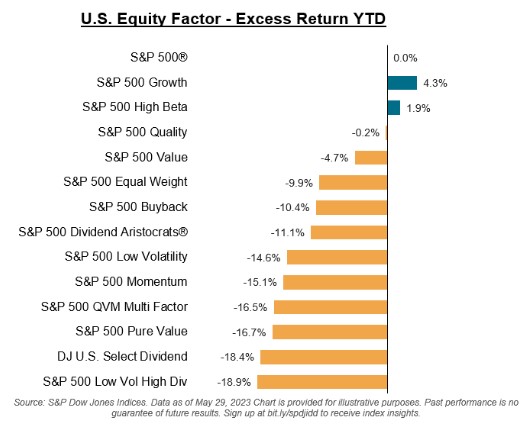

We have written previously about how the rising US market is an illusion for most investors because it is driven by a few large tech stocks. In the interview this week, CEO of Franklin Templeton, Jenny Johnson, elaborates on why fund managers diversify away from concentrated portfolios. Funds or individuals who don't own these stocks are missing out, and this chart starkly illustrates the point, showing performance of various equity factors relative to the S&P500. There are some large, traditional sectors having a tough YTD, and look at a favourite such as 'low volatility, high dividends', down 19%. Who doesn't want a fund targeting low volatility and high dividends?

***

Another Listed Investment Trust has given up on the battle to remove its discount to the value of its underlying assets, the Net Asset Value. It is embarrassing for some funds when the discount is persistent showing a general lack of interest from new buyers. Following in the footsteps of Monash and Ellerston, the Partners Group Global Income Fund (ASX:PGG) proposes to delist from the ASX and operate as an unlisted fund with monthly redemptions and subscriptions based on NAV. Redemptions from the unlisted fund will be limited to 5% of NAV per month and for 12 months from delisting, an exit fee will be applied to discourage arbitrage. The announcement has already caused the discount to NAV to reduce significantly, showing there are trading opportunities for anyone who can guess which funds might delist. There are plenty of LICs and LITs at significant discounts, as shown in the reports in our Education Centre.

***

Finally, thanks to the reader, Tony, who was inspired by recent articles on AI to ask ChatGPT the question: “Describe the Australian website Firstlinks in 100 words or less”. To which it replied:

“Firstlinks is a prominent Australian website offering independent insights on finance, investing, and wealth management. It caters to retail investors, financial advisors, and self-managed super funds.

The site features articles, research reports, and educational resources covering topics such as macroeconomics, asset allocation, stock selection, and retirement planning. It also delivers a weekly newsletter summarizing investment news and market developments.

Firstlinks is highly regarded for its valuable content and is a trusted resource for Australian investors. Its focus on independent analysis and educational materials makes it beneficial for both new and seasoned investors."

Neat. Further evidence of how good this AI is.

Graham Hand

Also in this week's edition ...

Australian investors are sometimes shielded from industry trends overseas so it was refreshing to hear more from Jenny Johnson at the recent Morningstar Investor Conference in Sydney. And she didn't hold back, suggesting banning commission-based financial advice is a bad idea for many investors, and explaining why private assets might carry different valuation than listed shares.

Most people love a good bargain, especially when it comes to stocks, though the allure, as well as gains or losses, are often short-term. Rudi Filapek-Vandyck thinks quality companies are a better option, as they beat cheap prices in the long run, and act as safe havens when markets get rough. He identifies an Australian tech company that wears the Quality label.

It's nearing the end of the financial year, so SMSFs and other super funds should check the strategies available to them. Verante Financial Planning's Liam Shorte gives us a comprehensive 24-point checklist of the most important issues to address.

Should you invest for the short-term or the long-term? There's no definitive answer and much will depend on your personality and investment style. Chris Demasi of Montaka Global Investments believes there are five things to consider before choosing between investments with shorter and longer time horizons.

While the macroeconomic picture seems volatile with soaring inflation and signs of weakening growth, stock markets remain remarkably calm. Casey Mclean of Fidelity International says Australia's prospects look better than most other countries and the outlook for consumer staples and small cap stocks is especially attractive.

Kaye Fallick became a retirement publisher in her early 40s and she's learned plenty about retirement planning in the 20 years since. Kaye shares five lessons she's learned about managing retirement savings, including getting out of denial, knowing the detail and embracing delayed gratification.

Two extra articles from Morningstar for the weekend. Joshua Peach looks at fast fashion retailer Lovisa's growth plans to 2030 as well as the most undervalued ASX stock in Morningstar's coverage universe.

And in this week's white paper, Van Eck investigates how equal weight allocation outperforms market capitalisation indices because it consistently gives greater exposure to smaller stocks.

***

Weekend market update

On Friday in the US, stocks edged higher as the S&P 500 managed to reach a fresh 52-week peak, though the major indices finished well off their best levels of the day. Short-dated Treasurys came under renewed pressure after yesterday’s bounce as two-year yields established fresh post-March highs at 4.59% while the long bond stayed unchanged at 3.89%. Meanwhile, gold held steady at $1,975 an ounce and WTI crude slipped to $70 a barrel.

From AAP Netdesk:

The local share market on Friday finished higher on weak economic data supporting a pause in US rate hikes, but the gains weren't enough to keep the bourse out of the red for the week.

The benchmark S&P/ASX200 index closed Friday up 18.8 points, or 0.32%, 7,122.5, while the broader All Ordinaries rose 24 points, or 0.33%, to 7,312.3.

For the week, the ASX200 closed down 22.6 points, or 0.32%.

Xero gained 2.7%, Altium added 1.4% and Wisetech Global climbed 2.6%.

The Big Four banks were mostly higher, with ANZ the biggest gainer, rising 0.8% to $22.85. NAB climbed 0.2% to $25.20 and Westpac added 0.3% to $20.25, while CBA edged 0.1% lower to $95.80.

In the heavyweight mining sector, BHP rose 1.3% to $44.72, Fortescue climbed 1.4% to $20.79 and Rio Tinto added 0.5% to $114.58.

Nickel Industries soared 13.3% to a seven-week high of 98c after Indonesian heavy equipment giant PT United Tractors agreed to invest $943 million to acquire a nearly 20 per cent stake in the company. Managing director Justin Werner said the partnership with one of Indonesia's largest public companies was a significant step forward for Nickel Industries - which has principal operations in Indonesia - becoming a leading global nickel producer.

Imugene advanced 7.5% to 10c after the Sydney immuno-oncology company announced its early-stage trial evaluating the safety of its cancer-fighting virus injection was progressing to its next cohort of three to six patients.

Eventually the study aims to enrol up to 100 Australian and American patients with metastatic or advanced solid tumours that haven't been successfully treated with two lines of standard cancer therapies.

Dexus fell 1.4% to $8.14 as the office tower owner announced it had sold a prime 26-level Sydney office tower at 44 Market Street for $393.1 million, 17.2% below its December 2022 valuation, in another sign that working-from-home trend is taking a toll on the price of office space.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website