From going it alone with an SMSF to defaulting into the AustralianSuper Balanced Option, administration time and fees vary materially. Price points across Netflix subscriptions vary materially, too, from $6.99/month for standard with ads compared with $22.99/month for premium. Consumers understand that the different price points meet individual viewing preferences. Superannuation admin fees are no different.

The different ways to access super

i) SMSF

The SMSF is a popular, do-it-yourself access point to super, with assets totalling almost $870 billion[1] last year. SMSFs allow investors a vast investment universe and a level of personalisation that is unparalleled, but they are certainly not do-it-yourself-for-free. There are:

- establishment fees

- ongoing regulatory costs such as Australian Taxation Office supervisory fees

- accounting fees

- possibly an online investment platform to help keep track of your investments.

- the personal time expended as a trustee.

For some investors, the flexibility and tailoring are worth it, but for others, SMSFs are a step too far. The time, cost, and complexity are too much for the reward.

ii) MySuper and Choice

At the other end of the spectrum are the ‘MySuper’ and the current ‘Choice’ cohorts[2] as defined by the regulator. These groups represent over $1.1 trillion of the approximately $3.5 trillion that Australians have invested in super.

So, what’s the difference between MySuper and Choice? The 69 investment options captured in the ‘MySuper’ heatmap are simply the low-cost, defaults offered to members. Conversely, there are over 1,000 investment options captured in the 2022 ‘Choice’ heatmap. They are typically multisector options commonly offered through a fund’s ‘generic’ investment menu.

The easiest example is to use AustralianSuper. Its default multi-asset ‘Balanced option’ is captured in the MySuper heatmap; its multi-asset High Growth, Conservative Balanced, Stable, Index Diversified, and Socially Aware options are captured in the 2022 Choice heatmap.

There are a range of services offered across these two cohorts in exchange for the administration fee. Investors can access the tax-effective world of superannuation, a range of investment options that are fully administered, insurances, and investor reporting, support services, and education. While investment fees paid for an investment option and insurance premiums are a different matter, administering an investment option or insurance product in super is not free. Dealing with incoming contributions, members switching between options, and members switching out of the fund incurs costs that need to be covered. Basically, all the non-investment-related costs, including the significant regulatory impost to run a fund, are covered in the admin fee.

iii) Advised or self-directed platforms

In the middle of the spectrum is another cohort of Australians who want more flexibility than a default option but not the responsibility of an SMSF. They could be advised or self-directed and typically opt for more-sophisticated investment platforms. For example, a fully advised offering on an investment platform (HUB24, Netwealth, Macquarie, Colonial First State, and BT, among others) that offers tailored managed accounts and comprehensive investment menus (including shares, ETFs, many funds, and term deposits), complete with sophisticated portals and reporting.

Superannuation access points sit across a spectrum, and what’s offered varies greatly. And unlike Netflix’s easily comparable options, there are many details to consider.

The range of admin fees

What should you expect to pay for these different access points to superannuation?

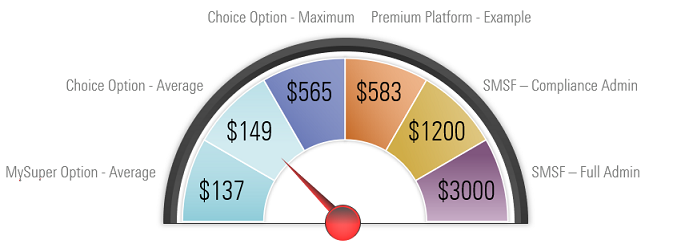

In the Rice Warner Report: Cost of Operating SMSFs 2020[3], it was estimated that SMSF admin fees range from around $1,200 a year (for compliance admin) to $3,000 a year (for full admin), but this may cover large amounts. This doesn’t consider the cost of your time as a trustee, which should not be underestimated. The report also outlines the levels of superannuation assets required to justify the higher levels of admin fees relative to other options.

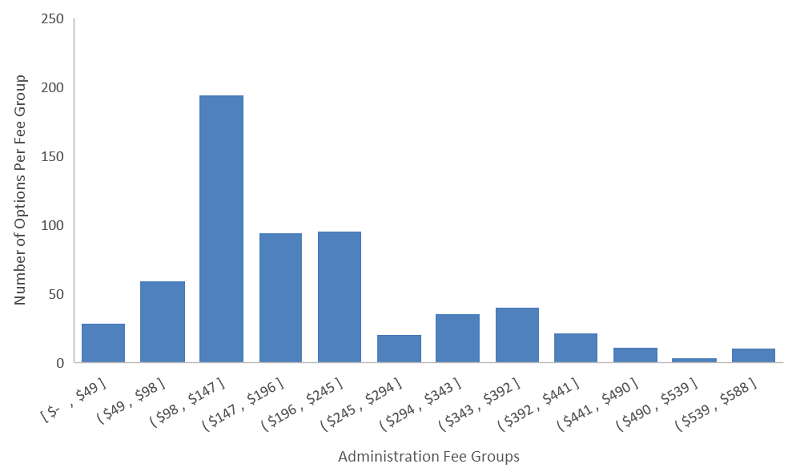

In the APRA Heatmap Insights Papers, the Choice Dashboard shows that the average annual administration fee for MySuper options is $137 compared with $149 for ‘open’ Choice options (based on a $50,000 account balance). Averages can hide a lot, though. Exhibit 1 shows that while many Choice options cluster around the price points of $100 - $250 a year, there are plenty that are more expensive.

Exhibit 1 APRA Choice Options – The number of options per administration fee group

Source: Australian Prudential Regulatory Authority’s (APRA) ‘Choice’ Heatmap – 2022.

Finally, the premium platform option. While there are no easily accessible 'average' costs for this cohort and the fee disclosures make comparisons tricky, the Netwealth Super Accelerator Plus Product Disclosure Statement (September 2022) provides a good example. It shows an administrative fee of around $583 a year. For that admin fee, you can access direct international equities, Australian equities, term deposits, and a broad menu of managed funds and managed accounts at additional cost. There is significant scope to tailor an investment portfolio here. It’s also worth noting that many advisors negotiate bespoke fee arrangements for premium platforms, and the cost of this access point may be lower through your advisor.

Exhibit 2 displays the spectrum of admin fees across the different access points discussed in this paper. The key takeout is that the range is wide. And that’s why it is important to understand what you need and pay an appropriate price for that service.

Exhibit 2 Spectrum of Administration Fees compared

Source: Quoted throughout paper.

Administration fees reduce returns

The more you pay in admin fees, the lower the net return you will receive over time, and less money in retirement. And given the power of compounding, every dollar counts. But administration fees are the price of admission to superannuation. They are an inevitable cost to access a tax-effective environment. Some people need the standard subscription with ads, while others prefer a premium subscription. What’s important is that you understand your own needs when it comes to super and pay for what you need. Admin fees matter, and they vary materially, so make sure you understand what you’re paying for and why.

[1] Australian Tax Office’s SMSF Profile – 30 June 2022

[2] Australian Prudential Regulatory Authority’s (APRA) “Choice” and “MySuper” Heatmaps and Insight Papers - 2022

[3] Cost of Operating SMSFs 2020: Rice Warner and SMSF Association

Annika Bradley is Morningstar Australasia's Director of Manager Research ratings. Firstlinks is owned by Morningstar. This article is general information and does not consider the circumstances of any investor. This article was originally published by Morningstar.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free trial below:

Try Morningstar Investor for free