Increasingly, industry superfund members also need quality advice, and advisers need detailed information as to what’s under the hood of the large industry superannuation funds.

In response, Morningstar is gradually expanding its research coverage and, in 2023, added UniSuper to our multi-asset options coverage. Its level of internalisation is high relative to its peers. But Tim Wong, Director of Manager Research, concluded that: “UniSuper's clever handling of a major internalisation program has seen it build a capable team while taking care to avoid overextending its reach.” Adding UniSuper to our coverage lineup of large superannuation funds highlighted that there are different ways internalisation can be approached. And it reinforced the benefit of looking under the hood.

UniSuper versus AustralianSuper—Different approaches to internalisation

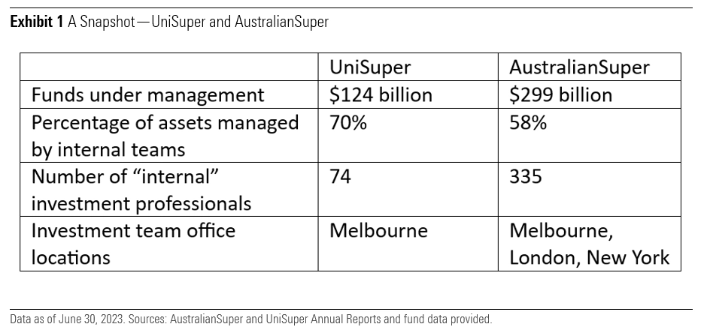

All three of UniSuper's assessment pillars (Parent, People, and Process) were awarded Above Average with an overall rating of Bronze. This puts it on par with AustraliaSuper’s overall rating of Bronze. As far as internalisation goes, both funds have a high proportion of assets managed internally, but the overall team size differs meaningfully as does the investment teams' global footprints.

In our “Is Your Industry Super Fund Too Illiquid?” paper, we took a look at the level of illiquid assets held at the fund and option levels of five large superannuation funds. AustralianSuper has a much higher proportion of illiquid assets compared with UniSuper (refer to Exhibit 2) and has built a large internal team to manage these assets.

Typically the management of private assets is more resource-intensive, which partially explains the stark difference in the number of internal investment professionals. In the AustralianSuper research report, we commented that “Phenomenal asset growth has seen AustralianSuper evolve continuously. Its suite of capabilities has expanded considerably, with private assets, illiquid credit, and global bonds priorities, alongside beefed-up operational and risk groups. To be clear, this isn't costless, and breakneck hiring needs to be balanced against becoming too bureaucratic.”

UniSuper has taken a more incremental approach to internalisation and to hiring. Its internalisation program started in 2009, and the first share was traded in 2010. Morningstar’s assessment is that “further internalisation is likely to be incremental rather than revolutionary." See Exhibit 3.

UniSuper has also elected more of a partnership approach for their private asset mandates. Let’s take the Direct Property asset class by way of example. UniSuper holds $4 billion of directly owned property assets that have been managed under a unique mandate arrangement for over 20 years. The partnership leverages the expertise of the external specialist property manager while enabling the internal team to maintain full control over all aspects of the portfolio.

The bottom line here is that internalisation can be executed in various ways across different funds and have meaningfully different outcomes when it comes to the number of investment professionals and the level of complexity inherent in a fund.

The number of internal investment team members is one thing; attracting quality people and retaining them is another. People are a vital pillar to any successful investment management business. And achieving equivalent levels of competence with external managers is a key ingredient to a successful internalisation program. There’s no point in internalising assets if the returns are subpar compared with an external manager. Therefore a deep dive into the quality of the investment team, its retention levels, the superfund’s culture and overarching governance bodies is necessary to determine whether the fund stands a chance of delivering equivalent returns to an external manager.

UniSuper and AustralianSuper are not immune to the challenges of assembling and retaining a quality investment team. Both funds have had their fair share of high-profile departures. At UniSuper, Simon Hudson and Mark Himpoo departed the high-performing equities team in 2021-22. AustralianSuper saw disruption in its property team with Bevan Towning departing in April 2023, and John Longo and Neil Harvey leaving in late 2019. And then there were the high-profile departures of AustralianSuper's Head of Equities Innes McKeand, who left in early 2021, followed by Justin Pascoe in early 2023. The point is that attracting and retaining quality people is a challenge, as is shaping the right organisational structure to accommodate bright, ambitious investment people. Growing pains should be expected given the rapid rate of growth these funds have experienced.

AustralianSuper is tackling the additional complexity of locating their investment teams globally. They have strategically inserted "head office" staff members into their global offices to ensure that the homegrown culture permeates these global offices.

Then there are the Chief Investment Officers, or CIOs. UniSuper’s John Pearce “would (also) be a hard act to follow” according to our research report. And “CIO Mark Delaney has overseen sound development of internal teams” as well as AustralianSuper’s investment success since the start. Culture starts at the top—so how long these two leaders stick around and how the organizations look to handle their eventual succession are definitely watchpoints.

The governance structures and trustees overseeing these investment teams should not be underestimated, and it is worth considering as part of the due diligence. Tim Wong notes that “UniSuper has assembled a credible board and investment committee, suggesting a sensible decision can be made on succession.”

Alignment to members is also important. One of the big selling points of working for a large, profit-for-member fund is the sense of purpose that an investment team enjoys from serving members. And the Morningstar report comments that, “Alignment with members is credible: Performance pay for senior investment staff is largely tied to the Balanced fund, and investment staff superannuation is defaulted into the AustralianSuper fund.”

The key point to note here is that an internalised investment function is a complex investment management business that should be scrutinized accordingly. There’s no point internalising if the fund is unable to build a high-quality investment team that is set up to deliver quality outcomes for members. Hiring and retaining quality people and putting the right governance and incentive frameworks in place are key to successful delivery.

So, have these internal investment teams delivered for members compared with an outsourced model? That’s a very difficult question to definitively answer, but both UniSuper and AustralianSuper’s Balanced Options have posted very strong long-term returns relative to both the Morningstar Australia Growth Target Allocation NR AUD Index (a tough hurdle!) and their category peers. Investors eat net returns, and it is pleasing to see that the internalisation programs at both funds have delivered solid outcomes for their members.

One of the key drivers of internalising investment management is to keep fees and costs low. Net returns should be the measure of success, however, given how heavily fees and costs are scrutinised in this market, it’s worth taking a look at them. Both funds have managed investment-related fees and costs as well, as shown in Exhibit 5. Unlisted and private assets are typically more expensive and might explain some of the differential between the two.

Approaches to internalisation—Take a close look

UniSuper and AustralianSuper have both attained Morningstar Medalist status for a reason—their investment people and investment process are high quality. But as these large superannuation funds grow and evolve, there’s no one-size-fits-all model to success. Managing large pools of capital can be approached in different ways—and no one way is more right or effective than the other. What is clear is that these funds are now large, complex investment businesses, and it's worth taking a look under the hood before making an investment decision.

Annika Bradley is Morningstar Australasia's Director of Manager Research ratings. Firstlinks is owned by Morningstar. This article is general information and does not consider the circumstances of any investor. This article was originally published by Morningstar.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free trial below:

Try Morningstar Investor for free