The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

The power of Australia’s $3.6 trillion superannuation sector has been on full display of late.

First, AustralianSuper used its influence as Origin Energy’s largest shareholder to reject a takeover offer led alternative investment titans, Brookfield. It’s not the first time that super funds have swayed the fortunes of Australian listed companies. In 2019, they were instrumental in getting Westpac CEO, Brian Hartzer, fired. In 2021, a consortium of IFM Investors, QSuper, and Global Infrastructure Partners, backed by AustralianSuper, acquired Sydney Airport for $32 billion. The Origin deal collapse is another marker for the growing heft of the super funds in listed markets.

The power of Big Super is testament to the success of our superannuation system. The OECD says our system is now the fourth largest in the world. A recent report from The Thinking Institute and Pensions and Investments shows five of Australia’s super funds rank among the top 100 in the world.

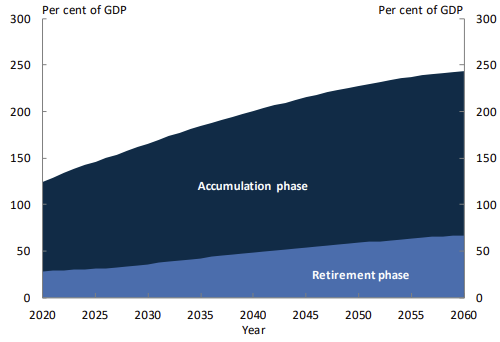

Forecasts from the Treasury Department and others suggest super fund assets may reach $10.5 trillion by 2040. To put that in context, residential property is currently the largest asset class in Australia and it’s valued at $10.1 trillion.

Total value of superannuation assets

Source: Treasury

At last count, super funds had about 22% of their $3.6 trillion in assets in listed Australian stocks. That equates to close to $800 billion, or 29% of the total ASX market capitalization of $2.8 trillion.

Given the forecast trebling in super fund assets by 2040, it’s not hard to see that Big Super will increase their ownership of ASX stocks over time. And that those companies offering real, long-term assets such as Origin Energy will be prime targets for these funds.

Given the limited size of the ASX, it can also be expected that super funds will continue to diversify their holdings into international stocks and private assets. Clime Investment Management’s John Abernethy has said that super funds have almost defaulted into private assets from listed assets due to their size. There's some truth to this.

Second, the Labor Government released a discussion paper called ‘The Retirement Phase of Superannuation’ this week. The paper floats an idea proposed in David Murray’s Financial System a decade ago, and backed by the two largest super funds, AustralianSuper and Australian Retirement Trust, of automatically rolling fund customers into pension products once they reach retirement age.

This seems another sign that super funds are pushing back against the Labor Government’s wish for these funds to be all things to all people. The government has previously pushed for super funds to be more involved in ‘nation building’ housing and infrastructure projects, as well as offering better financial/retirement advice to their members. This discussion paper seems to pave the way for a compromise on the latter issue.

Third, super fund bosses visited Canberra this week to lobby Treasurer Jim Chalmers to overhaul the Your Future, Your Super performance testing regime. The super funds suggest the testing discourages them from investing in the long-term projects that the Labor Government wants them to pursue.

The funds have a point. Short-term performance testing doesn’t align with long-term investments.

Yet, the lobbying is another indication that Big Super is trying to set boundaries with the government on what it should and shouldn't do. As super funds continue to grow, those boundaries are likely to become increasingly blurred.

-------------------------

Stocks, bonds, bitcoin, gold are all flying – we’re back to the everything rally!

In November, the ASX 200 was up 4.52%, its best month since January. And year date, the index has risen 4.4%.

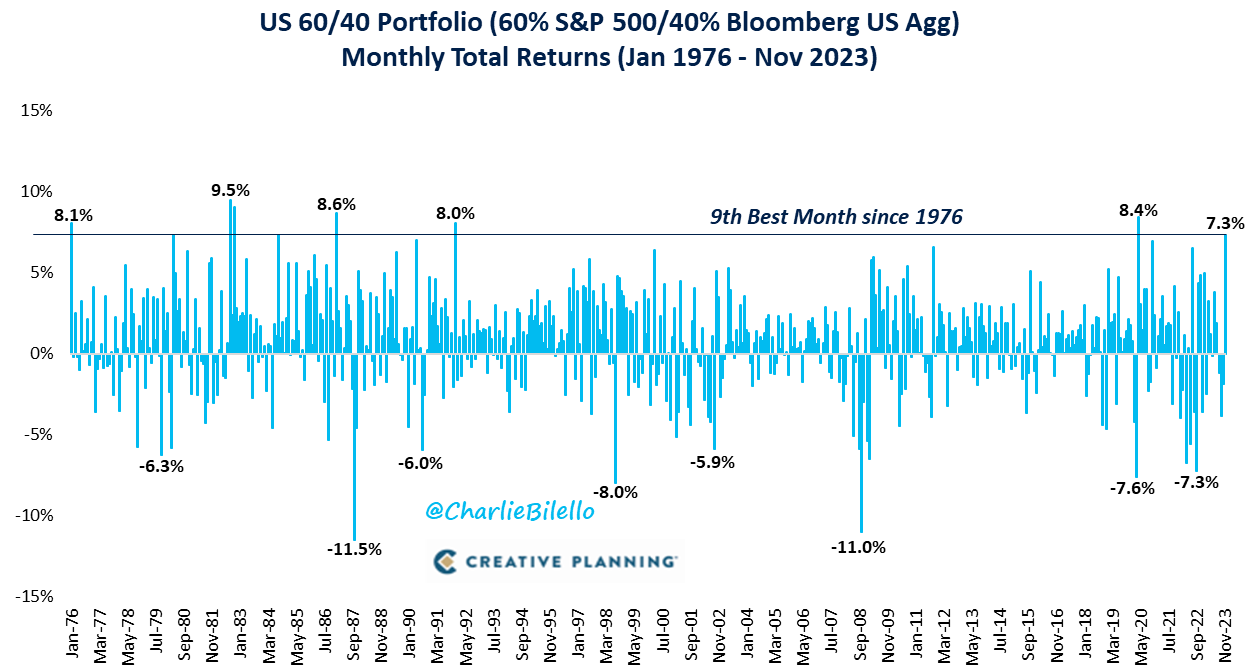

Meanwhile, the S&P 500 ripped 8.9% higher in November, it’s 7th best month in the last 30 years. The US bond market gained 4.5% for the month, its best month since 1985. And a US 60/40 portfolio had its second-best month in 30 years.

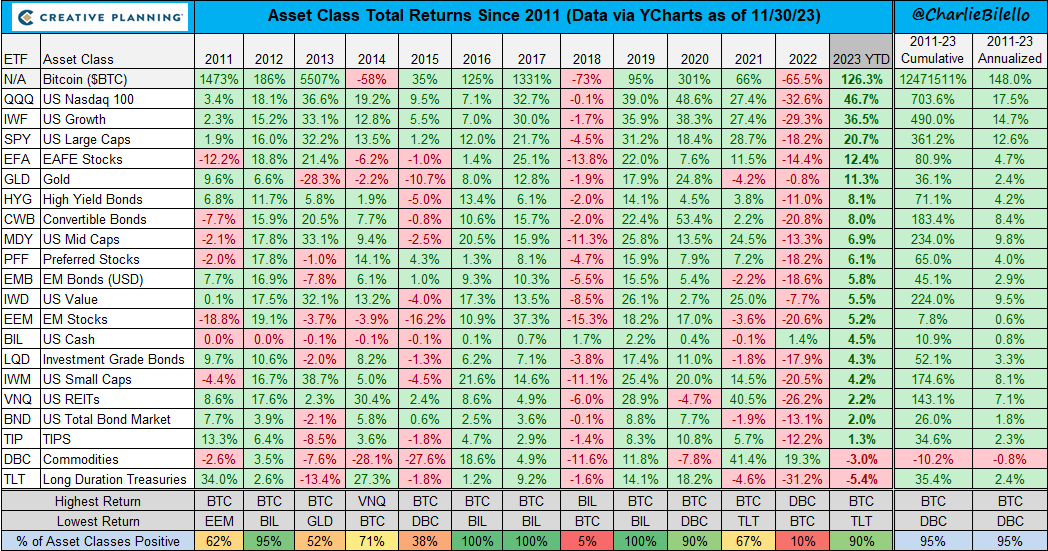

90% of key asset classes in the US are in the green in 2023, with Bitcoin and the Nasdaq 100 up a cool 126% and 47% respectively.

What happens next? Hedge fund titan Stanley Druckenmiller once said that liquidity, not fundamentals, moves markets in the short-term.

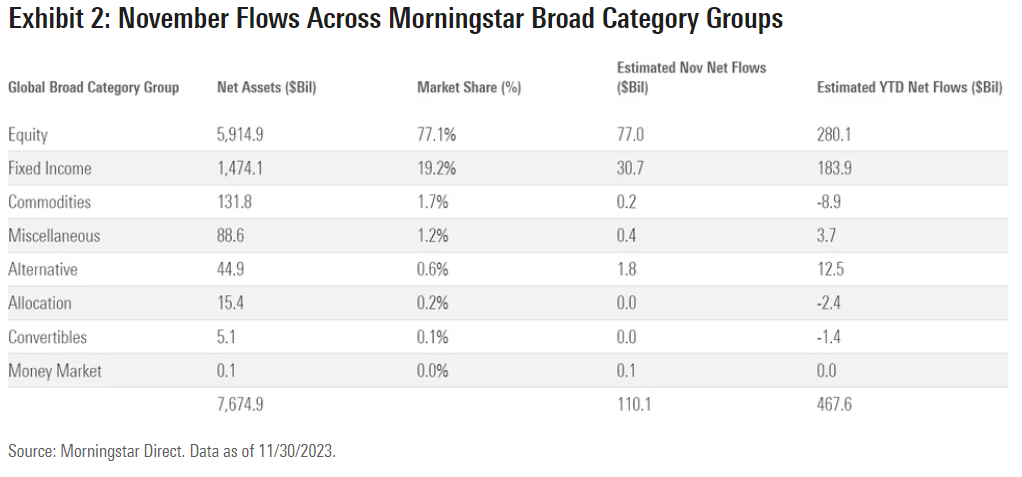

If right, we could see more money flowing from cash into stocks and bonds. In the US, it’s already happening, with net inflows of US$77 billion into equities in November.

That could happen in Australia too. In the first half of the year, money poured into cash after the stock market’s dismal 2022. For instance, SMSFs interviewed by Vanguard in June had increased cash and bond allocations at the expense of stocks.

Fundamentals also look reasonable for the ASX. Schroders’ Head of Multi-Asset in Australia, Sebastian Mullins, says Australia looks inexpensive compared to overseas markets:

“The US is trading at 17x forward earnings, expecting 12% earnings growth. Australia is trading at 15x earnings, expecting -1.2% earnings. So, there’s a potential for a surprise to the upside in Australia, relative to other countries.”

James Gruber

In this week's edition...

How should investors position their portfolios for 2024? Clime Investment's John Abernethy suggests tilting towards income assets, before switching more to equities in 2025. He likes bonds, especially investment grade corporate bonds, over the next 12 months. Long-term, stocks remain a good bet given Australia's favourable economic and demographic outlook.

Orbis Investments' Shane Woldendorp, Eric Marais and Rob Perrone are also thinking about the long-term. They believe investors are dangerously overexposed to recent market winners such large cap, growth stocks. They say these stocks are very expensive and investors to need switch tack if they're to outperform in the decade ahead.

Vanguard's Asia-Pacific CIO, Duncan Burns, looks at the best way to blend passive and active assets into a portfolio. He thinks investors should start with a diversified index core holding and add low-cost active satellite holdings where they have conviction, unique needs, or access to a talented active manager.

We've all heard about how younger people are being priced out of the housing market. But a new survey by National Seniors Australia reveals housing affordability concerns two-thirds of older Australians too, and more than half are living in homes unsuitable for later life because they need modifications, security of tenure, or assistance. Diane Hosking and Linda Orthia have the details.

It's happy birthday to the floating of the Aussie dollar. 40 years ago, the Hawke Labor Government made the momentous decision to float the dollar. Selwyn Cornish and John Hawkins look at the history behind the decision and how it's served the country well since.

India has overtaken China as the world's most populous nation and under a reformist Prime Minister, it's growing faster than most other emerging markets. What's often underestimated is how many well-run, global companies they have. Rajiv Jain and his team at GQG Partners think India is worth a closer look for global investors.

Morningstar's Annika Bradley peeks under the hoods of the investment businesses of UniSuper and AustralianSuper. She investigates the growing trend of funds bringing investment management back in-house, and the advantages and disadvantages of doing so.

Two extra articles from Morningstar for the weekend. Shaun Ler says Washington H. Soul Pattinson's takeover bid for Perpetual is a lowball offer, while Jon Mills assesses ASX gold miners after a recent surge in the price of the yellow metal.

Lastly, in this week's whitepaper, Vanguard examines the growth of the ETF industry in Australia.

***

Weekend market update

On Friday in the US, a solid November payrolls report spurred weakness across the Treasury curve as the two-year note jumped 13 basis points to 4.71% and the long bond rose to 4.31% from 4.25% on Thursday, though stocks were unconcerned as the S&P 500 racked up modest gains to settle higher by 1% for the week. WTI crude extended its bounce above $71 a barrel, gold fell to $2,003 per ounce and the VIX retreated to near 12.

From AAP Netdesk:

The Australian share market on Friday overcome morning losses to finish at a fresh 11-week high. After being down by as much as 0.4% in early trading on Friday, the benchmark S&P/ASX200 index climbed into the green after lunch to finish up 21.6 points, or 0.3%, to 7,194.9. The broader All Ordinaries gained 20.9 points, or 0.28%, to 7,405.6. The ASX200 climbed 1.7% for the week, its best performance since the week ending November 3.

Seven of the ASX's 11 sectors finished higher, with energy the biggest gainer, climbing 1% after Australia's top two energy companies confirmed on Thursday night they were in early merger talks. Woodside slipped 0.5% to $29.81 while Santos rose 6.2% to $7.25 as both confirmed the Australian Financial Review's reporting about the possible $79 billion deal.

The Big Four banks mostly finished little changed, with ANZ, Westpac and NAB closing basically flat, while CBA edged 0.2% higher at $106.44.

In the heavyweight mining sector, BHP rose 0.7% to $47.74, Fortescue added 1.1% to $25.75 and Rio Tinto climbed 0.9% to $128.89.

Lithium miners posted strong gains on early indications that prices for the battery metal had finally hit bottom. Pilbara rose 3.6%, Allkem rose 4.3% and Lionton Resources added 4.2%

From Shane Oliver, AMP:

The past week saw more evidence of easing inflation and major central banks being at the top on rates. Inflation in Thailand, Taiwan, the Philippines and South Korea all fell further in November, the Bank of Canada left rates on hold and more ECB officials are turning less hawkish or even dovish.

The Bank of Japan is an exception of course having not even started to raise rates but may do so in the next few months with comments by BoJ Governor Ueda (that his job will get more challenging from year end) and one of his deputies (playing down the adverse impact of a rate hike) interpreted as paving the way for a hike. Any BoJ hikes are likely to be gradual through leaving Japanese interest rates well below those in other countries for some time to come meaning that any impact globally should turn out to be modest (after any initial shock) – it will imply some upward pressure on US and Australian bond yields but this should be more than offset next year by falling inflation.

RBA on hold and most likely at the top ahead of rate cuts from the September quarter. As widely expected the RBA at its December meeting left rates at 4.35% noting that data since the last meeting was consistent with its expectations. While it retained the softened tightening bias used after the November meeting that “whether further tightening of monetary policy will be required…will depend upon the data and the evolving assessment of risks” the Governor’s commentary post the November meeting remained pretty hawkish and the same could happen again given the RBA’s ongoing concerns about inflation taking too long to get back to target. As such the risk of another rate hike remains high at around 40% - and if it occurs it will probably be at the February meeting.

Key to watch ahead of this meeting will be December quarter inflation data and the next two rounds of retail sales and jobs data. However, we remain of the view that the RBA has already done enough as the September quarter GDP data shows a sharply slowing economy and struggling consumer, October data suggests that consumer spending growth may be turning negative this quarter and monthly CPI inflation is likely to have a three in front of it by December. So our central view is that economic data between now and the February meeting won’t provide the justification for another rate hike and that the cash rate is at the top and we are continuing to allow for rate cuts starting from the September quarter next year. The money market is attaching no probability to any further rate hike with nearly a full rate cut priced in by September.

PDF version of Firstlinks Newsletter