The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

There are two new reports that shed light on wealth in Australia. The first is from UBS via its Global Wealth Report 2024.

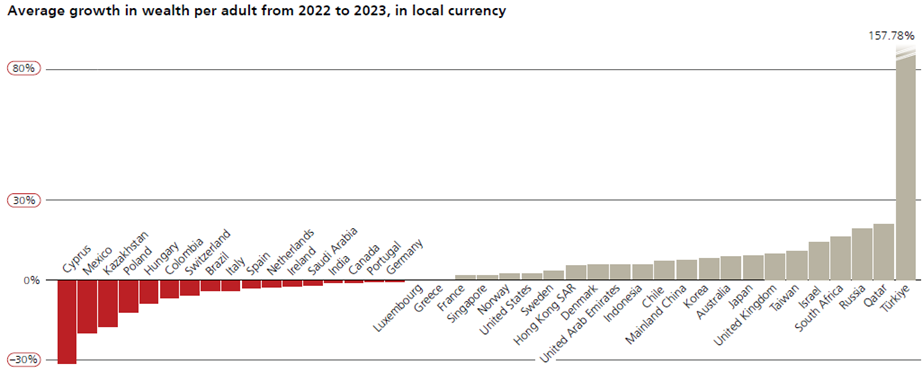

The report says that global wealth – defined as the value of financial assets plus real assets owned by households, minus their debts – grew 4.2% last year in US dollar terms. That was a rebound from the 3% decline recorded in 2022.

The rebound was driven by Europe, the Middle East and Africa (EMEA), which saw wealth grow by 4.8%, ahead of the Asia-Pacific’s 4.4%. The Americas trailed behind, with close to 3.5% growth.

Wealth in Australia grew at a faster pace, up almost 9% year-on-year, helped by the continued rise in residential property prices and the snapback in the local share market last year.

Source: UBS Global Wealth Report 2024

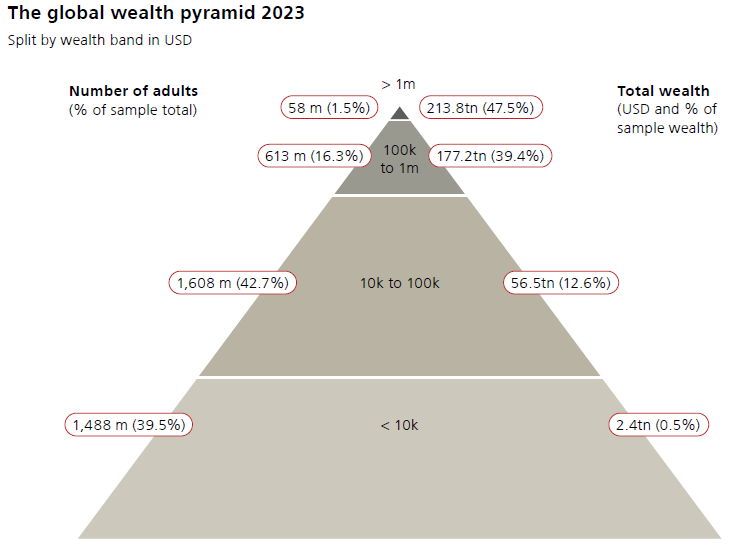

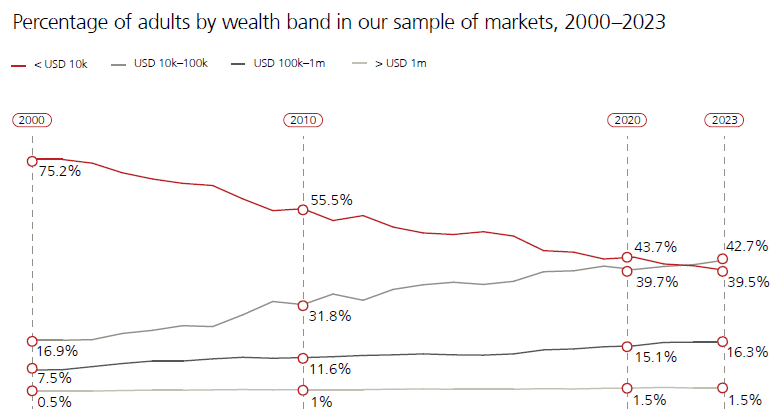

Globally, there are 58 million people, or 1.5% of the world’s population, with wealth greater than US$1 million. At the other end of the spectrum, there are 1.49 billion people with wealth of under US$10,000.

Source: UBS Global Wealth Report 2024

Australia remains the lucky country

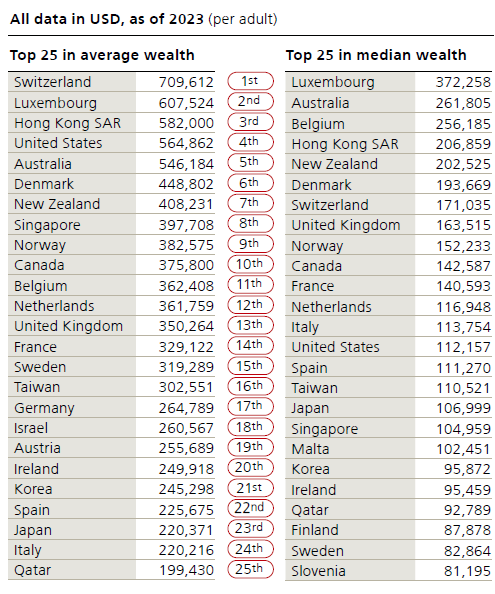

Australia remains one of the world’s richest countries. We’re ranked second in the world when it comes to median wealth per adult, well ahead of the likes of Switzerland, the UK, and the US.

On an average wealth per adult basis, Australia ranks fifth. According to the report, the average Australia has US$546,184 in wealth, or A$810,000.

Source: UBS Global Wealth Report 2024

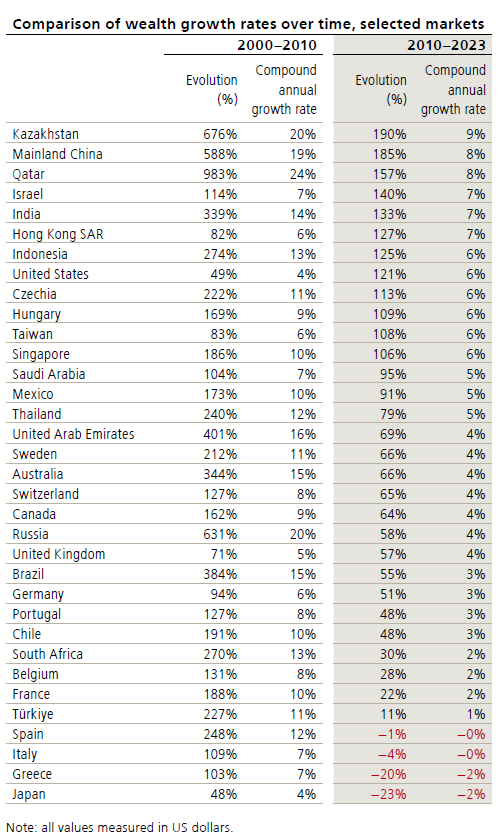

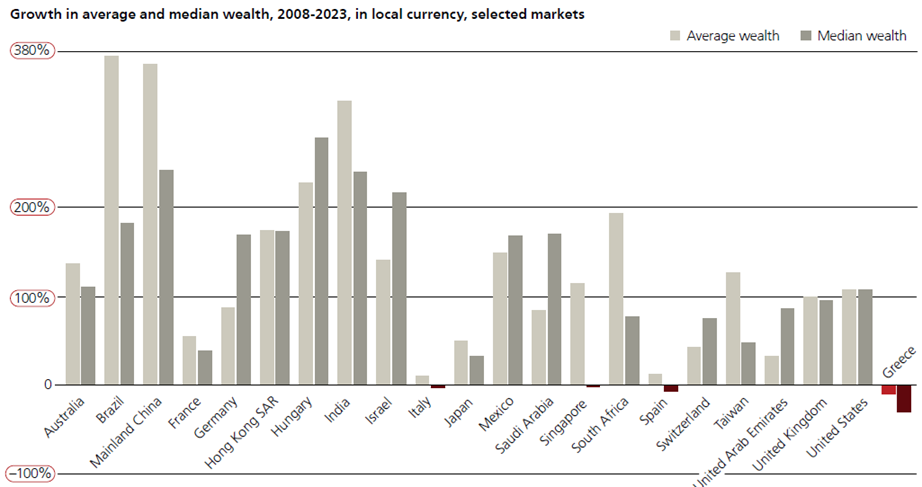

Zooming out, the report suggests that growth in global wealth has slowed in recent years, including in Australia. Global wealth has cooled from average annual growth of 7% from 2000 to 2010 to 4.5% from 2010 to 2023. The report says that demographics have played a role in the slowdown, with shrinking populations in the likes of Japan and Italy resulting in slower economic activity. Other factors include a stronger US dollar, the sovereign debt crisis in Europe in the early 2010s, and the maturation of economies in Asia and Latin America.

The growth in Australian wealth has also slowed since 2010. The sharp pullback in commodities from 2011-2012 has arguably been a big factor in this.

Source: UBS Global Wealth Report 2024

Source: UBS Global Wealth Report 2024

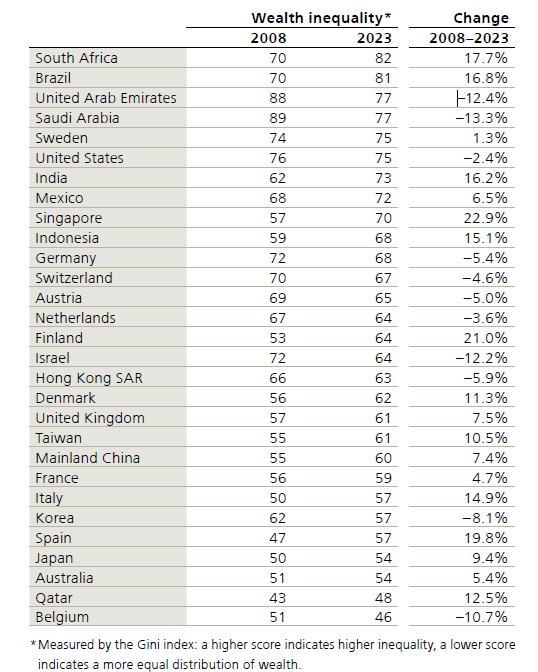

Wealth inequality

There’s been progress with inequality. The only wealth band that’s been in constant decline over the past 15 years is the lowest one. Adults with less than US10,000 have nearly halved from more than 75% in 2000 to below 40% in 2023. All other wealth brackets have been steadily expanding.

Inequality has tended to increase in fast-growing markets and decline in many developed economies. Despite all the negative headlines, wealth inequality has fallen in the US of late. Inequality in Australia has risen marginally, though remains low compared to other developed countries.

Source: UBS Global Wealth Report 2024

Source: UBS Global Wealth Report 2024

The great horizontal wealth transfer

UBS says wealth is more mobile than static, and that applies across the globe. If you’re wealthy, there’s no guarantee you’ll stay that way, and vice versa.

The report also touches on the intergenerational wealth transfer that’s about to take place. Globally, US$83 trillion is expected to be passed on within the next 25 years. Given that people over the age of 75 hold nearly 20% of the world’s wealth, and the average life expectancy for 75-year-olds ranges between 82-86 across most of the world, a large chunk of assets are expected to be transferred within the next ten years.

UBS also points out that before being transferred from one generation to another, wealth is frequently passed on within the same generation between spouses. Life expectancy varies between men and women, and couples can have age gaps, and the inheriting spouse will typically own and hold onto the wealth for an average of four years before passing it on. UBS calls this ‘the great horizontal wealth transfer’ and suggests around US$9 trillion of wealth will soon be transferred between spouses.

How Australia’s high net worth individuals are faring

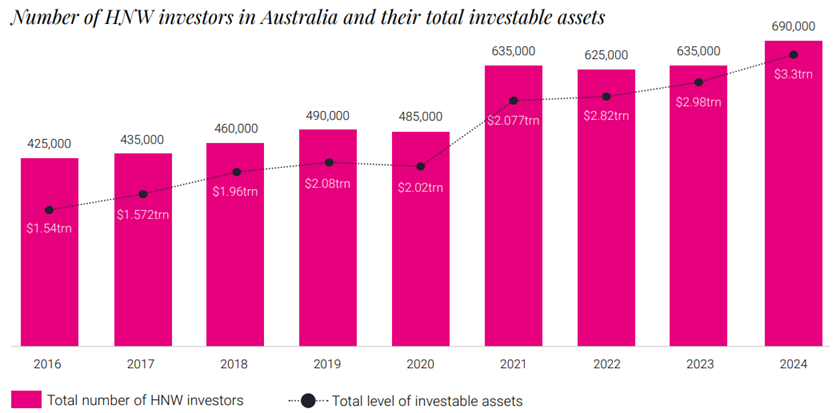

A separate report from Praemium and Investment Trends has looked at how Australia’s high-net-worth individuals (HNWIs) are faring. Pretty well, it turns out.

As of June this year, there are 690,000 high-net-worth investors in Australia, up 8.7% year-on-year. These investors are defined as those who have at least $1 million in investable assets – net wealth clear of debt, excluding their own home, business, and super (but including SMSF assets). They now control $3.3 trillion in assets, up from under $3 trillion in 2023.

Source: Praemium and Investment Trends

It seems the wealthy are getting wealthy. The report reveals a surge in wealth among ultra-HNWIs – those with investable assets of $10 million or more. Their assets saw an 11.6% increase in value in 2024, versus an 8.6% rise in 2023.

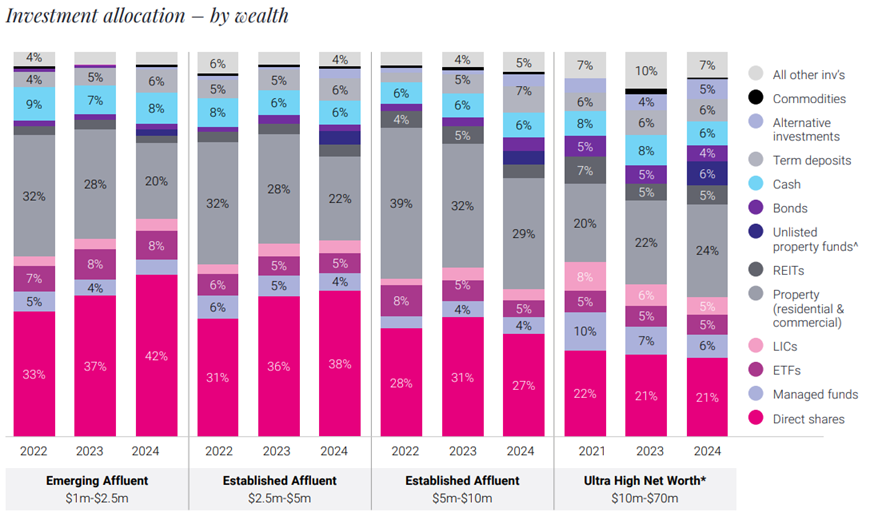

How the wealthy are investing their money

The breakdown of how HNWIs are investing their money makes for fascinating reading. The so-called ‘emerging affluent’ – those with $1-2.5 million in investable assets – are putting a lot more money into direct shares, compared to other asset classes such as property. Those wealthier than this hold much less in direct shares. Across the board, managed funds and listed investment companies are waning in popularity, while holdings in cash, term deposits, and bonds are relatively small. And alternative assets are gathering more funds, albeit off a small base.

Note: Trend data unavailable. *Note: ‘2022 – $10m to 70m’ is not displayed due to small sample size. Source: Praemium and Investment Trends

The report also notes that HNWIs continue to retain a preference for getting financial advice from time-to-time. The number identifying themselves as validators – who seek advice to validate their own opinions – remains high, yet unchanged, at 58% (at least they’re honest!). Those who describe themselves as self-directed investors stands at 35%. For those using an adviser, around 38% of their wealth is under the stewardship of an adviser while the remaining 62% is self-managed.

----

In my article this week - despite an explosion in data, investment legend Cliff Asness believes markets have become less efficient, not more, over his 34-year career. In a new paper, he explains why social media is mostly to blame for this, and how investors can take advantage of the market distortions.

James Gruber

Also in this week's edition...

Susan Lloyd-Hurwitz is one of the best female leaders in Australia. The former CEO of Mirvac now heads a Government housing council looking into solutions to the housing crisis. In a speech, she outlines the housing market that she'd like to see, and how we get there.

Prime Minister Anthony Albanese has described recent changes to aged care as “once in a generation”. He's right, and though much of the media coverage has been on how the wealthy will have to pay up, Rachel Lane says everyone will be forced to fork out more.

Draft regulations released this week finally provide the framework for unwinding legacy pensions. Meg Heffron's reaction: About bloody time! Meg details the ins and outs of the regulations, as well as some caveats.

Global defence spending is increasing as geopolitical tensions rise. VanEck's Arian Neiron believes it's a megatrend hiding in plain sight and he looks at the best ways to profit from the theme.

Index fund flows into the US market are relatively tiny. Yet a new research paper argues that they've distorted the size of the market's largest stocks to a surprising degree, as Joachim Klement explains.

After the extraordinary runup in the share prices of banks, many investors are wondering if it's time to sell, or to hang onto them for dear life. Te Okeroa says those aren't the only options for investors, and it may be time to think more creatively.

Two extra Morningstar articles from the week gone by. Mark Taylor explains why he upgraded this ASX share’s moat rating and Joseph Taylor highlights two stocks fit for a famous contrarian investor.

Lastly in this week's whitepaper, Neuberger Berman says that despite a rising tide of negative media coverage, private debt still has tremendous potential to deliver attractive risk-adjusted returns for investors.

****

Weekend market update

On Friday in the US, there was muted trading action as stocks took a breather following the previous day’s post-ease euphoria with the S&P 500 ticking lower by 0.2%, while two-year yields dropped four basis points to 3.55%, establishing fresh post-2022 lows. WTI crude finished little changed at US$71 a barrel, gold remained white hot at US$2,620 per ounce, bitcoin edged lower at US$62,700 and the VIX settled just north of 16.

From AAP Netdesk:

Another day, another record on the ASX on Friday. The benchmark index finished at its highest level for the fifth-straight day and hit an all-time intraday high for four days in a row. In its seventh-straight day of gains, the S&P/ASX200 index rose 17.6 points, or 0.21%, to 8,209.5, to enjoy a 1.35% gain for the week. The broader All Ordinaries on Friday climbed 20.2 points, or 0.24%, to 8,437.2, also a record close.

Eight of the ASX's 11 sectors finished higher, with consumer staples, health care and property lower.

The consumer discretionary sector was the biggest gainer, rising 1.1% as Wesfarmers climbed 1.5%, JB Hi-Fi added 1.4% and Tabcorp rebounded 5.8%. Myer rebounded from steeper losses to finish 0.6% lower at 87c after the department store chain reported its full-year profit was down 26% to $52.6 million.

The tech sector rose 0.6% as Technology One added 1.9% to an all-time high of $23.94 and Life360 grew 5.2% to $18.09.

In the heavyweight mining sector, goldminers were mixed even as the precious metal hit an all-time high. Northern Star rose 1.3% and West Africa Resources climbed 3.4%, but Evolution was flat and Newmont dipped 0.5%. Elsewhere in the sector, BHP added 0.4% to $40.34, while Rio Tinto dropped 0.5% to $113.02 and Fortescue edged 0.1% lower at $17.63.

The big four banks all finished higher, with ANZ up 1.2% to $31.89, Westpac advancing 0.6% to $33.57, NAB expanding 0.4% to $39.67 and CBA finishing 0.3% higher at $144.50.

Insurance companies IAG and Suncorp had dropped 0.5 and 1.3%, respectively, while Computershare had dropped 2.8%. Lower interest rates tend to hurt the bottom lines of all three companies, which need to have billions stashed in short-term investments on behalf of clients and policyholders.

Curated by James Gruber and Leisa Bell

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website