The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Active fund managers receive a lot of criticism, especially directed at their inability to consistently beat their benchmarks over time. The struggle to outperform is not because portfolio managers are inexperienced or lacking talent. In fact, it's probably the opposite. Almost every fund manager is smart and dedicated, and while there are a few with exceptional skills, everyone is competing against similarly-qualified investors. For every Sam Kerr, there are a hundred talented but not star players.

But one person's meat is another person's poison. We all have different tastes. Some investors prefer to see the value of their funds grow steadily over time, allocating to traditional fund managers who buy 'value' stocks, such as mainstream industrials, with less price volatility. Others go for high performance, which might mean up 40% year, down 20% the next in a riskier growth style, as long as the portfolio delivers over time.

Many years ago, I managed the borrowings for Colonial First State's geared share funds. In the 10 years to the GFC, the funds grew rapidly as equity markets rallied, reaching $10 billion at their peak, with borrowings of about $4.5 billion. It became like a mini-Treasury operation, with funding programmes locally and overseas.

There was never any doubt about our gearing strategy. We always made it totally clear at every presentation and offer document:

"We borrow to the maximum extent possible subject to the gearing rules."

We never tried to second-guess the market, up or down. In the main fund, the rules permitted a gearing of up to 60% (that is, for every $100 of assets, $60 was funded by debt and $40 was owned by investors), subject to an interest rate cover test. We figured that anyone investing in the fund wanted the leverage - the supercharging - and if they preferred to avoid the added risk, they would not invest in the fund. So we put the pedal to the metal all the time, which of course led to strong results in a rising market.

Then the GFC hit and the leveraged losses were extreme. As the market value of the shares fell, we repaid debt quickly to ensure the gearing did not go above 60%. It wiped billions from the funds and investors who bailed at the time suffered heavy losses. The price history of the fund below shows the large falls in 2008 and 2020 (the fund is now managed by First Sentier) but $10,000 invested in 2002 is now worth $80,000 with distributions reinvested (although not using a log scale disguises the fact that half the gain came prior to 2008).

Return history of the Colonial First State/First Sentier Geared Share Fund

Looking over 20 years in the chart shows how the leverage exaggerates the market's gains and losses. It is what it is - a geared fund - and any investor needs to accept the wild ride.

After the GFC, when investors complained and said, "You should have known the market would fall and reduced the gearing in advance, because you are supposed to be the experts," well, sorry, that's not the way it works. CFS (and me) had no more insight into the GFC than anyone else, and imagine the complaints if we had de-geared a couple of years earlier and missed the 2006 to 2008 rally.

Investors should know what they are likely to experience when they select a fund, and the manager should continuously explain how its style will respond to different conditions. Consider two Australian boutiques with a strong growth style, Montaka and Hyperion. Both are believers in the future potential of great global tech companies.

For example, Chris Demasi from Montaka wrote last week:

"While stock prices of some of the world’s best companies are up a lot this year, they are only just getting back to where they were at the beginning of last year. Meanwhile, their underlying businesses are much better positioned than they have ever been and keep getting better. These are companies that can multiply in value many times over by the end of this decade."

And in its latest investor update, Hyperion writes:

"A key structural theme that Hyperion identified approximately 10 years ago was AI and Machine Learning, however the potential upgrades to revenue streams, efficiencies in productivity and eventually earnings are only now starting to be recognised by market participants."

In 2022, investors marked down the 'Magnificent Seven' stocks (as Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta are now known) in the face of higher interest rates and lower growth. Then in the first half of 2023, the NASDAQ tech index had its best opening run in 40 years, up 31%. Both Montaka (for example, its global fund listed on the ASX as MOGL) and Hyperion (its global listed fund is HYGG) spent most of 2022 explaining to their clients that they still believed in their investment thesis, and investors should hang in for better times for their growth style. Over 2022, Hyperion lost about 44% while Montaka was down 38%, making for some difficult conversations.

But as shown below using Morningstar data, those who gave up and bailed at the end of 2022 have missed the recovery of most of the losses.

Montaka's MOGL and Hyperion's HYGG global funds since 1/1/2022

Source: Morningstar, MOGL in red, HYGG in blue

Source: Morningstar, MOGL in red, HYGG in blue

Looking at 2023 to date paints a much rosier picture than the pain of 2022. HYGG fell further and has recovered more than MOGL but both have rewarded the stayers.

Montaka's MOGL and Hyperion's HYGG global funds since 1/1/2023

Investing in active managers is as much a long-term decision as allocating to the stockmarket itself. The current market is frustrating for some value fund managers who have under-allocated to the Magnificent Seven. For all the hype, analysis, bravado, debating and presenting that goes on in every fund manager each day, recent relative performance comes mainly from one decision: how much was invested in the big tech companies?

These seven stocks are now so valuable that in the main measure of the global stockmarket, the MSCI ACWI (All Country World Index), they make up more than the weighting of the entire stockmarkets of the next four countries after the US. Little wonder most US investors cannot see past their own borders, as global diversification has not been a good performer for them.

To complicate matters further, the long-term evidence over 100 years of US data and 50 years of global data that many traditional managers rely on shows that value stocks outperform growth stocks over time. Or perhaps this 'value versus growth' debate itself is overdone, when fund managers should invest in great companies regardless of their label. In Australian equities, a value manager (Merlon Concentrated Value Fund) was the top performer in the year to 30 June 2023, beating a growth manager (Hyperion’s Australian Growth Fund) and a style-agnostic manager (Yarra Capital’s Australian Equities Broadcap Fund) so what does it all matter?

On the subject of 'risk on', there are increasing signs that institutional investors are discounting the possibility of a recession and taking more risk in equity markets, for the first time in about 18 months. It doesn't take much for the mood to change.

***

There also is growing confidence that the Reserve Bank has finished its current tightening cycle. CBA Economics expects cash rates to be held at 4.1% for "an extended period":

"The data flow before the August Board meeting appears crucial in allowing this more comfortable tone. The Minutes noted “the information received on inflation over the prior month had been reassuring”. Q2 23 CPI printed below expectations with headline CPI at 0.8%/qtr and 6.0%/yr. Further detail in the Minutes was provided “Inflation had fallen further and been a little lower than expected in the June quarter”. The weak retail trade print for June and confirmation of retail volumes contracting would also have contributed to the on hold decision. The RBA has also expressed its view the labour market is at a turning point, albeit labour market conditions remain tight."

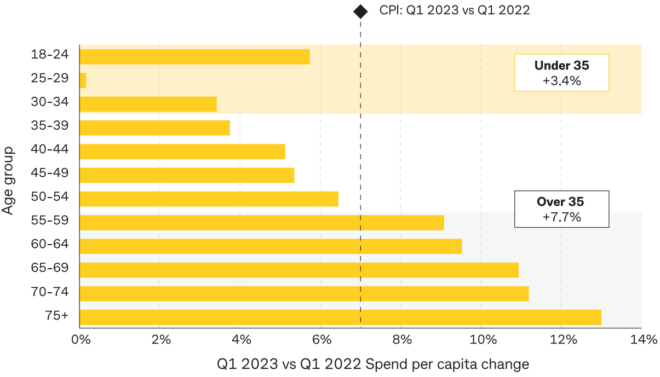

Data from CBA also shows that the traditional patterns of younger generations spending more to buy goods and services, while older people cut down on consumption to preserve their capital, is not playing out. Older generations have the wealth from rising property prices and interest earned on savings, while younger generations are hit with larger debt repayments.

CBA reports that Baby Boomers increased their spending the most, led by outlays at cafés and restaurants, which grew by 18% year-on-year. CBA says Baby Boomers carry little mortgage debt but hold 43% of total CBA savings. Boomer savings increased 5% over the year while savings shrunk for those households aged 34 and under.

"The data clearly shows that the RBA’s rate hikes are exacerbating intergenerational inequality ... The Baby Boomer generation is also driving Australia’s household consumption, which has forced the RBA to respond with higher interest rates to the detriment of young Australians with mortgages. The success in fighting inflation is heavily dependent on curbing spending for those households aged over 55, in particular the Baby Boomers."

Treasurer Jim Chalmers has announced that the latest version of the Intergenerational Report will be released next week. It will make fascinating reading about how future generations will need to cope with challenges facing the nation's finances.

There was also a good indication during the week of the higher costs the banks face as the highly-favourable (and largely unnecessary) Term Funding Facility starts to mature. CBA issued a massive $5 billion debt facility in the wholesale bond market with the following tranches (3m BBSW is currently about 4.15%):

- $1.1 billion 3 year floater at 3m BBSW + 0.75%

- $2.4 billion 5 year floater at 3m BBSW + 0.95%

- $1.0 billion 5 year fixed at 4.90%

- $500 million 3 year fixed at at 4.75%.

The TFF was provided by the Reserve Bank at rates of 0.1% to 0.25%. A gift.

In my article, I check the latest demographic data on life expectancy at the age of 65, and draw on Vanguard's 30-year performance chart as a guide to what retirees can expect in a long retirement. It should give more people confidence that their savings will keep up with their spending, rather than leaving most of it to the kids to enjoy. Do what the CBA data shows and get out there and enjoy your hard-earned.

Graham Hand

Also in this week's edition ...

Most agree that financial advice is a good thing yet not enough people, especially heading into retirement, access it. Whether the Federal Government's response to the Quality of Advice Review is enough to bring about much-needed change remains to be seen. Kaye Fallick examines what's gone wrong with financial advice and offers some solutions.

Electric vehicles are the future as the world targets net-zero emissions by 2050, but as Magellan's Ben McVicar and Ofer Karliner write, the current system isn't equipped for dealing with the shift to EVs. Trillions of dollars will need to be spent to address the issues and Magellan believes electric utilities are a low-risk way to play the multi-decade theme.

China is in the headlines for all the wrong reasons. Economic growth is tanking as the country grapples with deflation. It doesn't help that geopolitical tensions mean Western countries are trying to reduce their reliance on Chinese products. The big question is: which country or countries can replace China as the world's manufacturing powerhouse? Jason Hsu of Rayliant Global Advisors has some answers.

It's ASX reporting season and sometimes all isn't what it seems in a company's financial accounts. Hugh Dive of Atlas Funds Management offers a guide on analysing financial statements to help you spot potential red flags.

What went up in 2020-21 - cryptocurrency, commodities, real estate and economic growth - has retreated starting late 2021 and early 2022. Now, Brandywine Global's Francis Scotland says, it's inflation’s turn, and central banks are behind the curve again.

Superannuation is a valuable investment structure and contemplating the intended recipient of these savings in the event of death is crucial. Yet as Rohani Bixler suggests, there's a significant limitation: super benefits can't be directly allocated to charities.

Two extra articles from Morningstar for the weekend, one on earnings results from three undervalued ASX shares, and Susan Dziubinski reports on three Warren Buffett stocks to buy.

This week's White Paper from Neuberger Berman examines 10 key market themes for the remainder of this year.

***

Weekend market update

On Friday in the US, indices recovered from early session losses to close mixed. The Dow finished up 0.1%, the S&P 500 was flat, and the Nasdaq ended down 0.2%. After spiking earlier in the week, the US 10-year bond yield slipped marginally to 4.25%. Bitcoin got trampled again, down more than 5%. Brent crude oil rose 0.8% to US$84.79 a barrel.

From AAP Netdesk:

The local share market suffered its worst weekly losses in nearly a year, dragged down by fears about China's economy and rising bond yields in the United States.

The benchmark S&P/ASX200 index finished Friday basically flat, gaining 2.1 points, or 0.03%, to 7,148.1, while the broader All Ordinaries rose 1.6 points, or 0.02%, to 7,366.0. For the week, the ASX200 finished down 2.6%.

In a bit of consolation for investors on Friday a number of companies rallied after reporting earnings results.

Magellan Financial Group leapt 13.3% to a nearly one-year high of $10.42 after the asset manager announced a special dividend and a new chairman. Magellan has endured turmoil and outflows after the departure of star stockpicker Hamish Douglass in early 2022 but CEO David George said during 2022/23 the company had laid a foundation that would allow it to return to growth.

Packaging company Amcor added 5.6% to $14.96 and warehouse owner Goodman Group climbed 7.3% to $22.40, a day after both reported earnings.

Abacus Group rose 10.2% to $1.19 after the commercial property trust raised its payout following a 13% rise in property income.

The Big Four banks were lower, with CBA down 0.6% to $99.05, NAB 0.5% to $27.68 and ANZ and Westpac both dipping 0.4%, to $24.49 and $21.27.

In the heavyweight mining sector, BHP rose 1.4% to $43.69, Fortescue climbed 1% to $20.33 and Rio Tinto added 0.9% to $105.69.

Looking forward, there are no big macro events on the domestic calendar next week, although some of Australia's biggest companies will be reporting earnings, including BHP, Wesfarmers, Woodside and Woolworths.

In the US, the Jackson Hole summit of central bankers will be held toward the end of the week in Wyoming, where attention will be focused on Federal Reserve chairman Jerome Powell's address.

From Shane Oliver, AMP:

- Global share markets fell over the last week on the back of concerns about more central bank rate hikes, ongoing upwards pressure on bond yields and worries about poor growth and property problems in China. For the week US shares fell 2.1%, Eurozone shares fell 2.4%, Japanese shares fell 3.2% and Chinese shares lost 2.6%. Bond yields continued to rise. Oil prices fell back a bit but remain well up from June lows on the back of supply cutbacks. Metal prices fell but the iron ore price rose. The $A fell further as the $US rose, as RBA interest rate expectations fell relative to those in the US and as worries about the Chinese economy intensified.

- Shares look to be entering a correction. For some time we have been concerned about the risk of a correction for shares given strong gains for the direction setting US share market into July which left it technically vulnerable as we came into the seasonally weak August to October period. From their July highs US and Australian shares have pulled back by around 4-5% but markets remain at risk of further falls given: the still high risks of recession; intensifying risks around the Chinese economy; a pause in disinflation in response to higher energy prices and sticky services inflation; central banks still at risk of more hikes; the high risk of another US Government shutdown from 1 October; and rising bond yields. We would regard further falls as part of a correction though and we retain a positive 12-month view on shares as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.

- So what’s driving the renewed rise in bond yields? From their lows in April, 10-year bond yields have increased around 100 basis points pushing US yields to their highest since 2007 and Australian yields to their highest since 2014. The main driver has been stronger than expected economic data fuelling expectations of higher for longer central bank interest rates. But also acting to push up bond yields are increasing concerns about high budget deficit and public debt levels in the US following Fitch’s downgrade to the US’ credit rating, the return of US Treasury issuance following the resolution of the debt ceiling and the Bank of Japan’s loosening of its cap on its 10-year bond yields. Australian bond yields have just been dragged up with US yields, but this is hard to justify given domestic developments with smaller public debt and more vulnerable households. If global growth slows as we expect then it will help to put a lid on bond yields but that may take time. In the meantime, the rebound in bond yields is putting renewed pressure on share markets as higher bond yields make shares look less attractive to investors. It also risks higher fixed mortgage rates which is another drag for the residential property market, and it will intensify the hit to commercial property values. The combination of rising bond yields and renewed strength in the $US has also contributed to a 17% plunge in Bitcoin from its July high.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website