The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

The Treasurer, Jim Chalmers, released the sixth Intergenerational Report on Thursday. It gives an outlook for the economy, the budget and demographics over the next 40 years until 2062/2063. It is usually released every five years (previous reports were in 2010, 2015 and 2021) but the 2023 version was moved forward because the Treasurer wanted a frame of reference for a policy agenda. It's not clear why it was so urgent because the Government has made it clear that any major (read, unpopular) reforms will be kicked down the road.

The main implication for the budget was already known: health, aged care, the NDIS, defence and interest payments on debt will rise from one-third of Federal spending to a half over the next 40 years, an increase of $140 billion.

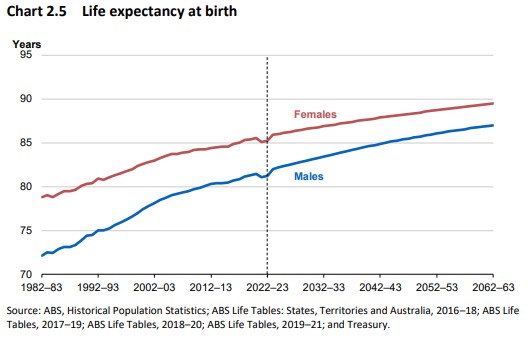

The narrow tax base with its dependence on personal income taxes draws attention to intergenerational inequity and a growing number of retirees supported by fewer young people. With life expectancy expected to continue to push out, the report says the number of Australians aged over 65 will double the current proportion, reaching nine million, and those over 85 will triple. As we explained last week, life expectancy at age 65 is significantly longer than life expectancy at birth.

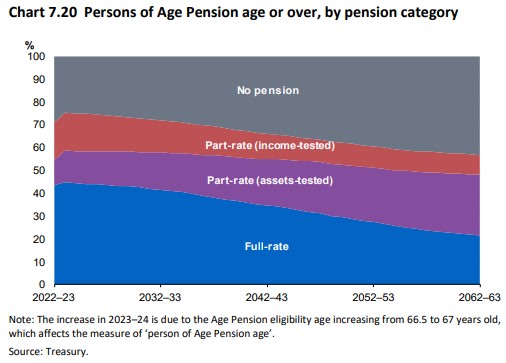

The cost of the age pension is expected to fall from 2.3% of GDP to 2% with the rise of superannuation, although this will highlight the cost of super concessions, rising from 1.9% of GDP to 2.4%. We have previously explained why the cost of super is exaggerated but this chart shows the percentage of people of pension age receiving full age pension will fall significantly while no pension rises.

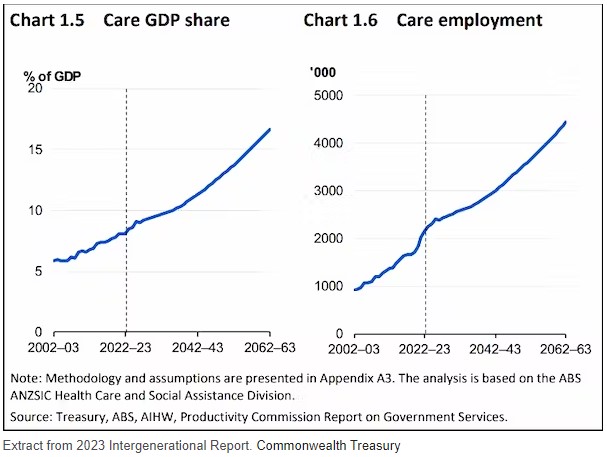

One number with profound implications is Australia's expected population, reaching over 40 million in 2062. As most people gravitate to a few major cities, it will be a challenge to house, care for, educate and transport another 15 million. With so many people living longer, the 'care economy' is forecast to increase from about 8% of GDP to 15%. Employment in 'care' will rise to 4.5 million. Chalmers said:

“Whether it’s health care, aged care, disabilities or early childhood education – we’ll need more well-trained workers to meet the growing demand for quality care over the next 40 years. The care sector is where the lion’s share of opportunities in our economy will be created.”

Where do we find millions of new workers willing to take low-paying jobs caring for others while packing into the most expensive cities in Australia? There's only one place - net inward migration - which is forecast at 235,000 a year for 40 years. Advances in robotics, AI and other technologies will need to fill some of the supply gap. Unlike other countries such as Japan and large parts of Europe, there should be no fear of a declining population and its negative impact on growth in Australia.

While the report will generate worries about whether there will be enough money to sustain aged pensions and health care, there is always money for defence. The Government announced a $1.7 billion for some new high-tech missiles, $800 million for rocket launchers and $430 million for anti-radiation guided missiles. And let's not start on the bottomless pit of submarines, now up to $368 billion, and climate change, costing the economy up to $423 billion.

If all this confirms one thing, it's that we can stop protesting about the new tax on $3 million superannuation balances. Somebody must pay for these expenditures and wealthy superannuants are an easy target. Treasurer Chalmers quotes this new super tax as evidence of his reform agenda but the anticipated revenue of $2 billion a year is tiny compared with the future funding needs.

***

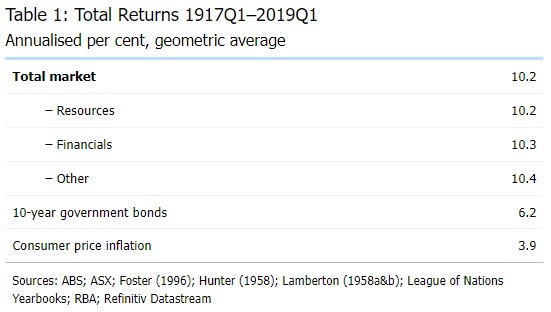

A primary focus of both equity and bond markets at the moment is the equity risk premium, the excess return over the rate on safe government bonds for taking a risk on equities. A 2019 Reserve Bank paper stated that the equity risk premium for Australia was about 4%, based on long-term returns from equities (price and dividends) of 10.2% and government bonds of 6.2%.

The current 10-year Australian bond rate is 4.25%, and the All Ords dividend yield (excluding franking credits) is 4.45%. While this is not total returns or expected earnings, it shows investors are taking the risk on equities (and other assets such as commercial property) without a dividend premium, in the hope that stock prices will rise.

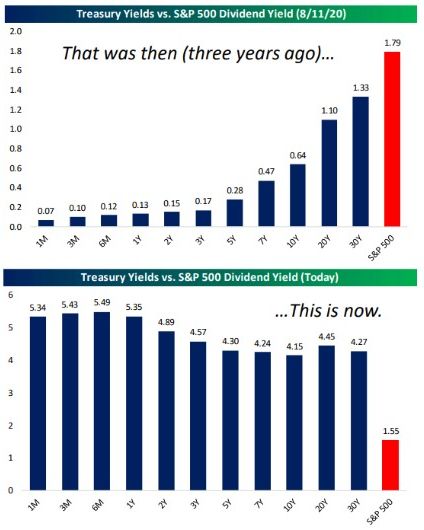

Looking only at dividend yields versus bond yields in the US, the change in recent years has been dramatic, with S&P500 dividend yields falling despite a rapid increase in Treasury bond rates.

Source: Bespoke Investment Group and Clime

Then based on earnings yield (earnings per share shows how profitable a company is while dividends per share shows how much is paid to shareholders), this chart from Bank of America shows the equity risk premium (measured as S&P earnings yield versus US 10-year Treasury yield) is the lowest for 20 years. It has been as high as 7% in this period, and BofA says it shows equities look expensive. Bonds are certainly back in the game for asset allocators.

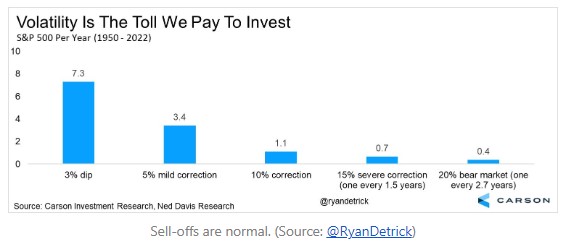

Still on US data after the recent 5% fall in the S&P500, it's good to remember that such corrections are regular and normal. The chart below shows the average number of 5% selloffs since 1950 is 3.4 a year, while at least one 10% selloff occurs on average each year, with a 20% correction every 2.7 years.

One reason for investor caution buying long-term bonds is the capital loss if rates continue to rise. While there is a growing belief that Australia is at the top of the cash rate tightening cycle, long-term bonds react to many factors other than short-term rates.

A recent offer of a bond in the market illustrates how a long bond can deliver gains or losses usually expected from equities. A Treasury Corp of Victoria (semi-government) bond maturing in November 2042 and paying a 2.25% coupon is currently offered with a yield to maturity of 5%, at a price of $66.26 (per $100 face value). If yields fall by 1% over a year, the price rises to $77.82 giving a one year capital gain of $10.98/$66.26 or 16.5%, in addition to the coupon. Looks great if rates fall. But if rates rise by 1%, the price will fall by 14%, according to the offer sheet.

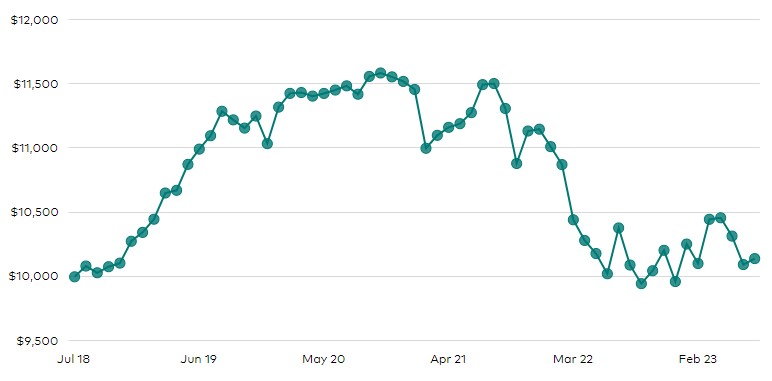

In the retail investor space, a common ETF is the Vanguard Australian Government Bond Index ETF (ASX:VGB). It offers a current yield to maturity of 4.15% with a weighted average maturity of 6.6 years and a modified duration of 5.6 years. If rates rise by 1%, investors will lose 5.6% on the price. It is important to know the duration of any fixed rate investment and be aware of exposure to rising and falling rates.

Here is the value of $10,000 invested in VGB five years ago with coupons reinvested, and no allowance for inflation. As rates fell during the pandemic, the price rallied, but all has been given back as rates rose. In nominal not real terms, the investment is back to the starting investment. Remember, this is a bond fund, not a bond, so it never matures.

The ultimate bond duration play is the Republic of Austria's Century Bond, due to mature in 2117, but it is more volatile than equity prices and not for the faint-hearted.

In the first of my two articles this week, I give examples of the confusing interpretation of economic and financial data, where it's possible to make bad news out of good news in some perverse ways. Little wonder the direction of markets is difficult to predict when the dismal science of economics does not know its good from its bad.

Then I review the amazing month of the Women's World Cup, a wonderful celebration of sport that brought millions of new faces, female and male, into the game I have played for 60 years. Amid the triumphing of a new era for women's sport and football generally, as the A-League heads into its 19th season, I check whether the Matildas will deliver bigger crowds and viewers for the domestic professional leagues.

Graham Hand

Also in this week's edition ...

Asset allocation doesn't receive enough airtime compared to individual assets such as shares and bonds. Clime Investment Management's John Abernethy addresses it, specifically for SMSF allocations. John offers some guidelines for how SMSFs should plan asset allocations and the macroeconomic events that could influence future allocations.

From going it alone with an SMSF to defaulting into a large super fund balanced option, administration time and fees for superannuation vary materially. Morningstar's Annika Bradley has an in-depth guide to the costs involved and the potential impact on returns.

There's been the fastest rise in interest rates in 50 years yet consumers and corporates have held up remarkably well. Munro Partners' Qiao Ma says we're not out of the woods with inflation proving sticky and further rate rises expected in coming months. But she's positive on the outlook with rates peaking soon and signs of a re-acceleration in corporate earnings.

A new Wealth of Experience podcast features special guest, Platinum Asset Management CEO Andrew Clifford. Andrew explains how investors fleeing China is paving the way for extraordinary opportunities, and why Japan is one of the best world's equity stories over the next five years. Graham Hand looks at life expectancy and investment returns, while Peter Warnes examines what CBA's result tells us about the outlook for banks and the economy.

Niall O'Sullivan of Neuberger Berman says now is not the time to be making major calls on asset allocation. While this 'neutral' view could imply there isn't much to do, Niall disagrees, suggesting there are many ways to generate incremental returns over the next 12 months, highlighting value in US government bonds and commodities.

Two extra articles from Morningstar for the weekend, one on 3 undervalued ASX shares reporting strong earnings, and Christine St Anne asks whether the Kogan sell off was overdone.

Lastly, in this week's White Paper, Franklin Templeton highlights investment opportunities that it likes, including fixed income, high-yield debt, and emerging markets.

***

Weekend market update

On Friday in the US, stocks like what they heard from Federal Reserve Chair Jerome Powell as the S&P 500 rose 70 basis points to wrap up a volatile week that ended slightly in the green. Meanwhile, Treasurys were weak at the front-end with two-year yields rising back above 5% and the long bond was steady at 4.3%. WTI crude oil rebounded to US$80 a barrel, gold edged lower to US$1,913 per ounce, and the VIX retreated below 16.

From AAP Netdesk:

The local share market on Friday closed lower amid jitters about what Fed chairman Jerome Powell might say at the Jackson Hole Symposium, an annual meeting of central bankers in the US. The benchmark S&P/ASX200 index on Friday finished down 66.9 points, or 0.93%, to 7,115.2. It was the second straight week of losses for the index, which dropped another 0.46% following its big 2.6% sell-off last week. The broader All Ordinaries on Friday finished 68 points lower, or 0.92%, to 7,332.6.

Nine of the ASX's 11 sectors finished lower on Friday - all except the consumer discretionary and consumer staples sectors.

Wesfarmers aided the former, climbing 3.2% to a one-week high of $51 after the conglomerate delivered better-than-expected full-year earnings, thanks in part to strong performances by Kmart and Bunnings. Kmart Group earnings soared 52.3% to a record $769 million as the chain attracted more shoppers, with some looking for bargains and other attracted by what Wesfarmers boss Rob Scott described as the increasing quality of its products.

Pilbara Minerals fell 8% to $4.70 despite the leading lithium producer more than quadrupling its net profit to $2.4 billion. Elsewhere in the mining sector, BHP was down 1.7% to $43.02, Fortescue dropped 0.6% to $20.93 and Rio Tinto retreated 0.9% to $107.90.

All of the Big Four banks were lower, with NAB falling 1.8% to $27.89, Westpac down 0.5% to $21.32, ANZ dropping 0.9% to $24.34 and CBA retreating 1% to $99.57.

Insurance Australia Group fell 3.2% to $5.68 after securities regulator ASIC filed civil proceedings against two of its subsidiaries concerning the pricing of premiums for customers renewing home insurance products. IAG said it would defend the proceeding and denied misleading customers about the extent of the discounts they would receive.

Accent Group soared 17.1% to a three-month high of $2.16 after the footwear retailer delivered a record full-year profit of $88.7 million, up from $31.5 million the year before. Total sales at its more than 800 stores were up 26.3% to $1.4 billion and, although the Platypus, Hype DC and Skechers brand owner said sales began slowing in May, there had been signs of improvement in recent weeks.

Bravura Solution rocketed 44% to a six-month high of 72c after the struggling financial software company achieved guidance and said it was on-track to return to positive cash earnings by year-end.

From Shane Oliver, AMP:

- After three weeks of falls, global share markets managed to rise over the last week helped by softer economic data easing concerns about higher for longer central bank interest rates, the ongoing interest in AI supported by strong sales at Nvidia and no hawkish surprises from Fed Chair Powell’s Jackson Hole speech. For the week US shares rose 0.8% and Eurozone and Japanese shares gained 0.6%. Worries about the Chinese growth outlook continued to weigh on the Chinese share market though and it fell 2%. Australian shares also fell 0.5% for the week amidst cautious earnings outlooks and ongoing concerns about China with falls in consumer staple, health, utility and energy shares leading the fall. Bond yields mostly eased back a touch after recent rises helped by softer global economic data. Oil prices also fell but metal and iron ore prices rose. The $A was little changed despite a further rise in the $US.

- Weaker economic data is good news for now, but correction risks remain high. Slowing business conditions PMIs for August have provided confidence in the last week that central banks won’t have to increase interest rates further and this has taken some pressure off bond yields and supported global share markets. However, it’s too early to conclude that the correction in shares is over: the risk of recession remains high; China’s economy is still slowing; there is a risk that the disinflation process could pause in response to higher energy prices and sticky services inflation; central banks are still at risk of more hikes; there is a high risk of another US Government shutdown from 1 October; high bond yields are still pressuring share market valuations; and the weak seasonal period for shares goes out to October. We would regard further falls as part of a correction though and we retain a positive 12-month view on shares as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.

- No surprises from Fed Chair Powell and ECB President Lagarde at Jackson Hole. Powell retained a tightening bias remaining tough on inflation, noting that it remains too high and that the Fed is prepared to hike further if appropriate but that its data dependent and in a position to proceed cautiously given lags, tighter financial conditions and the risk of doing too much. His comments did little to alter expectations that the Fed will leave rates on hold next month. Lagarde was hawkish on the medium to longer term outlook for inflation given energy/climate issues and geopolitical tensions potentially driving supply shocks to inflation and she noted that the ECB will set rates at “sufficiently restrictive levels for as long as necessary” but didn’t push back against market expectations for the ECB to leave rates on hold in September.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

2023 Morningstar Investment Conference for Individual Investors 11-12 October 2023. Secure your spot early at the ticket price of just $27.50. You’ll get access to two days packed with insightful sessions on the most pressing investing topics of 2023. Plus, bring a friend and every subsequent registration will be discounted by 50%. To register, click here.

ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website